Selling houses in Australia just got less profitable

Eliza Owen - making profit downgrades palatable since June 2022.

This just in:

Little Miss Prof’t she sat in her lof’t,

Eating her smashed-avo, when hey! –

Along came a spider who sat down beside her

And frightened miss Prof’t away,

And ate her cat.

Damning words, however poetical – and slightly abridged by our team at Gaggle translate – from CoreLogic’s Evil Queen of Numbers and Head of Research Eliza Owen.

The gist of which, for those unfamiliar with both irony and the work of *Dr. Thomas Muffet, is that suddenly there’s less profit in selling a house.

In her new report of terror, ominously titled Pain & Gain (actually they’ve been using that name for ages) Eliza says she’s seeing the rate of profit-making sales across Aussie property slink lower for the first first time since Dr Muffet, the notorious 16th century physician, author and entomologist penned “Little Miss Muffet” about a girl named Patience, who had none for spiders and was Dr Muffet’s stepdaughter.

Actually, the modest 30-basis point decline in the incidence of profit-making sales, hasn’t seen a reverse from August 2020, but it’s been a long few years and more importantly is another damned indicator that the unholy worm has turned for the Lord’s own property sector here in the country God built and the English divvied up for sale.

CoreLogic’s ghastly new issue of Pain & Gain, pumped about 106,000 March quarter property resales through the machine that is E Owen’s steel-trap-of a mind where she identified a few key factors in the drop of profit-making sales from 94% to 93.7%.

Turning tide for the sellers market

The biggie here is the addition of yet another key indicator screaming that the growth rate of Aussie property values is slowing.

Suddenly it’s taking heaps longer to sell a property in Australia. Prices have begun to plateau, and even – across Sydney and the Other One – actually forecast to shrink like hope.

Also damningly, sales volumes are falling.

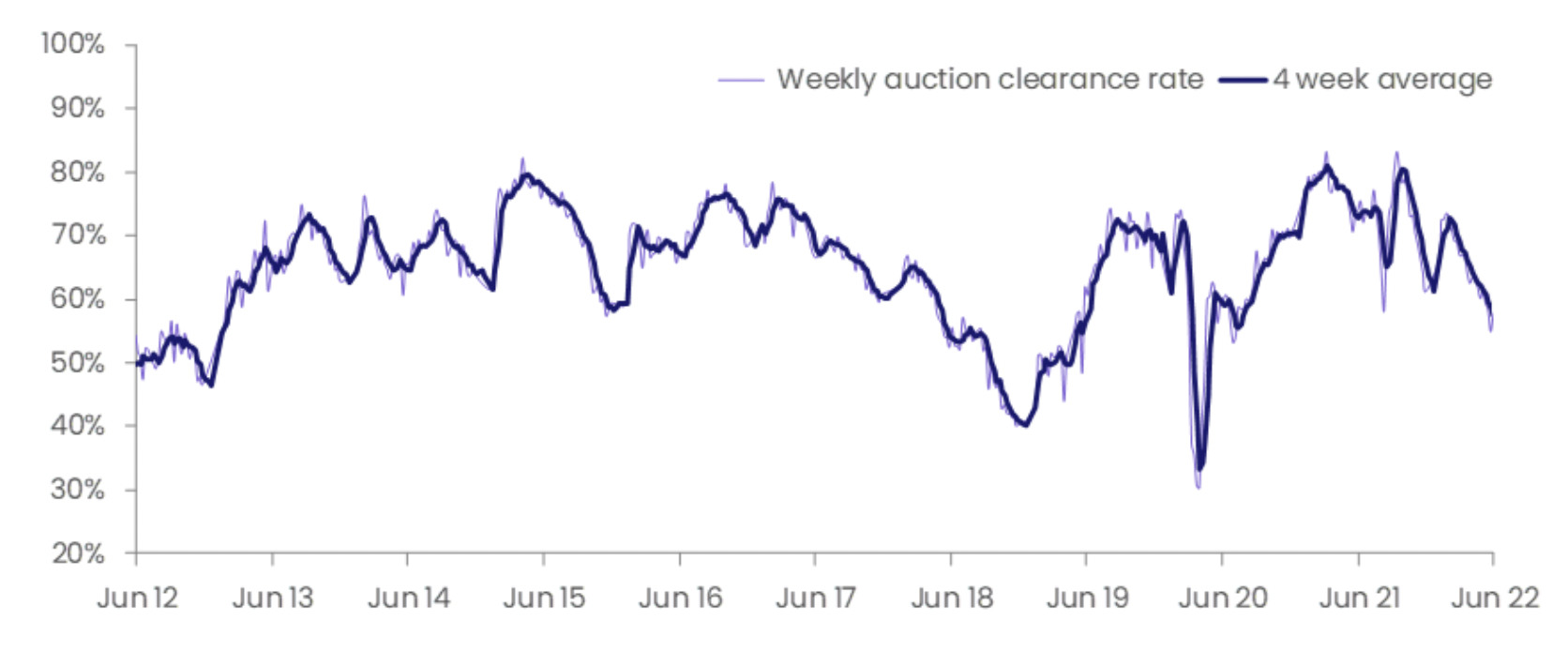

Here’s last weeks auction clearance rate for the combined capital cities

And anecdotally – like, from what I’ve just been seeing as I tour Sydney taking my kids to their unending birthday parties – there’s not much out there. Definitely, thankfully, not as many people want to drown you in bollocks talking about it.

After all, suddenly getting access to credit is harder and interest rates are jerking awake like a George A Romero zombie.

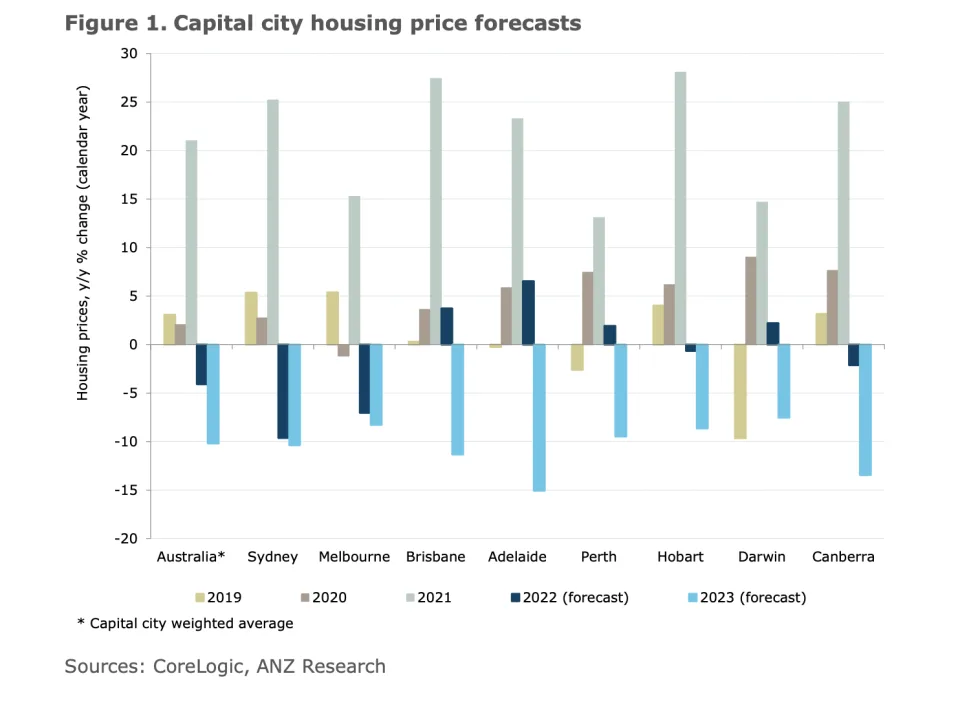

Last week the ANZ bank’s economic brains trust, led by Adelaide Timbrell and Felicity Emmett, warned of seriously constrained borrowing capacity – rates are rising like a bastard prince, and this’ll be a big drag on house prices.

“The increase in mortgage rates is now expected to be larger and to come at a more rapid pace,” they said, in duet.

But hold back the glee – it’s forced sell-offs, just the rising cost of credit which’ll be the key drag on values. Most mortgage holders have heaps of cash stored up during lockdown to cope with the extra costs.

Emmett and Timbrell say house prices could fall 20% by the end of next year, downgrading previous predictions in light of the rising from the dead mood of the official cash rate.

(Quick back of the envelope figs based on Australia’s $10 trillion housing market – that’s double what the entire global crypto market has shed in the latest bloodbath).

Less hawkish, and more willing to pin all of this on the RBA is Commonwealth Bank of Australia’s head of Aussie economics Gareth Aird, who now reckons house prices could drop by 18% in Sydney and Melbourne and 15% nationally.

“Home prices will move lower from here given the RBA is expected to tighten policy via rate hikes quickly,” Aird says.

“The extent to which prices contract will depend in large part on the speed and magnitude at which the RBA lifts the cash rate.”

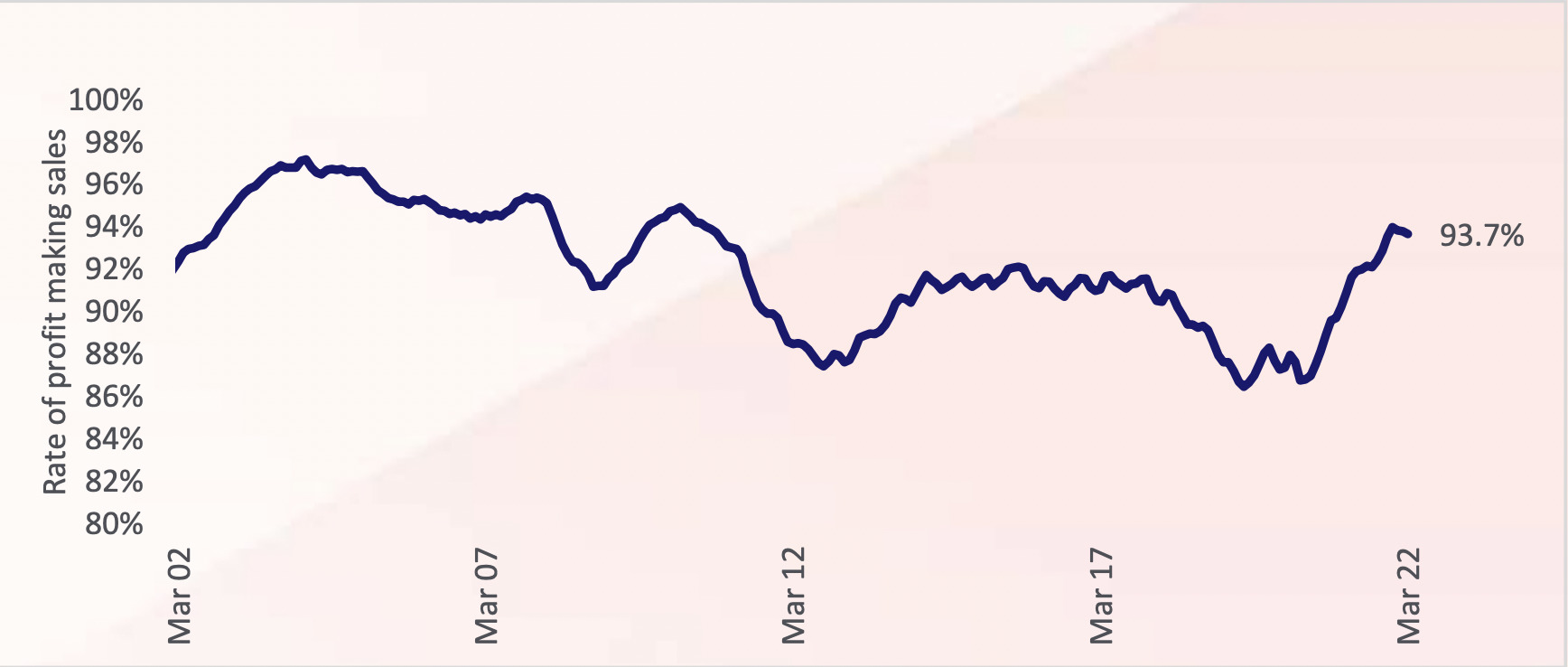

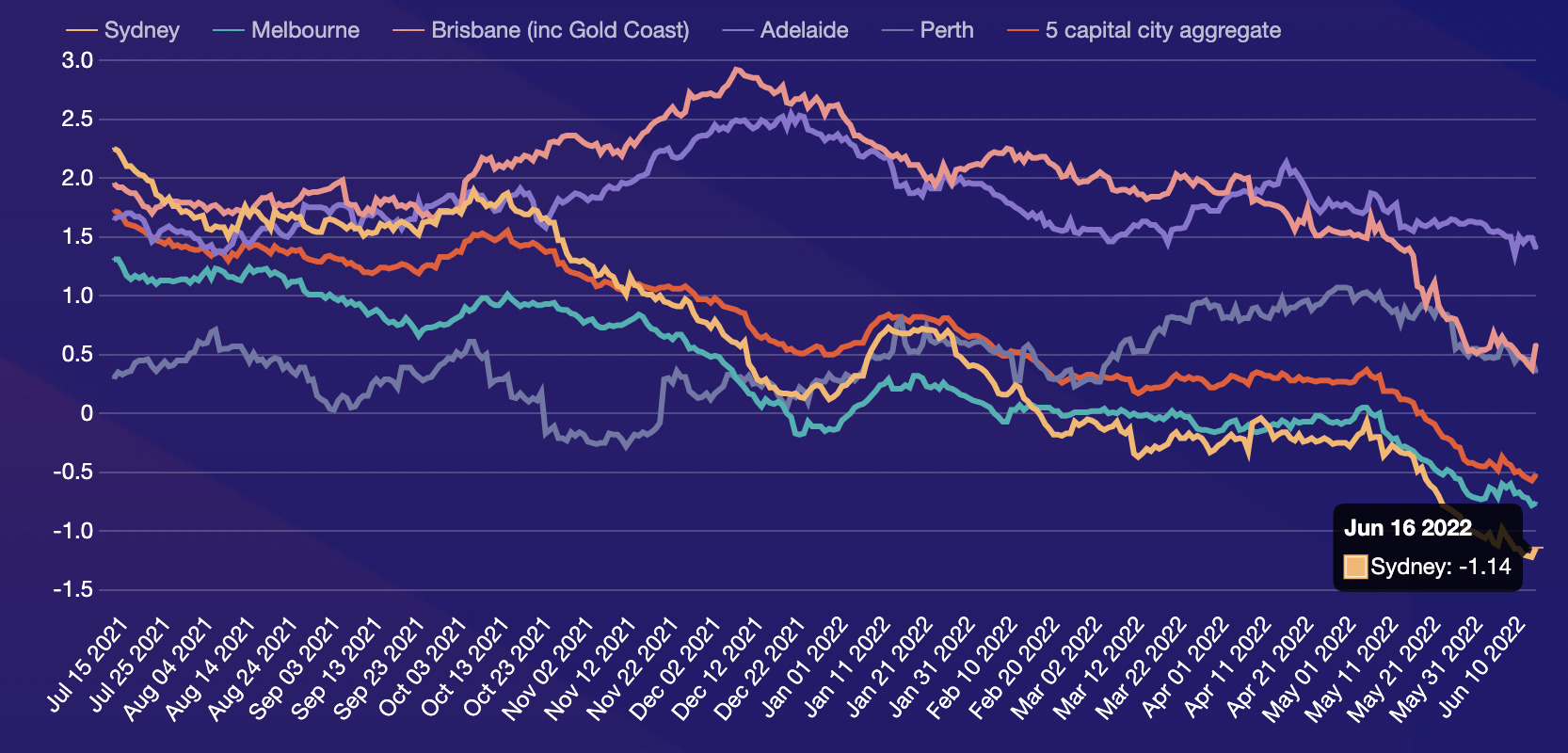

Rolling three-month rate of profit-making sales

Last month Australian dwellings delivered their first monthly decline in value since September 2020, says Eliza Owen.

“Against a backdrop of rising interest rates, tighter credit conditions and affordability pressures we are likely to see the instance of nominal gains from dwelling resales erode throughout 2022, which will have an even greater impact on buyers who have entered the market more recently.”

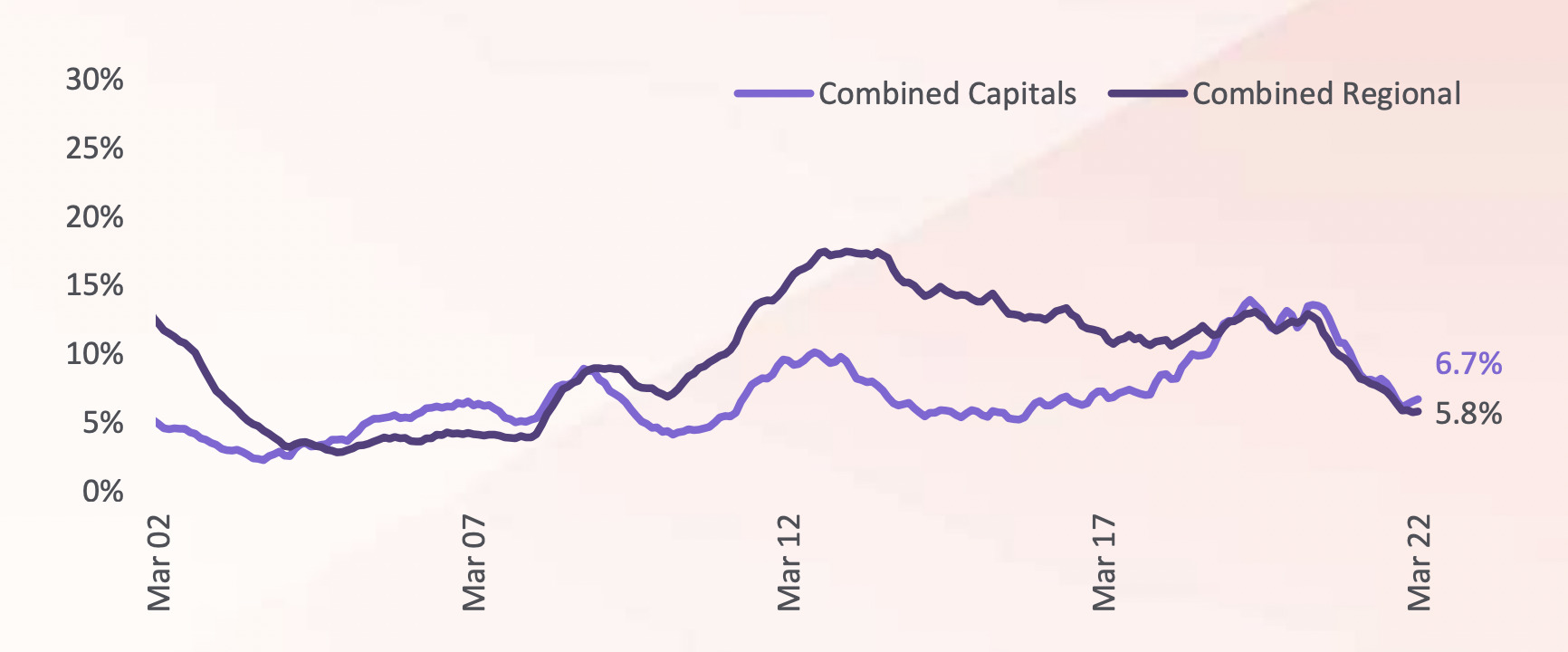

Portion of loss-making sales, capital cities versus regional – rolling quarter

In dollar terms the median gains from resales nationally were $290,000; highest for Sydney dwellings ($415,000) and lowest across Perth ($119,000). Nationally, median losses on resales through the quarter stood at -$33,000.

Higher hold periods have typically resulted in higher nominal capital gains with properties held for a period of 30 years or more achieving median gains of $781,750.

Eliza reckons outside of this, properties held between 24 and 26 years or purchased between 1996 and 1998 also achieved extremely high gains.

“Properties were acquired relatively cheaply at this time because of a significant housing market downswing through the mid-90s,” she says.

“Our analysis shows the median hold period nationally is 9.0 years, when properties were purchased during the March quarter of 2013. Since then Australian dwelling values have increased 70.3%, or the equivalent of around $309,000 in the median dwelling value across Australia.”

Capital cities suck

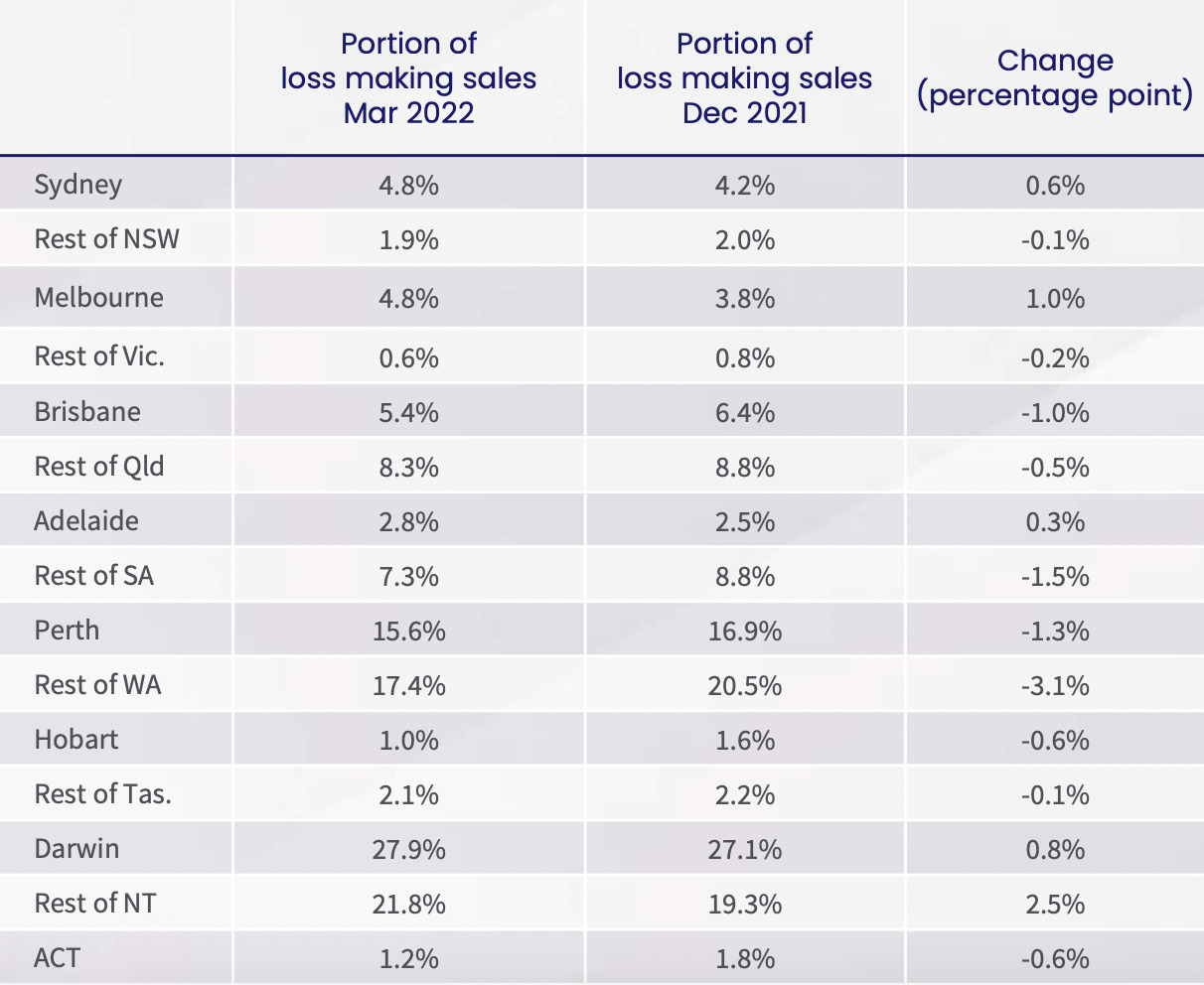

Australia’s capital cities are driving the deterioration in profit-making resales, falling 60 basis points to 93.3% in Q1 2022.

Leading the way was Melbourne where the rate of profit-making resales fell a full percentage point followed by Sydney’s fall of 60 basis points.

Regional areas remained strong, with the rate of profit-making sales lifting 10 basis points higher in the quarter, to 94.2%.

Hobart had the highest incidence of nominal gains for the 15th consecutive quarter, at 99.0% followed by the ACT, which recorded a record high 98.8% of resales making a nominal gain.

Regional Victoria had the highest rate of profitable sales in the regions, also at a record high 99.4%.

Portion of loss-making sales, capital cities versus regional – QoQ change

“Hobart dwellings have been in incredibly high demand over the past few years, being one of two capital cities – alongside Sydney – where dwelling values have doubled in the past decade,” Owen says.

“Both houses and units have been popular, however conditions across this market may be starting to shift. In April dwelling values saw the first monthly decline in almost two years and total listings have started to accumulate.

“For very recent buyers, the chance of making nominal gains on a resale may be reduced in the coming months, and median hold periods across the city may start to be extended as a result.”

Safe as houses vs units

The rate of profit-making sales for houses was 96.2%, and 88.3% across units in the quarter. The rate of profitability for both property types slipped nationally QoQ but units recorded a steeper drop of 50 basis points.

House resale median gains were $370,000, compared to $173,000 for units.

The difference in losses was also greater for units (-$36,000) compared to house resales (-$29,400).

Eliza also puts the big diff here down to a surge in apartment construction between 2012-2017 – one major factor that contributed to the lower rate of profitability among unit sales.

More pain less gain

“Price declines across the market signal there could be a higher probability of loss-making sales in the coming months, though hold periods will play an important role here,” Owen says.

The rate of profit-making sales in Sydney, for example, has deteriorated for two consecutive quarters reflecting a softening in housing market conditions.

But the tightening cycle, which began in May, is likely to reduce the flow of credit towards housing, which will impact prices and profitability.

Housing market values declined -0.1% nationally through May, with the rolling 28-day change suggesting price declines are accelerating.

The rolling four-week change in capital city dwelling index values

“However, it is worth noting that price gains through the current housing market upswing have been very strong. It may only be recent buyers who will take a loss when selling compared to those who purchased before the upswing,” Eliza says.

“Even in a declining market the extent of Australia’s loss-making sales will largely be in line with future capital growth trends.”

Key findings for Pain & Gain, March Quarter 2022

- The incidence of profit-making sales nationally declined to 93.7%, down from 94.0% in the December 2021 quarter

- The median nominal gain made on resales nationally was $290,000, while median losses were -$33,000

- The March 2022 quarter marks the first decline in national profitability rates since the three months to August 2020

- Capital cities are driving the fall in profit-making resales nationally

- Profitability across both houses and units declined nationally quarter-on-quarter

- Through the quarter, the median gain from house resales nationally was $370,000, compared to $173,000 for units

- Nationally the median hold period for profit-making resales was 9.0 years

- Hobart remained the most profitable of the capital cities for the 15th consecutive quarter

- Canberra houses had the highest rate of profitability with a record high rate of 99.7% of resales making a nominal gain

- Darwin units had the lowest incidence of profit-making sales in the quarter at 55.4% recording a nominal gain.

*The first recorded version of “Little Miss Muffet” nursery rhyme dates back to the early 19th century England.

It was first printed in the “Songs for the Nursery” collection published in 1805.

The origin of “Little Miss Muffet” is most commonly attributed to Dr Thomas Muffet, a notorious physician and entomologist from the 16th century, the author of a scientific illustrated guide about insects. “Little Miss Muffet” is about a girl named Patience, who was Dr Muffet’s stepdaughter.

The lyrics probably tell the story of an incident when Patience ran away from her breakfast, being frightened by an arachnid from Dr Muffet’s collection. However this speculation was never proved.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.