ASX Small Caps Lunch Wrap: Who else is crying out for some decent proofreaders this week?

News

News

The ASX opened with a dip this morning, tracking Wall Street into the doldrums ahead of Big Jim Chalmers dropping his first proper Big Boy Budget tonight in Canberra.

Local investors are no doubt waiting with bated breath to see who’s going to win (and who, as is always the case, is going to lose) once the dust has settled. For the moment, though, they will need to be happy with a -0.3% benchmark hit at lunchtime.

I can only imagine the stress of whichever panel of Treasury Department drones were tasked with spending weeks of their lives poring over the spreadsheet to make sure The Hon. Mr Chalmers wasn’t about to stand up before the nation and give himself the uppercut to end all uppercuts.

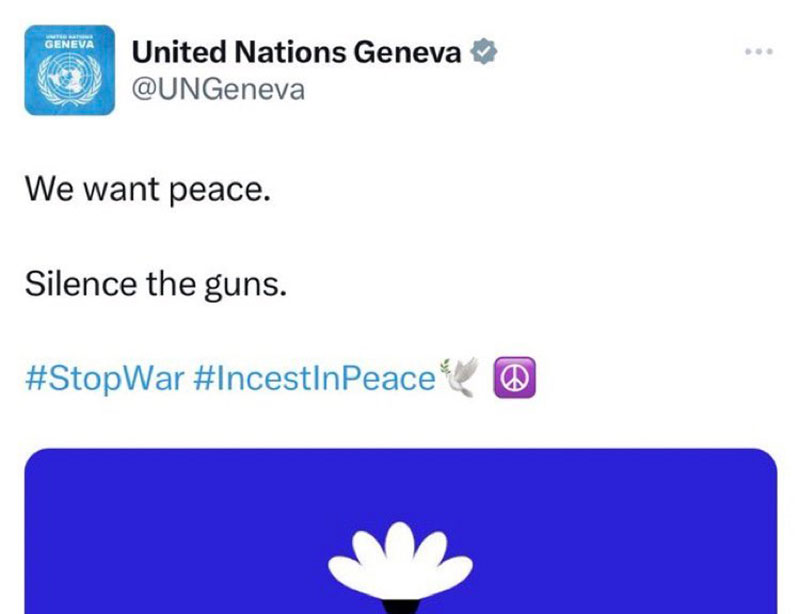

But it’s odds-on that they’re unlikely to have reached out to the United Nations for assistance in proof-reading the spreadsheet – or anything else for that matter – after whoever’s in charge of the UN’s social media account made the mother of all mistakes by urging the world to have sex with their immediate family members, in the name of world peace.

The Tweet in question has since been deleted, but luckily for us, the internet is good at remembering our every mistake, so this screenshot of the United Nations urging us all to peacefully bang our cousins in the dirt still exists.

It could be worse. Not by much, though, because as far as typos go, that one is the social media equivalent of issuing a press release urging people to donate money to Help Fight Kids with Cancer.

Morally speaking, of course, it’s a disaster – somewhat akin to the so-called “Sinner’s Bible”, an edition of the Regular Bible published in 1631 by the Royal printers in London, which accidentally changed one of the 10 Commandments in the Book of Exodus to read “Thou Shalt Commit Adultery”.

And aside from costing the UN an awful lot of respect from the global community (or, more worryingly, gaining some from certain sectors…) it’s not like the typo actually cost anyone any money.

Unlike the single error in a computational equation, buried deep within the navigation software for NASA’s ill-fated Mariner 1 interplanetary probe.

Launched in 1964 to go take a squiz at Venus, the US$80 million (equivalent to about $780 million modern US dollars) probe took off through the galaxy, missing its target by a considerable margin and zooming off into space, thanks to a missing hyphen.

So keep an eye out in tonight’s budget for any errors – because when it comes to mistakes, our Glorious Treasury Overlords have some serious form.

Like the 2014 Budget, which forecast the Wine Equalisation Tax to bring in $780 million during 2014/15, rising gently to $810 million in 2015/16 – at which point it was (apparently) meant to go supernova, and drain over $60.7 billion (a rise of 7,397%), in 2016/17.

It’s enough to drive a man to drink.

Speaking of which, it’s time to take a look at what’s happening on the ASX this morning.

Local markets opened lower this morning, falling 0.3% at open, then further to -0.5% in just 20 minutes, after a mixed and mediocre result on Wall Street overnight, where the action was muted ahead of key data drops.

The benchmark has since recovered to be back at -0.3%, and things are likely to stay subdued for a while today – it was always going to be a little flat on local markets, as tonight is the Big Reveal for the federal government’s first “proper” budget.

Despite plenty of strategic leaks and hints from Albo’s mob, there’s likely to be more than a couple of unhappy campers when the full details are revealed.

But, Federal Treasurer Jim Chalmers seems optimistic, at least, forecasting a modest surplus of about $4 billion, which is vastly different from the “Oh, Woe is Me. And you guys, too” forecast of a $37 billion deficit from seven months back.

“If it eventuates, this would be the first surplus in 15 years,” Chalmers said, in a manner that sounds more desperately hopeful than anything else.

Nothing quite instils confidence than someone upping a potential national budget outcome like it’s a harebrained climactic action movie scheme that has about a 1:50,000 chance of actually working.

A look over the market sectors and it’s bleak reading so far today – everything’s in the red, from Consumer Staples on -0.04% down to Real Estate on -1.14%. Blergh.

In terms of market cap, Imugene (ASX:IMU) is the biggest of the best performers today, up 6.5% on no fresh news, bouncing at $0.115 after a steady decline since 20 April from $0.13.

Overnight, Wall Street delivered a mixed bag of results, with US investors flat-footed while waiting for what the Fed might do after the release of the quarterly survey of senior loan officers.

Earlybird Eddy Sunarto reports that the survey showed “tighter bank lending standards and weaker demand for business and most consumer credit through Q1 versus prior quarter”.

Another takeaway from the survey was that the commercial real estate space is going to feel more pain soon.

The focus for investors will now shift to the US CPI report on Wednesday (US time), and the uncertainty surrounding the debt ceiling.

Occidental Petroleum shares dropped 2% after Warren Buffett said Berkshire Hathaway was “not going to buy control of Occidental”.

Up the pointy end of the gains, cybersecurity company Zscaler surged 20% after boosting its revenue guidance for the quarter, while data company Palantir Technologies rose 4.5% after saying that it expects to be profitable every quarter this year on the back of its new artificial intelligence products. (Read “we don’t need to pay humans anymore lol”.)

Tyson Foods plunged more than 16% on a pretty serious earnings miss for the self-described “protein leaders”.

In Japan, the Nikkei has climbed 0.7% this morning after what at first appeared to be a pathetic attempt at terrorism turned out to be an example of Grade-A stupidity.

According to local reports, a coffee can exploded yesterday afternoon near a ticket vending machine at a train station in Tokyo, injuring a nearby woman in her 20s.

Police swooped on the area, arresting a Chinese man who they believe placed the can at Nishiarai Station in Adachi Ward, who confirmed that the can was his, and contained “detergent from work” that he planned to use at his home.

Whether the man was planning to use the explosive detergent to very rapidly clean his house remains unclear.

Meanwhile in Chinese markets, a distinct lack of accidental detergent explosions has prompted feelings of disappointment amongst bored investors, leaving Shanghai markets 0.22% lower and Hong Kong’s Hang Seng down by 0.55% in early trade.

In crypto, Rob “I Could Have Died!” Badman is off crook this morning, so here’s a quick look at what’s been happening: Everything is broadly down since this time yesterday, including BTC (-2.0%), ETH (-0.5%), XRP (-3.4%) and that immeasurably stupid PEPE coin fiasco has fallen 24.1%.

It’s like watching a toddler play Frogger at a Timezone arcade…

Hop. Hop. Hop. SPLAT! – please insert more coins to keep playing.

Here are the best performing ASX small cap stocks for May 9 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap VSR Voltaic Strategic 0.049 81% 83,432,752 $8,297,106 CHZ Chesser Resources 0.12 64% 29,335,077 $42,967,898 VPR Volt Power Group 0.0015 50% 32,537 $10,716,208 CLE Cyclone Metals 0.002 33% 1,947,500 $13,633,872 OAR OAR Resources Ltd 0.004 33% 750,000 $7,233,114 BEZ Besra Gold 0.29 32% 14,824,020 $77,849,615 CPH Creso Pharma Ltd 0.017 31% 28,376,214 $27,781,529 AJQ Armour Energy Ltd 0.005 25% 5,621,617 $15,050,431 GNM Great Northern 0.0025 25% 50,000 $3,418,102 ZEU Zeus Resources Ltd 0.017 21% 2,104,859 $6,136,200 APL Associate Global 0.3 20% 114,771 $12,105,222 SPN Sparc Tech Ltd 0.33 20% 69,758 $23,552,560 ERL Empire Resources 0.006 20% 849,999 $5,564,675 FG1 Flynngold 0.074 19% 501,719 $6,378,159 WC8 Wildcat Resources 0.04 18% 1,888,308 $22,508,773 GMN Gold Mountain Ltd 0.0035 17% 652,010 $5,909,798 NZS New Zealand Coastal 0.0035 17% 5,044,102 $4,962,030 OAU Ora Gold Limited 0.0035 17% 46,799,916 $11,810,775 IMC Immuron Limited 0.093 16% 1,336,212 $18,223,868 OJC The Original Juice 0.11 16% 400,149 $23,236,125 PPY Papyrus Australia 0.03 15% 23,501 $12,352,129 NTM Nt Minerals Limited 0.008 14% 334,120 $5,604,892 TAS Tasman Resources Ltd 0.008 14% 29,000 $4,988,685 XTC Xantippe Res Ltd 0.004 14% 55,228,531 $37,030,349 PL3 Patagonia Lithium 0.215 13% 522,344 $9,310,665

There are three Big Winners among the Small Caps this morning, with Voltaic Strategic Resources (ASX:VSR) wearing the crown at lunchtime after gaining 81.5% so far today.

Just six days after it got the drills spinning at its Ti Tree project in WA, the company says it has completed its first-pass exploration and things are looking very, very nice indeed.

Several thick (up to ~60m) pegmatite bodies have been intercepted down-dip from surface, and drilling has successfully confirmed key structural trends for identified LCT pegmatites and deepened the Voltaic’s understanding of the broader geological controls within the project.

The company says that confirmation of pegmatite continuity at depth significantly bolsters the Project’s prospectivity where >300 pegmatites have been mapped and <10% of the tenure explored to date.

Voltaic chief executive Michael Walshe said he is extremely encouraged by these maiden drill results as multiple thick pegmatites have been intercepted from surface and all targets remain open at depth.

Actual assay results are due in six weeks.

In second place, but for entirely different reasons, is Chesser Resources (ASX:CHZ) which has gone soaring 64.3% this morning on news that it has entered into a binding proposal from Fortuna Silver that will see Fortuna acquire 100% of the company.

Under the proposal Chesser shareholders will receive consideration of 0.0248 Fortuna shares per Chesser share, representing an implied value of $0.142 per Chesser share. At the time of writing, Chesser was sitting at $0.120 per share.

And in third place, Besra Gold (ASX:BEZ) has jumped 34% this morning on news that it has signed a binding gold purchase agreement for up to $300 million with major shareholder Quantum Metal Recovery, giving effect to the non-binding term sheet previously announced in late March this year.

The agreement provides up to a US$300m deposit, to be paid over 30 months, against future gold production ounces, enabling Besra to fully fund production at its Bau gold project and the appraisal of other deposits within the Bau goldfield corridor.

It’s an important shift in phase for Besra, which the company says necessitates a reshuffle in management structure as the company moves from exploration towards production.

Hence, Dr Ray Shaw has agreed to step down as CEO and move into the role of chief operating officer to focus on in-country development and exploration activities, while Jocelyn M. Bennett has been appointed to assume the role of Besra’s executive chair.

“This extraordinary funding deal should provide ample funding for the development of Bau and allows us to bring the project into production in a way that is uniquely non-dilutive to our shareholders and to retain exposure to gold price movements, free of hedging or other onerous covenants,” Bennett said.

“Whilst we have several Conditions Precedent yet to fulfil we expect the US$300m Facility to be fully operational by June 30, 2023.”

Here are the most-worst performing ASX small cap stocks for May 9 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap ARE Argonaut Resources 0.001 -50% 2,150 $12,723,743 NGS NGS Ltd 0.011 -42% 1,749,723 $2,817,842 FGL Frugl Group Limited 0.007 -30% 80,000 $7,648,496 AVE Avecho Biotech Ltd 0.004 -27% 3,753,751 $10,108,281 MEB Medibio Limited 0.0015 -25% 17,175 $8,301,188 MTL Mantle Minerals Ltd 0.0015 -25% 112,000 $10,691,210 RMX Red Mount Min Ltd 0.003 -25% 377,692 $9,087,404 WEL Winchester Energy 0.003 -25% 468,979 $4,081,688 CHK Cohiba Min Ltd 0.004 -20% 501,005 $9,066,221 CUL Cullen Resources 0.008 -20% 1,477,636 $5,042,909 THR Thor Energy PLC 0.004 -20% 12,428 $7,368,064 MTH Mithril Resources 0.0025 -17% 5,681,667 $9,789,271 G6M Group 6 Metals Ltd 0.145 -15% 2,148,849 $132,512,275 CPT Cipherpoint Limited 0.006 -14% 26,786 $8,114,692 IVX Invion Ltd 0.006 -14% 23 $44,951,425 MRQ Mrg Metals Limited 0.003 -14% 702,912 $6,950,715 NVU Nanoveu Limited 0.03 -14% 570,511 $13,557,152 OLI Oliver'S Real Food 0.025 -14% 37,173 $12,781,226 APS Allup Silica Ltd 0.051 -14% 20,000 $2,270,149 ASW Advanced Share Ltd 0.135 -13% 3,225 $29,978,205 ADR Adherium Ltd 0.0035 -13% 7,088 $19,985,753 AHN Athena Resources 0.0035 -13% 168,800 $4,281,870 ICN Icon Energy Limited 0.007 -13% 302,462 $6,144,109 TSI Top Shelf 0.37 -12% 63,253 $35,351,204 SSH SSH Group 0.15 -12% 22,999 $7,345,038