New data confirms ASX trading signups are surging — should retail investors be wary?

News

News

The surge in retail trading participation during the post-COVID bull market has been well documented.

And data yesterday from Commonwealth Bank helped confirm that along with frenzy of activity in US markets, plenty of new Australian traders joined the ASX in 2020.

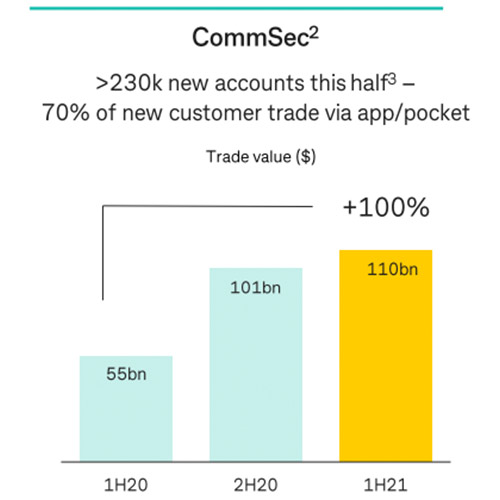

Over the course of the pandemic year, trading activity through Commsec and the Commsec Pocket investing app promptly doubled:

While CBA didn’t provide previous half-year figures for a historical context, 230,000 new accounts in six months is a material move.

Although it still pales in comparison to some of the trading coming out of US markets.

At the height of the GameStop frenzy, US retail trading app RobinHood said it add 600,000 app downloads in a single day January 29, rounding out a record monthly download total of three million.

Tied to the post-COVID retail rush are some pretty strong narratives, arguably led by the GameStop storyline where a rag-tag bunch of redditors took on the might of Wall Street trading firms and won (until they didn’t).

Some Wall Street firms view it as a new trading reality – quant firm Cindicator Capital has posted a job ad for someone skilled in the dark arts of reddit who can help gauge the more qualitative aspects of market sentiment.

For Travis Clark, head of ASX trading platform Marketech Focus, surging retail investor interest and rising stock prices should also warrant a dose of caution as 2021 progresses.

Particularly when some of the key drivers of post-COVID stock markets also throw up some tricky regulatory grey areas.

“I think the big uplift in retail activity is being compounded by social media, which in turn is increasing herd behaviour,” Clark told Stockhead.

“So we’re seeing a lot of distortions that aren’t based on investment fundamentals.”

And in Clark’s view, a schism has emerged, in the sense that full-service brokerage — where firms providing research and advisory services to retail customers — is still a highly regulated industry.

However, investment forums on social media platforms such as Facebook, reddit and TikTok currently exist beyond the traditional regulatory scope.

“Yet a lot of people are getting their ‘advice’ on there. It’s a bit like going to Belle Gibson for a medical check-up,” Clark says.

In Australia, platforms such as Commsec and Marketech provide investors with their own individual HIN (holder identification number).

For a new member, that extends the signup process to two or three days, but it also gives them the legal right to own shares directly.

They compete against new entrants such as Superhero, which was described in the AFR as a ‘Robinhood-style” trading app with low-cost brokerage via a pooled HIN structure.

For his part, Michael Burry — the investor who foresaw the house of cards in US real estate that turned into the 2008 financial crisis — reckons the era of fast-signup stock trading feeds isn’t shifting the power structure to retail investors.

Rather, Wall Street owns that game.

Clark said another thing for investors to be aware of is that smaller retail stocks often trade different to, say, a Commonwealth Bank or Wesfarmers.

Capital markets activity for those companies is much deeper and importantly, more liquid, with plenty of buying and selling by large institutional funds.

Retail investors “don’t always manage their investments the same way so if the price starts to fall, there’s not always someone there to buy it”, he said.

“The big point is that you can’t just go into the market like you go into the races and pick a horse with a catchy name,” Clark says.

“If you’re investing and you’re doing it to make money, you’ve got to read — and read every day.”

“Look at what US stocks did overnight, look at commodity prices, what are bond yields doing? There’s a lot of information you’ve got to take into account.”

At Stockhead, we tell it like it is. While Marketech is a Stockhead advertiser, it did not sponsor this article.