You might be interested in

News

Market Highlights: Reddit, Bitcoin pop; and why Aussie small caps are undervalued compared to the US

News

Market Highlights: New record in sight for Bitcoin, and 5 ASX small caps to watch on Thursday

News

News

Aussie shares are poised to rise again at the open after a rally on Wall Street. At 8am AEST, the ASX 200 index futures was pointing up by +0.4%.

In New York, the S&P 500 rose by +0.52%, the blue chips Dow Jones index was up by +0.40%, and the tech-heavy Nasdaq lifted by +0.28%.

US bond yields eased as traders bet the Fed is done with rate hikes following recent dovish comments from Fed Reserve officials.

The latest comment came from Atlanta Fed President Raphael Bostic, who said that current rates were already high enough to get inflation back to the Fed’s 2% target.

The VIX index, sometimes called the stock market’s fear index, fell by 4% on his comments.

To stock news, Amazon rose 1% after kicking off its 2023 Amazon Prime Day. Pepsi rose 2% after its Q3 earnings beat forecasts by a long shot.

Block Inc shares on the NYSE surged 5% after Bank of America maintained a Buy rating on the stock.

Back home, a handful of annual general meetings (AGM) will be hosted today including CSL, CBA and IAG.

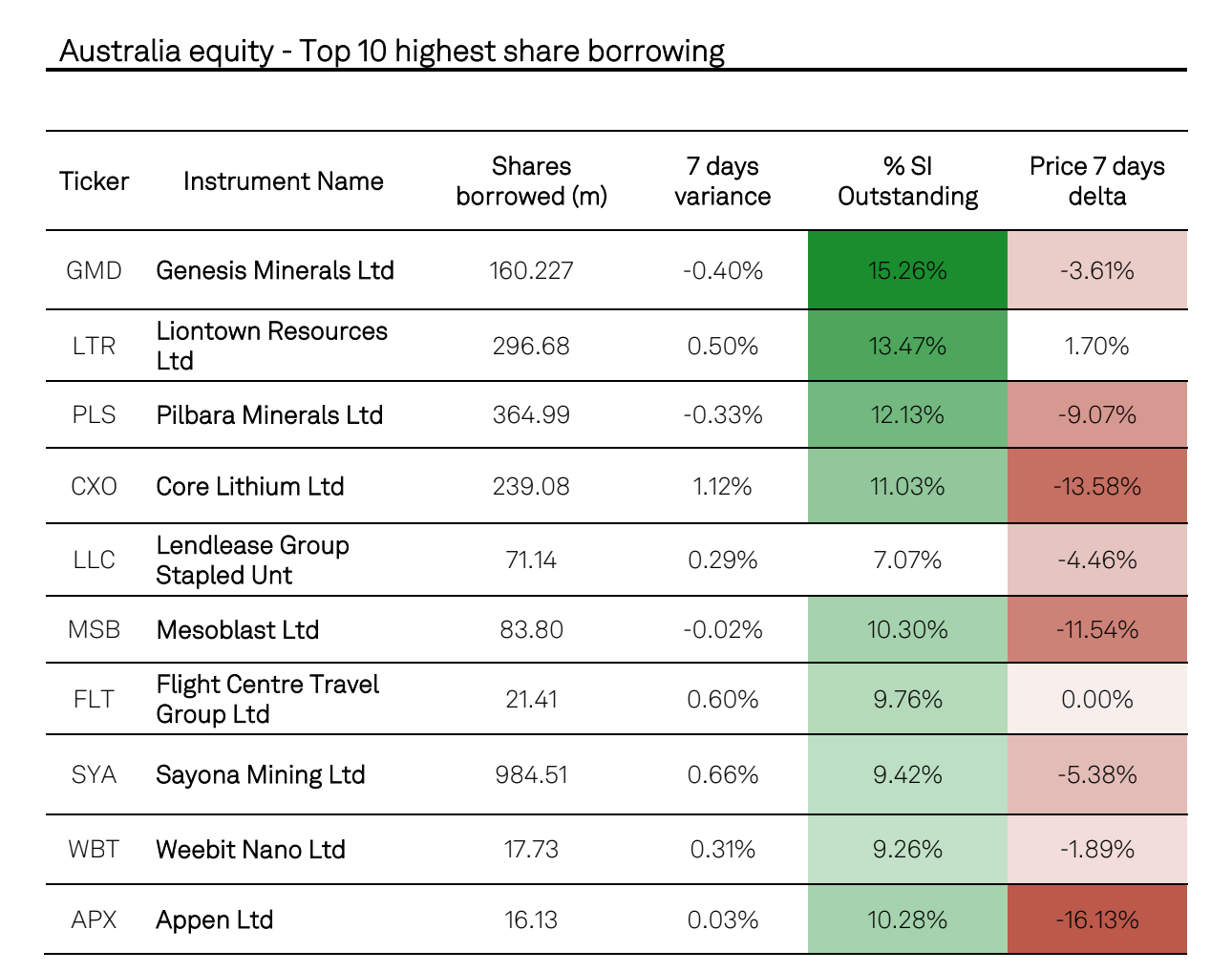

S&P Global Market Intelligence has released the 10 most shorted stocks in Australia.

The metric used to calculate the short interest is the percentage of outstanding shares on loan, which is part of the mechanic of shorting a stock.

Gold price traded flat at US$1,860.23 an ounce.

Oil prices eased by -0.5%, with Brent crude now trading at US$87.74 a barrel.

Iron ore futures also slipped by -0.65% to US$117.40 a tonne.

Base metals prices lifted with nickel futures rising by +2%, and copper futures climbing by +0.7%.

The Aussie dollar keeps on fighting its way back, up +0.3% to US64.28c.

Bitcoin meanwhile fell -0.5% in the last 24 hours to US$27,440.

Data from LMAX Digital shows that Bitcoin market dominance rate is currently hovering around 52%, near its 26-month high.

According to LMAX, Ether’s underperformance against Bitcoin is due to the recent “healthy increase” in Ether supply over the past month.

Okapi Resources (ASX:OKR)

Okapi, the largest shareholder of private Australian company Ubaryon, says that Ubaryon has continued to progress its Uranium Enrichment Technology as planned, securing additional staff to accelerate development and the renewal of its permit to operate. Ubaryon is also investigating new applications for its technology on both alternative materials for isotope separation and uranium waste management.

Mount Ridley Mines (ASX:MRD)

Drilling has confirmed continuity at the Mount Ridley REE Project. Rare Earth drilling highlights include: 22m at 2,160ppm TREO1 (23% MagREO2) from 11m, and 26m at 1,780ppm TREO (23% MagREO) from 30m.

Matador Mining (ASX:MZZ)

Matador announced the results from its inaugural reconnaissance-style diamond drill program at Malachite in Canada. The results confirmed gold in basement at both Long Range and Grandy’s targets, and continues to demonstrate the prospectivity of the Cape Ray Shear Zone for structurally controlled, orogenic gold deposits.

Mandrake Resources (ASX:MAN)

Mandrake is assessing the uranium potential of its 93,755-acre Utah Lithium Project located in the Lisbon Valley mining district, which is the most significant uranium mining district in Utah. Lisbon Valley accounts for nearly 78 million pounds of historic U3O8 production, representing 64% of all uranium ever mined in Utah – the third largest uranium mining state in the US.

Argosy Minerals (ASX:AGY)

The company is progressing operational works at the 2,000tpa lithium carbonate facility targeting continuous production operations. Current works are focussed on the primary solids filtration circuit to improve filtration rates by resolving equipment performance issues via modifications to piping and design layout. Works on pre-FID scope have progressed, including conceptual engineering.

At Stockhead we tell it like it is. While Mount Ridley Mines is a Stockhead advertiser, it did not sponsor this article.