Lunch Wrap: ASX seesaws into a slippery dip as markets await tariff pause deadline

The ASX 200 seesawed back and forth in the first few hours of trade, struggling to find an equilibrium. Pic: Getty Images.

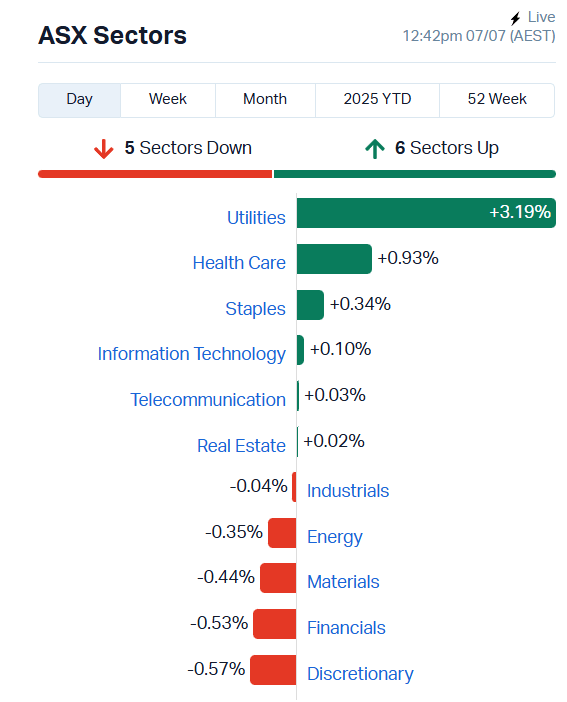

- Utilities and healthcare stocks on the up

- Gold stocks dragging, down more than 2pc

- ASX All Tech adds 0.24pc

ASX seesaws wildly ahead of tariff pause deadline

The ASX wasn’t quite sure which way to go earlier this morning, but as of about 1pm AEST it seems to have made up its mind, dipping by about 0.36% at the time of publishing.

Jumping 10 points in the first five minutes, the ASX 200 dropped about the same before spiking back up again an hour later.

It’s been a choppy affair ever since, but at least the utilities sector is doing its best to stem too much blood.

Looking at our large caps, market favourites Commonwealth Bank (ASX:CBA) and Northern Star Resources (ASX:NST) are trending lower, down 0.12% and 6.6% each.

NST failed to meet its revised production guidance range for the Kalgoorlie production centre, offloading 842k ounces compared to guidance of 850-860k.

The company managed to scrape just over the line for its total gold production guidance numbers, producing 1.643m ounces compared to estimates of 1.63-1.66, but the market was overall displeased with the update.

Healthcare giant CSL (ASX:CSL) is moving in the opposite direction, adding 1.94% alongside a 1.85% jump for James Hardie Industries (ASX:JHX).

Origin Energy (ASX:ORG) has also jumped more than 6% intraday, leading the greater utilities sector higher.

12 countries to receive “take it or leave it” offers

Twelve countries currently negotiating trade deals with the US Trump administration will soon receive letters offering a final deal from the White House.

A pause on tariffs set to be imposed on the majority of US trading partners will expire on July 9, with most tariffs going into effect by August 1.

“I signed some letters and they’ll go out on Monday, probably twelve,” Trump said, when asked about the trade negotiations. “Different amounts of money, different amounts of tariffs.”

While the Trump administration was initially very optimistic about establishing concrete trade deals with its major partners, the prez has since changed his tune, stating it was easier to send a letter.

That tracks – most major trade deals take years to negotiate, so it was always going to be a tall order to come to dozens of agreements in a matter of months.

Hotly anticipated deals with India and the EU appear to have fallen through at the last minute, leaving the door open for some big market upsets when the new tariffs finally come into effect.

On Friday, Trump added more fuel to that fire, stating tariffs could range up to 70% compared to the 10% to 50% threatened in April.

That said, investors aren’t running for the hills as they were on Liberation Day.

“The markets are discounting a return to tariff levels of 35%, 40% or higher, and anticipating an across-the-board level of 10% or so,” Boston-based Twinfocus chief investment officer John Pantekidis told Reuters.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for July 7 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| VN8 | Vonex Limited. | 0.036 | 100% | 2156808 | $13,546,863 |

| BMM | Bayanminingandmin | 0.06 | 71% | 21465707 | $3,603,439 |

| EEL | Enrg Elements Ltd | 0.0015 | 50% | 546851 | $3,253,779 |

| BPM | BPM Minerals | 0.043 | 48% | 9538695 | $2,531,709 |

| ZMM | Zimi Ltd | 0.011 | 38% | 495333 | $3,420,351 |

| GTR | Gti Energy Ltd | 0.004 | 33% | 13565308 | $8,996,849 |

| FRB | Firebird Metals | 0.098 | 27% | 1505249 | $10,961,828 |

| NWM | Norwest Minerals | 0.014 | 27% | 4401658 | $10,651,944 |

| KPO | Kalina Power Limited | 0.0075 | 25% | 2850600 | $17,597,974 |

| BIT | Biotron Limited | 0.0025 | 25% | 1617648 | $2,654,492 |

| BUY | Bounty Oil & Gas NL | 0.0025 | 25% | 297011 | $3,122,944 |

| MMR | Mec Resources | 0.005 | 25% | 8400000 | $7,399,063 |

| SKK | Stakk Limited | 0.005 | 25% | 102300 | $8,300,319 |

| SRZ | Stellar Resources | 0.02 | 25% | 15750554 | $33,276,009 |

| TMK | TMK Energy Limited | 0.0025 | 25% | 501642 | $20,444,766 |

| SCP | Scalare Partners | 0.13 | 24% | 2500 | $4,392,677 |

| NH3 | Nh3Cleanenergyltd | 0.05 | 22% | 3120545 | $26,093,310 |

| ALY | Alchemy Resource Ltd | 0.006 | 20% | 45000 | $5,890,381 |

| WSR | Westar Resources | 0.006 | 20% | 840301 | $1,993,624 |

| CMO | Cosmometalslimited | 0.02 | 18% | 878586 | $5,476,306 |

| DRE | Dreadnought Resources Ltd | 0.0105 | 17% | 4930863 | $45,715,500 |

| AON | Apollo Minerals Ltd | 0.007 | 17% | 413000 | $5,570,741 |

| AS2 | Askarimetalslimited | 0.007 | 17% | 1859773 | $2,425,024 |

| LML | Lincoln Minerals | 0.007 | 17% | 1550000 | $12,615,418 |

| RRR | Revolverresources | 0.036 | 16% | 114474 | $8,564,502 |

In the news…

Bayan Mining and Minerals (ASX:BMM) has staked 72 lode claims in the Mojave Desert of California in a bid to form the Desert Star rare earth project.

It’s a Tier 1 area for rare earth mineralisation, just 4.5km from the Mountain Pass REE Mine (supplied 15.8% of global rare earth production in 2020) and 4.7km from Dateline Resources’ (ASX:DTR) Colosseum project, which has shown similar radio metric signatures for REE mineralisation to Mountain Pass.

BMM will begin with a desktop review, field recon and rock chip sampling to drum up some early drilling targets.

Back on Australian soil, BPM Minerals (ASX:BPM) is preparing to begin drilling at its newly acquired Forelands gold project in the Yilgarn Craton–Albany Fraser Orogen margin of WA.

The project has already produced bonanza-grade hits up to 3m at 65.8 g/t gold from 25m of depth in drilling, and BPM reckons Foreland presents a near-term resource conversion opportunity.

Tenement acquisition is a bit of a theme today – Westar Resources (ASX:WSR) is also moving higher after staking a new copper tenement application in the under-explored Birrindudu Basin of Northern Territory.

The Northern Territory Geological Survey and CSIRO both found evidence of sedimentary copper deposits in a review of drill core from Birrindudu, highlighting the area as a potential frontier district for copper mineralisation.

Finally, Dreadnought Resources (ASX:DRE) is launching a test work sampling program at the Mangaroon critical metal project after fielding growing commercial interest in the rare earth and critical mineral potential of the Gillford Creek prospect.

Gillford Creek is prospective for a suite of rare earths as well as niobium, scandium, titanium, phosphorus and zirconium.

DRE management stresses that this sampling program won’t distract from its ‘More gold, Faster’ strategy, but will advance its critical metal commercialisation ambitions.

ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks for July 7 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GMN | Gold Mountain Ltd | 0.002 | -33% | 7556216 | $16,859,278 |

| FAU | First Au Ltd | 0.003 | -25% | 1009478 | $8,305,165 |

| EXT | Excite Technology | 0.008 | -20% | 1136999 | $20,726,419 |

| GGE | Grand Gulf Energy | 0.002 | -20% | 750000 | $7,051,062 |

| HTG | Harvest Tech Grp Ltd | 0.015 | -17% | 773452 | $16,362,330 |

| PV1 | Provaris Energy Ltd | 0.015 | -17% | 613604 | $12,564,023 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 1224333 | $11,104,423 |

| ARV | Artemis Resources | 0.005 | -17% | 156112 | $15,214,033 |

| MRD | Mount Ridley Mines | 0.0025 | -17% | 751500 | $2,335,467 |

| NES | Nelson Resources. | 0.0025 | -17% | 31999 | $6,515,783 |

| AVM | Advance Metals Ltd | 0.041 | -16% | 6485856 | $12,986,707 |

| AGY | Argosy Minerals Ltd | 0.029 | -15% | 13769095 | $49,501,312 |

| AKN | Auking Mining Ltd | 0.006 | -14% | 2943588 | $4,023,451 |

| AYT | Austin Metals Ltd | 0.003 | -14% | 104766 | $5,544,670 |

| LCL | LCL Resources Ltd | 0.006 | -14% | 95362 | $8,394,800 |

| SPX | Spenda Limited | 0.006 | -14% | 750000 | $32,306,508 |

| SFM | Santa Fe Minerals | 0.125 | -14% | 40492 | $10,558,724 |

| SVG | Savannah Goldfields | 0.02 | -13% | 630461 | $26,256,272 |

| AJX | Alexium Int Group | 0.007 | -13% | 39265 | $12,691,429 |

| AM5 | Antares Metals | 0.007 | -13% | 2163706 | $4,118,823 |

| ATS | Australis Oil & Gas | 0.007 | -13% | 20000 | $10,544,500 |

| GSM | Golden State Mining | 0.007 | -13% | 2000000 | $2,234,965 |

| RGL | Riversgold | 0.0035 | -13% | 875981 | $6,734,850 |

| BRU | Buru Energy | 0.023 | -12% | 1504129 | $20,264,650 |

| SPQ | Superior Resources | 0.004 | -11% | 490000 | $10,669,422 |

IN CASE YOU MISSED IT

Break it Down: MTM Critical Metals (ASX:MTM) is adding national security expert Gregory L. Bowman to the advisory board of US subsidiary Flash Metals USA.

Indiana Resources (ASX:IDA) has leveraged results from geochemical sampling near the Minos project to identify new gold targets.

Australia has a new globally focused deep tech company in MagnaTerra Technologies following the merger of mining innovator NextOre and explosives detection startup MRead.

As the US starts to ramp up domestic antimony support, Nova Minerals’ (ASX:NVA) Estelle Project in Alaska is shaping up as a strategic solution.

QMines (ASX:QML) has finalised acquisition of Mt Mackenzie and accelerated its goal to establish a multi-asset copper and gold production centre.

StockTake: Anson Resources (ASX:ASN) has boosted its exploration prospects at the Green River lithium project in Utah.

Break it Down: Antipa Minerals (ASX:AZY) is raising $40 million dollars by way of placement to put its Minyari Dome gold project on rails to development.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.