Lessons of a Day Trader: Part 3 – How to deal with your Inner Pickle

News

Whilst Bottom Picker has closed the coffee shop in Nelson Bay and gone on holiday, we asked him to put down on paper some of his insights on daytrading.

You can find Part One (getting started) here and Part Two (spotting a day trade) here.

In today’s final part – how to get yourself out of trouble. Hopefully.

Now, when you have gone through parts one and two and are getting yourself comfortable and more confident you will at some point find yourself in a pickle.

You can’t expect the market to be all sunshine and roses.

I look at it like going sailing. You can leave on a most glorious sunny day, with a nice comfortable wind and not a cloud in sight… and return in a mother of a storm.

Normally I find myself in a pickle after I break a few of my trading rules.

Sometimes out of boredom, you do something. Or when you have been having a good week, you get too confident or cocky.

Usually for me, my main pains come from opening up a trade in too big a size and as it moves against me, the averaging down can become just too large a position.

As I have said earlier, a 1c movement in 1000 shares is +/- $10 and 10,000 is +/- $100, so that’s where your gearing can come into play. It’s not the amount of money you are using, it is the amount of shares you are playing with.

As a rule of thumb, I have always used about 30% to 50% of my trading capital on a daily basis. Never 100%.

When I was writing calls and puts in currency options, I would use 30% for margin cover, with the other 70% as my margin buffer. Sometimes the buffer could be almost used up overnight, before things cooled down again or I had to roll them over into new positions.

The idea of the buffer was I could always control my positions and not get stopped out by my broker.

As I pointed out in parts one and two, averaging down two times is about my limit, so three goes in total and if it has come good at some point, then normally I have to cut the position.

Cutting a position can be hard but it allows you to come back another day and try again.

A boots ‘n all trade is really like playing Russian roulette with your capital. Holding a losing position overnight is the same.

Just because you got your timing wrong, mother market just doesn’t care.

Having a position held on till the next day brings in so many things out of your control. Especially if held on from Friday night to Monday morning.

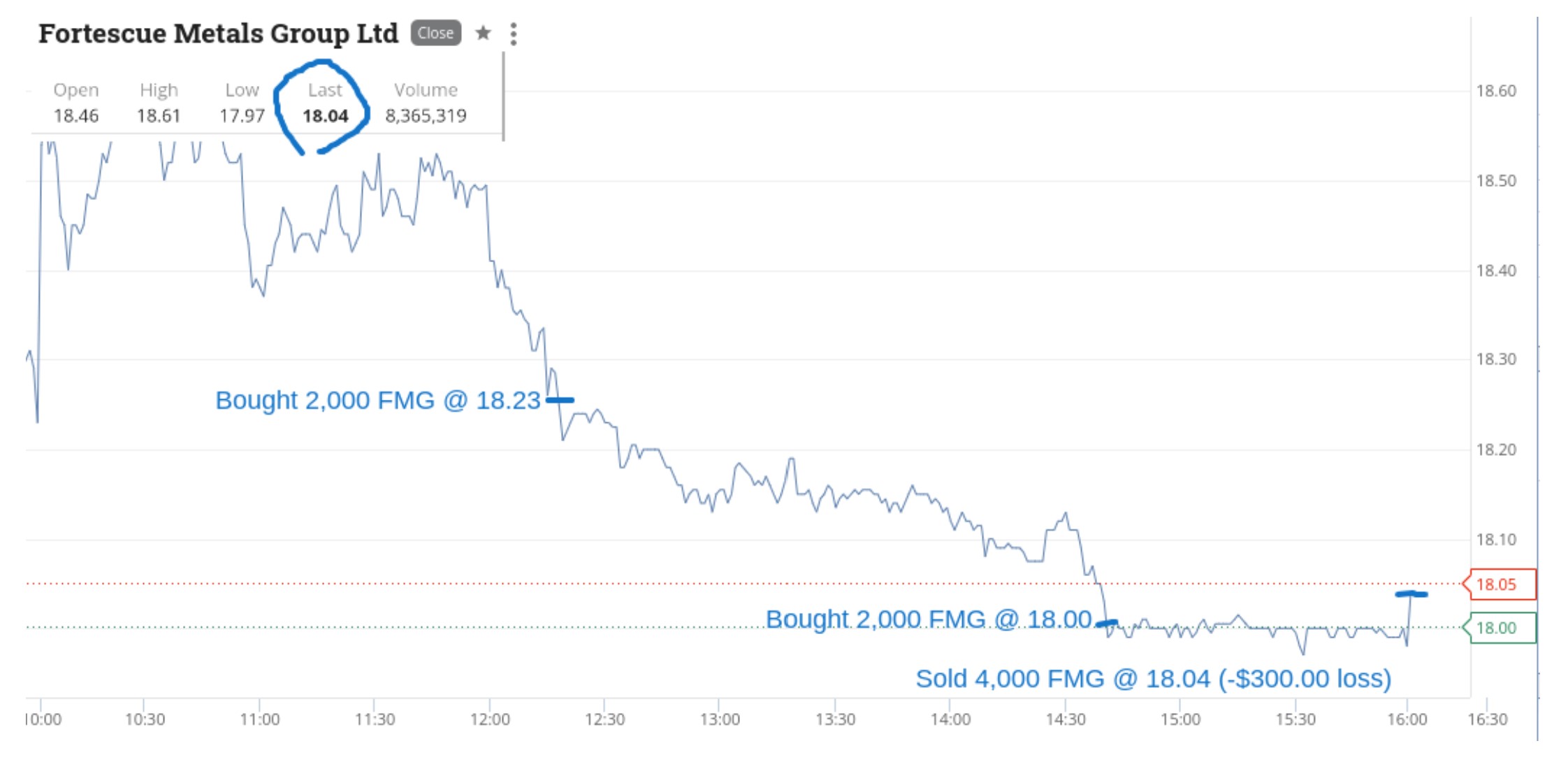

Here is an example from March this year, when I had to cut and run:

Now in this case, the stock had already fallen 38c from its day’s high on the first trade and then 61c on the second trade.

I was obviously thinking it would bounce from $18.00 and could have doubled the size on the second trade, but time was against me.

Having only an hour to go on the second trade to come good made me keep to the same size. Leaving it in the hands of the 4.10pm matchup was a bit risky but I thought in for a penny, in for a pound. It worked a bit in my favour but that is not always the case.

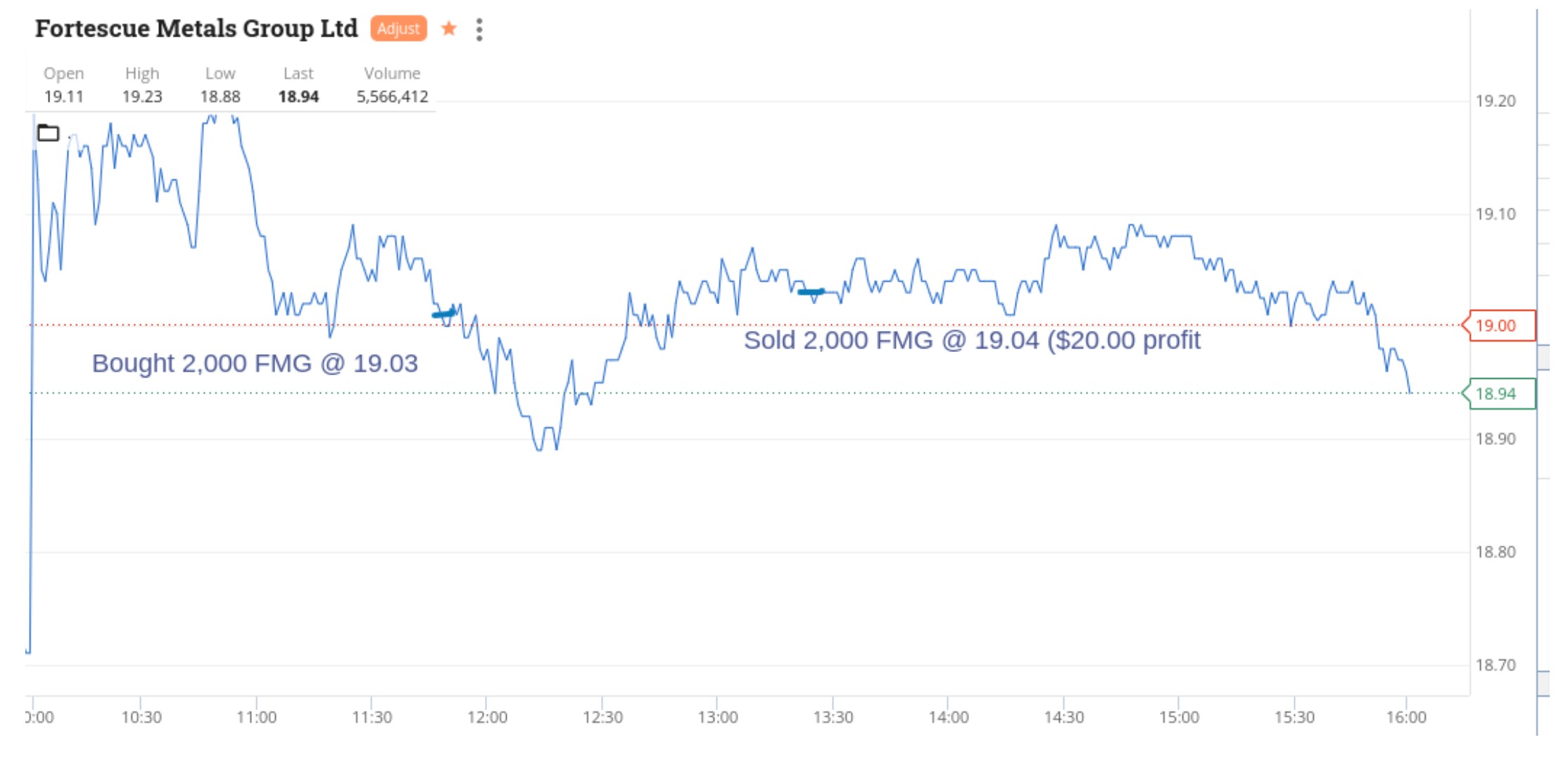

A week later I had another go at FMG. This was the result:

Wow, a $20 profit, with the stock a $1 higher than the previous week.

Next trade in them resulted in this:

Then this:

Now my size is smaller and I missed out on a 30c ride but my confidence is getting back. I was still doing okay in other trades, it was just FMG I was having a personal battle with.

Next trade three weeks later:

I remember thinking that $20 must be a good level, as they had been $2 or $3 higher in the last three weeks and on that day they were 78c off their high.

The amazing thing of keeping and publishing these charts every week is that each one captures a stock in a day’s trading moment.

Going back over them doesn’t really mean very much, other than giving real examples of what can happen in a day.

Over a total year, I reckon that I would have made more than I had lost in FMG and they are one of only 10 on my watch list.

Spreading the love around to other stocks certainly helps to level out the profit and losses.

I’m back today from my break and who knows, I may just have a dabble in FMG, which may or may not ruin my holiday.

Cheers,

BP.