Less miners, more Resmed: T.Rowe Price is overweight Australian equities, but prefers quality over cyclical

News

News

As the world heads towards more lockdowns, it’s becoming apparent that we may have passed the peak of global economic rebound.

Uncertainty over the coronavirus could present short term risks globally over the next year – which includes higher inflation, interest rates and taxes, and a fall in GDP.

Against this backdrop, global fund manager T.Rowe Price says it will remain underweight on equities relative to bonds and cash, as the risk/reward profile is now looking less compelling for stocks.

But despite this global view, the fund manager has in fact retained its ‘overweight’ position on Australian equities.

According to T.Rowe Price head of Australian Equities, Randal Jenneke, rising global commodity prices and higher yields had favoured our two largest sectors, mining and finance.

But as the Australian economy decelerates, Jenneke says that a return to “quality stocks” from cyclical stocks could be in play.

In June, the ASX 200 outperformed both developed and emerging markets for the second straight month in local currency terms.

Jenneke notes the present environment tends to favour stocks with certain characteristics and quality.

“We’re looking for qualities such as strong return on capital, and resilient earnings growth,” he says.

“Indeed this is what we’ve been doing in our portfolio, increasing our exposure in select healthcare names such as Resmed (ASX:RMD), as well as adding Goodman Group (ASX:GMG), and Carsales (ASX:CAR),” Jenneke said.

“Our experience and research data have taught us that holding quality stocks over the longer-term not only benefit performance, but also lower volatility.”

Resmed’s share price has been rising by around 15% since its major competitor in the US, Philips, announced a recall of of its sleep apnea breathing machines and ventilators in June, due to faulty foams in some devices.

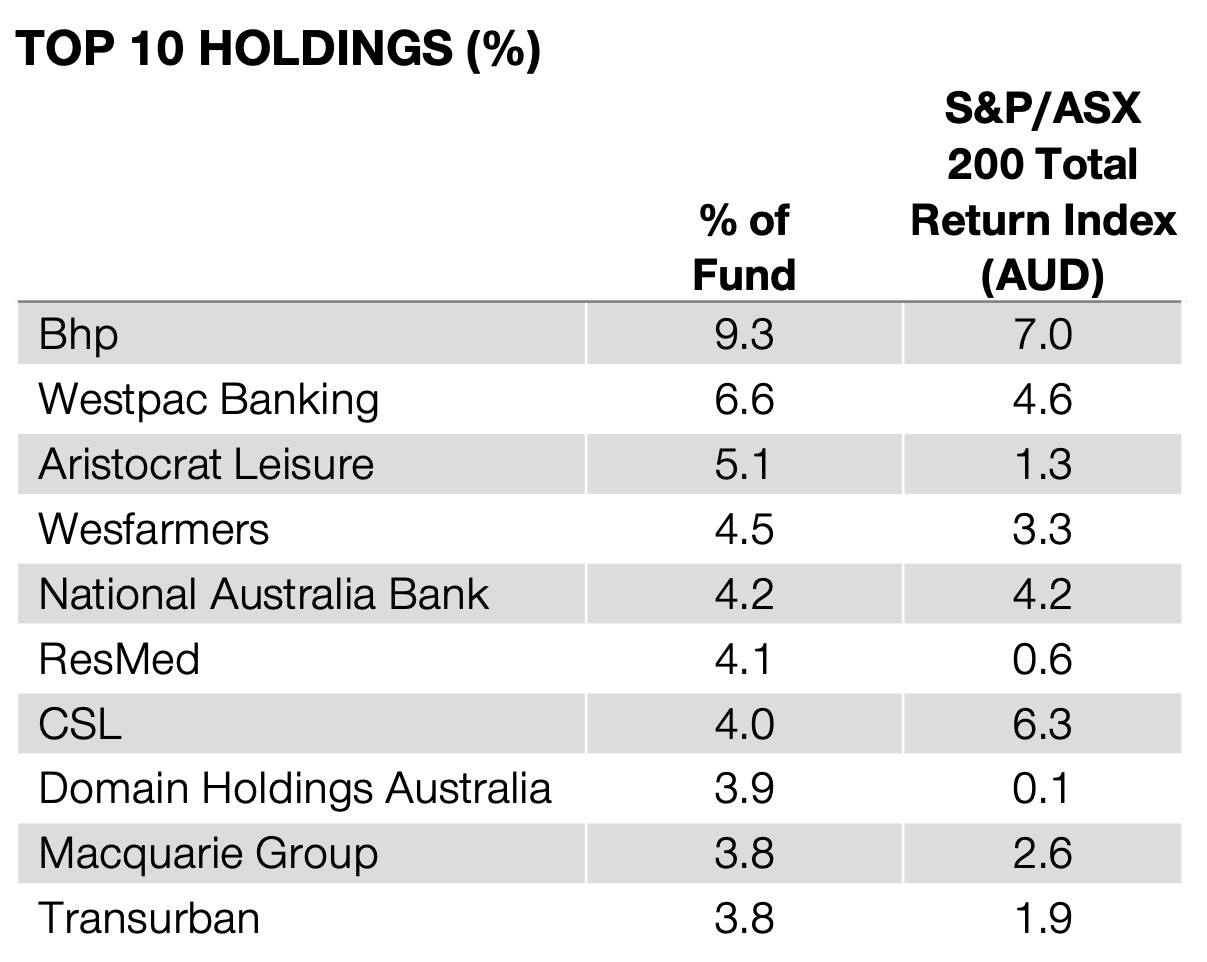

In line with the shift, Jenneke has trimmed positions in the ASX’s two largest sectors – banks and miners – which are now underweight in the T.Rowe Price portfolio.

In place of cyclical and value stocks, he’s adding positions in quality and growth.

“More recently we have been increasing our exposure to high quality companies and funding this by taking profits in financial and mining names,” explained Jenneke.

Jenneke believes this portfolio is well positioned in cyclical and recovery growth, and has tilted the positioning more towards domestic exposures to reflect the good economic performance of the Australian economy.

“While we expect a choppy market environment, we believe quality growth stocks should do well, particularly when growth and inflation decelerate from the expected near- term spike.”

Jenneke says there are early signs of inflationary pressures seen in the housing and construction markets, where a bubble seems to be forming.

Recent data from CoreLogic does show that Australian home prices are experiencing a boom not since the 1980s.

In June, national house values rose by 1.9 per cent, following a 2.2% increase in May.

Compared to a year ago, home prices nationally have surged by 13.5 per cent, driven by the ultra low borrowing rates, stimulus payments, and solid employment growth.

Despite this massive jump, the Reserve Bank has decided to keep the cash rate at an ultra-low 0.1 per cent until 2024.

But Jenneke offers a word of warning.

“We believe the RBA might change its policy guidance abruptly as it upgrades economic forecasts. Beware of a U-turn.”

Jenneke also said that ongoing tensions with China are lurking as a potential catalyst for longer term issues for the economy.

China accounts for more than a third of export dollars earned by Australia, and some experts believe the impact to the Australian GDP from a prolonged trade war could be as high as 6%.

It could also affect the disposable income per capita in the country by as much as 14%.