Kick Back: The biggest stories you might have missed on Stockhead this week

Pic: d3sign / Moment via Getty Images

Headlines, huh?

Let’s compare the pair. Google “elon musk lost billion“.

You’ll get a sense of what turns humans on. Literally tripping over each other to finally hear what they always hoped would happen to that guy who dared to think he could fly closer to the sun than everyone else. Lol, wanker.

Not so interesting: how he made it all back. Overnight.

You might notice a slight change in tone and quantity.

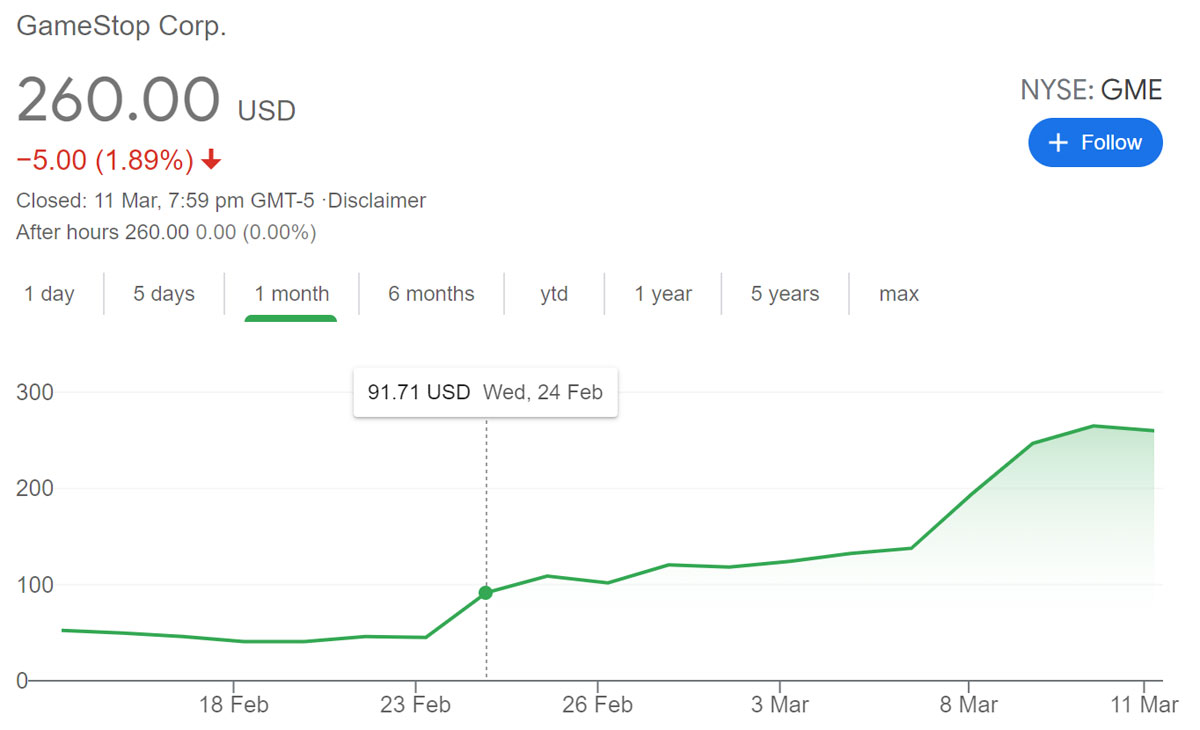

What about that GameStop clown who could have made $US22 million but he was determined to “hodl” with his “diamond hands”?

Hahah- oh, wait…

Remember it was just two weeks ago when GME champion DeepF..kingValue was hauled in front of US Congress and used the opportunity to encourage the kids to buy more GME.

SOMEBODY STOP HIM! HE’LL BREAK EVERYTHING!

If you’d taken his advice – and many clearly did – you’d have been about 650 per cent up today.

Then, suddenly…

Digital artist Mike Winkelmann became one of the top three most valuable living artists, after his piece “The First 5000 Days” sold for nearly $US70 million.

It’s the first non-fungible token (NFT) to be sold by Christie’s. The first.

Laugh or cry – Winkelmann told Insider that until recently he’d never expected to pull $1000 for one of his digital pieces. And the punchline? It’s called “5000 days” because it’s just all his 5000 digital art pieces smashed together.

Le sigh. Or, as Beeple himself put it:

holy fuck.

— beeple (@beeple) March 11, 2021

The kids are having fun. Leave them to it. The world is changing before our eyes and there’s nothing you can do about it.

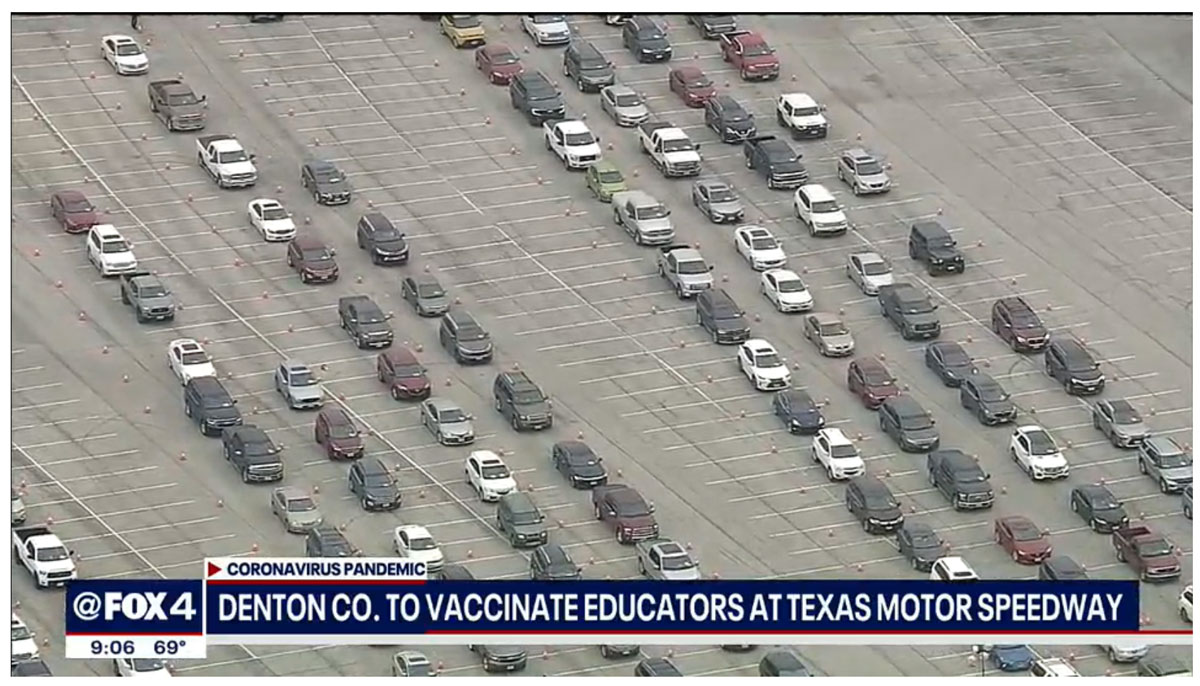

Even vaccinations have become breathtaking in the US, which – whatever you may think of that mad, dangerous, beautiful country – never, ever leaves anything in the tank.

This is how you vaccinate 2 million citizens a day, US-style:

That’s leadership.

Still no cure for institutional sexism though – happy, uh, International Womens Day, burger fans:

Yes, that was actually posted on International Womens Day.

Here in Australia, we did what we do best – follow the US up, down and around, and ended the week not far from where we started it.

In the gaps, there were some cracking and essential reads right here, on Stockhead. To wit:

Emotional investing is costing you money – here’s what to do about it

Do you pile into stocks when they’re soaring, and ditch them when they plummet?

Oops. That’s actually the opposite of what you should be doing.

Behavioural finance experts Oxford Risk say emotional investing costs investors around 3 per cent in lost returns a year over the long-term. And in the current wild stock market environment, it could be lot higher.

Everywhere you look it feels like a gold rush is on. Yet every time you jump in, the gold rush is on somewhere else.

Don’t panic – you’re just falling into the “Behaviour Gap”. And there’s a couple of simple steps you can take – including not hitting Refresh on those prices every 5 seconds – that can help you get a life again, and make the money you think (confirmation bias can be a bitch) everyone else is making.

No, really – here’s why “don’t panic” is literally the best investing advice anyone could receive.

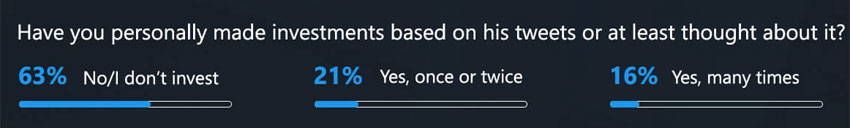

37pc of American investors use Elon Musk tweets in their decision-making: survey

Or you just do what 37 per cent of American investors do – ask Elon Musk.

Here are the results from a Piplsay survey of 30,400 Americans (ie enough to take it seriously):

And retail investors are about to pour $US30 billion of stimulus money into US markets.

We are Rome before the fall.

How to profit from the ‘biggest reopening trade since World War 2’

Everyone’s talking about yields and inflation. And earlier this week, there was even a little bit of related market action – especially in the US where tech stocks got sold off, heavily, for a couple of days.

Then they didn’t.

But value stocks are slowly, surely, climbing off the mat, if only because they just have to, eventually. Some time.

Pro investor (he loves it when we call him that) James Whelan said there’s a “battle between the bond market and that rerating of equity valuations to the downside”.

In fact, sticking to the war theme, he says markets are now adjusting for the “biggest reopening trade” since World War 2 ended.

We can’t be bothered researching that, but it sounds like a big deal. But not a surprise, says Whelan, and he’s already positioned for it, because he’s a pro.

Here’s where Whelan’s positioned himself for when things go boom.

Guy on Rocks: Junior miners take a hit as investors flip the switch to ‘risk off’

Here’s the gold prediction you’ve been holding out for. US natural resource investors Goehring & Rozencwajg have a prediction for gold to be at $US15,000 per ounce at the end of the gold cycle.

Phew. Guy le Page likes it.

As would anyone who has watched gold sink more than 12 per cent over the past six months.

(You might want to note that Goehring & Rozencwajg have also flagged – as a boost for gold prices – “a flight of capital from Bitcoin”.)

But there is hope, Guy says. And it’s linked to silver…

Also in last week’s bumper edition of Guy on Rocks, why nickel has the spooks, and whether Teflon coated American Pacific Borates (ASX:ABR) is headed for the Promised Land.

(Editor’s note: No real babies were punched in the making of the comedy film from which the image in this story was taken.)

Is inflation coming? These are the ASX stocks to buy if yields rise

So, inflation is coming. We just don’t know when.

Well, UBS does. It’s pinning its forward view on the likelihood that bond yields will rise in alignment with economic growth.

With that in mind, UBS has a category of stocks it calls “Defensive Growth”. In it are are companies that can benefit in an environment where the economy is rebounding and yields are rising.

Companies such as, not BNPL ones.

Companies such… these ones. Ha.

Directors Trades: The sellers outnumbered the buyers by nearly 10 times

So were you a buyer or a seller this week? Did you let your emotions get the better of you?

If you did, you were in big money company. Nick Sundich did his fortnightly dive into which directors bought, and parted with, skin in their own game.

And, as you might have already guessed from the headline, the hottest move on the dancefloor this fortnight has been:

There were 27 trades over $100K, and the buyers only just outnumbered the seller, 14-13. But the sellers were 10 times bigger.

And one of them was Bevan Slattery, who offloaded a cool $13 million of one of his own tech darlings.

With America vaccinating 2 million a day, here are 3 ASX medtechs that will benefit as lockdowns are lifted

So yeah, back to those 2 million Americans getting COVID-proofed every day now. More than 31 million are now indominitable, or about 13 per cent of the population. Another 61 million are halfway there, having had the first jab.

The lockdown in the US in particular has hurt several ASX small cap biotechs, putting trials on hold, limiting purchasing power, and generally setting back most traditional business practices to virtual standstills.

But it’s all coming back online, fast. At this rate, the entire country will be vaccinated by the end of June.

And these three small cap medtechs are ready to set sail again. In fact, 12 months out of the main game has produced some unexpected bonuses.

The construction tech boom is coming. These are the ASX contech stocks you’re looking for

We have all teh techs.

We have Dr Nigel Finch discusses the edtech sector in a post-pandemic world with the people from Janison (ASX:JAN), OpenLearning (ASX:OLL) and Schrole Group (ASX:SCL).

We have Tim Knapton discussing the proptech sector with the people from Archistar, Inspace and Listing Loop.

And best of all, we have Hadrian, the bricklaying robot. He’s been quiet for a while.

But Hadrian is the pin-up boy for contech. That’s construction technology, and the future of it looks like this:

It’s a disruptor in the largest industry in the world, and in 2019 VC investment in construction tech outpaced the overall VC industry 15-fold through 2019.

And now 2020 has all but been dusted off, it’s time to have a look at who’s ready to bolt again. Or, as the case may be if one of these ASX small caps gets going, who’s going to be welding 100 times faster than everyone else.

That’s quite enough for one wekk. And we didn’t even mention Bitcoin. Much.

Oh, go on then.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.