The construction tech boom is coming. These are the ASX contech stocks you’re looking for

ASX contech stocks are primed to cash in on a post-COVID boom. Pic: Getty Images

Construction — the largest industry in the world — is a notorious dawdler when it comes to tech adoption.

Too many important processes on multi-million dollar construction projects are carried out using Excel spreadsheets, PDFs, or pen and paper.

This leads to job delays, missed budgets, and increased safety risks.

Construction technology (contech) start-ups involved in 3D printing, modularisation, robotics, artificial intelligence (AI) and supply-chain optimisation are emerging to help solve these problems.

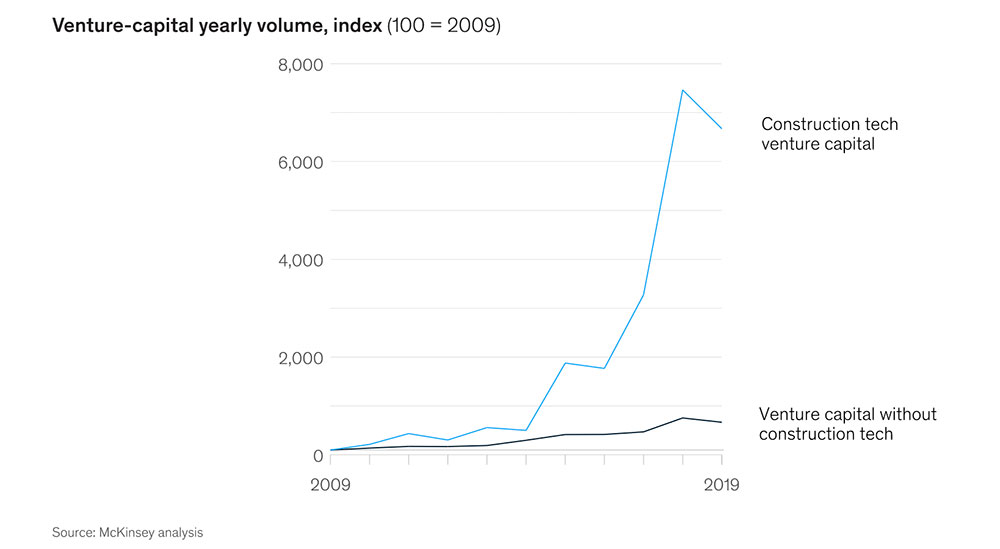

Venture capital (VC) has long seen the potential. From 2014 to 2019, VC investors poured $US25 billion into engineering and construction (E&C) tech, up from $US8 billion over the previous five years, according to McKinsey research.

“VC investment in construction tech outpaced the overall VC industry 15-fold through 2019, with clear indicators for continued momentum,” McKinsey said last year.

A nascent post-pandemic construction boom has now added rocket fuel to the contech movement.

In October last year, spending on roads, rail and other infrastructure projects received a $14 billion boost in the Australian Federal Budget.

Other major economies around the world are pouring cash into construction-led recoveries of their own.

But construction remains a very competitive environment, with margins on jobs as thin as they have ever been, Felix (ASX:FLX) chief exec Mike Davis says.

“We talk to head contractors who are out there competing for major contracts on negative margins hoping to make that back on their supply chain,” he says.

“It forces the industry to look to technology for productivity gains.

“Every per cent of productivity that can be gained – when jobs are succeeding or failing at the margins – is so critical.”

Felix, which listed on the ASX early this year, is one part of this new construction ecosystem.

It is an enterprise software as a service (SaaS) platform built specifically for construction and related industries.

“We see Aconex as a blueprint platform in terms of our aspirations,” Davis says.

Aconex, the original Aussie contech, listed on the ASX in 2014 at $1.90 per share.

Three years later it was sold in a deal worth $7.80 per share — a very nice 380% gain.

“We look to what they have achieved, and that is probably the addressable market that we are going after,” Davis says.

Felix started out as an online quoting marketplace, matching builders and contractors with suppliers and subcontractors in the market.

But the largest users of that platform delivered Felix the same message – they needed software or tech to manage ‘mission critical’ processes like third party vendor prequalification, compliance, management of supply chains, contract management and bidding.

“Everything was still being managed by paper based forms, PDFs, and spreadsheets,” Davis says.

“Everyone was working in ‘silos’ with no visibility, and poor or incomplete data from vendors.

“This causes increasing levels of supply chain risk and low productivity for contractors. We saw that as a really big problem to solve.

“Our bread and butter began with the commercial construction and engineering and construction contractors. We are now really moving into the mining services and mine builders space.”

The amount of investment in infrastructure and commercial construction is now at historic levels, Davis says.

“The increasing number of projects means increasing investment from head contractors in the industry,” he says.

“The rising tide lifts all boats. “If there are more contracts to be won, and there is more money in the industry that will mean the level of investment into Contech is increasing as well.

“Things are really accelerating.”

Other ASX contech stocks to watch

FBR builds robots for the construction sector. The first of these, called Hadrian X, is a bricklaying robot designed to build structural walls “faster, safer, more accurately and with less wastage than traditional manual methods”.

“I am confident that in 2021 you will see Hadrian X machines on many different sites around Perth. [Western Australia], building single detached, multi-storey, multi-unit and commercial structures for a range of recognised builders and end use customers,” managing director Mike Pivac said late last year.

“Perth, Western Australia will be the first city on earth to see the regular commercial use of Hadrian X construction robots to build homes and buildings for real families and businesses.”

Despite all the activity Hadrian is yet to turn a profit for FBR, which reported a $4m loss in the December half.

K-TIG’s precision welding tech is supposed to weld up to 100 times faster than a traditional TIG welder, “drastically improving the economics of metal fabrication”, it says.

It is set to enter the US$800 billion carbon steel market after successfully developing welding procedures for A516 Grade 70 carbon steel — one of the world’s most in-demand high strength, low alloy materials used in heavy industries such as petroleum, chemical and nuclear energy.

According to reports, the carbon steel market is eight times the size of the stainless steel market – valued at US$887 billion in 2019 and will grow at 3.4% per year to 2027.

K-TIG’s share price has surged 284% over the past 12 months but, like FBR, the company is yet to turn a profit.

Mastt

Founded in 2019, this unlisted startup — backed by the founders of Aconex — provides a SaaS platform “offering project owners more transparency across various projects, helping them make quick decisions without blowing out timings and cost”.

It recently raised $2.2m “to support the growing capital and infrastructure project boom bringing Australia out of a COVID-19 recession and to fuel an overseas expansion”.

Mastt clients include the Australian Army, Jacobs Engineering, RPS Group and Aurecon.

The company aims to expand globally in the second half of 2021.

“Thanks to the success of Aconex, there’s a global appetite for Australian innovation in construction technology,” Doug Vincent co-founder and CEO of Mastt says.

“We’re well placed and supported by amazing investors to follow Aconex’s footsteps both abroad and towards being a leading Australian construction technology company.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.