Guy on Rocks: Junior miners take a hit as investors flip the switch to ‘risk off’

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

“Guy on Rocks” is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Risk off

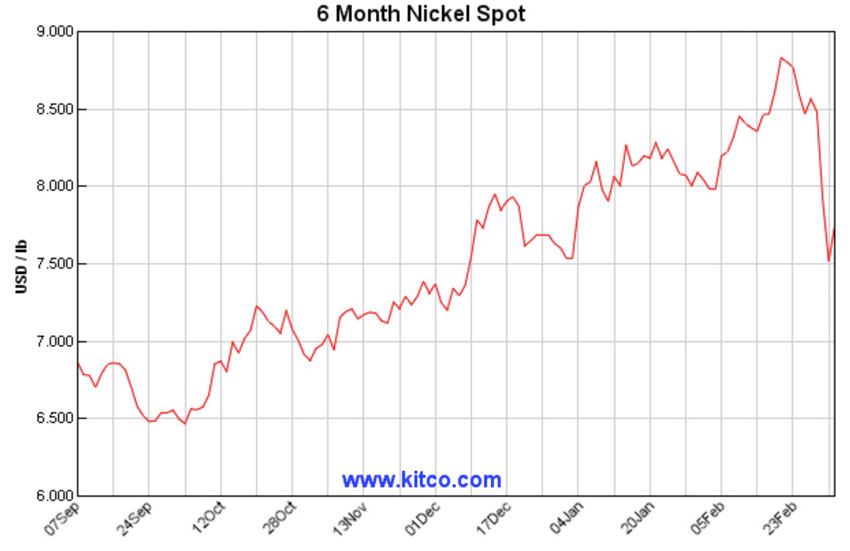

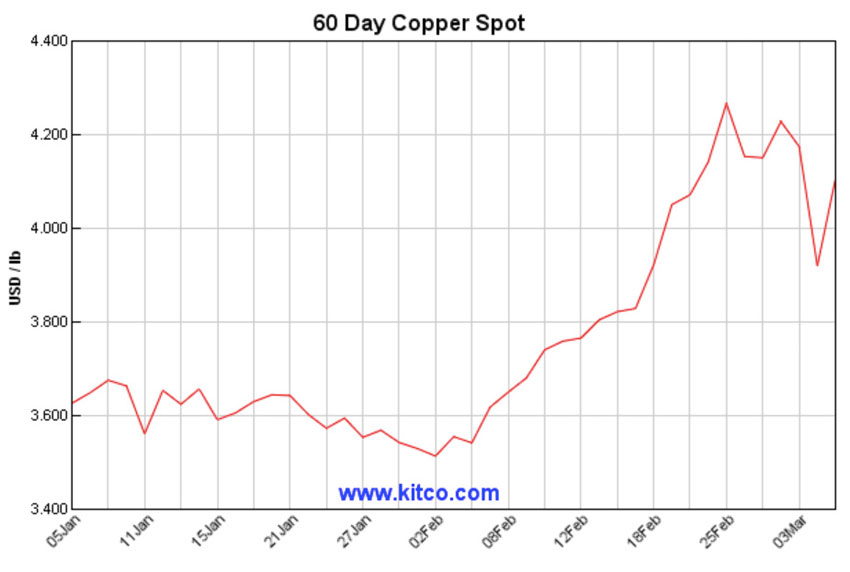

The last week has seen money flows out of risk assets with a fairly aggressive sell down late this week across junior resources. Commodities were also softer with nickel (figure 1) and copper (figure 2) off from recent highs (figure 1 and 2).

Nickel was spooked by Tsingshan’s plans to increase output from its laterite deposits in Indonesia from 600,000 tonnes this year to 850,000 tonnes in 2022 and then 1.1 million tonnes per annum by 2024.

While nickel sourced from laterite is not the preferred source of nickel for battery metals, it is likely to be somewhat bearish for nickel short term. The plan requires about 25,000 kilowatt hours of electricity to make 1 tonne of contained nickel.

The big question is, will this really happen? We have seen many bold statements on production forecasts over the years, but history has taught us that many well intended forecasts fail to materialise. The bottom line here is nickel is more than likely set to bounce back.

Recent comments by Elon Musk about using more non-nickel/non-cobalt battery technology in Tesla’s EVs by switching to lithium iron phosphate (LFP) batteries for some of its models is indicative of the real fear that companies like Tesla have over future nickel availability.

While there has been some chatter on cobalt substitution (in my view unlikely), nickel-rich chemistries in batteries are likely to remain for the medium to longer term.

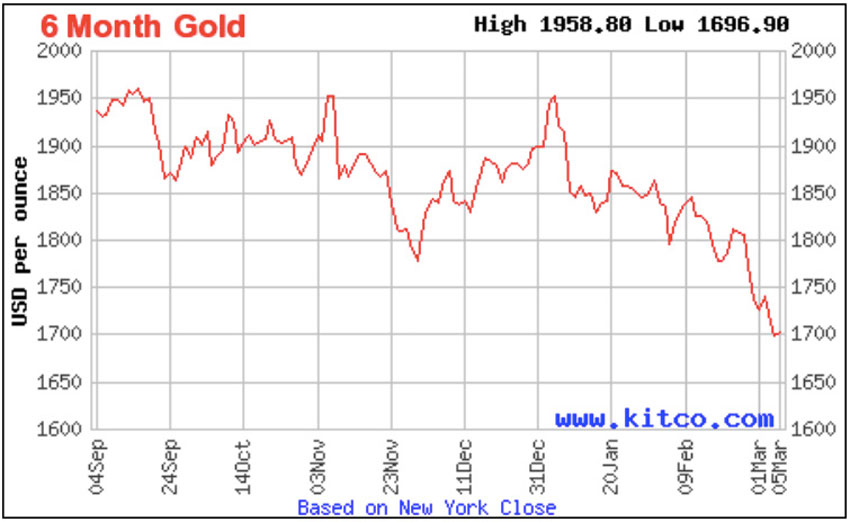

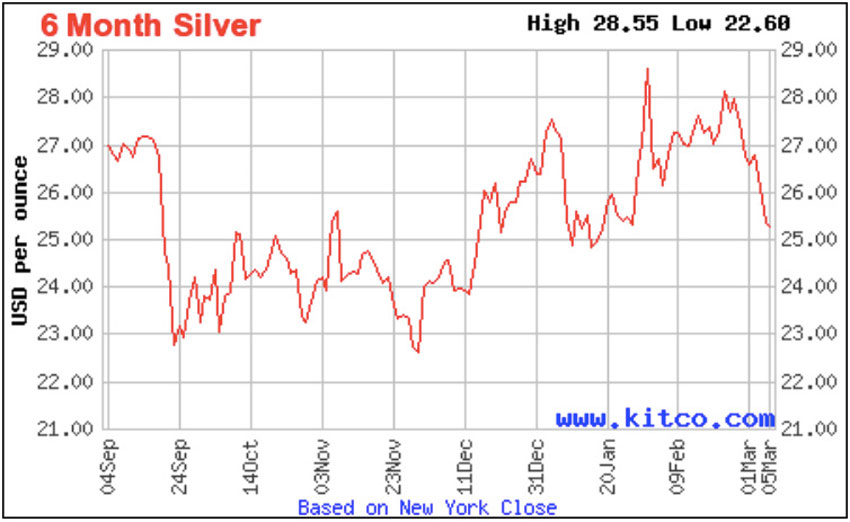

Meanwhile, gold fell below $US1,700 ($2,212) on Thursday as Federal Reserve Chair Jerome Powell continued to highlight that inflation is not a concern, however at the same time failing to address rising bond yields. But there is a school of thought that silver’s continued strength is likely to pull gold up, as we have seen in previous bull markets for gold.

At the time of writing, April Comex gold futures were trading at $US1,696.60, down 1.12 per cent on the day and 12 per cent over the last six months. Gold is down more than 12 per cent.

Goehring & Rozencwajg consider this is a corrective period for gold, highlighting silver’s performance as an indication of possible future moves in gold. “In a gold bull market, you have periods where silver lags behind gold. Silver lagged from 2016 to 2020. Then from April to July, silver had a massive move up. To us, that signalled that gold had entered a corrective phase. We’ve been in that phase ever since.”

Other shocks according to Goehring & Rozencwajg could come from rising grain prices, a flight of capital from bitcoin and our old friend rising inflation could see a reversal of gold fortunes later in CY 2021.

Their prediction for gold is $US15,000 per ounce at the end of the gold cycle. I am going to personally fund a bronze statue of these two fine young upstanding men to be placed in a prominent position in Kalgoorlie if they are right! I think a commentator last year suggested Donald Trump deserved one as well. I’m not going to argue…

Movers and shakers

The Teflon coated American Pacific Borates (ASX:ABR) appears to be moving in the opposite direction to its peers in the junior resources space at its 100 per cent owned Fort Cady borate project located in Southern California, USA.

This is one of the largest known conventional borate occurrences owned outside of the two major borate producers Rio Tinto (ASX:RIO) and Eti Maden. I first mentioned the company when it was trading at around 28c in April last year. Great call from this author.

ABR announced in February last year the appointment of NASDAQ listed Matrix Service Company (NASDAQ: MTRX) to complete the construction of phase 1A, with initial borate production on track for Q3 2021.

The company remains fully funded for phase 1A construction with $67m in cash. I recommend reading their corporate presentation released to ASX on March 2, 2021. It’s an excellent presentation that is easy to digest with some compelling numbers on page 4 (magazines usually saved their best pics for page 3) including an unlevered net present value of $US2bn for phase 3.

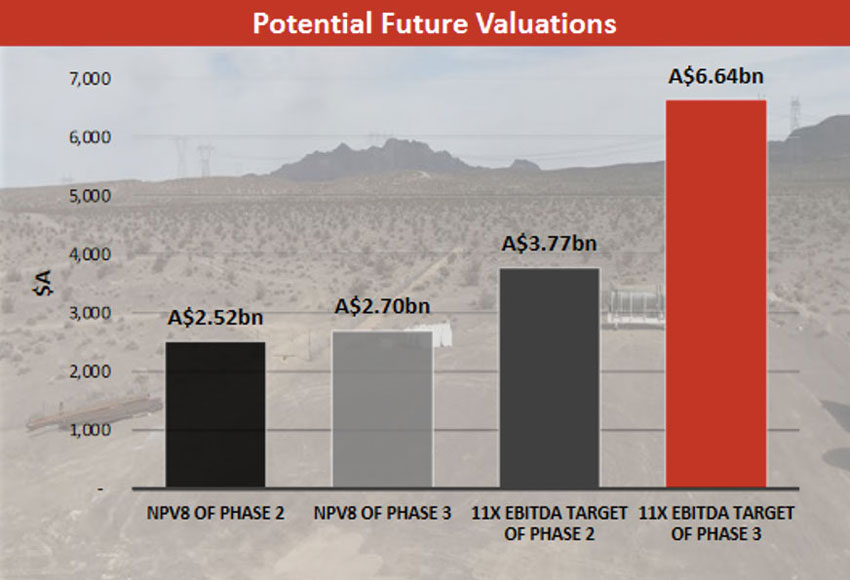

All analysts love bar charts showing their favourite company’s valuation disappearing into the heavens so I thought I wouldn’t miss this opportunity (figure 5). With an enterprise value of $660m I will let the reader do some basic maths to see where the share price could go. Suffice to say it looks like it could be heading to the promised land…

Hot stocks to watch

Speaking of the promised land, I have had my eye on Azure Minerals (ASX:AZS) for some time, however some fairly lofty valuations (figure 6) had prevented me from rolling this chestnut out.

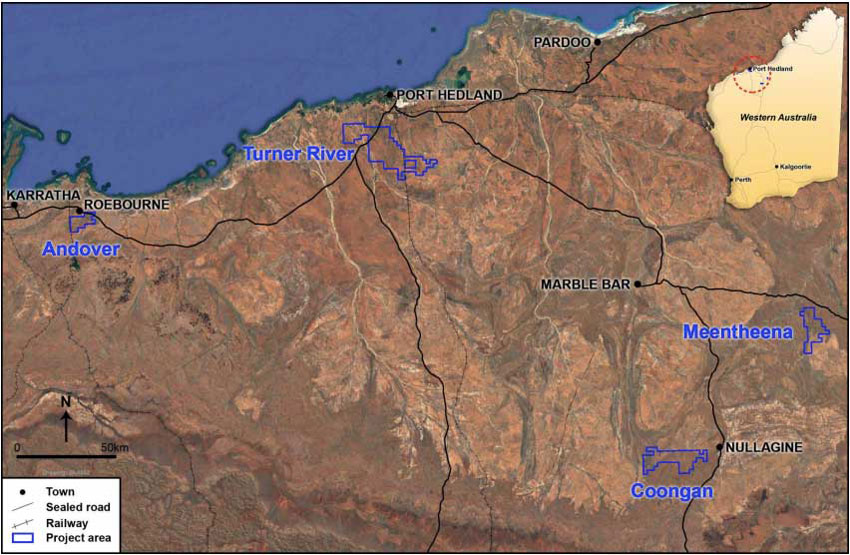

The company has an enterprise value of around $50m and $35m or so of cash (my estimate) and is busy exploring in the Pilbara on three projects (figure 7), namely Andover (AZS 60 per cent/Creasy Group 40 per cent), and the Turner River, Meentheena and Coongan gold projects (AZS 60 per cent/Creasy Group 40 per cent).

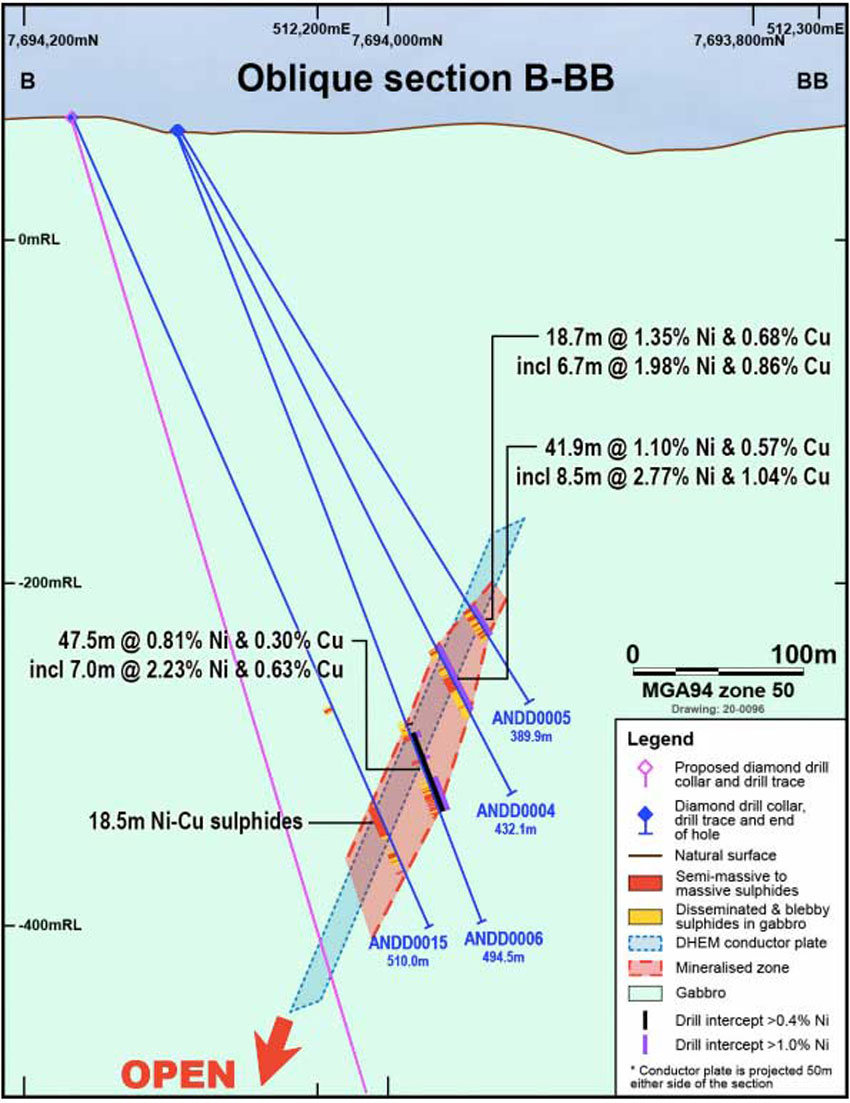

The flagship asset is the Andover nickel-copper project with electromagnetic anomalies over 1km of strike and some serious nickel-copper intersections set out below:

The recent retracement has energised me to roll this one out. The presentation (released on February 16, 2021) talks about the project as the last nickel-copper sulphide project, which may be a bit of a stretch (a bit like a stockbroker telling his last porky?), however the presentation details a multitude of electromagnetic targets which makes for some compelling reading.

While Andover has been around for some time, like the rejuvenated Carr Boyd nickel project (Estrella Minerals, ASX:ESR), recent exploration results would indicate this is the real deal and a serious contender in the near term, being spun out of the Mark Creasy stable a few years back.

For those of you who don’t know, Creasy is a struggling prospector (and mining engineer) who is in need of some luck having only discovered a couple of world class ore bodies (Bronzewing and Nova-Bollinger) over the journey, not to mention the recent nickel-copper discovery Silver-Knight in the Albany Fraser Range Province (WA).

Let’s hope we can see Mark off JobSeeker by mid-year on the back of some more compelling results from this emerging base metal play.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.