Kick Back: The biggest stories you might have missed on Stockhead this week

Oh look we're using the short shorts pic again. Picture: Getty Images

There’s no avoiding the big news this week. It’s got Elon Musk in it, and Bitcoin.

When Musk’s EV company Tesla went out and added $1.5 billion BTC, everyone rushed their corner.

Wearing the sexy red Tesla shorts, the Musk, BTC and anti-short evangelists.

There’s a whole suite of memes involving Stan’s dad Randy Marsh, the internet, and ectoplasm that sums up their week.

In the blue corner was, well.. pretty much every business journo and fund manager that has failed to buy BTC for the past 10 years. The usual rent-a-quote rollout began:

“Ooh, Bitcoin destroys the environment.”

“Ooh, Warren Buffett has 16 quotes about why it’s rat poison squared.”

“Buy real estate instead kids, you’ll double your money in eight years.”

Bitcoin, meanwhile, has doubled four times since March.

“Ooh, but it’s not real.”

Okay, buy $50K in CBA shares and one Bitcoin. At the end of the year, you keep your “real money” CBA profit and we get to give the change to a charity of our choice. Pretty sure they won’t care how it’s “made”.

Pah. It wouldn’t be a proper week unless we found something to fight about.

Eventually, something interesting got written – well, two interesting things.

One – maybe Tesla suddenly got interested in Bitcoin because a report had just come out that Teslas were failing Chinese quality control standards. Lol.

Maybe. But keep in mind Elon Musk himself has outright told buyers not to buy a Tesla at the start of their production run, because they’re prone to crapness.

At least he’s honest.

And the other interesting thing was “Australia’s favourite beer” is now… Stone & Wood Pacific Ale?

Haha, just kidding. It’s the favourite beer of news.com.au readers who take surveys by news.com.au. So, in no way linked to actual reality.

We all know it should be Boag’s Red.

Welcome to the week that was… pretty much all about EVs and Bitcoin. And beer. Here’s what you might have missed.

1. Electric vehicle sales will crack 5 million in 2021

Or, if you prefer a little ham with your sandwich:

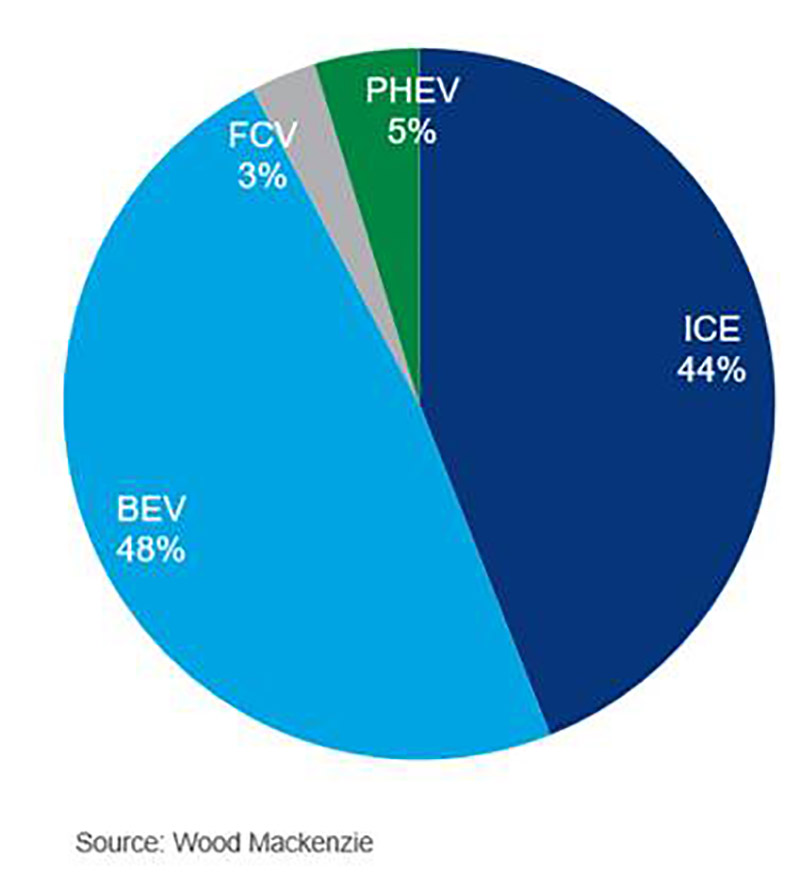

This is actually a story about electric vehicles. Because by 2050, EVs will be the dominant lifeform on our roads. WoodMac did a pie chart, so you can’t argue – look:

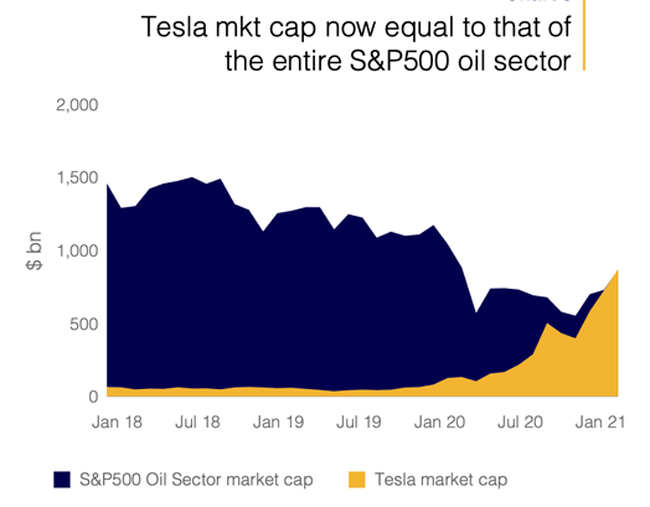

If you think it won’t happen, oops – it’s already begun. In 2020, EV sales surged 38 per cent despite a decline of 20 per cent in total car sales.

The numbers are undeniable. Also, hahaha:

2. High Voltage: Lithium-ion megabatteries will be built faster (and bigger) than anyone expected

And it’s not just cars. Stationary storage – mega batteries – are now sprouting everywhere. Remember Hornsdale in 2017?

Or rather, remember what Matt Canavan called it? “The Kim Kardashian of the energy world: it’s famous for being famous. It really doesn’t do very much.”

It did, Matt. Lots. So much so that another battery, about eight times the size of Horsndale, is about to be built in the NSW Hunter Valley.

There are three more such projects rolling out around Australia right now.

3. Magnis Energy and EcoGraf ride wave of lithium-ion investor interest

It goes on. Lithium-ion battery company Magnis Energy Technologies (ASX:MNS) has doubled to 32 cents per share after it raised $34m to fast-track a lithium-ion battery manufacturing plant in the US state of New York.

Its business partner Charge C4V was selected to supply its CCCV (C4V) lithium-ion battery to the US government’s Department of Energy.

Also having money chucked at it is Ecograf, which raised $54.6 million and will use it to to accelerate construction of its commercial scale battery anode material purification facility in Western Australia.

4. Build Your Own Portfolio – lithium: Experts say start with these 8 ASX stocks

No surprise then, that it’s a sea of green out there:

| CODE | COMPANY | PRICE | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP ($) |

|---|---|---|---|---|---|---|

| VUL | Vulcan Energy | 7.2 | 78 | 1130 | 3170 | $827.5M |

| RLC | Reedy Lagoon | 0.032 | 88 | 256 | 967 | $13.6M |

| LKE | Lake Resources | 0.325 | 317 | 803 | 733 | $352.7M |

| CXO | Core Lithium | 0.27 | 19 | 482 | 664 | $275.7M |

| ADV | Ardiden | 0.021 | 0 | 40 | 600 | $47.1M |

| PLL | Piedmont Lithium | 0.375 | 56 | 658 | 513 | $1.1B |

| JRL | Jindalee Resources | 1.66 | 114 | 312 | 492 | $78.0M |

| EMH | European Metals | 1.35 | 4 | 335 | 400 | $177.0M |

| LTR | Liontown Resources | 0.425 | -7 | 240 | 325 | $741.3M |

| INF | Infinity Lithium | 0.23 | 21 | 149 | 301 | $68.8M |

| AVZ | AVZ Minerals | 0.21 | 5 | 218 | 239 | $563.5M |

| FFX | Firefinch | 0.255 | 11 | 55 | 227 | $195.5M |

| PLS | Pilbara Minerals | 0.95 | -13 | 152 | 215 | $2.8B |

| SYA | Sayona Mining | 0.04 | 186 | 300 | 192 | $157.1M |

| ASN | Anson Resources | 0.099 | 183 | 395 | 191 | $84.9M |

| TKL | Traka Resources | 0.019 | -17 | -32 | 174 | $10.1M |

| AGY | Argosy Minerals | 0.18 | 50 | 227 | 147 | $193.7M |

| LIT | Lithium Australia | 0.15 | 100 | 121 | 142 | $137.4M |

| INR | Ioneer | 0.425 | 35 | 270 | 136 | $741.8M |

| GXY | Galaxy Resources | 2.48 | -14 | 99 | 132 | $1.3B |

| GLN | Galan Lithium | 0.525 | 30 | 239 | 128 | $129.4M |

| MIN | Mineral Resources | 37.34 | -8 | 33 | 122 | $6.9B |

| LPD | Lepidico | 0.026 | 44 | 225 | 103 | $134.9M |

| ORE | Orocobre | 5.01 | 0 | 57 | 46 | $1.7B |

| PSC | Prospect Resources | 0.19 | 12 | 31 | 21 | $61.4M |

| ESS | Essential Metals | 0.13 | 41 | 24 | 8 | $26.1M |

| LPI | Lithium Power International | 0.31 | 15 | 59 | 7 | $89.9M |

| EUR | European Lithium | 0.071 | 31 | 45 | -13 | $68.5M |

| HWK | Hawkstone Mining | 0.045 | 309 | 181 | 800 | $72M |

| CXO | Core Lithium | 0.265 | 22 | 511 | 686 | $265.64M |

And no surprise that we get this kind of message on our Facebook small caps chat page every. Single. Day:

But we’re not allowed to tell you our secrets, because we’re not a licensed financial advisor.

We are, however, allowed to facilitate the sharing of advice. And trust us, you are much, much better off listening to real experts than a journo. Journos are boozy, and loose.

So, you want a lithium stock, have about $5K for a starter kit, and don’t know which one to spend it on?

How about eight of them?

Here’s what Niv Dagan, from Peak Asset Management, and Gavin Wendt, founder of MineLife, would do with that $5,000.

That’s free, for you. You’re welcome.

5. Iron ore market seen as the cornerstone of a new commodities super cycle

Let’s just put the Musk BTC part on hold a little longer, because we don’t like to see readers get too excited about their new age investments.

Especially when this is actually our most popular post of the week, by some margin.

Ah, that iron ore price. This is what happens when phrases such as “chronic underinvestment in new mines” start to get thrown around. You get talk of a “super cycle”.

And now, many market experts are seeing the early signs of a new super cycle in commodities, including iron ore, that “could equal the wild ride that prices experienced in the 1970s and 2000s”.

(Note: It was a good ride, kids.)

Goldman Sachs’ global head of commodities research, Jeffrey Currie, in a recent speech, gave out the bank’s price target for iron ore – $US150 per tonne ($197/tonne) for the first half of 2021.

Fill your boots for another four months, iron bulls.

In fact, Morgan Stanley went several levels up. It’s laid out a ‘plausible scenario’ in a report last week of iron ore prices trading at more than $US165 per tonne ($216/tonne) for a three-year period out to 2024.

Here’s what it means to be caught up in a market deficit.

6. ASX thermal coal ‘rapidly finding new homes’, touches 20-month high

If you don’t like that, you might want to skip this one. Thermal coal prices hit a 20-month high this week.

Ironically – and we don’t use that word lightly – it’s because we need it to warm the globe. Or at least, the cold bits of it in Japan and South Korea, with their heat and energy demands in a particularly bitter winter.

This isn’t your regular 5,000 kcal/kg coal though. It’s the good 6,000 kcal/kg stuff. And the price rise is linked to the rocketing price of LNG.

7. New data confirms ASX trading signups are surging — should retail investors be wary?

Aussies are finding out about this “day trading” thing.

That’s a worry, because Aussies are awful at making sensible decisions with money when faced with the triple headwinds of FOMO, YOLO and headlines about 4,950% rises in something called a “meme stock”.

Because who cares, right? Janice at the golf club who’s 57 but still plays off 9 – although they say she kicks her ball out of the long grass – made more than $6,000 last week off her lithium stocks. And she’s just hired a cleaner, even though she’s retired.

Bitch.

Then there’s a couple of other things to consider. Namely a) we’re a nation of gamblers; b) we believe what Facebook says before anything else; and c) worst of all, we’ve got about $100 billion in savings that we’ve pulled together accidentally due to being in lockdown.

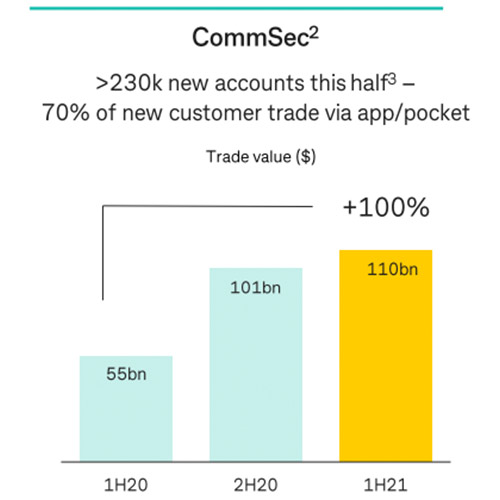

What to do with it? Well, what that snooty cow Janice is doing with it – this:

230,000 new accounts in six months, just for CommSec. If that sounds like a lot, at the height of the GameStop frenzy, US retail trading app RobinHood said it added 600,000 app downloads in a single day January 29.

Here’s what Marketech’s Travis Clark has to say on why we need to be very, very careful moving forward with this rise in trading activity.

And now, confirmation of a problem lurking ahead – quant firm Cindicator Capital has posted a job ad for someone skilled in the dark arts of reddit who can help gauge the more qualitative aspects of market sentiment.

8. Bitcoin, Elon, Doge… crypto is on fire again — so where to from here?

It started, as all Elon Musk’s headline moves start, with a tweet:

Bitcoin is almost as bs as fiat money

— Elon Musk (@elonmusk) December 20, 2020

Then on Monday,the big reveal in Tesla’s 2020 annual report (to December 31) – the electric car company had changed its investment policy and dropped $US1.5 billion on Bitcoin.

Musk followed up the news by suggesting people would one day be able to pay for their Teslas in BTC.

And so Bitcoin’s biggest week since the last one began:

From $US37,000 to $US48,000 in four days. A hefty return – especially if you own $US1.5 billion in them. What price an Elon Musk tweet, we hear you ask?

About $US445 million.

No wonder the haters got angry. Dr Doom himself said Musk should be investigated for market manipulation.

Those along for the ride dgaf. ASX blockchain tech company DigitalX (ASX:DCC) had no market-moving announcements, but its shares rose by as much as 21.74 per cent in early trade the day after the news broke.

It holds 215.95 Bitcoins, and is actually an easy way for nervy investors to ride the crypto rollercoaster and get that “trading in real money” feeling.

The real test for the naysayers looms. There’s talk of Apple getting on board… but even Apple has some catching up to do if it wants to match Michael Saylor-led MicroStrategy (NASDAQ:MSTR). It bought an inital lot of 20,000 BTC last August, and has added to its position since to now total around 71,000 coins.

Investors have since lifted its share price from US$425 per share to $US1,272 – this year.

World gone mad?

9. Trading with Focus – Momentum. Nothing else matters

Anyhoo, if you’re jumping on the trading bandwagon, it’s handy to know there’s more to it than stonks and IPOs.

For starters, charts are not only your friend, they’re fun. Even if you’re not A NERD.

Here’s Marketech’s Travis Clark again with a quick primer on Divergence, Convergence and Stochastic Oscillators. Or, as you’ll soon be referring to them in the bar, “Stoch-Os”.

What you’re really learning about is momentum, and how to learn to trust it, and stick with a stock, dump it, or jump on board.

And here’s Steve Collette chiming in on why the chart for ETPMAG – the exchange traded commodity (ETC) on the ASX offered by ETF Securities – is a “fascinating ascending triangle”.

You know it makes sense.

See you next week, and thanks for being a Stockhead.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.