Kick Back: The 10 biggest stories you might have missed on Stockhead this week

Why are you still at work? Picture: Getty Images

Grab a coffee. Here’s something to browse while you’re trying not to think about what you need to do today, in case it’s work.

It’s a look back at what Stockhead’s readers liked most this week, and a couple of things our analytics say they didn’t.

Analytics – pfft.

1 – Dairy formula: Who’s dabbling in it right now and are they exporting to China?

Every time our schedule says it’s time to look at white gold, we think surely there’s not a lot more to be read about it.

And every time, we’re wrong about that. Especially when you can rely on a company such as Bubs (ASX:BUB) racking up year-on-year sales in China.

By, ooh, 2,281 per cent.

And we get to run the Moss milk gif again.

2 – Just 3 of 19 small cap ASX tech hardware stocks are winning – and one’s about to jump ship

This one’s a smokey. It’s all in the lead:

“When it comes to hot-spot sectors among small-cap ASX stocks, tech hardware companies rarely rate a mention.”

Maybe they should, because there are actually a solid number of them, and most are really not doing well at all.

And the one that is – Netcomm (ASX:NTC) – up 40 per cent for the month, is only up 40 per cent for the month because it looks like it’s about to be taken over by the NASDAQ-listed Casa Systems.

Can any of the rest turn things around? Pitt Street Research managing director Marc Kennis thinks so.

3 – Why didn’t all of those Queensland gas takeovers happen last year?

There are days when things just work. Dropped toast lands the right side up, England is humiliated in a sporting contest somewhere, and stock photos are actually a) relevant, b) hilarious and c) photos of stock:

Seriously, if you had a choose a vegetable to represent Queensland…

And then you get to stay for a rundown of why all these Queensland gas takeover targets actually didn’t get taken over like analysts said they would after a flurry of deals in the first half of 2018.

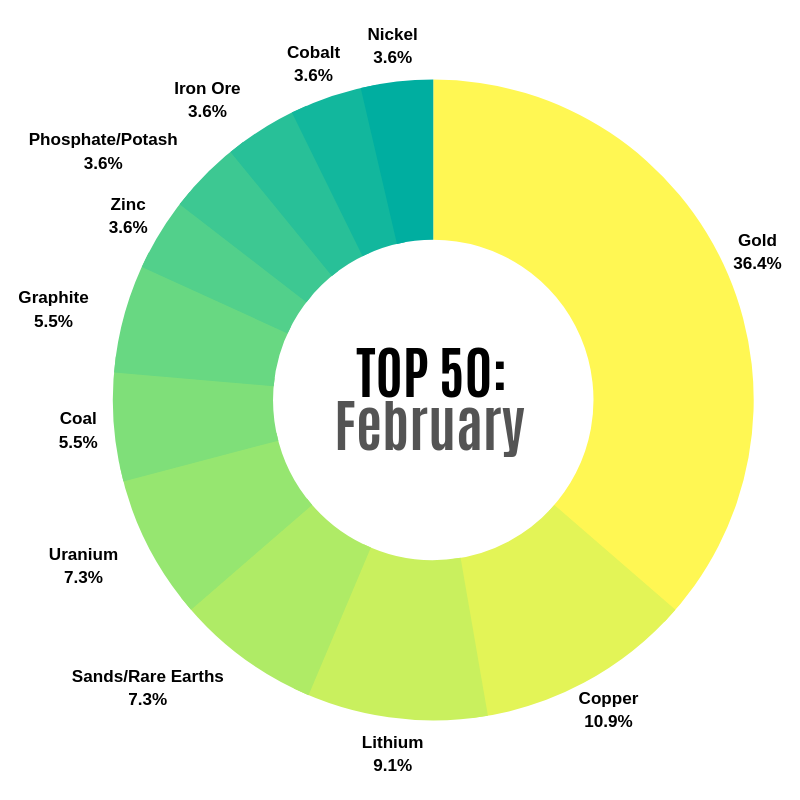

4 – Who made the gains? Here are February’s top 50 small cap miners and explorers

“The last quarter of 2018 no longer haunts us,” Reuben Adams wrote. “For now.”

He’s right. While the short term outlook for cobalt looks “sh*&house”, copper, nickel, gold and even lithium are all heading in the right direction for our junior miners and explorers.

A great example was Perpetual Resources (ASX:PEC), which was just kicking up dust for a while until it took an option to acquire a WA silica sands project.

Result? Stock up 221.5 per cent for the month.

Here’s a nice look at what’s hot:

5 – ‘Google Maps for earth’s crust’: Bill Gates, Jeff Bezos fund search for cobalt using digital prospecting

Even if cobalt is on the smelly side, get in quick if you want a stockpile, because there won’t be a lot of it around in 2023.

You can add Ray Dalio’s name to the other two cash monoliths who want all the rest of the cobalt.

Gates and Bezos have enlisted some disruptive technology called Machine Prospecting to find it all and are rolling the eight-sided dice on a new venture they’re calling Kobold Metals.

6 – Why this nine-time Young Rich Lister joined the board of a $14m adtech

Mark McConnell told us he thought long, and hard, and then a bit longer about joining the board of $14 million adtech Adveritas (ASX:AV1).

But he did, eventually, and given he’s a nine-time Young Rich Lister worth “somewhere in the ball park” of between $100 million and $200 million, chances are he’s onto a winner.

“I couldn’t find another company anywhere in the world that is doing what they are doing,” Mr McConnell told us.

Which is what, exactly? Yes, we’re going to make you click here.

And here, again, for his three pieces of advice for traders. Ha.

7 – ASX cannabis stocks right now: here’s everything you need to know

Finally, the growth strategies are working and the Office of Drug Control is clearing some paperwork to allow Australian pot companies start making some actual cash.

THC Global, for instance, bagged $815 from a resin sale recently.

There are 13 pot stocks on the ASX that are neck-deep in the cannabis business, and a couple more than that which dabble in related products and services.

Things are looking up, it’s not too late to get on board, and this guide to what to look for is a great start if you’re interested.

8 – Check-up: What’s happening with the ASX small cap health stocks?

Daniel Paproth’s monthly look at the 140-odd small cap health stocks stuck around in the top 10 for a second week.

But who isn’t watching the drama around Factor Therapeutics (ASX:FTT) right now? Factor is the company which lost 97 per cent of its value last year when its venous leg ulcer trial failed to show any improvement over standard of care.

It’s coming back, along with another busted-trial victim, Bionomics (ASX:BNO). We love a battler.

And we noticed a common factor for the biggest losers in the past month – they all reported financial results that have been met with skepticism from investors.

9 – Here are 4 things people get wrong about the ‘murky world’ of lithium-ion battery manufacturing

Wut. People get things wrong about the EV revolution?

BloombergNEF head of energy storage Logan Goldie-Scott has had enough.

So here he is, clearing the air on four of the biggest fallacies that, if you can see them for the bollocks they are, will be key to successfully managing the EV transition.

Sorry, battery prices won’t fall faster than forecast.

10 – This small cap biotech proves it is possible to have more women than men on a board

Entering the top 10 after being on the site for less than a day is about as impressive as any picture with IMF managing director Christine Lagarde looking like she’s spelling something out in simple terms for… someone. Which is just about every picture of Christine Lagarde.

This story about a small cap biotech proving it is possible to have more women than men on a board is on our charts with a bullet right now.

It’s International Women’s Day, and there are stats that say boards with a more than 30 per cent make up of women make more cash, if you really insist on arguing.

But don’t actually – ever. Because there’s no good reason for low representation of women on our boards, and an increasing number of strong female role models like Anatara Lifesciences (ASX:ANR) and Novita Healthcare (ASX:NHL) chair Sue MacLeman proving it.

Bonus – Captain’s Call

Here’s a couple that slipped through to the ‘keeper.

Gold is always exciting, but visible gold is best – especially when it comes from an old minefield. Revisiting old holes with new tools are our favourite plays right now, mainly because they’re a bit romantic.

AuStar (ASX:AUL) got excited at McNally’s Reef, and rightly so, because of this:

McNally’s Reef is at Victoria’s Morning Star operation, which produced some 800,000 ounces at an average grade of 26.5 grams per tonne over its life. Anything over 5 grams is considered high grade.

And one grading at McNally’s in the past returned 937.5 grams per tonne. That’s about $60,000 if you’d prefer us to do the math.

Here’s another one. Barry FitzGerald ran his ruler over Spectrum (ASX:SPX), which recently acquired the old First Hit gold mine, 50km west of Menzies, WA.

But the real interest lies in what it might have found at Penny West, which it picked up shortly after the First Hit acquisition.

Shareholders were waiting on some potential early success as the company went into a trading halt a week ago, waiting on “preliminary exploration results”.

And when the news came, it wasn’t too shabby.

That’s all.

See you Monday, anyone not in Tasmania, Victoria or South Australia.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.