Who made the gains? Here are February’s top 50 small cap miners and explorers

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

January wasn’t a fluke, with (almost) every major commodity in good spirits this year.

The last quarter of 2018 no longer haunts us. For now.

Copper is on a tear, nickel prices are up 26 per cent since the start of January, and gold continued its rise to about $1850 an ounce in Australian dollar terms.

But take your pick, most of them look good right now.

The short term outlook for cobalt still looks sh*&house, but the worst for lithium could be over as global majors release some very bullish demand projections.

Even uranium stocks, stuck at the bottom of the sock drawer for years, have been rattling their chains as the spot price recovers.

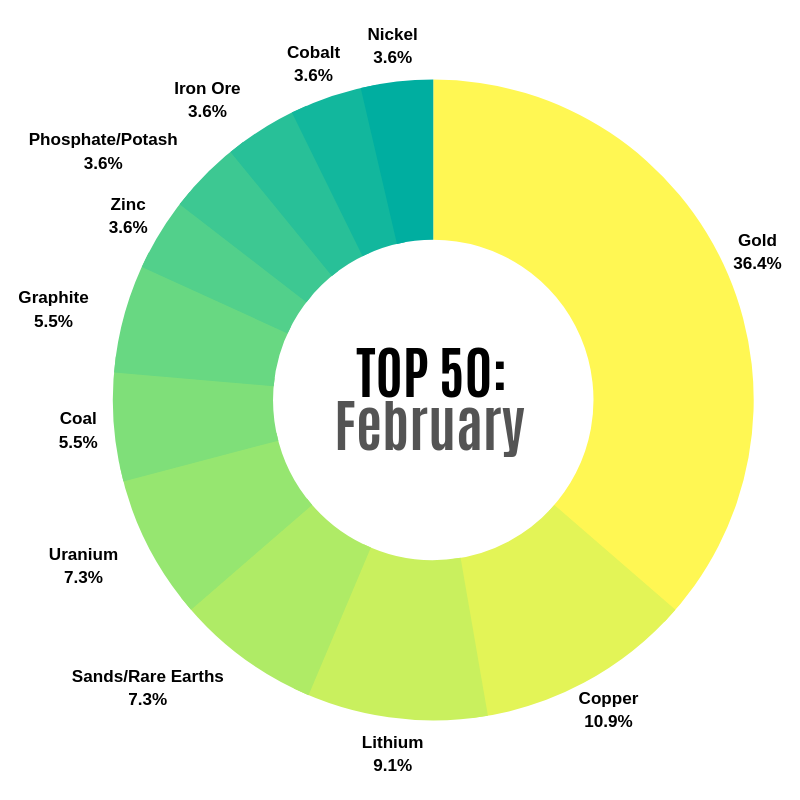

Our top 50 mining stocks for February are, once again, dominated by gold. Check this out:

TOP 50 HIGHLIGHTS

This cautious market positivity is translating into good results at the smaller end of the market.

Perpetual Resources (ASX:PEC) was drifting around project purgatory before getting its hands on an option to acquire a Western Australian silica sands project — which sent the stock up 221.5 per cent for the month.

Perpetual reckons the project could potentially produce high purity silica above 99.8 per cent. At this purity the market is relatively small and demands premium prices.

It’s early days, but here’s hoping.

Similarly, copper explorer Hot Chili (ASX:HCH) locked in an option to buy a project neighbouring two of its own copper projects.

This is not a new deal – Hot Chili announced it in early February. The company just took some time to complete due diligence before making the agreement formal.

But Hot Chili’s shares still shot up 93 per cent in a week, which was a bit spicy for the ASX’ liking.

Hot Chili pleaded ignorance — saying it didn’t know what could have spurred the sharp rise — but it kept climbing to finish the month up 187 per cent.

In late February, private miner Hancock Prospecting launched a sensational takeover offer for Riversdale Resources, which valued the unlisted Canadian coal explorer around $740 million.

This offer had an immediate effect on explorer Atrum (ASX:ATU), which has a neighbouring project called Elan.

The Atrum share price has soared from 14c to 24c since the takeover offer for Riversdale was announced; that’s a 72 per cent jump. Over the month Atrum is up 138 per cent.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

And finally, we profiled battered explorer Celamin (ASX:CNL) as a stock due for re-rate in early February.

At that time it had a market cap of $4.7m – it’s now worth almost $8.7m.

Celamin had been in dispute with its partner in Tunisia for several years over a phosphate project, but it may have got the upper hand legally.

“Its been a sleeper – waking up I hope,” said Lion Manager director and part time fortune teller Hedley Widdup at the time.

Smells like winning.

Here are the top 50 mining small caps for the month of FebruaryScroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| Ticker | Name | One Month Price Change % | One Year Price Change % | Share Price [01/03] | Market Cap [Million $AU] |

|---|---|---|---|---|---|

| PEC | PERPETUAL RESOURCES | 221.4286 | 73.0769 | 0.045 | $11,156,418.00 |

| GLA | GLADIATOR RESOURCES | 200 | -62.5 | 0.001 | $4,408,002.50 |

| HCH | HOT CHILI | 187.6035 | 2.0529 | 0.029 | $27,991,984.00 |

| ATU | ATRUM COAL | 138.0952 | 97.8022 | 0.245 | $90,207,696.00 |

| CUX | CROSSLAND STRATEGIC METALS | 100 | 20 | 0.006 | $6,069,878.50 |

| E2M | E2 METALS | 100 | 45.4545 | 0.18 | $12,113,270.00 |

| CNL | CELAMIN HOLDINGS | 84.8485 | -93.9 | 0.061 | $8,692,402.00 |

| FEX | FENIX RESOURCES | 67.5676 | -11.4286 | 0.062 | $13,199,684.00 |

| GLN | GALAN LITHIUM | 66.6667 | 257.1429 | 0.545 | $56,070,736.00 |

| IRD | IRON ROAD | 65.3846 | -47.754 | 0.085 | $59,656,792.00 |

| LPD | LEPIDICO | 62.5 | -46.9388 | 0.025 | $87,260,552.00 |

| BAU | BAUXITE RESOURCES | 62.1622 | -1.6393 | 0.06 | $12,865,340.00 |

| NML | NAVARRE MINERALS | 61.5385 | -2.3256 | 0.084 | $29,820,862.00 |

| CAZ | CAZALY RESOURCES | 61.1111 | -35.5556 | 0.029 | $6,751,752.50 |

| A1C | AIC RESOURCES | 50 | -18.1818 | 0.18 | $13,500,000.00 |

| AKN | AUKING MINING | 50 | -70 | 0.0015 | $1,398,876.75 |

| MDI | MIDDLE ISLAND RESOURCES | 50 | -59.8214 | 0.009 | $9,421,669.00 |

| CXU | CAULDRON ENERGY | 47.0588 | -34.2105 | 0.025 | $8,232,242.50 |

| G1A | GALENA MINING | 46.9388 | 57.8947 | 0.365 | $121,328,224.00 |

| TIE | TIETTO MINERALS | 45.8333 | -43.2432 | 0.105 | $24,070,300.00 |

| ODM | ODIN METALS | 45 | -45.283 | 0.145 | $22,289,304.00 |

| MEY | MARENICA ENERGY | 44.5783 | -4 | 0.12 | $8,785,475.00 |

| NZC | NZURI COPPER | 43.1818 | -1.5625 | 0.32 | $93,210,232.00 |

| BC8 | BLACK CAT SYNDICATE | 42.8571 | -46.6667 | 0.2 | $11,452,000.00 |

| FML | FOCUS MINERALS | 41.6667 | -20.3125 | 0.255 | $46,600,884.00 |

| MOH | MOHO RESOURCES | 40.9091 | 0.18 | $6,585,112.00 | |

| TMZ | THOMSON RESOURCES | 40.7407 | -15.5556 | 0.038 | $4,286,939.00 |

| ORM | ORION METALS | 40 | -86 | 0.007 | $3,346,682.00 |

| NCR | NUCOAL RESOURCES | 40 | -36.3636 | 0.014 | $10,760,574.00 |

| TLG | TALGA RESOURCES | 40 | -40.6061 | 0.51 | $106,914,400.00 |

| VXR | VENTUREX RESOURCES | 40 | 2.0833 | 0.245 | $63,363,440.00 |

| ERX | EXORE RESOURCES | 35.5932 | 48.1481 | 0.08 | $37,243,392.00 |

| EAR | ECHO RESOURCES | 35.4839 | -31.8525 | 0.205 | $115,697,896.00 |

| KLL | KALIUM LAKES | 35.4331 | 0 | 0.43 | $80,510,464.00 |

| INF | INFINITY LITHIUM | 35 | -44.1379 | 0.08 | $15,403,859.00 |

| ORN | ORION MINERALS | 34.7826 | -31.1111 | 0.031 | $58,085,740.00 |

| PGI | PANTERRA GOLD | 34.6154 | -2.5164 | 0.025 | $7,381,546.50 |

| SYA | SAYONA MINING | 33.3333 | -61.9048 | 0.024 | $41,310,240.00 |

| ARO | ASTRO RESOURCES | 33.3333 | 33.3333 | 0.004 | $5,088,389.50 |

| NME | NEX METALS EXPLORATION | 33.3333 | -16.6667 | 0.02 | $3,813,191.00 |

| SAU | SOUTHERN GOLD | 33.3333 | -20 | 0.2 | $12,513,674.00 |

| GPX | GRAPHEX MINING | 33.3333 | -25 | 0.245 | $20,956,830.00 |

| MAU | MAGNETIC RESOURCES | 32.4324 | 36.1111 | 0.245 | $46,789,332.00 |

| ENR | ENCOUNTER RESOURCES | 30.9091 | 20 | 0.075 | $18,891,006.00 |

| SLR | SILVER LAKE RESOURCES | 30.7692 | 94.2857 | 0.68 | $345,414,304.00 |

| CRL | COMET RESOURCES | 30.7692 | -60 | 0.035 | $7,886,300.00 |

| VMY | VIMY RESOURCES | 30 | -53.5714 | 0.065 | $31,503,674.00 |

| BRB | BREAKER RESOURCES | 29.8507 | -17.9245 | 0.435 | $79,469,928.00 |

| SMR | STANMORE COAL | 29.7297 | 75.6614 | 1.22 | $303,393,024.00 |

| ERA | ENERGY RESOURCES | 29.1667 | -53.3835 | 0.32 | $160,494,768.00 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.