Hancock’s $740m bid for this explorer says all you need to know about coking coal right now

Pic:Getty

“With no more tier-one operating mines for sale we could see a stronger push towards further brownfield [existing project] expansion and greenfield [new] project development,” Wood Mackenzie said of the coking coal sector earlier his year.

On Tuesday afternoon, private miner Hancock Prospecting launched a sensational takeover offer for Riversdale Resources which valued the unlisted Canadian coal explorer around $740 million.

The $2.50 share offer (which increases from $2.30 if Hancock reaches more than 50 per cent ownership before the offer closes) is 47 per cent higher than the price Hancock paid last year for an initial 19.8 per cent stake.

Riversdale’s key asset is the Grassy Mountain coking coal project in Alberta, Canada, which neighbours the massive Elk Valley complex owned by diversified Canadian miner Teck.

The confident offer from Hancock sends positive signals to investors about future demand for quality coking coal, an essential part of the steelmaking process which cannot be replaced.

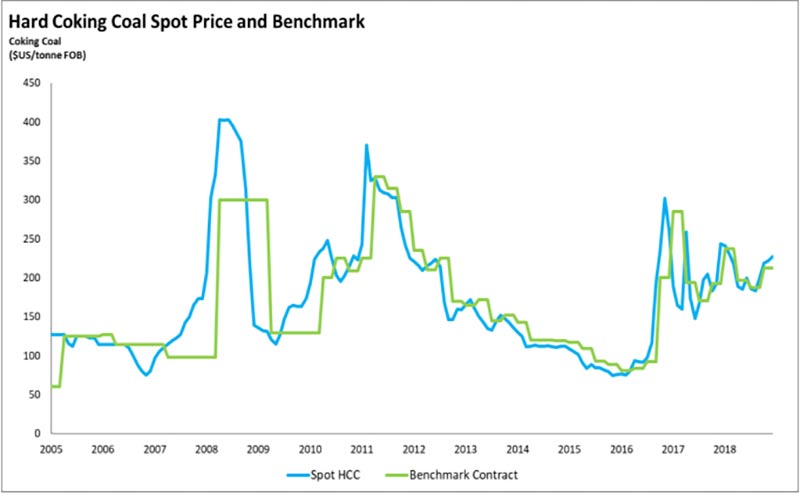

Prices have looked healthy for some time, but the long term outlook looks just as good.

In February, Teck president Donald Lindsay said seaborne coking coal prices would “remain robust” and should average about $US200/t for the foreseeable future.

Who lives next door?

There’s a cluster of Aussies explorers nearby, from private company Montem Resources with its advanced Tent Mountain project, through to listed juniors like Pacific American Coal (ASX:PAK) and Jameson Resources (ASX:JAL).

But the Riversdale takeover offer had an immediate effect on explorer Atrum (ASX:ATU), which has a neighbouring project called Elan.

Atrum’s key initial development area, Elan South, actually borders the Grassy Mountain project area.

The Atrum share price has soared from 14c to 24c since the takeover offer for Riversdale was announced; that’s a 72 per cent jump.

Grassy Mountain may be more advanced, but Atrum took advantage of the subsequent ASX price and volume query to lay out some pretty favourable comparisons between the two projects.

The coal seams at Elan are directly correlatable with those at Grassy Mountain, “having very similar physical and geophysical attributes”, the company says.

Recent test work also shows Elan South coal has Tier 1 hard coking coal properties “readily comparable to those from Teck’s nearby Elk Valley complex, and the product planned to be produced at Riversdale’s Grassy Mountain development”.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Grassy Mountain has a measured and indicated resource estimate of 195 million tonnes; Atrum has a resource estimate of 97 million tonnes (indicated and inferred) at Elan South, as part of a total project estimate of 298 million tonnes.

But the size of Elan, combined with its thick, shallow and hiqh quality coal seams, means it could potentially host “multiple, large Tier 1 hard coking coal developments”, the company says.

Atrum director Max Wang told Stockhead that drilling in the upcoming field season was aimed at growing this resource further as well as refining the resource classifications.

“Test work has demonstrated that Elan, like Grassy Mountain, contains premium quality hard coking coal and this material will continue to be in high demand by global steel makers,” Mr Wang says.

“The existing and underutilised rail infrastructure within 15km of Elan provides a clear pathway to export markets as we progress through feasibility studies and permitting in the coming years.”

READ: These stocks could benefit from the strong outlook for steelmaking coal

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.