Here are 4 things people get wrong about the ‘murky world’ of lithium-ion battery manufacturing

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

It’s getting harder and harder to argue against a future in which electric vehicles play a major role.

But there are a thousand different opinions on current and future lithium-ion battery costs, and hence the speed of the transition.

This makes removing misconceptions around the opaque lithium-ion battery manufacturing more important than ever, according to BloombergNEF.

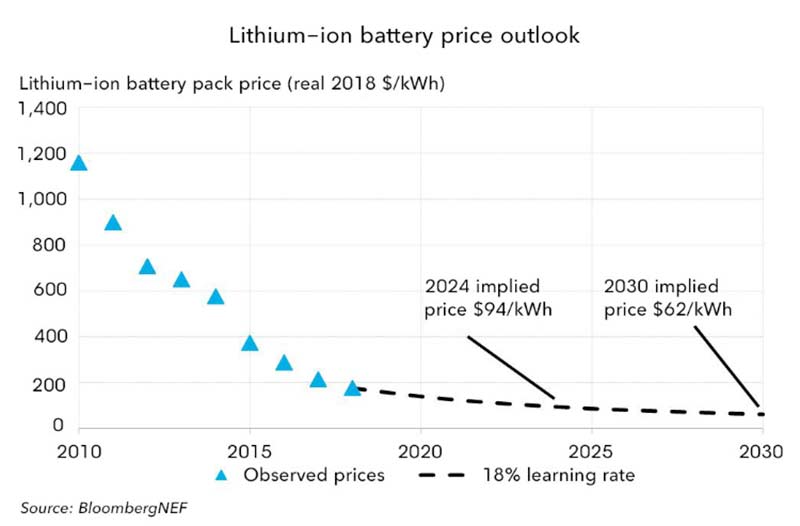

In December, BNEF’s 9th annual Battery Price Survey showed average battery pack prices falling 85 per cent from 2010 to 2018, reaching an average of $US176/kWh.

BNEF now predicts average battery prices will fall well below $US150/kWh in 2019, driven by intense competition between manufacturers and falling cobalt and lithium prices.

Interest rises every year BNEF publish the survey, and 2018 was no exception, says BNEF head of energy storage Logan Goldie-Scott.

Among the many questions and comments they receive, a few broad themes stand out. Seeing through these fallacies will be key to successfully managing the EV transition, Mr Goldie-Scott says.

So here he is, clearing the air on four of the big ones.

‘Higher metals prices will make batteries unaffordable’

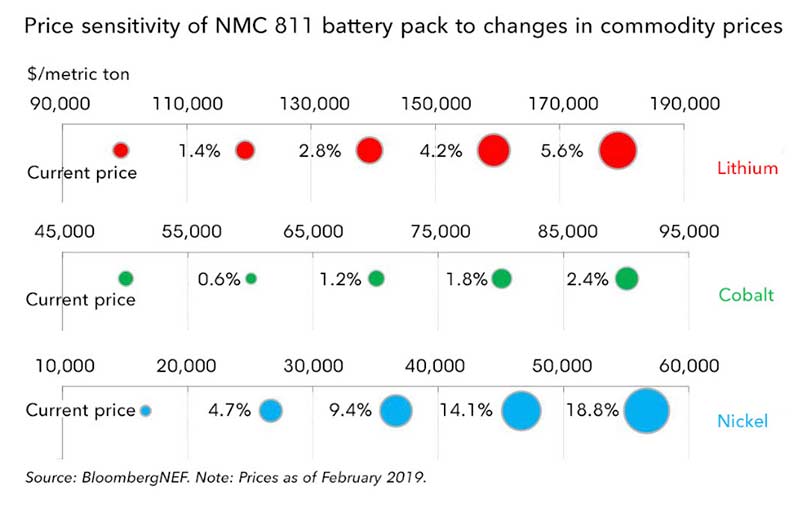

No, to a point. Battery prices are not as sensitive to underlying metals prices as many think, Mr Goldie-Scott says.

“A 50 per cent increase in lithium prices would increase the battery pack price of a nickel-manganese-cobalt (NMC) 811 battery by less than 4 per cent,” he says.

“Similarly, a doubling of cobalt prices would result in a 3 per cent increase in the overall pack price.”

Check out this handy graphic:

‘Current battery prices are lower than reported’

There are numerous examples of pack prices that are both lower and higher than the BNEF average – which is why it’s an average.

It’s also weighed by volume.

“The inclusion of Tesla’s [low] pricing has an important impact due to the large volumes the company has shipped,” Mr Goldie-Scott says.

“Other companies may have lower prices but less impact on the average due to lower volumes. In other cases, people are incorrectly comparing cell and pack costs.”

“Overall, we receive feedback that our stated number is both too low and too high and this gives me some confidence that it reflects the market reality.”

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

‘Current battery prices are higher than reported’

This misconception comes from individuals or companies midway through their own battery procurement process, Mr Goldie-Scott says.

“They often sigh with disbelief as they are unable to secure the prices we’ve disclosed,” he says.

“While unfortunate for them, they do not have the clout of a Volkswagen or Nissan when it comes to negotiations.”

(Another potential reason — demand is just too high at the moment. Kia reckons European buyers are looking at lengthy delivery times as “demand clearly exceeds expectations and current battery production capacity”.)

Vehicle type will also have a large impact on prices, Mr Goldie-Scott says.

“For example, the requirements of a battery in a heavy-duty vehicle are likely to be quite different to those in a small passenger electric vehicle, even if there are many commonalities between the two,” he says.

“The good news is that the overall industry average is falling, which will ultimately benefit them too.”

READ: High Voltage — Lithium demand ‘extremely healthy’ as Tesla rolls out $US35K Model 3

“Battery prices will fall faster than forecast.”

Historically, every time battery volume doubles BNEF observes an 18 per cent drop in average prices.

“Based on this observation, and our battery demand forecast, we expect the price of an average battery pack to be around $US94/kWh by 2024 and $US62/kWh by 2030,” Mr Goldie-Scott says.

Again, this is the average price.

“Of course, some companies will undershoot and go to the market with lower prices, sooner. Others will be higher.

“Different cell and pack designs, a range of cathode chemistries on offer, economies of scale and regional differences will ensure there is a range in the market.”

NOW WATCH:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.