You might be interested in

Coinhead

Animoca Brands reveals strong financial position as it looks to capitalise on a big web3 year

Coinhead

The Bitcoin Halving: This Time it’s Institutional – coming to a crypto portfolio near you

News

News

Welcome back to pubs, Melbourne. We know they’re everything to you.

And cafes. And, of course, the crickets. Please stay out of Kmart so we don’t have a Boxing Day Test on the Gabba freeway.

As for the rest of the world, thanks for turning our week on the ASX red. Finding the best bits hasn’t been easy.

Let’s start with something mildly interesting. If you’re old enough to remember 2006, you might also remember thinking how idiotic Google was for handing over $US1.65 billion in stock to a few early Paypal employees for their video-sharing service, YouTube.

That seemed a lot. There was talk of a dot.com bubble V2.0.

Today, that stock is worth around the $US13 billion mark, which is peanuts for any tech stock that could boast even a fraction of YouTube’s estimated 2 billion user base.

Any tech stock such as, say, Zoom, which at best last count was wobbly on claiming 300 million users.

Yet today, dotcombubble doomsayers, Zoom’s market cap passed that of Exxon’s. Zoom Video (300 million users) is now worth.

Wait for it.

It happens to the best of us. The best of you.

This week, shareholders in debt-laden lithium producer Altura Mining (ASX:AJM) watched as their investment slid inexorably into voluntary administration. And there’s not a lot they could do except watch. Not anything, in fact.

Fortunately, there might be a rescue offer in train, from Pilbara Minerals. But that still doesn’t mean AJM holders will get their money back. Because when it comes to recovering any money, shareholders are at the bottom of the heap. Secured creditors, like banks, are at the top.

Then there’s liquidation, when a company cannot be recapitalised, and assets are sold to pay back creditors. This is a ‘worst case’ scenario for shareholders, because they get… nothing. Again.

It’s all a bit grim, sorry. But you should still be fully aware of how this works before you start throwing money at ASX small caps. And there is a way out if you’re lucky – in the US, at least.

Here’s the explainer about what happens to your busted stocks, and your chances of getting anything back.

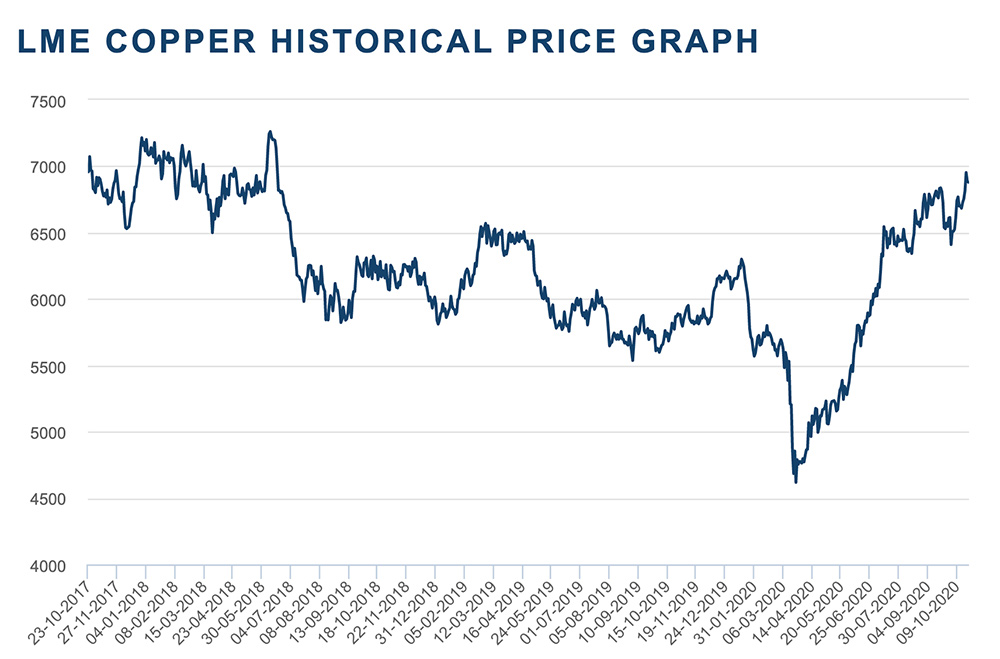

Copper prices experienced yet another surge in the September quarter, up 22 per cent.

We’re currently sitting at 28-month highs, and it’s mainly down to:

– stronger-than-expected demand from China

– a lack of recycled scrap, and

– major pandemic-induced supply disruptions.

That last one mainly applies to South America, which normally supplies 42 per cent of the world’s primary copper, but can’t now because it’s got a touch of the Covids.

That’s great news for established local copper producers like Sandfire Resources (ASX:SFR), Oz Minerals (ASX:OZL), and Aeris Resources (ASX:AIS), and anyone who got on this rocket back in March and held on for dear life:

It’s also great news for Reuben Adams, because he gets to write a story with Scotiabank analyst Orest Wowkodaw in it.

It shouldn’t be too hard to spot anyone who backed BNPL stocks in March. Pretty much all of them have made anywhere from 10x to 20x their money by now.

It can’t last. Surely. Just like the Sydney housing and Bitcoin bubbles, you’d be crazy to… oh.

Anyway, UBS is ADAMANT it won’t and back in August said it reckons Afterpay is worth less than $30. So it’s just done a deep dive into the sector, interviewing 1000 people to prove it’s been right all along. And it found… a surprisingly high awareness of BNPL, a surprisingly high number of new users, and a “vast majority” of users understanding the service is a credit service.

Damn.

But wait, wait – it also found two-thirds of Afterpay users said they wouldn’t use the service if on-charged the 4pc merchant fee currently paid by vendors. That’s kind of a big deal, because, well, there’s an RBA draft review of this issue coming very, very soon.

Chart of the day/week/month:

Is the world’s most popular cryptocurrency heading for a US$20,000 breakout? Maybe. And if it does, you can thank Paypal president and chief executive Dan Schulman, who during the week said:

“The shift to digital forms of currencies is inevitable, bringing with it clear advantages in terms of financial inclusion and access; efficiency, speed and resilience of the payments system; and the ability for governments to disburse funds to citizens quickly.”

There is a lot to unpack there. In the real world, it meant Paypal would allow its 346 million users to pay for goods and services in cryptocurrencies. Boom.

But the other part that not many people missed at all was “the ability for governments to disburse funds to citizens quickly”.

There are a bunch of conspiracy theories that have floated around since Covid was launched spread across the world, and the most compelling involve online crackpot roundtables about world leaders trying to find ways to eliminate hard cash. But in the real world, US Federal Reserve chairman Jerome Powell said a US central bank digital currency continues to be on the bank’s radar.

And here’s eToro cryptocurrency analyst, Simon Peters, on why it would make perfect sense for governments that want to pump out stimulus, but guard against rampant inflation, to issue Bitcoin instead.

BONUS BTC Item: If you got this far, you might like to start getting to grips with why decentralised finance, or DeFi, is one of the fastest growing areas in cryptocurrency.

Even The Secret Broker has been swept away by Bitcoin’s mature makeover, complete with cool shades and black leather jacket. Like Fat Elvis, Cool Mature BTC’s volatility has slowed down a bit and he has started to find a level where he is starting to feel more comfortable about himself and what he is capable of doing.

Such as anonymously funding civil uprisings and helping make $US1.6 billion transactions cost less than a Melbourne latte. Now governments are making their own digital currencies (there it is again, sneaking in with the regular news).

But for now, all that matters is Bitcoin’s dogged resistance gives TSB the chance to have another hilarious pop at that guy from JP Morgan, and Blockbuster.

How’s your NBN? Before you say “okay”, Elon Musk knows it’s rubbish.

That’s why he’s named the first run of his space internet service, Starlink, the “Better Than Nothing” test. To run it, SpaceX has put at least 800 satellites into orbit, with several thousand to follow. Beta access to the service rolled out to the first users this week, for a cost of US$99 ($140) a month, plus US$499 ($700) for a setup kit.

Musk reckons that will give users at least a 50Mbps service, ranging up to 150Mbps – but currently, only in some US states. Obviously, because it’s satellites, the world is next, and because it’s technology, the service will improve as takeup grows.

But your internet speeds aren’t the only thing on the rise. In 2020, just about anyone can send a satellite or 300 into Low Earth orbit – and they will, because mining data from above is the new, er, mining.

Kleos is one ASX-listed stock that’s been chipping away at launching things since chief executive Andy Bowyer and chief technical officer Miles Ashcroft co-founded the company back in 2017. If all goes, well, it’s first four radio frequency scouting nanosatellites will be in LEO this time next week.

Space is big. Really big. If you want a piece of it, here’s a few of the ASX players bravely going etc etc.

Oh, New Zealand, what have you done?

Voted Jacinda Ardern in with record support? Well done. Green light for euthanasia? Sweet as, bro!

Legalise recreational marijuana?

That doesn’t fit, surely. And probably not great news for any chance of it happening here soon.

There’s one hope left – the roughly 480,000 “special votes” left to count that come in from the likes of overseas voters, prisoners on remand and people in hospital.

In other words, the kind of people who’d vote yes.

Here’s one way to stave off the lithium liquidators. Mali Lithium failed to get the market excited about its Goulamina lithium project, so meet Mali Lithium, gold producer. It recently closed a $74m financing and the acquisition of an 80 per cent interest in the Morila gold mine, which has produced about 8.7 million oz.

It’s scheduled to produce just over 26,000oz and generate around $17m in free cash flow between now and May next year, assuming an $US1850 gold price. But former geologist and experienced stockbroker Guy Le Page has good news for Mali “Lithium”. He expects gold to “go above $US2300 by the end of this year or early next year”.

And Mali Lithium will change its name to Firefinch, which is actually kind of cool.

The IPOs just keep coming and this week’s winner is – you guessed it – a BNPL play. Kind of.

Credit Clear (ASX:CCR) has found a niche for investors who want to make money off a BNPL, but worry about all that debt BNPL customers get themselves into. Credit Clear works for business clients to collect that unpaid money. And it’s been a good quarter or two to be collecting potential revenue from all those shiny new BNPL users. Credit Clear jumped 47% on debut, to 68 cents, then just kept going. It made the $1 club after a 22.4% gain today, and sits at $1.04, a solid +200% up in four days since birth.

Other good-looking launches in the past fortnight include WA junior gold explorer Miramar Resources (ASX:M2R), which joined the ASX boards on Thursday. Its shares last traded at 38c, well up from its 20c IPO. And today, Israeli protein powder maker Nutritional Growth Solutions joined the party. It’s main play is selling protein shakes that help your kids grow taller.

Target market? China.

Here’s the IPO scoreboard from the past fortnight:

| Code | Name | Price | % Change since IPO | Market Cap (millions) |

|---|---|---|---|---|

| ABY | Adore Beauty | 5.85 | -13% | 546 |

| CSX | Cleanspace Hodlings | 6.84 | 55% | 555 |

| MEG | Megado | 0.24 | 20% | 7.8 |

| ZBT | Zebit Inc | 1.16 | -27% | 98.5 |

| M2R | Miramar | 0.38 | 90% | 15.8 |

| MYD | Mydeal.com.au | 1.27 | 27% | 396 |

| ABB | Aussie Broadband | 1.82 | 82% | 377 |

Each week, we give the people at low-cost trading platform Marketech Focus five minutes of fame to tell us why their product is ace, for three reasons:

This week, it’s all about heightened vigilance, the death of bees, one-armed feminist truck drivers and how to recognise a perma-bear’s mating call.

Come for the Immortan Joe/Donald Trump comparison you can’t understand how you’d never seen until now. Stay for the All Ords with a Donchian Channel overlay.

You’ll laugh, you’ll cry, it’ll change your life.

See you next weekend, after whatever comes after the US presidential election. It’s going to be a wild few days.