Kick Back: The 10 biggest stories you might have missed on Stockhead this week

What he said. Picture: Getty Images

Welcome to your weekend, which is apparently looking like a bit of a wet and wild one for Sydney. Ha.

It’s been an interesting week. Trump – or at least one of his lizard clones – shook off the plague and is probably entirely serious about selling Trump Blood. We got a new world’s biggest pumpkin. And reddits’ ASX_Bets community – the little bro of YOLO investment pioneer r/wallstreetbets – now has +20,000 members.

Surely only good can come of all that.

Here’s the week that was, that you might have missed.

1. Gold miners and nickel explorers enjoy day one in the sun at Diggers & Dealers

For three days this week, we were buried under an avalanche of announcements from ASX miners and explorers at Australia’s biggest, uh, miners and explorers forum, Diggers and Dealers.

Then on Thursday, it all went quiet in Kalgoorlie. Very quiet, as attendees nursed hangovers and quietly died inside wondering how to explain some colourful and expensive entries on their credit card statements to their partners when they got home.

Here are some highlights:

– Kalgoorlie Super Pit joint owners, Northern Star Resources (ASX:NST) and Saracen Mineral Holdings (ASX:SAR), lit the M&A fuse in the gold sector, forming a $16bn top 10 global gold miner with target production of 2 million ounces per year.

– Chalice Gold Mines (ASX:CHN) and West African Resources (ASX:WAF) briefly joined the billion-dollar market cap club, but lithium explorer Liontown Resources (ASX:LTR) popped 7 per cent after its day two presentation.

– And Day 3 only saw two of the 15 presenting companies impress the market with their pressos – minerals sands producer Image Resources (ASX:IMA) and Salt Lake Potash (ASX:SO4).

A lowlight…

Of the 53 presenters over three days at Diggers and Dealers, just three were women. Fortunately, one of those presenters, Fortescue Metals Group (ASX:FMG) chief executive officer Elizabeth Gaines, made sure attendees knew all about it. Best call – Gaines noted there were more male speakers called “Peter” than there were women.

And the official winners:

– Gina Reinhardt worked on the imbalance a bit, becoming the first woman to take out the GJ Stokes Memorial Award for making an “exceptional lifetime contribution to the Australian mining industry”. About $21.2 billion worth, at last count.

– That $16 billion merger also won Saracen Mineral Holdings and Northern Star Resources the Dealer of the Year Award. Money well spent.

– Ramelius Resources (ASX:RMS) was Digger of the Year. A 420 per cent profit lift across three mines will do that for you. And don’t the shareholders love those 24 per cent top end guidance beats?

– They also love De Grey Mining (ASX:DEG) and its Hemi discovery in the Pilbara which sent shares up to $1.34 this year… from 5 cents. Take a bow, Best Emerging Company.

But the ultimate winners were… west coast miners who didn’t have to mingle with east coast bankers and analysts this year thanks to the Covid-enforced hard border.

2. How to find the next multi-bagger resources stock: Part 3

Odds are that even amongst all that success, there are still a few multi-baggers waiting to be discovered by people like, well, everyone. De Grey, for example, is up 2000 per cent… this year. But if you think hitting a multi is pure luck, you’re wrong, because if you’re a bit diligent, and a bit patient, the odds move a bit more in your favour. Part 3 of Reuben Adams’ cut-out-and-keep How To guide has landed, and it this week’s edition are these six key things to consider when running the ruler over your next small cap exploration investment. You know they make sense.

3. Kiwis are about to vote on legal weed – will it boost Aussie pot stocks?

Our UnZed bros head to the polls this weekend as Crusher Collins tries to trump the most admir’d Jacinda Ardern. But there’s another vote taking place, because the brilliant Kiwis have done it yet again, inventing referendums that take place on the same day as general elections. They’ll also be asked whether they want to make recreational cannabis use a legal thing. It’ll take a couple of weeks for the numbers to be confirmed and any legislative changes required to be put in train, but the big question is – will a Yes vote mean mega bucks for Aussie pot stocks?

Probably not.

4. The Secret Broker: Who wants to Be a Mill-… Billionaire? I do!

Things were simpler back in The Secret Broker’s day. The Poms won the crickets, there was only one fat kid in the class, and you could always spot a millionaire because someone else was driving their car. These days, making a mill is as simple as settling on a Paddington one-bedder in the morning and flipping it after your second macchiatto for the day. But you know what’s cool? A billion. And in the UK, there are two of them in just one family. Here’s a story about why you should always respect your veggies.

5. Aussie Broadband becomes the ASX’s newest telco; gains 90pc on debut

Hello, telco. The ASX welcomed a new player in the poles and wifis business this week when Aussie Broadband (ASX:ABB) went public. You might know it as that one that’s proud of its Aussie accents on the other end of the help line…

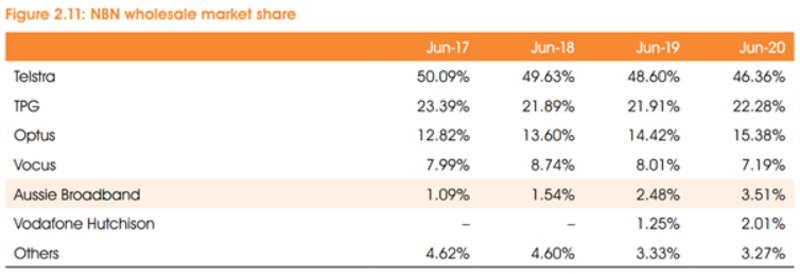

You can’t fault its ambition – there are some 189 NBN resellers out there, but more than 90% of users are serviced by the just four of them. Aussie is fifth and growing:

Still, ABB hit the boards with a solid bang, rising by up to 90 per cent on IPO. We spoke to managing director Phillip Britt about what makes Aussie Broadband different.

6. Upcoming ASX IPOs: There’s a big bunch coming this fortnight

And if IPOs are your thing, there are still at least seven more on the calendar ahead, just in October. Note – the average gain for the 23 new listings in 2020 is 58 per cent.

7. Brickbats and bouquets

Best performers: These five Aussie fund managers over the past 12 months.

Worst performer: The ASX’s new website. Overheard in the newsroom:

“and we’re supposed to trust them to roll out a blockchain clearing system”

8. GEV to build world’s first ship for hydrogen exports – and it’s hydrogen powered

Never get high on your own supply. Unless you’re supplying hydrogen to export markets in the Asia-Pacific, and news of building the world’s first ship that can carry it sends your stock price up a solid 8 per cent. That good day belonged to Global Energy Ventures (ASX:GEV), which announced to the market that its vessel – the wonderfully Aussie-ly named H2 Ship – will have a storage capacity for compressed hydrogen of up to 2000 tonnes. Also exciting – the ship’s design includes engines that run on pure hydrogen, providing a zero-carbon shipping solution.

9. Tigers Realm Coal’s shares soar 370pc on production increase, China news

If you thought walking around on a deck with 2000 tonnes of hydrogen between you and the deep blue sea was a bit curly, how about a hat-tip to Tigers Realm Coal (ASX:TIG)? It’s just announced it’s building a coal handling plant for its coking coal mine in… Russia. And not just any Russia – Russia’s Chukotka autonomous region, where Roman Abramovich was sentenced to governed in the early 2000s. The red bit:

So, not a lot of FIFO Aussies lining up for work. But what it does have is something a lot of Aussie coal exporters are not so sure of – an export route to China. Result? A 370pc share price rise. За здоровье!

10. US election tips and ASX stock picks from pro investor James Whelan

Invest like a pro. Always good advice, but even more so when political risk is rampant. To be fair, that’s been pretty much most of the past four unhinged years, but we still got James Whelan from FS Group to help give us some idea of how smart people are positioning themselves just three weeks out from the US presidential election. According to Whelan, a good start is to “cut out the noise”.

“It’s what you discount that makes you good or bad at your job,” Whelan says. “So immediately, anyone that knows Trump and his negotiating tactics, knows he’s the guy who walks out of the room and slams the door.”

Here’s why Whelan prefers to listen to Tolga Kumova.

That’ll do. Enjoy your weekend.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.