Diggers & Dealers day two: Lithium steals the spotlight from fresh billionaires

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

- Nine of 20 companies presenting to Kalgoorlie mining forum suffered negative share price reactions

- Chalice Gold Mines and West African Resources under the microscope for their gold projects

- Lithium explorer Liontown Resources the standout performer after its conference presentation

For some gold companies presenting to the Diggers & Dealers forum Tuesday it was a bittersweet day with a number experiencing share price falls just after they joined the billion-dollar club.

Chalice Gold Mines (ASX:CHN) and West African Resources (ASX:WAF) experienced a heavy sell-off in their shares at 7.4 per cent and 10.7 per cent, respectively.

Both gold companies achieved milestones on Monday when their market capitalisations passed the $1bn mark, and at Tuesday’s market close Chalice Gold Mines was just holding on to this title.

The billion-dollar valuation for Chalice Gold Mines may have been a trigger for some shareholders to reap profit by selling its shares, suggested some analysts.

Trading volume in Chalice Gold Mines leapt to 3.6 million shares on Monday, from 2.2 million shares on Friday, and was at 2.7 million on Tuesday, according to ASX data.

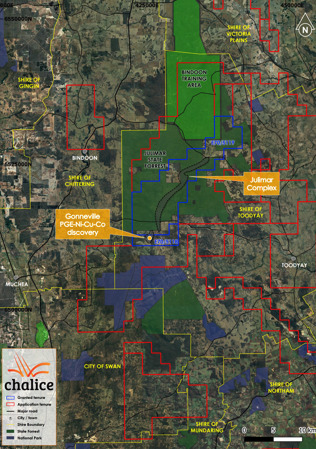

Julimar project set amid WA state forest and conservation area

Share trading bulletin boards were full of chatter about other possible reasons that may have set off the reverse in its share price.

Some investors pointed to the location of Chalice Gold Mine’s flagship Julimar nickel-copper-cobalt project amid a state forest conservation area, expressing doubts about the project proceeding to full development.

Julimar state forest is located 100km east of Perth and covers 28,600ha, and in the 1980s it became a conservation park in which timber production was halted.

Other investors said, however, mining operations are present in WA forest areas and stated that part of Chalice’s deposit did not impinge on state forest.

In its presentation to the Diggers & Dealers event, Chalice Gold Mines said Julimar was ‘Australia’s first major palladium discovery’ that contained ‘a suite of critical metals for a clean energy future’.

Julimar is a 26km-long layered intrusive complex with no previous exploration for nickel-copper-platinum group elements that was only discovered by the company in March.

Burkina Faso gold company sees sizeable share trading volume

For West African Resources, trading in its shares was even heavier than for Chalice Gold Mines.

A total of 8.7 million of its shares changed hands Tuesday, up from only 2.2 million on Monday.

The company has started a feasibility study for its Toega gold project, a 1.1 million-ounce deposit at 2.1 grams per tonne recently acquired for $US45m.

Toega is located 14km from its Sanbrado asset which is ramping up to full production.

The company has been a star performer in the West African gold space.

| ASX ticker | Company | Price ($) | 1 Day % Change | 1 Year % Change | Market Cap |

|---|---|---|---|---|---|

| KLA | Kirkland Lake Gold | 70.76 | 1 | 4 | $69.9B |

| WAF | West African Res Ltd | 1.08 | -11 | 143 | $1.1B |

| MGX | Mount Gibson Iron | 0.72 | 0 | 0 | $853.8M |

| SBM | St Barbara Limited | 3.04 | -1 | 12 | $2.2B |

| FMG | Fortescue Metals Grp | 16.62 | -1 | 89 | $51.9B |

| CMM | Capricorn Metals | 1.86 | -1 | 69 | $643.0M |

| PNR | Pantoro Limited | 0.235 | 2 | 27 | $323.9M |

| STN | Saturn Metals | 0.75 | -1 | 63 | $82.4M |

| KRR | King River Resources | 0.03 | -3 | -6 | $48.2M |

| BOE | Boss Resources Ltd | 0.066 | 2 | 6 | $118.5M |

| G1A | Galena Mining | 0.235 | 2 | -32 | $106.2M |

| PEX | Peel Mining Limited | 0.265 | 2 | -4 | $88.8M |

| POS | Poseidon Nick Ltd | 0.071 | -4 | 34 | $195.6M |

| LTR | Liontown Resources | 0.29 | 7 | 215 | $465.6M |

| MGT | Magnetite Mines | 0.017 | 0 | 368 | $40.0M |

| MGV | Musgrave Minerals | 0.58 | -4 | 644 | $287.2M |

| LEG | Legend Mining | 0.14 | 0 | 250 | $375.0M |

| AOP | Apollo Consolidated | 0.34 | 0 | 36 | $91.5M |

| CHN | Chalice Gold Mines | 3.25 | -7 | 1485 | $1.1B |

| NTM | NTM Gold Ltd | 0.12 | 4 | 126 | $78.6M |

Performance of 20 mining companies that presented to Diggers & Dealers forum on Tuesday

Investors withdraw from WA gold miner and WA nickel company

Musgrave Minerals (ASX:MGV) and Poseiden Nickel (ASX:POS) also endured a testing day after making their presentations to the Kalgoorlie mining forum on Tuesday.

Each companies’ share price fell 4 per cent in ASX trading.

Musgrave is focused on developing its Cue gold project in WA and its share price jumped in May on a higher gold price and high-grade drilling hits at its Starlight discovery.

Poseiden shareholders traded 18.5 million of its shares Monday compared with 9.7 million on Tuesday.

The company’s flagship project is its Black Swan nickel asset and in March it discovered its high-grade Golden Swan discovery both in WA.

Nickel has been an in-demand metal for EVs and battery storage units as evident by Tesla chief executive Elon Musk’s call for more production of the metal.

Lithium explorer Liontown Resources is day’s top performer

Another five companies that gave presentations to the mining forum lost between 1 and 3 per cent in share price terms.

They included St Barbara (ASX:SBM), Fortescue Metals Group (ASX:FMG), Capricorn Metals (ASX:CMM), Saturn Metals (ASX:STN) and King River Resources (ASX:KRR).

A few companies present at the Diggers & Dealers event saw positive share price moves.

Boss Resources (ASX:BOE), Galena Mining (ASX:G1A), Kirkland Lake (ASX: KLA), NTM Gold (ASX:NTM), Pantoro (ASX:PNR) and Peel Mining (ASX:PEX) were in this group.

Meanwhile, Mount Gibson Iron (ASX:MGX) and Magnetite Mines (ASX:MGT) had a flat share price performance Tuesday.

Lithium explorer Liontown Resources (ASX:LTR) with its Kathleen Valley project in WA – the world’s fourth largest spodumene lithium resource — was one of the few share price gainers present at the forum with a 7 per cent rise in Tuesday trade.

Lithium has been the talk of the battery metals market after Tesla signed a supply deal with Piedmont Lithium (ASX:PLL).

At Stockhead we tell it like it is. While Chalice Gold Mines, Magnetite Mines, Musgrave Minerals and Saturn Metals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.