Zero to Hero: The incredible discovery that shaped West Africa’s newest gold miner

Pic: getty

From the many hundreds of listed small cap explorers, just a handful will become long-term success stories. But pick the right one as an investor and the gains can be enormous.

In June 2010, 30-something geologist Richard Hyde and his young team listed greenfields explorer West African Resources (ASX:WAF), raising $6.5m in an IPO.

In 2020, this freshly minted +200,000oz per annum gold miner has a market cap of +$800m and growing. Managing director Hyde says he has grown alongside his company.

“My skills have improved and developed over time,” he says. “You don’t often see a geologist who is part of a discovery that takes it through to production.”

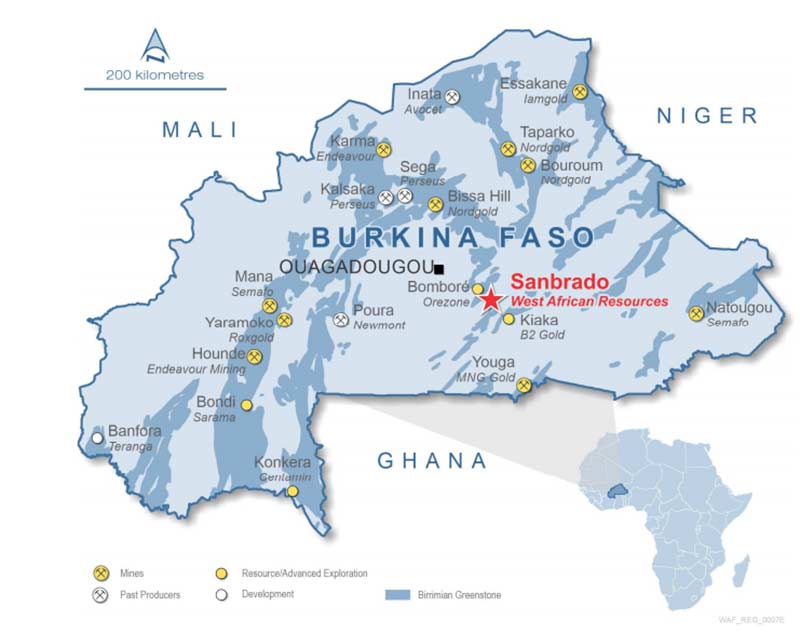

Hyde’s jurisdiction of choice in 2010 was Burkina Faso, where four new gold mines had entered production in the last two years. Two more were in development.

The gold price ran hard in 2010/2011.

“These were big years in Burkina, with quite a few Australian explorers [picking up ground] over there,” Hyde says.

“[Formerly ASX-listed] Ampella and Gryphon Minerals had become companies with plus-$500m market caps based on discoveries in Burkina Faso.”

West African’s 2,000sqkm greenfields Boulsa project was also immediately along strike from the then-nascent 5.1-million-ounce (moz) Bomboré deposit, owned by TSX-listed Orezone Gold.

West African quickly increased its ground to +6,000sqkm, making it the largest ASX-listed landholder in Burkina Faso.

It drilled hard and made a number of high-grade discoveries which, coupled with the gold price and buzz around West Africa as an exploration destination, saw the West African share price peak above 60c per share in April 2011.

In November that year it launched an aggressive 200,000m drilling campaign made possible by a fleet of six company-owned rigs.

“Most of us in the company had run rigs before. So, we ended up just buying our own rigs and saving a heap of money,” Hyde says.

“We drilled with our rigs for about six years.”

By about 2013 the heat was coming out of exploration, and gold.

It was hard to raise money and many of the explorers in Burkina Faso were forced to stop work or relinquish their ground. But West African kept drilling.

“When no one wanted to know about West Africa or know about gold – well, what do you do? You have to keep plodding along,” Hyde says.

“You have to be ready for when the market turns around.

“That’s what happened for us, when we had our drill rigs and were keeping the company running on about $3m-4m a year.”

In late 2013/early 2014 West African acquired neighbouring TSX-listed explorer, Channel Resources and its Tanlouka gold project.

“When we took over Channel in 2014 the markets were pretty terrible,” Hyde says.

“We still had some cash, Channel had essentially run out of money, and so we took them over.

“We did all the drilling on the M5 [deposit] with a little aircore rig on the back of a Landcruiser.”

This was a pivotal moment as Tanlouka became the focus.

In 2014, the Mankarga 5 (M5) gold deposit at Tanlouka delivered a maiden resource estimate of 1moz.

West African completed a couple of development studies on a ~50,000oz per annum low-cost ‘starter’ operation which would cost about $45m to build.

The company wanted to develop M5 ASAP.

“At the time we were working on a small mine plan just to get into cash flow, because markets were really challenging,” Hyde says.

“We got to the point where we knew we could build a small operation that would make money.”

In December 2015, the gold price touched its lowest point in years.

“We had just done a challenging capital raise at 6.5c, and then we got hammered down to 4.5c in January 2016,” Hyde says.

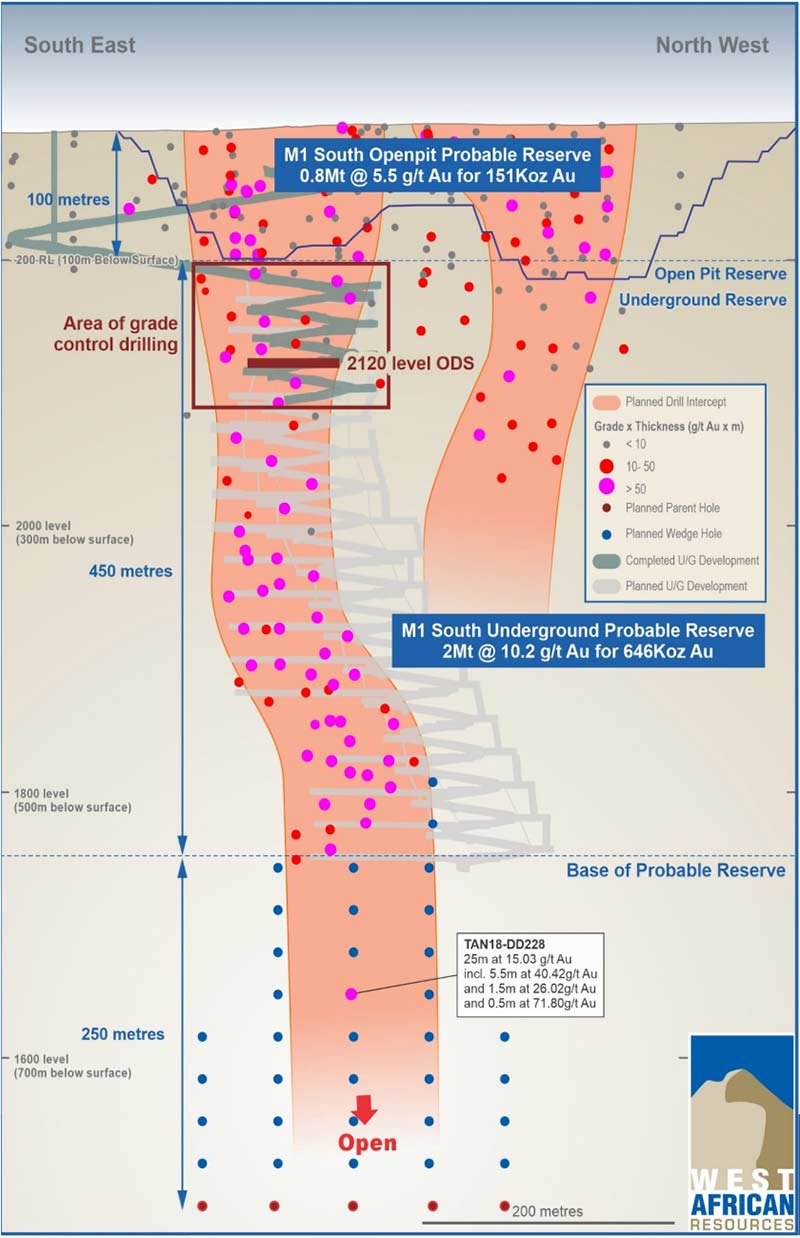

“Then we made the high-grade discovery at M1 South and that changed everything.”

M1 South: The game changer

On February 4, West African announced that it had hit high-grade gold shoots at the M1 prospect, including 4m at 36.6 grams per tonne (g/t), 60m from surface.

This sparked a re-rating event. In a note to clients, Hartley’s called it a “game changer” and by August that year the share price had hit ~35c.

M1 South turned out to be a very short strike length, steeply plunging, high-grade gold chute. West African still hasn’t found where it ends yet.

“It was a nice surprise,” Hyde says. “And we didn’t really realise [we’d hit it] until we had done about two or three rounds of drilling.

“It’s a lot of ounces per vertical metre which means you’re going to make a lot of money out of it.”

A mounting collection of high-grade results up to 1107g/t prompted the company to completely reassess its project development options.

In 2018, an updated feasibility study confirmed the 2.35moz Sanbrado as a +200,000oz per annum producer.

Sanbrado would have super low all-in sustaining costs (AISC) of $US551/oz ($802/oz) over the first five years.

M1 South alone boasted an indicated resource of 780,000oz at an eyewatering ore grade of 15.9g/t.

In 2020, the 2.2-million-tonne-per-annum Sanbrado build and commissioning has been completed 10 weeks ahead of schedule and $US20m under budget.

West African is now ramping up towards full production, on target for +300,000 ounces of gold in its first full year.

“Each achievement – listing the company, establishing our first resource, first study, finally getting project finance away, finishing the build, pouring gold – these are all big milestones,” Hyde says.

“In the next couple of years, we want Sanbrado to be a solid 200,000oz per annum producer at high margins.

“So, what’s next? Now we’ve poured gold, how are we going to grow the company?

“Over the next five to 10 years we want to keep building gold mines.”

The company is a young team which is motivated and incentivised to keep delivering for shareholders, Hyde says.

“I was lucky that our shareholders kept backing me and the team to deliver,” he says.

“We still have a lot of those early shareholders on the register, including seed shareholders from 2008.”

They’ve ridden it up, ridden it down, and now ridden it back up again.

“We peaked at 60c in 2011 and they rode it all the way back down to 4.5c – and then all the way back up to +90c currently,” Hyde says.

“It’s really enjoyable speaking to some of these people, because you get to know them really well and become friends.

“And it’s nice to make people money.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.