Gold miners and nickel explorers enjoy day one in the sun at Diggers & Dealers

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

- Centaurus Metals a star performer at D&D forum after exceedingly good drilling results

- ‘We are rapidly elevating Jaguar to the next level as a premier nickel sulphide project’

- Gold companies Evolution Mining and Ramelius Resources appreciate on solid performance

Several gold miners and a nickel explorer presenting at the annual Diggers & Dealers mining forum saw an uplift in their share prices on a mix of positive news flow and speculation of possible industry consolidation.

Centaurus Metals (ASX:CTM) was the standout performer Monday with its share price lifting nearly 7 per cent in ASX share trading after releasing some impressive drilling results.

The nickel explorer is starting to receive recognition as a significant nickel play in a sector with positive tailwinds, analysts said.

The company said drilling at its Jaguar Central deposit in Brazil had intersected thick, semi-massive to massive nickel sulphides that confirmed down-dip extensions of previous high-grade intercepts.

Hits at Jaguar Central included 44.9m at 1.36 per cent nickel and 0.11 per cent copper from 128m in step-out drilling, and similar results were achieved for its Jaguar North deposit.

“The existing resource of 517,000 tonnes, which includes a significant high-grade component, already provides a very strong foundation for our aspiration to become a new-generation nickel sulphide producer,” said managing director, Darren Gordon.

Five drilling rigs are currently operating at the Jaguar project site and the company is planning 75,000m of drilling in the next 15 months.

Centaurus acquired the Jaguar nickel project from Brazilian miner Vale for around $401,000.

“We are rapidly elevating Jaguar to the next level as a premier nickel sulphide project with the potential to support a sustainable operation that is ideally positioned to meet the new era of nickel demand stemming from the rapid growth of the EV sector globally,” Gordon added.

Evolution Mining jumps on better-than-expected results

Evolution Mining (ASX:EVN) saw its share price jump 4 per cent, lifting its market capitalisation to $10.5bn.

The company released its September quarter results Monday, which showed better-than-expected performance especially in terms of its average all-in sustaining costs, analysts said.

Gold production for Evolution was 170,020oz in the September quarter, and its all-in sustaining costs were $1,198oz. Forecast 2021FY production is at 670,000 to 730,000oz.

“Our operations are performing well, and it is pleasing to be ahead of where we planned to be at the end of the first quarter,” executive chairman, Jake Klein, said.

“The submission for approval of the Cowal underground mine is another important step towards our objective of producing 350,000 ounces per annum of low-cost gold from this cornerstone operation,” added Klein.

The annual mining gathering in Australia’s gold capital of Kalgoorlie is seen as a focal point for companies wanting to provide positive updates to investors.

Merger talk increases following Northern Star and Saracen tie-up

Kalgoorlie Super Pit joint owners, Northern Star Resources (ASX:NST) and Saracen Mineral Holdings (ASX:SAR), have lit the M&A fuse in the gold sector following their agreed merger.

The two gold producers are forming a $16bn top 10 global gold miner with target production of 2 million ounces per year that will bring synergies and cost savings of $2bn.

The mega-merger at the apex of Australia’s independent gold sector has triggered market speculation that more companies could follow Northern Star and Saracen into wedlock.

Industry experts are starting to discuss possible next merger candidates in the gold sector.

Several mid-tier Australian gold miners are present in the global top 20 list based on their market capitalisation such as Evolution Mining and Ramelius Resources (ASX:RMS).

| ASX ticker | Company | Price ($) | 1 Day % Change | 1 Year % Change | Market Cap |

|---|---|---|---|---|---|

| NST | Northern Star Resources | 15.99 | 0.25% | 42% | $11.9B |

| SAR | Saracen Mineral Holdings | 5.95 | -0.17% | 78% | $6.6B |

| MCR | Mincor Resources | 0.88 | 1.14% | 40% | $381.7M |

| RMS | Ramelius Resources | 2.2 | 0.46% | 74% | $1.8B |

| EVN | Evolution Mining | 6.14 | 4.07% | 39% | $10.5B |

| TIE | Tietto Minerals | 0.56 | 1.82% | 107% | $252.0M |

| ORR | Orecorp | 0.44 | 3.49% | 24% | $141.2M |

| CTM | Centaurus Metals | 0.68 | 6.25% | 224% | $221.6M |

| BDC | Bardoc Gold | 0.079 | 1.28% | -21% | $136.7M |

| PLS | Pilbara Minerals | 0.39 | 0.53% | 18% | $839.6M |

| GOR | Gold Road Resources | 1.55 | 1.64% | 45% | $1.4B |

| S32 | South32 | 2.19 | 0.00% | -12.40% | $10.6B |

Share prices of ASX mining companies presenting on Day One of Diggers & Dealers forum

Strong results favour Ramelius Resources’ share price

Ramelius Resources had a good day Monday, its share price rising 1.3 per cent, which analysts said was linked to its strong September quarter results.

The gold miner with a market cap of $1.78bn was tracking ahead of its performance guidance and generating good cashflow, said analysts.

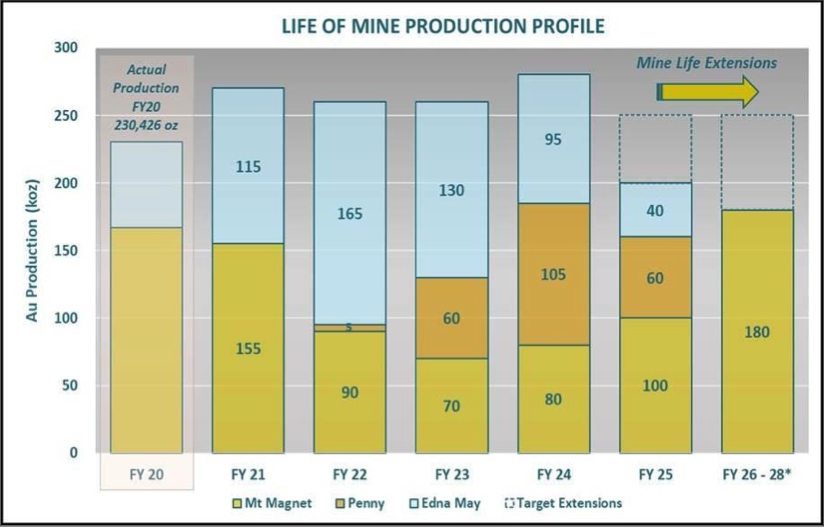

The company is expecting to produce 260,000 to 280,000oz in the 2021 financial year, up from 230,426oz in the 2020 financial year and representing a 17 per cent rise on 2019FY, according to a presentation to the Kalgoorlie conference.

Ramelius has a strong cash position on its balance sheet, holding $222m in cash and gold at September 30. All-in sustaining costs for the miner in the 2021 year are $1,230 to $1,330oz.

The WA-focused miner’s operations include the Mt Magnet and Edna May gold mines. It recently tied up a takeover of Spectrum Metals (ASX:SPX).

St Barbara (ASX:SBM) tumbled 0.3 per cent in Monday trade ahead of its presentation to the Diggers & Dealers event on Tuesday.

Share prices for Centaurus (ASX:CTM), Evolution (ASX:EVN), Northern Star (ASX:NST), Ramelius (ASX:RMS), Saracen (ASX:SAR) and St Barbara (ASX:SBM)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.