You might be interested in

Mining

Monsters of Rock: Beam me up! Vulcan rockets 25% on lithium production start, budding price rebound

Mining

Gold Digger: Gold vs Bitcoin, analysts vs analysts – store of value narratives get in the ring

Mining

Mining

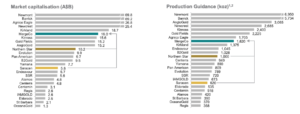

A new top-10 global gold company worth $16bn and targeting production of 2 million oz is being created from a friendly merger of Northern Star Resources (ASX:NST) and Saracen Mineral Holdings (ASX:SAR), joint owners of the Kalgoorlie Super Pit.

Northern Star will acquire 100 per cent of Saracen’s shares with shareholders receiving 0.376 Northern Star shares for each of their Saracen shares.

“This is a significant value-creating merger and acquisition,” said current Northern Star executive chairman, Bill Beament, who assumes the chairmanship of the new company.

“Our position as joint venture partners at KCGM, the close proximity of the majority of the combined company’s assets and a host of other synergies makes this a unique opportunity exclusive to Saracen and Northern Star shareholders.”

Kalgoorlie Consolidated Gold Mines (KCGM) is the holding company for the Kalgoorlie Super Pit, in which Northern Star and Saracen have equal shares, both acquired nine to 10 months ago.

The boards of both Northern Star and Saracen have recommended their shareholders approve the merger which could unlock $1.5bn to $2bn of synergy cost savings.

Analysts believed a merger of Northern Star and Saracen was a possibility after they each acquired interests in KCGM.

They see significant value in having a single operator for the Super Pit to streamline costs.

And analysts have suggested other mergers could flow in the gold sector in Australia.

At the completion of the merger, Northern Star shareholders will own 64 per cent of the new entity, and Saracen shareholders the remaining 36 per cent.

The merged company will have gold production of 1.6 million oz per year and is targeting 2 million oz by 2027. It will have a market capitalisation of $16bn and net cash of $118m.

Consolidating the ownership of the Kalgoorlie Super Mine into one company will “align vision, improve simplicity of operation, drive operational efficiencies and bring forward expansion opportunities,” the companies said in a joint statement.

“This is one of the most logical and strategic merger and acquisition transactions the mining industry has seen,” said Saracen managing director Raleigh Finlayson, the merged entity’s new managing director.

“The savings, the synergies and growth opportunities it will generate make the transaction extremely compelling.”

The merger with Northern Star was a “unique opportunity” for Saracen unlikely to be replicated by any other avenue, Finlayson added.

Northern Star and Saracen each have strong track records of delivering superior shareholder returns and significant organic growth and are led by two industry-leading management teams, the companies said.

The new merged company’s board of nine directors will comprise five Northern Star directors and four Saracen directors.

Ther merger of Northern Star and Saracen will have three large gold production centres in Kalgoorlie and the Yandal in WA, and Pogo in Alaska, North America.

The merger is set for completion in February 2021, subject to shareholder approvals.