Kick Back: The 10 biggest stories you might have missed on Stockhead this week

Pic: d3sign / Moment via Getty Images

Hello Friday:

And it took its own good time too, just when we were getting used to all those work-week days off.

Sadly, a lot of people we loved checked out for good, between the Avengers, the defenders of Winterfell, and this guy:

About Peter Mayhew: He was very kind to fans, never regretted being typecast and was an actual force of good. Rest in power, Chewie. pic.twitter.com/UkD3XMHLfF

— Jorge I. Castillo (@jicastillo) May 2, 2019

Onward and upward. And a little bit backward, with all the top stories you might have missed on Stockhead this week.

1 – Aussie scientists have discovered an effective way to recycle rare earths metals

Rare earths metals are an essential ingredient in mobile phones and electric cars.

It’s a bit of a worry then, that just 3 to 7 per cent of REMs are recycled from end-products for various good reasons, including generating huge amounts of toxic waste.

Here comes the Aussie scientists with a potential fix. And a few ASX small caps that are finding ways to recover critical metals such as lithium and cobalt.

2 – How the biotech community is fighting back against superbugs

A World Health Organisation study of 65 countries found that, in 2015, more than 13,000 metric tonnes of antibiotics were used.

That’s probably a hang-up for that time in the late 19th Century when tuberculosis killed one in every seven peeps, so fair enough.

But now we have to contend with drug-resistant infections which one Cosmos article suggested could be wiping out 10 million people a year by 2050. Gah.

“It’s a festival of bugs out there,” Next Science (ASX: NXS) CEO Judith Mitchel told us.

Here’s what they and others plan to do about it.

3 – Double-shot: These ASX small caps have already gained 100pc in 2019

Obviously, you came for the morning crema – and probably ducked off to grab one before you read it.

If you missed it, the good news about “double shots” is that it’s a good name for stocks that have already gained 100 per cent in 2019.

It’s actually an impressively healthy list. We found no less than 52 ASX small caps you could have doubled your money on by now this year alone.

4 – Uranium might fly again, but your money might be better invested elsewhere

Oh, uranium.

Not so great at powering Chernobyl, Fukushima or Three Mile Island. Excellent at stopping you from an early death by cancer.

And historically, for making pots of money on – until it lays waste to the surrounding countryside for 20,000 years.

Pre-Fukushima, it hit $US135 a pound. On the short-term market right now, it’s struggling around $US26/lb, but there’s talk it’s ready for a comeback. Trump is involved, so yes, anything could happen.

But don’t get excited, Tim Treadgold says, because there are much better ways to invest your money, even if uranium does hit the un-mothball price point of $US65.

5 – Carmakers want non-DRC cobalt… and these ASX small caps could get the green light

When they say they want “non-DRC” cobalt, carmakers really mean “not dodgy” cobalt, like the kind they probably getting from kiddies mining for it in the Congo.

Last week BMW announced it would be bypassing the DRC — which controls more than two-thirds of supply — altogether.

It’s going to source cobalt for its next-gen electric vehicles from Australia and Morocco.

That sounds great, but in 2018, the combined cobalt output from us and Morocco was enough to produce about 350,000 EVs.

If BMW says 25 per cent of its 2.5 million annual vehicle output will be EV by 2025, then… hang on a minute:

Still, here are the ASX miners that will be pretty busy around then – just for BMW.

6 – Got milk: Bubs Australia leading the dairy formula pack as ANS listing remains uncertain

Bubs is the upstart dairy formaula company in 2019.

Its shares were fetching 45.5c at the start of the year but have risen 184 per cent as a swathe of positive news has made it the small cap dairy stock to beat — and the one best placed to join the big players like Bellamy’s (ASX:BAL), Synlait Milk (ASX:SM1) and A2 Milk (ASX:A2M).

That’s been helped largely by the fact it has a $1.3 billion Chinese infant formula business agreeing to sell its products actually on shelves in China.

Here’s how the dairy formula pack performed in April.

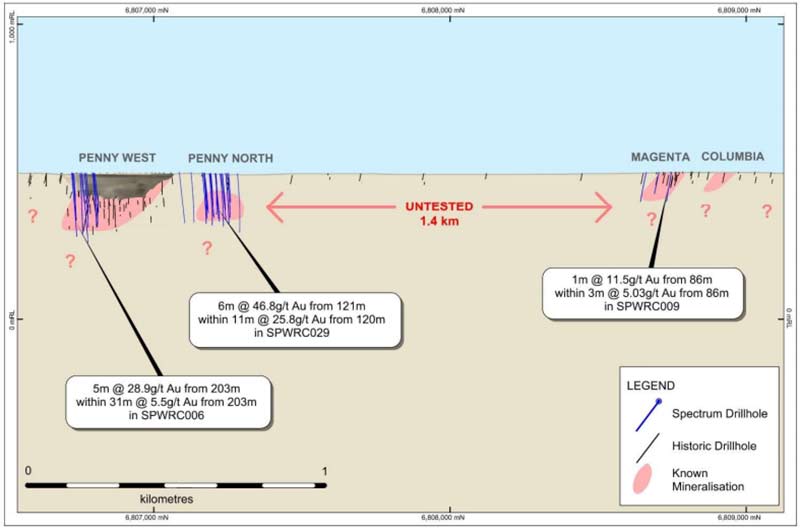

7 – Gold: Spectrum plays it cool, but Penny West could be turning into a monster

Investors have sent Spectrum flying over the past month and a half, as the good results roll in from its Penny West gold experiment.

Back in the 90s, the site was legendary, mined for 85,000oz at a record-breaking grade of 21.8 grams per tonne. (Anything over 5g/t is impressive enough.)

Spectrum is back in there, and just got results that show mineralisation “is continuous over 200 plus metres of strike”. So that’s great.

But what about this 1.4km-long untested ‘gap zone’?

Spectrum boss Paul Adams told Stockhead that no deep drilling has been done in between.

1.4km.

Spectrum could be sitting on a monster.

8 – Kidman shares are in the blocks on huge $776m takeover offer

The big news came late in the week. Kidman Resources (ASX:KDR), owns 50 per cent of the Mt Holland lithium project in Western Australia.

It could do with $600m though, to get the project up and running in 2022.

Hello, Wesfarmers takeover, with a $1.90 a share offer – a huge 47 per cent premium on Kidman’s closing share price on Wednesday.

It took about three seconds for that share price to roar 48 per cent on the Thursday morning news.

Who knew?

Uh, this guy, on April 4:

And Thursday, with one of the a great small cap Twitter flexes:

9 – Money Talks: This expert reckons there’s only one small cap ‘data centre’ worth backing

A couple of times each week, we tap into our list of expert investors and ask them what three stocks caught their eye recently.

Hani Iskander, a partner at specialist technology investment bank Cube Capital, only had one.

“We live in a world where nothing is deleted,” he told Stockhead. “People keep storing data, from a photo of every meal one has uploaded to Instagram to people’s entire lifetime of financial history stored by banks.

“I think there will never be too many data centres on planet Earth.”

This is where Iskander’s got his data-centre dependent savings.

10 – Nine pot stocks made money from marijuana in the March quarter

You lot can’t get enough dope on the dope.

Fortunately, Stockhead monitors some 32 listed companies which have announced a connection to cannabis, of which 15 are ‘pure’ pot stocks in that their businesses are entirely involved in marijuana.

They’re all holding firm as popular picks among investors, and… some of them make money. Right now, nine, to be exact.

Broadly, hemp stocks are doing better than marijuana. And keep in mind, it’s still a fledgling industry, where there’s a lot of often expensive experimentation going on, and speculation on where legislation is headed.

Captain’s Call – Director Trades: Who was buying and selling last week?

Rich people got richer, maybe.

More important – this kitteh’s munny:

Have a great weekend, and thanks for being a Stockhead.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.