Closing Bell: Baffled ASX200 steals victory from Tuesday’s yawning jaws of indifference

Via Getty

- ASX200 ends choppy day 0.2% higher

- Miners and med stocks offset banks and Energy

- Small caps led by NickelSearch, Odin

All shook up, but home alive – Aussie shares somehow brought home the bacon on Tuesday, with both the All Ords and the XJO ASX200 closing +o.2%, despite wavering throughout the day and squandering a wholehearted overnight rally on Wall Street.

The local tech sector, with none of the strong US corporate results which drove the Nasdaq, spluttered home to close just a few bips higher.

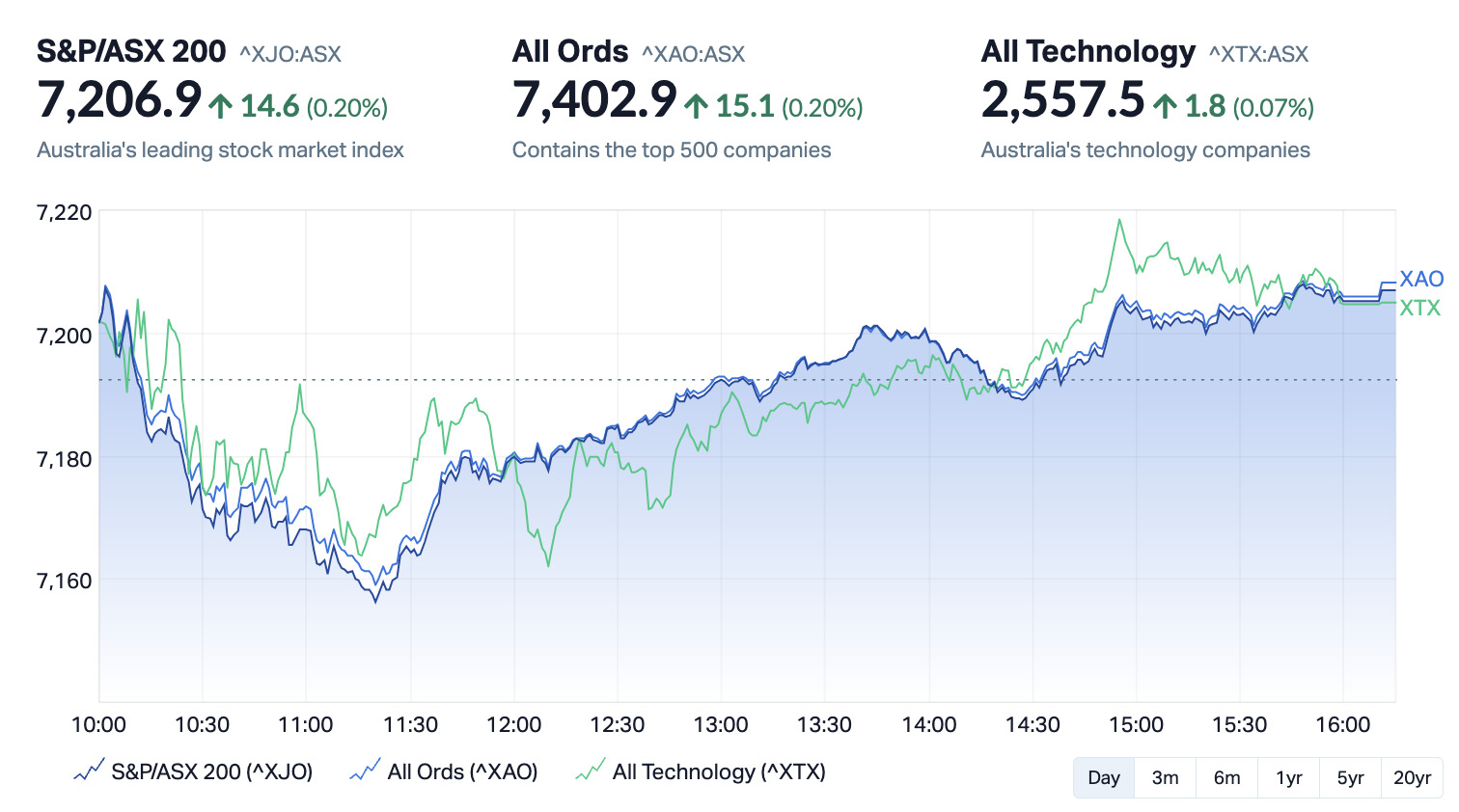

Here’s a pic of the ASX wobbles, being worth one or two hundred words:

Wobbly old trade: XJO vs XAO vs XTX

Big Tech led US stocks out the gate, as the top US indices recouped more than half last week’s losses in one day.

Crazy-brave might’ve been the mood on Wall Street ahead of some seriously market-moving indictors like Apple’s iPhone launch and the latest US CPI read on inflation – but local traders were hesitant on mixed local business and consumer reads.

NAB’s business confidence lifted to a 7-month high in August – good.

Westpac’s busybody consumer sentiment read continued to backtrack – bad.

We are not confident, is the gist of that one and it showed on the benchmark.

The best story of the day is lithium debutant James Bay Minerals. We have a new lithium horse to cheer on. More of that below.

Here are your ASX Sectors on Tuesday

Emerging Companies (XEC) index gained 0.3%, while the Small Ords (XSO) ended absolutely flat.

RIPPED FROM THE HEADLINES

As mentioned the Westpac-Melbourne Institute Index of Consumer Sentiment slips 1.5% to 79.7 in September, despite the Reserve Bank of Australia keeping interest rates on hold.

Westpac’s chief economist Bill Evans says persistent pessimism has continued despite easing fears of further interest rate rises amid cost of living and inflation pressures. Evans says Aussie households are still very concerned about finances and cautious on spending

Let’s stay on Westpac.

The oldest bank just raised a handy $2.3bn in five-year notes, paying a margin of 93 basis points over swap and BBSW.

The notes are expected to yield 5.01%. Noice.

The deal was cleft into:

- A $1.9 billion floating rate piece, and

- A $400 million fixed rate.

WTI crude futures firmed above US$87 a barrel earlier today, according to Trading Economics, that’s holding near 10-month highs as investors breathlessly await mega important updates from both OPEC+ and the US EIA which dump their monthly market reports in a few hours.

TUESDAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| EDE | Eden Inv Ltd | 0.003 | 50% | 9,324,140 | $6,727,274 |

| AXP | AXP Energy Ltd | 0.002 | 33% | 3,315,000 | $8,737,021 |

| DXN | DXN Limited | 0.002 | 33% | 34,987,429 | $2,585,010 |

| KEY | KEY Petroleum | 0.002 | 33% | 20,440,488 | $2,951,892 |

| KNM | Kneomedia Limited | 0.004 | 33% | 1,600,000 | $4,514,356 |

| MTH | Mithril Resources | 0.002 | 33% | 1,500,050 | $5,053,207 |

| OMX | Orangeminerals | 0.04 | 33% | 42,290 | $1,490,021 |

| M2M | Mtmalcolmminesnl | 0.033 | 32% | 469,140 | $2,558,588 |

| CNW | Cirrus Net Hold Ltd | 0.0535 | 30% | 36,373,691 | $38,130,262 |

| CTQ | Careteq Limited | 0.027 | 29% | 1,422,799 | $4,664,580 |

| NVO | Novo Resources Corp | 0.25 | 25% | 2,243,889 | $7,500,000 |

| DCX | Discovex Res Ltd | 0.0025 | 25% | 1,000,000 | $6,605,136 |

| EMU | EMU NL | 0.0025 | 25% | 50,000 | $2,900,043 |

| ID8 | Identitii Limited | 0.016 | 23% | 2,868,136 | $4,505,988 |

| SRT | Strata Investment | 0.19 | 23% | 62,000 | $26,260,654 |

| WCN | White Cliff Min Ltd | 0.011 | 22% | 5,499,526 | $11,313,167 |

| WGR | Westerngoldresources | 0.039 | 22% | 282,130 | $3,255,032 |

| MOB | Mobilicom Ltd | 0.0085 | 21% | 7,102,984 | $9,286,737 |

| KLI | Killiresources | 0.064 | 21% | 796,600 | $3,157,478 |

| DVL | Dorsavi Ltd | 0.012 | 20% | 248,333 | $5,566,616 |

| T92 | Terrauraniumlimited | 0.115 | 20% | 660,001 | $4,954,095 |

| AKP | Audio Pixels Ltd | 11.8 | 19% | 5,071 | $289,179,990 |

| ACM | Aus Critical Mineral | 0.425 | 18% | 2,502,318 | $10,703,250 |

| CNQ | Clean Teq Water | 0.41 | 17% | 532,124 | $20,256,803 |

| AOA | Ausmon Resorces | 0.0035 | 17% | 1,100,000 | $2,907,868 |

Debutant James Bay Minerals (ASX:JBY) has announced itself as a significant new name in lithium, rising strongly on its first day on the ASX and bringing with it one of the largest exploration portfolios in Canada’s prolific James Bay lithium district.

Totalling ~224km2, James Bay Minerals’ (ASX:JBY) Joule, Aero and Aqua properties are located in the ‘La Grande’ sub-province, along trend from the Corvette deposit, where Patriot Battery Metals (ASX:PMT) has an inferred MRE of 109.2Mt @ 1.42% Li2O and 160ppm Ta2O5.

The Troilus project is further to the south, only 5km north of Sayona Mining’s (ASX:SYA) Moblan lithium project and near Winsome Resources’ (ASX:WR1) Sirmac-Clappier project.

JBY, also boasts an embarrassment of Aussie lithium royalty.

Exec director Andrew Dornan has 18 senior commercial management experience with heavy hitters like Pilbara Minerals, Tianqi Lithium, Fortescue, and Rio Tinto.

Ontario-based non exec chair Gerard O’Donovan – also managing director of Battery Age Minerals – was project manager at Pilbara Minerals, overseeing development of the Stage 1 Pilgangoora mine and concentrator.

Also on the board is former Nemaska director Judy Baker and Dean Ercegovic, founding director and CEO of lithium plant builder Primero Group.

Everyone loves a comeback story, and as I write the COVID-era anti-bacteria maker Zoono Group (ASX:ZNO) is pulling off a bit of a one, up 25% to 4.5 cents.

ZNO is a local biotech which makes and sells super-dooper, inhouse ‘scientifically-proven, environmentally-friendly anti-microbial solutions’ which come in the guise of various sprays, wipes and foams – suited for skin care, surface sanitisers, food wraps and the lot.

But as you can see (below), it’s quite good in a pandemic but otherwise…

Anyway, the firm’s been cutting deep and targeting new markets. So despite posting a fine FY23 loss in its 4E report earlier today, it was much less than expected.

Zoono MD Paul Hyslop says his crew undertook a tough operations review to slash overheads and preserve capital ‘while existing growth opportunities come to fruition’.

To that end, Barry Woolcott agreed to step down as CEO, among other cost reduction initiatives undertaken in FY23 which Hyslop says will drive overhead cost savings of circa NZ$2.4M for FY23 and in excess of NZ$4.5M in FY24 compared to the FY22 year without hitting Zoono’s ability to service key markets or execute on key business development and/or growth initiatives.

They’ve got a few promising irons in the fire around the world:

Trials with a major European supermarket chain focused on increasing the shelf life of fresh food and other products sold in its supermarkets are nearing completion, with expectations of product sales to that supermarket in Q4 this year. In store trials are now commencing.

Zoono’s also targeting the Early Childcare education sector in China. Trials have been arranged for 11 centres in Guangzhou through a group which runs more than 4,000 centres in China.

Hang about: They’re up 38%.

But it’s NickelSearch (ASX:NIS), who continues to own Tuesday.

The nickel-now-lithium aspirant jumped on news of a collaboration with Allkem (ASX:AKE), owner and operator of the Mt Cattlin lithium mine, 10km from the Carlingup Nickel Project.

Under the terms Allkem will review the lithium-related data for Carlingup and advise on target generation and prioritisation.

“The arrangement is not yet at the level of a formal lithium joint venture and there is no guarantee that the technical collaboration will lead to a formal agreement in the future,” NickelSearch says.

Odin Metals (ASX:ODM), has risen throughout the day on news ex-Kidman founder and boss Martin Donohue, founder and former CEO of Kidman Resources (since de-listed and operating as Australian Light Minerals), is now non-executive chairman of the company, effective immediately.

Donohue is a big name in Aussie business, mining and also regarding China’s predatory approach during the mining boom, among old China Hands.

Before selling Kidman to Wesfarmers in 2019 for a handsome three quarters of a billion dollarbucks, he spun deals with global lithium giant Sociedad Quimica y Minera de Chile (SQM), was the first Aussie to strike off-take agreements with Elon Musk’s Tesla. He nailed further terms with Japan’s Mitsui and then South Korean giant LG Chem.

There’s a few legal rodeos in the bio as well. The scarier one being in the Supreme Court, when Marindi Metals claimed it had a binding agreement to acquire the lithium rights for the Kidman assets near Southern Cross while juggling another court battle with different parties who reckoned Kidman had to give away its 13 tenements.

Simon Peters will assume the role of CEO/managing director as a result of this appointment, Odin says.

TUESDAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CLE | Cyclone Metals | 0.001 | -50% | 1,014,094 | $20,529,010 |

| MEB | Medibio Limited | 0.001 | -50% | 1,439,115 | $12,201,488 |

| ERD | Eroad Limited | 0.695 | -35% | 172,494 | $120,984,925 |

| XTC | Xantippe Res Ltd | 0.001 | -33% | 1,112,999 | $26,292,008 |

| OLI | Oliver'S Real Food | 0.017 | -26% | 2,842,278 | $10,136,834 |

| MCT | Metalicity Limited | 0.0015 | -25% | 33,340,250 | $7,472,172 |

| TYM | Tymlez Group | 0.003 | -25% | 225,000 | $4,952,781 |

| MSG | Mcs Services Limited | 0.018 | -25% | 409,800 | $4,754,392 |

| RCE | Recce Pharmaceutical | 0.5 | -23% | 1,097,327 | $115,865,302 |

| TZL | TZ Limited | 0.017 | -23% | 100 | $5,648,679 |

| KOB | Kobaresourceslimited | 0.075 | -21% | 100,021 | $10,014,583 |

| MRI | Myrewardsinternation | 0.012 | -20% | 628,088 | $6,399,507 |

| RMX | Red Mount Min Ltd | 0.004 | -20% | 4,852,170 | $12,621,755 |

| FTC | Fintech Chain Ltd | 0.013 | -19% | 170,266 | $10,412,313 |

| LBT | LBT Innovations | 0.014 | -18% | 715,760 | $6,030,144 |

| NAG | Nagambie Resources | 0.024 | -17% | 801,797 | $16,870,063 |

| CLU | Cluey Ltd | 0.1 | -17% | 109,791 | $24,193,628 |

| ME1 | Melodiol Glb Health | 0.005 | -17% | 3,464,557 | $17,683,922 |

| ROG | Red Sky Energy. | 0.005 | -17% | 979,965 | $31,813,363 |

| STP | Step One Limited | 0.535 | -16% | 54,860 | $118,617,786 |

| GSM | Golden State Mining | 0.037 | -16% | 2,323,458 | $8,407,884 |

| TOR | Torque Met | 0.3 | -15% | 1,816,966 | $34,448,148 |

| WC8 | Wildcat Resources | 0.3 | -15% | 15,200,431 | $236,294,235 |

| AFL | Af Legal Group Ltd | 0.165 | -15% | 58,514 | $15,319,477 |

| GHY | Gold Hydrogen | 0.205 | -15% | 670,049 | $13,661,526 |

TRADING HALTS

SRJ Technologies Group (ASX:SRJ) – Capital raising.

PainChek (ASX:PCK) – Capital raising.

Pental (ASX:PTL) – Proposed material transaction.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.