Gold: Spectrum plays it cool, but Penny West could be turning into a monster

Pic: John W Banagan / Stone via Getty Images

Spectrum Metals (ASX:SPX) already knew that its Penny West project in Western Australia was turning into a pretty amazing discovery.

And investors know as well, because they’ve sent the small cap stock flying over the past month and a half.

Last week, Spectrum boss Paul Adams told us that if fresh mineralisation could be established over a strike length of 200m the explorer could be sitting on “another Penny West”, just north of the original open pit.

Penny West was mined for 85,000oz at a record-breaking grade of 21.8 grams per tonne between 1991-1992. Now the results are in, and they confirm that mineralisation is continuous over 200 plus metres of strike.

But here’s the thing.

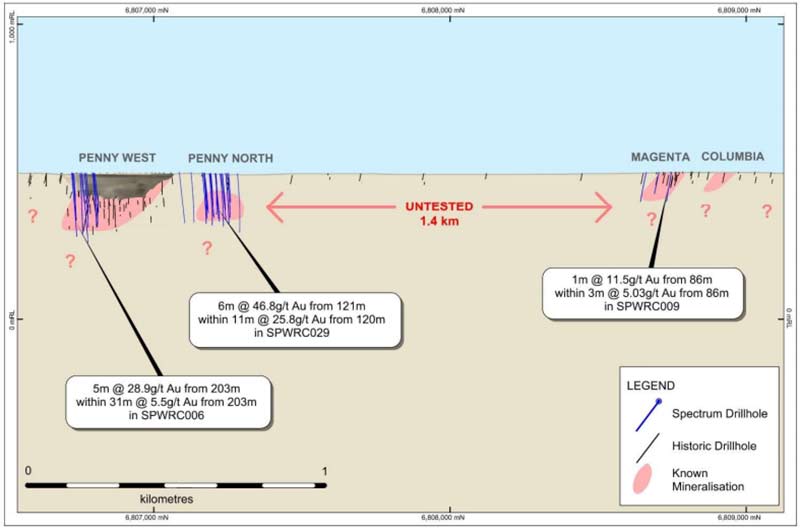

Another Penny West deposit just north of the existing open pit is great and all, but what about this 1.4km-long untested ‘gap zone’? Spectrum could be sitting on a monster.

Check this out:

Spectrum says results from three holes at the Magenta prospect further north, including 1m at 11.5 g/t gold from 86m, show that high grade gold exists at either end of a 1.4km long untested ‘gap zone’.

Adams told Stockhead that no deep drilling has been done in between.

“We are left with the prospect of mineralisation being open to the north of our Penny North discovery, and mineralisation open to the south of Columbia-Magenta, which is 1.4km away,” he says.

“We just don’t know what lies in between.”

Spectrum does know that previous shallow drilling hit some gold anomalism, running north of Penny North, but this drilling was only 40m deep.

“What Penny North taught us is that when you get a sniff of grade in shallow drilling there could be anything underneath,” Mr Adams says.

That [shallow] mineralisation has to come from somewhere.”

In more ASX gold news today:

The majors want a piece of Bellevue Gold (ASX:BGL) and its 1.5moz (and growing) namesake gold project in Western Australia.

Bellevue confirmed the takeover speculation, raised in an Australian article a few days ago. It told investors that Canaccord Genuity had been appointed as its financial advisor “to deal with any interest expressed by third parties in relation to Bellevue or the company’s Bellevue Gold Project”. The Bellevue Gold share price is up almost 200 per cent over the past 12 months – and a takeover offer from a major miner could push it even higher.

Calidus Resources (ASX:CAI) announces $2.16m share placement to producer Alkane Resources (ASX:ALK) — at a 13 per cent premium to its last closing share price. Calidus now has sufficient funding to complete a pre-feasibility study (PFS) on its shallow, 1.24moz Warrawoona gold project in Western Australia.

Indonesian miner Kingsrose Mining (ASX:KRM) increases production, lowers costs and increases revenue for the 3rd successive quarter. Kingsrose gold production jumped almost 54 per cent from the prior quarter to 5471oz. All-in sustaining costs dropped 27 per cent to $US1190/oz ($1686/oz) – which is still high but profitable at current gold prices. The small cap miner squeezed out a small EBITDA (Earnings Before Interest, Tax, Depreciation and Amortisation) for the quarter of $530,683.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.