You might be interested in

News

Westpac: It's a two-speed house market! AMP: It's simpler. There's more Australians than homes

Uncategorized

ASX April Winners: The best 50 stocks as inflation and Middle East tension cloud markets

News

The International Monetary Fund (IMF) has unleashed its latest Life is Hell publication on the global economic outlook.

It’s full of feel good observations, as per.

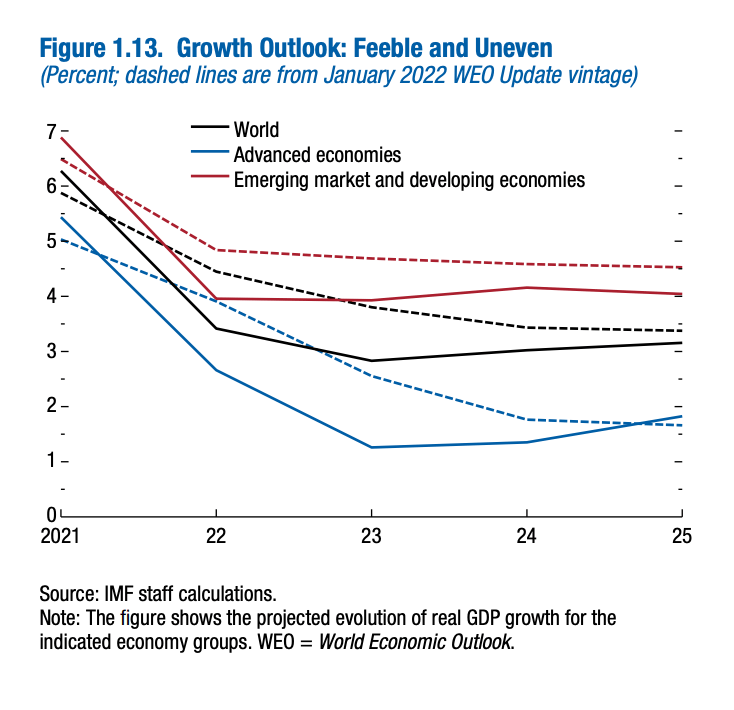

For example, I like this chart (and subhead) from page 7 of the 207 page tome of agony.

The IMF says its baseline scenario is for feeble and uneven growth.

“The baseline forecast is for global output growth, estimated at 3.4 percent in 2022, to fall to 2.8 percent in 2023, 0.1 percentage point lower than predicted in January 2023, before rising to 3.0 percent in 2024.

“This forecast for the coming years is well below what was expected before the onset of the adverse shocks since early 2022.”

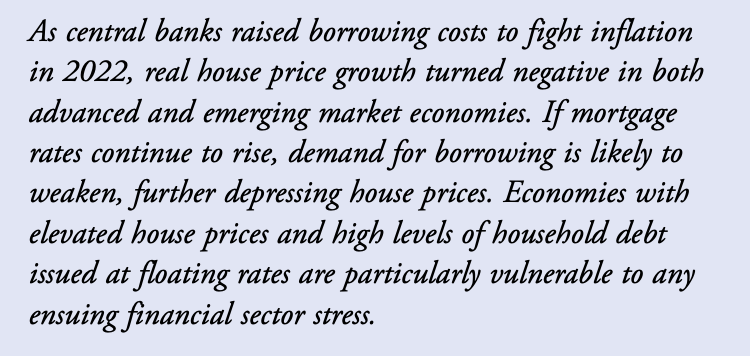

Now an observation from the IMF on property stuff:

… Wait, economies with elevated house prices and high levels of household debt…??

Particularly vulnerable?

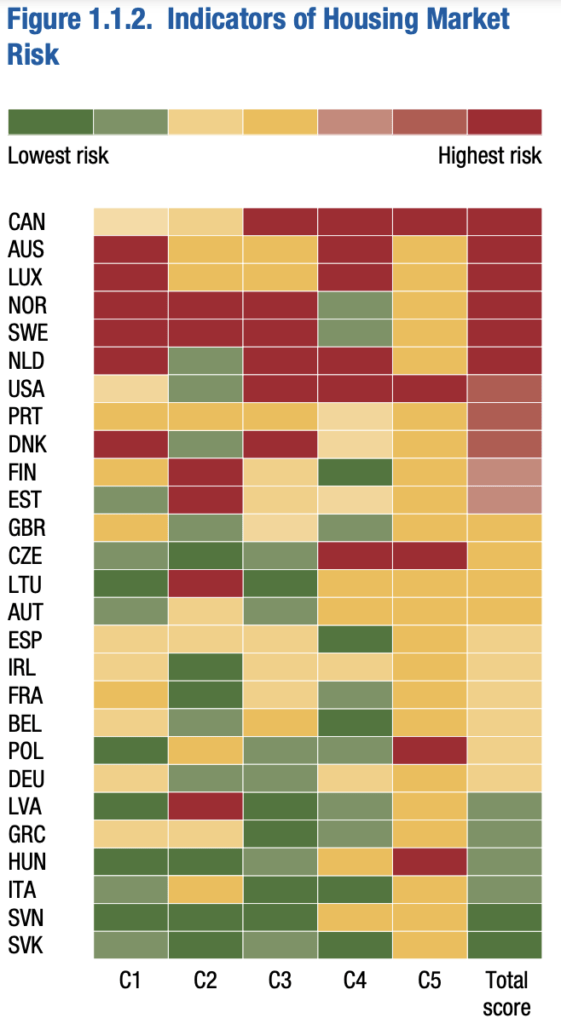

Oh yes. The fund presages – among other dire forecasts and there’s many – that our calamitously soaring household debt makes the Aussie housing market one of the highest-risk in the world.

In fact we rank No. 2 for ‘housing market risk’ out of 27 countries. Behind Canada.

Fake views? Panic stations? We at Stockhead say yes and yes.

But to make sure, we also asked CoreLogic’s Head of Research and Calculatrice of Woe Eliza Owen, for the truth and nothing but the truth.

Here is that discussion adapted into screenplay format by Golden Globe winner Lena Dunham:

Eliza:

Christian, it’s great to be back. I only wish we could meet under happier circumstances.

Stockhead:

What? I’m happy.

Eliza:

No you’re not. I see you.

Stockhead:

(…a little flustered): So. This IMF nonsense. Is Australian housing really at risk? And shouldn’t we just ignore the IMF like everyone else? And what happens should this prediction materialise?

Eliza:

Ultimately, the IMF reporting is important. The report highlights key vulnerabilities in housing markets that exacerbate the risk associated with a surge in unemployment. How safe is your job?

Stockhead:

I’m good. Just stick to the questions please.

Eliza:

Some of the outcomes associated with this risk include a sharp housing market decline, which could have implications for economic growth and financial stability. You’ve socked away a few denarii?

Stockhead: …

Eliza:

(rolls eyes) For now, regarding the Australian housing market, I’d say there’s room for… cautious optimism. Many households have accrued strong savings buffers through the low interest rate period, and labour markets remain extremely tight. How strong are your buffers Christian?

Stockhead:

They’re fine.

Eliza:

(nodding) I believe they are. Housing market conditions are turning a corner amid low stock levels, rising demand from overseas migration, and consumer sentiment shifting higher as we approach what may be the end of the rate-tightening cycle.

Stockhead:

The IMF scored countries on five different measures of housing market risk, (classifying our housing as “relatively ‘high risk’.”) … I’ll read them out. And you can, Eliza Owen, share your perspective on the elements of risk at play.

Eliza:

Maybe…

Stockhead:

Just do it.

Eliza:

…or maybe not. No. I’ll do it. I have 35 more of these today.

Stockhead:

IMF high-risk reason #1 – Outstanding housing debt vs household income?

Eliza:

According to the RBA, Australian housing debt represented around 145.4% of the country’s total disposable household income, around $2 trillion. While slowing credit growth has since resulted in a slight decline in this ratio to the end of 2022, it’s still hovering around record highs.

Entrants to the housing market have taken on more debt to buy homes over time because housing value growth has outpaced income growth. But the flip side of this is that because housing values have grown so much long term, outstanding housing debt represented just 17.6% of the asset value at the end of 2022.

Debt levels are undoubtedly high, so it is important that Australian unemployment remains contained to support mortgage serviceability.

Stockhead:

IMF high-risk reason #2 – Share of housing debt on variable interest rates?

Eliza:

Australia has a high portion of outstanding housing debt on variable rate terms (around 70% at the close of 2022). This means that, unlike the US and many European counties, mortgage holders feel the sting of higher interest rates more rapidly. Amid cash rate rises, outstanding mortgage rates in Australia have increased an average of just over 200 basis points for owner occupier and investor loans.

However, this could arguably be a positive for Australia. The fast transmission of monetary policy was reportedly one of the factors that empowered the RBA to pause the rate-hiking cycle in April, according to a recent address from Governor Lowe.

Australian mortgage holders have so far dealt well with rising rates. CoreLogic data shows little indication of an increase in distressed properties hitting the market, as the flow of new listings volumes remains subdued nationally (trending -14.8% lower than the five-year average). APRA lending data to December showed the portion of the mortgage market associated with late repayments was rising, but remains low, at around 1%.

Stockhead:

IMF high-risk reason #3 – Share of home owners with a mortgage?

Eliza:

As housing-debt-to-income ratios have risen, and loan terms have gradually become longer over time, more home ownership in Australia is comprised of owners with a mortgage. ABS data shows that between 2018 and 2020, the portion of home owners with a mortgage jumped from 32% to 37%.

This means more households may be feeling the direct impact of rising rates through their housing payments, and rate rises could have a stronger impact on household consumption.

The same figures show 31% of Australians rent, while 30% of households own a home without a mortgage.

Stockhead:

IMF high-risk reason #4 – Cumulative cash rate changes (from March 2020 to September 2022…)

Australians are experiencing the sharpest rate-hiking cycle on record, as the underlying cash rate went from emergency lows of 0.1%, to 3.6% as of March this year. Rapid rate increases have not yet fully been passed on to fixed-rate holders, or even variable-rate holders.

Stockhead:

IMF high-risk reason #5 – Real house price growth between March 2020 to March 2022

Australian home values rose 25.4%, or about 19% when accounting for inflation, between March 2020 and March 2022. According to the IMF, housing prices will likely cool more in markets like Australia, relative to other countries, where households are more sensitive to rate hikes, and housing prices rose substantially during the pandemic.

But as of April 2023, a sharp decline in home values has already occurred. National home values declined a record -9.1% from their peak in April 2022, before recovering 0.6% last month. While it may still be too early to call the bottom of the market, the steep price falls to date have seen limited increases in home loan defaults or forced sales.