Highly Compelling: What Moelis Australia is buying on the ASX this morning

News

This week, the MA equities division is all over these ASX mid-to-small caps.

Enjoy.

MTO is a locally-listed motorcycle dealership and accessories group with 48 franchises operated from 31 dealership and eight retail accessory locations in Queensland, NSW, VIC and the ACT. The group is engaged in the sale of new and used motorcycles, accessories, parts, finance, insurance as well as service, repair and the ownership and operation of engaging in the wholesaling and retailing of motorcycle accessories business.

Stock Price: $2.23; Target Price: $2.80

Industry sales rebound in the September quarter.

Research analyst Sarah Mann says MTO’s bike sales in the nine months to Sep 23 YTD are down -2.3%, but sales in September quarter grew +5.4% pcp, representing the first quarter of volume growth since Dec 21.

“Sequential sales growth was 4.2%, which is a strong result given the seasonal strength in the June quarter associated with the instant asset tax write off,” Mann notes.

“Apart from ATVs, all market segments delivered growth. Scooters were the strongest segment, +41.9% pcp, while off-road bikes were +8.5% and MTO’s core road bike category was up +5.4%. Whilst we are careful not to extrapolate one quarter of positive data, it does appear that sales are at least plateauing (if not recovering).”

This bodes well for MTO’s core motorcycle retailing business, Sarah adds.

“ATV sales fell -15.8% pcp, despite cycling a weak pcp. Weakness in ATV volumes may be partially attributed to the instant asset tax write off that concluded in June 23 (for assets over $20k).

“Furthermore, with farming conditions getting tougher, there is a chance that ATV sales remain soft. While Mojo’s CFMOTO brand is not captured in the industry data, management stated at the result that it was ‘maintaining’ market share (rather than taking market share). Therefore, CFMOTO is likely not immune to the soft start to the year for ATV sales.”

There are ‘highly discretionary products’ Sarah notes, but are we past the worst of it?

“While motorcycles are discretionary purchases, in a weak macro environment it is not surprising that bike sales have declined over the past 18 months.

“However, we also note that new bike sales remain below historic long term average levels, and with demand rebounding since May, we may have bottomed. That being said, we assume ~5% LFL sales declines in FY24 (reflecting tougher macro), however, there is now some upside risk.”

And what do weaker ATV sales mean for Mojo?

“While CFMOTO has likely experienced a similarly soft start to FY24, our estimates already assume >20% decline on FY23 run-rate levels,” Sarah says.

“Despite a stronger than expected start to 1Q24 for the industry, our FY24-26 EPS estimates remain unchanged, given the September quarter is the smallest quarter of the year.

“However, trading at ~9x FY25 P/E with upside risk, MTO remains attractive. TP $2.80, BUY retained.”

Eagers Automotive (formerly AP Eagers) sells new and used motor vehicles, distributes and sells parts, accessories and car care products. It provides repair and servicing, extended warranties, facilitates finance and leasing for motor vehicles, as well as property and investments.

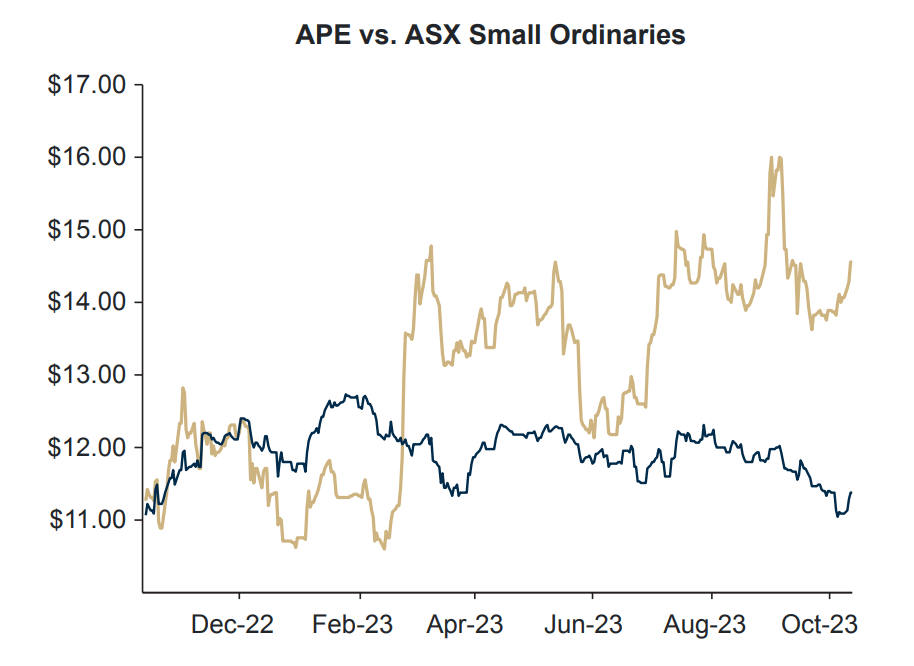

Stock Price: $14.58; Target Price: $16.05

On Tuesday last week, Eagers revealed a ‘non-binding agreement to acquire a portfolio of dealerships and key strategic properties’ across Melbourne and the Mornington region of Victoria from a group of companies associated with Nick Politis.

“The acquisition will include the dealership group and three associated properties for a total purchase price of approximately $245 million, comprised of $111 million for goodwill, $100 million for property and $34 million for net assets,” APE told the ASX.

According to Mann, the deal ‘significantly expands’ APE’s presence in VIC.

“The acquisition generates $1bn in revenue through 12 OEMs (skewed to prestige) across 13 sites located in Melbourne/Mornington.

“Given the business’ skew to Mercedes-Benz, we assume PBT margins are ~2.7%, lower than APE group margins, implying a PBT multiple of ~4.1x. The deal is expected to complete in early 2024, once shareholder approval has been sought (Nick Politis is an APE board member),” Sarah says.

Strategically sensible deal at a reasonable price is the short wrap.

“While industry margins are elevated, we believe the acquired businesses’ margins are sustainable. The business is currently operating below APE group PBT margins – and similar to the ACT acquisition – APE should be able to drive margin upside from operational efficiencies. This should offset GP margin normalisation as supply returns. Therefore, ~4.1x current PBT is a reasonable price.”

VIC is now similar size to QLD.

Historically, Sarah says APE has been overweight QLD and WA, and underweight NSW and VIC (which represent ~60% of the overall market).

“Since the AHG acquisition in 2019, APE have stated the intention to grow in both markets. Post this acquisition, APE’s VIC business will be a similar size to QLD (and slightly larger than WA).”

The property purchases are in line with strategy to own the property behind strategically located hubs.

“The properties in Brighton and Mulgrave have a combined area of 53.5k sqm and are both strategic locations with the potential to consolidate further brands on these sites.

“In the short term, the interest costs associated with owning the property will be offset by the rental cost savings. We also note that the acquisition’s assumed 2.7% PBT margin excludes the rent savings that comes from owning the properties,” she adds.

Although retail demand is softer, fleet orders have likely offset this and trading conditions are still supportive, according to Moelis research, with industry wide deliveries in Jul/Aug/Sep ‘at record levels.’

Sarah puts the acquisition at +4-5% FY24-25 EPS, ‘while our FY23 estimates remain unchanged.’

“Strong deliveries across Jul-Sep bode well for FY23, however, we have left our estimates unchanged pending deliveries in the key months of Nov/Dec.”

Trading Price of $16.06 moves in line with EPS upgrades, the BUY rating is retained.

RUL is involved in software licensing, consulting, implementation and support, technical, advisory and training services and laboratory coal gas testing.

Stock Price: $1.48; Target Price: $2.03

Moelis Australia’s Ronan Barratt notes that RUL’s FY24 revenue guidance was bumped higher by $2m to a range of $107m to $112m (prior $105m-$110m).

“Implying 11% YoY growth at midpoint, and EBITDA guidance (before management incentives) upgraded by $1m to range of $18.5m to $20.5m (prior $17.5m-$19.5m) implying 30% growth YoY.”

Subscription and maintenance Aggregate Run Rate (ARR) ended 1Q24 at $56m (+$1m vs Jun 23). First quarter new software TCV was $13.2m (1Q23: $5.2m). RUL starts 2Q24 with $133m in pre-contracted & non-cancellable software revenue.

Thew company also signed another tier-1 miner under a global framework agreement (GFA) which included a $6.4m, 60-month commitment for ongoing use of existing solutions, plus an incremental $2.3m new software TCV across their global operations.

RUL’s advisory order backlog increased to $24m (vs $18m at Jun-23), Ronan notes, saying strong demand for advisory services drove $16m in advisory sales in 1Q24.

The company says:

“As a result of this stronger than expected start to the financial year by both the software and advisory divisions, management have upgraded FY24 guidance (from that previously disclosed to the market on 28 August 2023):

• Total revenue is projected to now be in the range of $107.0 million to $112.0 million (previously projected to be in the range of $105 million to $110 million (FY2023: $98.4 million));

• Underlying EBITDA is now projected to be in the range of $18.5 million to $20.5 million (previously projected to be in the range of $17.5 million to $19.5 million (FY2023: $15.0 million before management incentives);

• Profit before Tax is now projected to be in the range of $13.5 million to $15.0 million (previously projected to be in the range of $12.5 million to $14.0 million. FY2023: $9.2 million before management incentives).

“While upgraded guidance was largely driven by strong advisory demand, the signing of another tier-1 miner under a Global Framework Agreement (GFA) is a further strategic deal which supports the TCV/ARR outlook into FY24+,” Ronan notes.

“In addition to this Tier 1 miner, the FY23 result announced GFA’s with multiple Tier 1 customers (e.g. Glencore, Rio Tinto, South32), that position RUL as a preferred software vendor, significantly increasing the speed & efficiency of its sales function.

“Across FY24, we assume EBITDA growth of ~$5m is driven by strong demand for advisory (+$3.7m) plus drop-through of incremental software sales.”

“We increase our FY24 EBITDA to $17.2m (prev: $16.6m) inclusive of management incentives, primarily driven by stronger Advisory performance.

“This implicitly assumes that RUL reaches the upper end of its EBITDA guidance range which triggers the payment of management incentives.

Buy rating maintained, $2.03 target price (prev: $2.01).”

Ronan’s thesis comprises:

(a) Operating inflection reached, with strong organic growth outlook (2yr fwd EBITDA CAGR of ~23% supported by deep up/cross-sell opportunities);

(b) flagship ‘asset maintenance’ solution considered industry-leading within its niche; and

(c) ~$35m net cash B/S with buyback in place.

Aspen Group (APZ) is into owning and operating properties in the affordable accommodation sector. It’s also a provider of ‘quality accommodation on competitive terms’ in the residential, retirement and park communities.

Stock Price: $1.72; Target Price: $2.45

Moelis Australia’s real estate equity analyst Murray Connellan says APZ’s first quarter EBITDA of $8m, vs FY24 guidance $29-30m, is ‘buoyed by seasonal strength at Darwin FSR, and a half-yearly dividend from EGH fully reflected in Q1.’

“On an adjusted basis, we believe that Q1’s EBITDA performance was inline with the run-rate implied by guidance. However, we would expect EBITDA to increase over the course of the year, given development completions and the gradual realisation of the ~13% under-renting in the resi assets reported at Jun’23,” Connellan adds.

Operating EPS of 3.67cpu is 15% ahead of the average run-rate implied by the midpoint of APZ’s guidance range.

Development outlook:

Aspen recorded 19 settlements in 1Q24, with a further 35 contracts on hand (a total of 54 vs 84 for FY23).

Guildford Rd update: The apartment development is now expected to be completed in Q3 FY24 (from Q4 previously) with average rents expected to be $375/w (from $350) and stabilised NOI of $1.5m (from $1.4m).

Capital management: 17 houses and apartments in Perth have been divested YTD for a total price of $9.7m and an average net yield of ~3%.

“This should largely fund the remaining capex at Guildford Rd, with gearing therefore likely to be unchanged from 25% @ June’23 (before retained earnings and revaluations),” Murray says.

“We believe that Q1’s operating performance may put APZ on track to beat FY24’s guidance, based on current run-rates and capital commitments. That said, one third of our FY24 EBITDA estimate is contributed by the Park assets (ex-Karratha), and therefore largely a function of tourism.

“With rising interest rates placing consumers under pressure, we have factored in the potential of softening conditions at these assets, and thus our estimates remain within guidance.”

“Aspen currently trades at a 14% discount to its NAV; a NAV that should continue to grow given project upside and the general discount to replacement cost at which the portfolio is valued. Earnings should also maintain momentum, given exposure to the substantial growth currently being seen in residential rents across Australia.”

ED: And look, they have the caravan park next to where this Stockhead author grew up:

“We continue to view the stock as highly compelling at current levels and increase our FY24 expectations; now at the top-end of guidance. Our $2.45 target price is unchanged, and we maintain our Buy rating.”

Moelis Australia is MA Financial Group’s Corporate Advisory and Equities division.

They provide strategic and financial advice for mergers and acquisitions, equity capital markets (ECM), debt capital markets and restructuring as well as cash equities trading. Its specialised sector capabilities include real estate, credit and restructuring, technology and small to mid-cap industrial companies.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.