GICS stock classifications are set to be overhauled; here’s why it’s a big deal and which ASX sectors will be impacted

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

The Global Industry Classification Standard (GICS) is set to be overhauled next year and it could lead to the ASX tech sector shrinking.

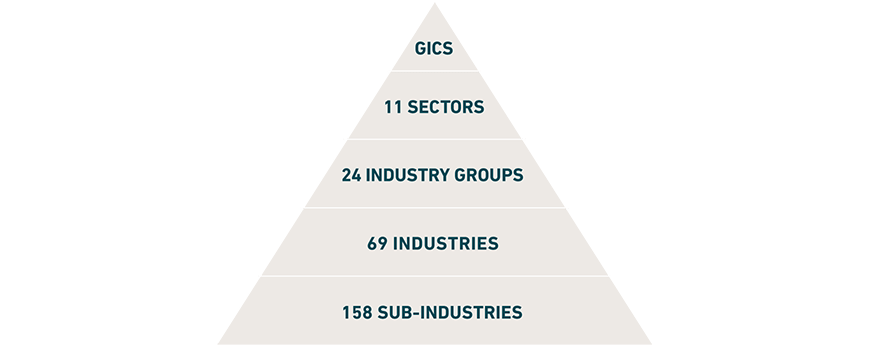

The GICS structure was launched in 1999 by MSCI and S&P Dow Jones as an attempt to create an efficient investment tool to capture the breadth, depth and evolution of particular sectors.

Companies on stock markets such as the ASX are assigned a GICS classification according to their business activity.

The 11 “sectors” are the most broad but also the most important, allowing stocks to be called “health stocks” or “tech stocks”.

Why does this matter? When markets such as the ASX say that a certain proportion of the market is “tech” this is typically the measure utilised.

Indeed the ASX and other exchanges placed a heavy emphasis on attracting technology stocks in recent years.

For funds, particularly ETFs, a company’s classification can make a difference as to whether or not it can fit into an ETF.

It might only be allowed to invest in companies with the relevant GICS code or only in companies in a market index. GICS is a major way companies are sorted into them, particularly indices that are sector specific such as the ASX’s All Technology Index.

How might GICS be overhauled and which ASX stocks might be impacted?

Last month S&P and MSCI launched a consultation on potential changes to the GICS classification system.

This consultation is currently halfway through a two-month consultation period and these changes are scheduled to be implemented in the March quarter of next year.

There were several changes proposed but one of the most pertinent was to move data processing from tech to industrials and payments companies currently in tech to financials (the same category as the big banks).

There are approximately a dozen ASX stocks in a GICS classification that would be impacted by this proposed change that are collectively worth over $50 billion.

These include BNPL giants Afterpay (ASX: APT) and Zip (ASX:Z1P) as well as Link (ASX:LNK) and Computershare (ASX:CPU).

Here’s a list of ASX stocks with the applicable GICS codes…

| Code | Company | Price | ReturnMRoll% | ReturnYRoll% | ReturnWRoll% | Return6MRoll% | MktCap$ |

|---|---|---|---|---|---|---|---|

| APT | Afterpay Limited | 116.42 | 2 | 17 | -1 | 30 | $ 33,793,018,372.26 |

| CCA | Change Financial Ltd | 0.105 | 5 | -25 | 6 | -5 | $ 42,289,235.10 |

| CPU | Computershare Ltd | 19.7 | 11 | 44 | 3 | 39 | $ 11,893,467,919.20 |

| EML | EML Payments Ltd | 2.82 | -9 | -18 | -4 | -47 | $ 1,053,064,771.68 |

| FTC | Fintech Chain Ltd | 0.061 | 5 | -45 | -10 | -19 | $ 39,696,944.87 |

| IP1 | Int Payment Tech Ltd | 0.023 | 21 | -26 | 10 | -8 | $ 28,139,211.33 |

| LBY | Laybuy Group Holding | 0.45 | -6 | -68 | -2 | -33 | $ 114,507,990.45 |

| LNK | Link Admin Hldg | 4.77 | 13 | -4 | 1 | -6 | $ 2,446,950,284.37 |

| PPH | Pushpay Holdings Ltd | 1.4 | -19 | -23 | -22 | -9 | $ 1,595,795,644.80 |

| SMP | Smartpay Holdings | 0.77 | -3 | 25 | -5 | 2 | $ 183,479,421.51 |

| SPT | Splitit | 0.335 | -14 | -75 | -6 | -49 | $ 157,240,441.76 |

| SZL | Sezzle Inc. | 4.5 | -21 | -32 | -11 | -40 | $ 891,648,036.00 |

| TYR | Tyro Payments | 3.27 | -13 | -19 | 0 | -13 | $ 1,685,291,337.78 |

Meanwhile in the US, this would shift companies such as Visa, Mastercard and Paypal from tech to financials.

Bloomberg Intelligence analyst Gina Martin Adams says this would result in the US tech sector shrinking in size by 14% and as a portion of the S&P500 from 27% to 23%.

Nonetheless it might be good news for those that stay. In the US, Microsoft and Apple would account for 59% of tech’s market cap put together.

Why is this a big deal? Inevitably it would shrink the size of the tech sector making it more difficult to use that point to promote Australia as a destination for tech stocks.

It might also result in some fund managers with specific sector mandates having to sell them – although it could see other fund managers buy in.

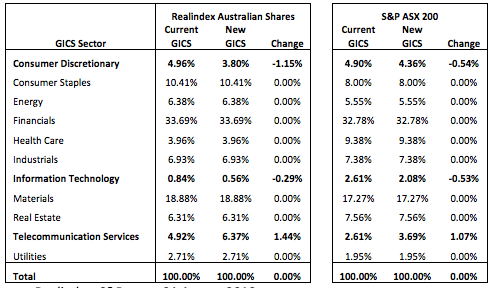

One preview to how it might play out on the ASX this time is what happened when GICS was last changed.

Prior to 2018, companies that provided platforms for communications existed under tech, but S&P and MSCI opted to shift them to telcos – which at the time only included pure-play firms such as Telstra (ASX:TLS).

Australia was hardly impacted with slight shifts in sector shares but a handful of companies did get shifted including REA (ASX:REA) and Carsales (ASX:CAR).

Of course with the BNPL sector being much bigger than it was in 2018 there would be an impact this time. And that’s before you take into account Square’s entry onto the ASX courtesy of it buying Afterpay.

But as Bloomberg Intelligence’s Adams noted last week, Wall Street saw a greater impact back in 2018.

The changes resulted in the shift of Alphabet and Facebook – which then accounted for 19% of tech – over to communications. A substantial movement of capital followed suit.

“Prior to the move there was $21.6 billion sitting in SPDR ETFs benchmarked to US technology and $173 million in telecom companies,” Adams said.

“The move resulted in a significant shift in capital – by the end of 2018, the communications ETF held $3.7 billion.”

She warned that investors might be in for a bumpy ride once again if the proposed changes go ahead next week.

“The most recent experience of major GICS redefinition was relatively tumultuous for stocks and may suggest volatility should be expected if GICS sectors are redefined next year.”

However for the stocks that are left in tech, it might enable them to play a greater role in driving the sector’s performance.

Which other sectors could be impacted?

Most other proposed changes to the GICS classification system were minor and would have little impact on the ASX but two were noteworthy – one of which involved cannabis companies.

S&P and MSCI proposed updating the definition of Pharmaceuticals companies (which sit in healthcare) to include companies primarily manufacturing cannabis-based drugs used to treat diseases.

But it would exclude manufacturers of other cannabis-based products classified based on their end use.

The other change was to consolidate all energy producers and related equipment and service providers under energy – a change from the status quo where some energy generation companies (both renewable and non-renewable) are in the utilities sector.

Inevitably this reclassification aims to decrease the energy sector’s sensitivity for oil shocks and protect against the long-term decline of crude oil.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.