ASX Small Caps Lunch Wrap: Who’s ready to get violently ill on cheese-flavoured booze this Xmas?

News

News

Local markets are pedaling hard, but not making a whole lotta headway this morning, as the market seems divided on which way to lurch.

Pre-Christmas Mondayitis, am I right? … of course I am.

I’ll get into the specifics of why things are so all over the shop this morning in a minute, but first we have to head to the United States of America, where it would appear that they are still – despite the whole Trump thing – yet to learn the lesson that “just because you can, doesn’t mean you should.”

Today’s example comes from the food technologists at Pepsi-Co, a company that really should have stopped trying to develop new things when its “The Choice of a New Generation” slogan turned out to be darkly portentous, with none other than Micheal Jackson at the helm.

But, lesson un-learned, they’re at it again, launching what must be the single-least appetising beverage known to humankind – a hugely alcoholic spirit that (allegedly) tastes like Doritos Nacho Cheese flavoured corn chips. #hhuuuurrrk.

Leaving aside the initial gag-inducing idea of a spirit that seems destined to taste unspeakably foul, the name of this bold new product leaves a little to be desired.

Even with one of the most prodigious collection of marketing minds ever collected by one company, the best they seem to have been able to come up with is “The Empirical x Doritos Nacho Cheese Vacuum Distilled Spirit”.

Which is great, if you’re into the whole “it is precisely what it says on the label” branding thing, but still… it sounds less like a fascinating new product, and more like “we were forced to call it that, because of what’s in it”.

The The Empirical x Doritos Nacho Cheese Vacuum Distilled Spirit promises to deliver “all the indulgent flavours of your favourite Nacho Cheese in liquid form”, probably in precisely the same way throwing up the aftermath of a meal consisting of a half a bottle of gin and a family pack of corn chips would.

Tellingly, the initial release of this liquid abomination will be restricted to select outlets in New York and California, giving rise to speculation that it’s actually a Republican-led effort to poison as many dumb hipsters as possible before word spreads about how unspeakably foul it tastes.

Now, don’t take my word for it… here’s the whole concept explained by a man who looks exactly like the kind of Mustang-driving douche who reckons nacho cheese-flavoured alcohol belongs in people’s mouths, instead of in the bin.

If you’re curious, it will be available for purchase online, for around $97 a bottle – which is utter madness, when you consider that the wording on the label quite clearly indicates that each bottle is likely to contain about $2 worth of generic grain alcohol, and some admittedly thorough food techonologist wizardry designed to somehow make the whole thing taste almost exactly, but not quite the same as a bottle of luke-warm, post-nachos party sick.

Local markets are variable this morning, after a less-than-ideal lead in from Wall Street on Friday, thanks to some “clarification” from the US Fed around rumours of rate cuts on the horizon.

It took just 10 minutes for the ASX 200 benchmark to drop 37 points this morning when local markets opened, and another 70 minutes or so for the benchmark to recover, poking its snout briefly above break-even before starting to settle into the negatives again just before lunch.

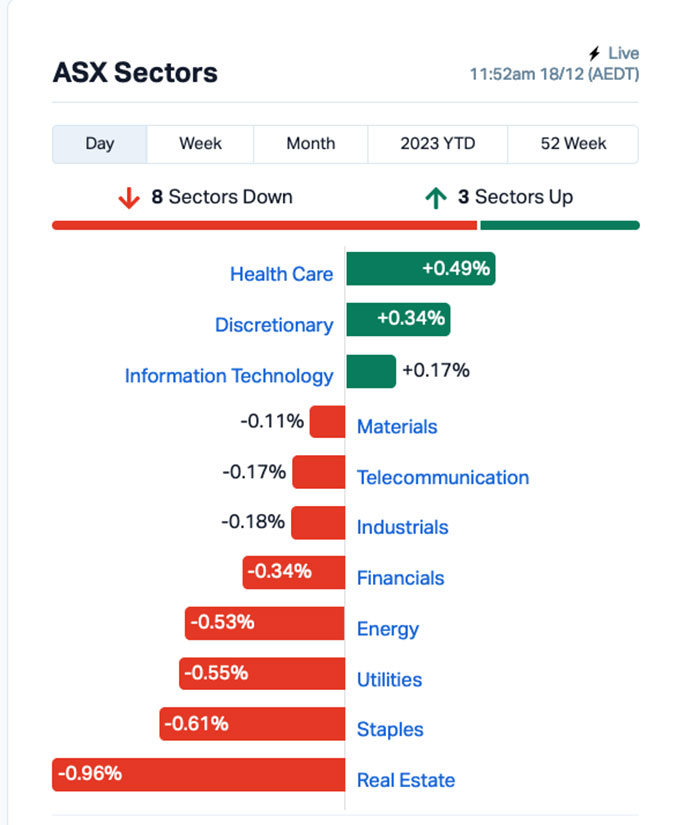

A snapshot of the market sectors shows that Health Care is leading the way this morning, thanks in no small part to a stunning leap for Large Capper Neuren Pharmaceuticals, which has dropped some really good news today.

The company says there’s been a stack of highly positive results from the Phase-2 clinical trial of its drug NNZ-2591 in children with Phelan-McDermid syndrome.

The open label Phase 2 trial in children aged three to 12 years was conducted at four hospitals in the US and with primary endpoints safety, tolerability, pharmacokinetics and efficacy over 13 weeks of treatment with NNZ-2591.

The company says that “significant improvement” was assessed by both clinicians and caregivers across clinically important aspects of Phelan-McDermid syndrome, “including communication, behaviour, cognition/learning and socialisation”.

Health Care has Consumer Discretionary and InfoTech keeping it company on the happy side of the ledger this morning, with the rest of the sectors in the red to varying degrees – but it’s not a complete disaster by any measure, since the worst performer (I’m looking at you, Real Estate) hasn’t broken through -1.0%. Yet.

A couple of other large caps are swinging for the stands this morning, namely Adbri (ASX:ABC) which was soaring this morning, after the company revealed it had received a non-binding indicative takeover proposal from CRH and the Barro Group at a price of $3.20 cash per share, a 41% premium to last close.

And Link Administration Holdings (ASX:LNK) was climbing quickly this morning, on news that it has entered into a scheme implementation deed with Mitsubishi UFJ Trust & Banking Corporation (The Trust Bank), a consolidated subsidiary of Mitsubishi UFJ Financial Group, under which The Trust Bank has agreed to acquire 100% of the shares in Link Group by way of a scheme of arrangement.

Wall Street had a bit of the wind knocked out of its sails during the session on Friday, which left the S&P 500 flat, the blue chips Dow Jones index up by +0.16% and the tech-heavy Nasdaq up by +0.35%.

It was a somewhat muted effort, considering the jag that US markets had been on in previous days – that same wave of buoyant optimism that drove the ASX to a killer +3.76% for the week.

That had largely been driven by comments from the US Fed about potential interest rate cuts next year – so, it only seems fitting that it was … *checks notes* … comments from the US Fed downplaying previous comments from the US Fed that poured cold water on US markets on Friday.

We have Fed Reserve president John Williams to thank for it, after he told CNBC on Friday that talk of a March rate cut was premature.

“We aren’t really talking about rate cuts,” Williams said. “Have we gotten monetary policy to a sufficiently restrictive stance in order to ensure that inflation comes back down to 2 per cent? That’s the question in front of us.”

The Wall Street party tunes turned rapidly to sad trombones, and a lot of the pep went out of investors’ strutting, which in turn left the ASX 200 Futures index pointing a -1.0% a couple of hours before things got happening locally this morning.

To US Stock news, and Earlybird Eddy Sunarto reported that Costco gained +4.5% and hit an intraday record high, after reporting Q1 results that beat analysts’ expectations. Costco said consumers are flocking to Costco’s lower priced groceries and other products.

Cybersecurity company CrowdStrike rose 3% after new SEC rules that require US companies to disclose a breach within four days of determining that a hack will have a material impact on the business are set to take effect on December 18.

Chinese e-commerce JD.com lifted by +4.5% as investors digested a fresh stimulus boost in China, as well as the prospect of further measures.

In Asian markets this morning, Japan’s Nikkei is down 1.24%, and – at the time of writing – both Hong Kong and Shanghai markets were still rubbing the sleep out of their eyes, so… you’re on your own with those two, I’m afraid.

Here are the best performing ASX small cap stocks for 18 December [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap SLZ Sultan Resources Ltd 0.022 38% 637,000 $2,371,041 T3D 333D Limited 0.011 38% 573,181 $955,559 FHS Freehill Mining Ltd 0.004 33% 11,716,336 $8,549,503 RML Resolution Minerals 0.004 33% 12,500 $3,771,875 ABC Adbri Limited 3 32% 3,269,064 $1,483,058,063 HMD Heramed Limited 0.026 30% 894,047 $5,590,284 LNK Link Administration 2.2 29% 4,810,377 $877,858,718 LIS Li-S Energy 0.23 24% 927,512 $118,437,043 TAH TABCORP Holdings Ltd 0.9 22% 28,462,579 $1,677,572,077 AML Aeon Metals Ltd. 0.011 22% 297,406 $9,867,606 ZMM Zimi Ltd 0.033 22% 5,000 $3,250,730 NEU Neuren Pharmaceutical 20.68 21% 1,523,581 $2,169,335,687 M2M Mt Malcolm Mines NL 0.03 20% 3,437,275 $2,933,588 RVS Revasum 0.155 19% 4,833 $15,420,534 PSQ Pacific Smiles Group 1.41 18% 759,539 $190,700,416 UBI Universal Biosensors 0.21 17% 80,112 $38,226,498 KRR King River Resources 0.014 17% 2,934,196 $18,642,299 AZL Arizona Lithium Ltd 0.045 15% 34,959,255 $130,436,062 NVO Novo Resources Corp 0.15 15% 53,664 $5,841,957 INR Ioneer Ltd 0.1325 15% 2,886,403 $242,812,397 FG1 Flynn Gold 0.055 15% 611 $6,994,764 ATH Alterity Therap Ltd 0.008 14% 1,116,134 $19,616,523 ETR Entyr Limited 0.008 14% 5,925,700 $13,881,727 RNX Renegade Exploration 0.008 14% 63,000 $6,998,066 SEN Senetas Corporation 0.016 14% 1,299,754 $18,497,969

Sultan Resources (ASX:SLZ) is the market leader this moring, up 37.5% for the day so far, presumably off the back of last week’s announcement that it submitted a programme of works to facilitate drilling to test the Calesi magmatic nickel prospect, which is the subject of a farm-in agreement with Rio Tinto Exploration (RTX), a subsidiary of Rio Tinto.

The news last week confirmed that pursuant to the agreement, RTX has now formally elected to farm-in to E70/5082, which forms part of Sultan’s broader Kondinin-Lake Grace exploration project, with a right to earn an 80% interest by sole funding $2m of exploration within 5 years.

Mt Malcolm Mines (ASX:M2M) is also moving nicely this morning, on news that the company has reported visual confirmation of the presence of pegmatite in historic drill spoil following an on-ground inspection of the company’s Lake Johnston Project’s tenure.

M2M intends to prioritise and carry out several staged exploration programs targeting lithium and rare earth mineralisation, the company says, with follow up geological mapping, additional sampling of historical drill spoil, rock chip sampling and sampling any outcropping pegmatites planned as a follow up evaluation.

HeraMED (ASX:HMD) has moved the needle about 25% this morning, on news that it has signed a Memorandum of Understanding with FemBridge, a leading innovator in maternal healthcare solutions, based in Winfield, West Virginia.

The MoU will see the companies collaborate on the development of a scalable, seamless, and comprehensive maternity care solution, building on previous work that saw FemBridge engaged by HeraMED as an out-sourced business development function.

“FemBridge and HeraMED will collaborate to integrate HeraCARE into a comprehensive service offering and source grants and payment options best suited to the offer,” HeraMED says, adding that by utilising FemBridge’s increased sales reach in their area of expertise will allow the more opportunity to focus on other verticals.

Here are the most-worst performing ASX small cap stocks for 4 December [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap STK Strickland Metals 0.086 -46% 44,276,612 $261,001,611 KEY KEY Petroleum 0.001 -33% 1,000,000 $2,951,892 RHY Rhythm Biosciences 0.13 -30% 1,726,477 $40,911,379 HCT Holista CollTech Ltd 0.01 -29% 304,000 $3,903,201 POS Poseidon Nickel 0.01 -29% 36,511,590 $51,972,487 S3N Sensore Ltd 0.095 -27% 164,048 $4,731,121 RGS Regeneus Ltd 0.003 -25% 72,500 $1,225,748 VML Vital Metals Limited 0.0075 -25% 58,192,099 $53,061,498 KP2 Kore Potash PLC 0.01 -23% 1,425 $8,710,079 MEL Metgasco Ltd 0.007 -22% 122,371 $9,574,981 88E 88 Energy Ltd 0.004 -20% 14,736,711 $123,204,013 KPO Kalina Power Limited 0.004 -20% 119,374 $11,050,640 SKN Skin Elements Ltd 0.004 -20% 50,000 $2,947,430 AUE Aurum Resources 0.23 -16% 45,977 $10,037,500 SOC Soco Corporation 0.19 -16% 207,950 $31,044,855 MYE Metarock Group Ltd 0.11 -15% 118,090 $39,788,669 IBG Ironbark Zinc Ltd 0.006 -14% 685,505 $11,157,108 LRL Labyrinth Resources 0.006 -14% 24,000 $8,312,806 OAR OAR Resources Ltd 0.003 -14% 2 $9,243,713 PTR Petratherm Ltd 0.03 -14% 134,680 $7,866,290 ARD Argent Minerals 0.0095 -14% 3,652,361 $12,968,793 ST1 Spirit Technology 0.045 -13% 214,748 $38,320,778 GUE Global Uranium 0.1 -13% 586,421 $24,404,032 LM1 Leeuwin Metals Ltd 0.135 -13% 80,431 $7,132,423 CE1 Calima Energy 0.061 -13% 361,887 $43,800,454