ASX Small Caps Lunch Wrap: Osteopore’s gone 1000% bananas, and here’s the rest of the news.

Eric was shattered that he'd ducked out for a spot of morning tea, and missed all the excitement. Pic via Getty Images.

The ASX is up slightly this morning, and medtech minnow Osteopore (ASX:OSX) cranked out an actual 10-bagger, peaking at +1076% just after midday – which was very exciting and has proven to be something of a massive distraction.

So here’s Lunch Wrap, slightly truncated, because I was watching the fireworks and forgot to do my job. My bad.

Sticking with the theme of the brave new world of medical tech, serial megabrain Elon Musk is carving another notch on the bedpost of his life, thanks to a successful implantation of his Neuralink Brain Computer Interface (BCI) device.

Musk famously launched the company in 2016, with the goal of building an implant that would – eventually – do things like restore sight to the blind, and allow users with damaged spinal cords to walk again.

The company recently announced that, despite an increasingly large pile of dead monkeys from earlier experiments, an implant had been put into an actual human being – 29-year-old quadriplegic Noland Arbaugh.

During a Neuralink livestream showing off the technology, Arbaugh let slip that one of the first things he did following the surgery and his mastery of the new tech inside his head, was to sit up all night playing video games, like a total legend, because that’s clearly the best possible use of such life-changing tech.

There are still a lot of wrinkles to iron out with the system, but given the company’s track record and the drive of tech guru chief Musk, there’s no possible way that it’s likely to get rushed to market and be a PR disaster.

The day one of these things gets hacked and everyone with a brain implant suddenly starts doing the zombie dance from Michael Jackson’s Thriller video is going to be quite the sight.

TO MARKETS

Let’s get the obvious news outta the way – Osteopore has gone mental this morning, blasting through +1000% on news that its admittedly impressive bone scaffolding tech has been approved to go to market in Singapore and Vietnam.

We’re looking at a few potential asterixes that might have a bearing on just how big that news is – stay tuned, we’ll have more on it shortly.

But the short version for now is this: Osteopore, an Australian/Singapore based medtech, has been developing some super-interesting products that essentially work as artificial scaffolding to promote bone growth, for – as the company puts it – “high-value complex bone reconstruction procedures as well as general bone grafting procedures”.

This morning, OSX announced that it has received clearance from two regulators, namely Singapore’s Health Sciences Authority (HSA) and Vietnam’s Department of Medical Equipment and Construction (DMEC), for its aXOpore product, which is essentially a porous lattice that is used around existing bones, which mimics the natural bone microstructure to promote new bone growth. It’s very cool.

However… this massive spike comes on the tail of a recent huge fall in share price for Osteopore, after the company went to market seeking $3,000,000 through a placement priced at a massive 94.42% discount to last closing price. That came about through a number of factors, including an ill-timed 15:1 consolidation.

So… 1000% is still a massive jump, but it’s not been from a standing start. It has, however, put OSX up on a longer-term basis – +350% for the year to date, which is nothing to sneeze at – but the company is still boasting a market cap of just $5.5 million at the time of writing.

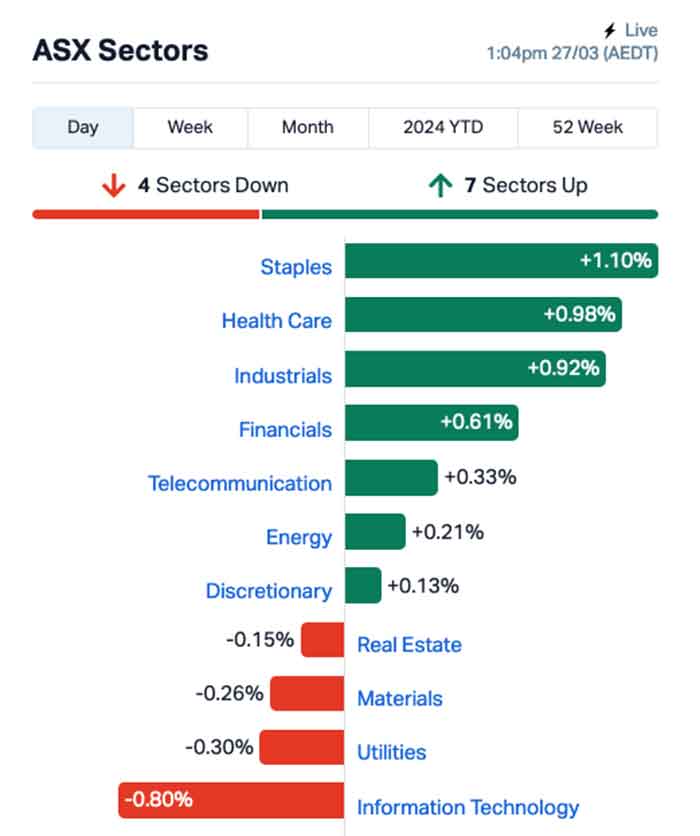

Aside from that, though, things are fairly sedate around the rest of the market. The benchmark is around +0.3% for the morning, and it’s being driven by reasonable gains in Consumer Staples, and Health Care.

The macro news of the day from the ABS is that inflation remained steady, with the CPI needle unbudged from 3.4% for the 12 months up to February.

Up the fat end of town, Johns Lyng Group (ASX:JLG) has managed a handy 4.6% lift, Zip Co (ASX:ZIP) has added 5.6% to its price and PolyNovo (ASX:PNV) is up 4.3%.

NOT THE ASX

In the US overnight, stocks pulled back further. The S&P 500 fell by -0.28% , the blue chips Dow Jones index was down by -0.08%, and the tech-heavy Nasdaq lifted by -0.42%.

As Earlybird Eddy Sunarto pointed out this morning, there is speculation that this is “the correction we’ve had to have after a stunning start to the year”.

In US stock news, Digital World Acquisition Corp (Nasdaq:DJT), the SPAC company that merged with Donald Trump’s social media startup, Truth Social, went soaring on launch.

DJT rose as much as 60% on the first day of public trading, before paring gains to close just 16% higher. The merger, which valued Trump’s company at US$7.9bn, provided a windfall for Trump as he faces mounting series of legal problems.

Tesla shares rose +3% after CEO Musk said US customers can use the company’s self-driving software, the so called Full Self-Driving or FSD, as part of a month-long free trial.

Biggest mover however was Krispy Kreme, which jumped 40% after announcing that its donuts would be available across all of McDonald’s US outlets by the end of 2026.

Meanwhile, cocoa futures touched above US$10,000 a metric ton for the fist time ever, which will make the price of chocolates more expensive ahead of the Easter holiday.

Asian markets are, I am assured, still there.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 27 March [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap OSX Osteopore Limited 0.61 838% 1,678,105 $671,365 SKN Skin Elements Ltd 0.004 33% 767,500 $1,768,458 TLM Talisman Mining 0.225 29% 1,246,150 $32,956,061 PTR Petratherm Ltd 0.028 27% 380,167 $4,944,525 WNR Wingara AG 0.015 25% 150,000 $2,106,510 ARD Argent Minerals 0.0125 25% 36,259,745 $12,917,590 FLN Freelancer Ltd 0.25 25% 86,624 $90,182,976 CTN Catalina Resources 0.005 25% 319,739 $4,953,948 ESR Estrella Res Ltd 0.005 25% 3,999,848 $7,037,487 TMR Tempus Resources Ltd 0.005 25% 700,000 $2,923,995 MPK Many Peaks Minerals 0.24 20% 1,883,586 $7,993,727 AQX Alice Queen Ltd 0.006 20% 20,824 $3,454,921 EPM Eclipse Metals 0.006 20% 1,188,615 $11,048,278 EXL Elixinol Wellness 0.006 20% 6,686,220 $6,328,716 MHC Manhattan Corp Ltd 0.003 20% 200,000 $7,342,449 ICU Investor Centre Ltd 0.032 19% 20,000 $8,186,347 AFP AFT Pharmaceuticals 2.91 16% 1,030 $262,165,650 EIQ Echoiq Ltd 0.13 16% 818,827 $55,704,867 EZZ EZZ Life Science 0.595 16% 124,701 $21,993,075 EFE Eastern Resources 0.008 14% 130,000 $8,693,625 NC6 Nanollose Limited 0.025 14% 107,122 $3,784,140 OLL Openlearning 0.017 13% 227,530 $4,018,036 TDO 3D Energi Ltd 0.069 13% 103,670 $20,219,887 HXG Hexagon Energy 0.026 13% 794,443 $11,797,066 FG1 Flynn Gold 0.054 13% 80,800 $7,878,764

Leaving Osteopore aside as the clear winner for the morning, the rest of the Small Caps are doing their thing this morning.

Talisman Mining (ASX:TLM) jumped nicely on news that follow-up diamond drilling has intersected multiple zones of massive sulphide galena-sphalerite-chalcopyrite (lead-zinc-copper) mineralisation at the Durnings Prospect, part of the 100%-owned Lachlan Project in NSW.

Similarly, Argent Minerals (ASX:ARD) spiked after revealing that two major mineralisation extensions from the Kempfield Deposit have been discovered through surface sampling along strike from Lode 300 Mineralised Block, which contains 5.1Moz Ag @ 102 AgEq (g/t), totalling 65.1 Moz Silver equivalent resource.

Artificial Intelligence and Medical Technology company Echo IQ (ASX:EIQ) climbed after telling the market that it has completed its US Reader Study, a “key step” towards securing final FDA clearance for its cardiology decision-support technology, and an important milestone in Echo IQ’s commercial development.

And EZZ Life Science (ASX:EZZ) has risen after dropping an investor prezzo this morning, which included news that the company has lifted revenue 43% from $15.1m in 1H FY23 to $21.7m in 1H FY24, with a gross margin of 70% stable for the period.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 27 March [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap HAS Hastings Tech Metals 0.43 -29% 2,466,038 $78,775,024 CNJ Conico Ltd 0.0015 -25% 3,000,000 $3,140,190 LSR Lodestar Minerals 0.0015 -25% 5,179,597 $4,046,795 MRD Mount Ridley Mines 0.0015 -25% 487,475 $15,569,766 MRQ MRG Metals Limited 0.0015 -25% 90,909 $5,050,237 PBL Parabellum Resources 0.054 -23% 134,999 $4,361,000 SNS Sensen Networks Ltd 0.018 -22% 605,724 $17,789,937 PLN Pioneer Lithium 0.11 -21% 5,005 $3,979,500 CAV Carnavale Resources 0.004 -20% 527,500 $17,117,759 PRX Prodigy Gold NL 0.004 -20% 8,670,895 $8,755,539 SCT Scout Security Ltd 0.008 -20% 100,000 $2,324,274 PTM Platinum Asset 1.045 -20% 8,543,012 $759,728,086 8CO 8Common Limited 0.036 -18% 194,763 $9,860,176 CCZ Castillo Copper Ltd 0.005 -17% 50,000 $7,797,032 CRB Carbine Resources 0.005 -17% 1,473,681 $3,310,427 OPN Openn Negotiation 0.005 -17% 275,000 $6,775,078 SRR Sarama Resourcesltd 0.02 -17% 391,566 $1,925,258 VRC Volt Resources Ltd 0.005 -17% 1,212,315 $24,780,640 HHR Hartshead Resources 0.0055 -15% 1,369,653 $18,256,434 LCL LCL Resources Ltd 0.011 -15% 187,296 $12,417,932 BKT Black Rock Mining 0.0695 -15% 4,699,692 $89,992,737 DBO Diablo Resources 0.017 -15% 433,759 $2,061,429 LAM Laramide Res Ltd 0.85 -15% 290 $21,297,152 AON Apollo Minerals Ltd 0.023 -15% 874,208 $18,801,258 1MC Morella Corporation 0.003 -14% 516,629 $21,625,798

ICYMI – AM EDITION

Brightstar Resources (ASX:BTR) has raised $12m through a strongly supported two-tranche placement to fund mine life extension at the operating Second Fortune gold mine and fast track development of its Jasper Hills, Menzies and Laverton gold projects.

The placement, which brings the company’s cash balance up to over $20m, to leading domestic and international institutional and sophisticated investors had included a strategic $2m investment from St Barbara (ASX:SBM), which will emerge as BTR’s largest shareholder with a 13% stake.

Other major institutional backers include Collins St Asset Management which subscribed for ~$2.3m in the placement and well-regarded mining investment house Lion Selection Group (ASX:LSX) that subscribed for $2m worth of shares.

Future Battery Minerals (ASX:FBM) has received firm commitments from new and existing institutional and sophisticated investors – including major shareholder Hancock Prospecting – to subscribe for ~109.1 million shares priced at 5.5c each to raise $6m.

Proceeds from the capital raising will be use on the new Miriam project acquisition and aggressive growth-oriented exploration across its flagship Kangaroo Hills and Miriam lithium projects.

Managing director Nicholas Rathjen said the placement provided strong validation of the company’s existing portfolio strategy along with the recently announced acquisition of Miriam.

Phase 4 drilling testing northern extensional and regional targets is currently underway at Kangaroo Hills while a maiden resource is expected for its Nevada lithium project in the next few weeks.

At Stockhead, we tell it like it is. While Brightstar Resources and Future Battery Minerals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.