Closing Bell: ASX down but smiles all round after surprise M&A Monday

Via Getty

Local markets were slip sliding away on Monday, but have staged a half-arsed comeback of sorts following a spate of surprise M&A moves including offers for Link Administration, Adbri and Pacific Smiles.

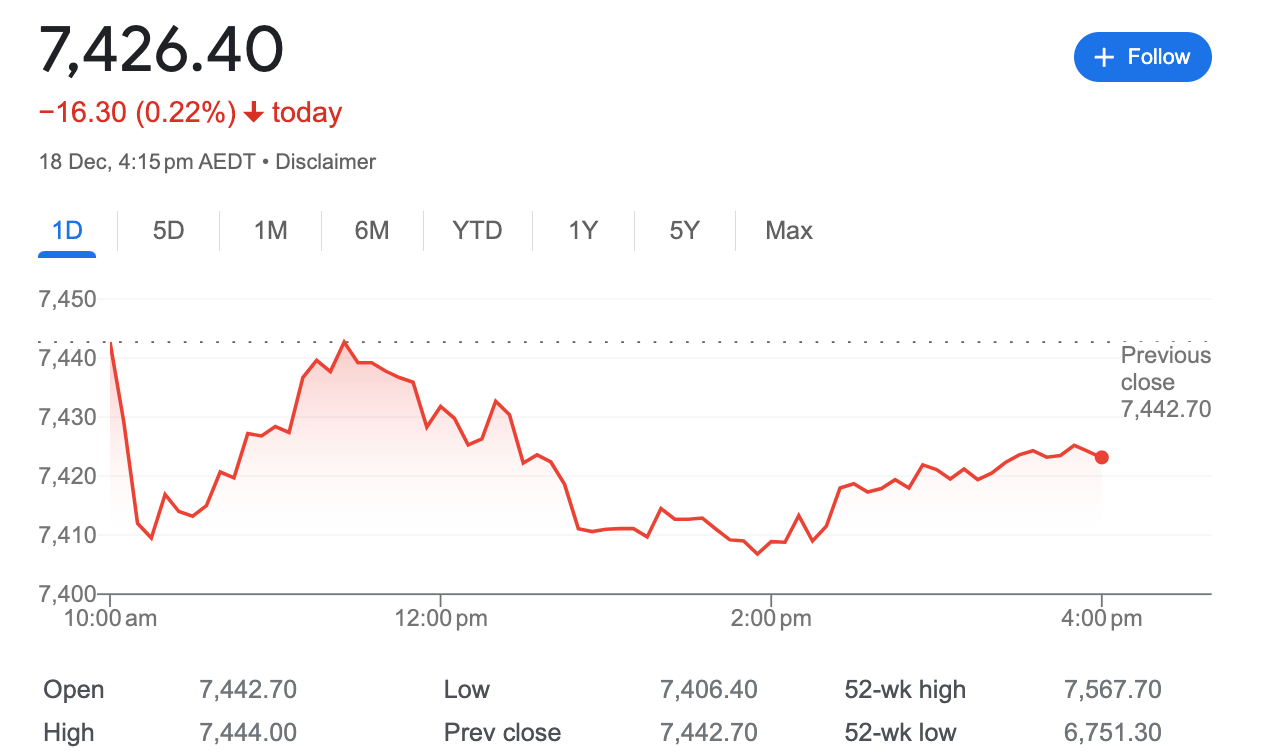

At 4.15pm on Monday December 18, the S&P/ASX 200 (XJO) index was down 16 points, or -0.22%.

After a mixed Friday lead on Wall Street trading on the ASX was further muddied by negative Fedspeak suggesting the US Federal Reserve might be further from interest rate cuts than many investors had been hoping.

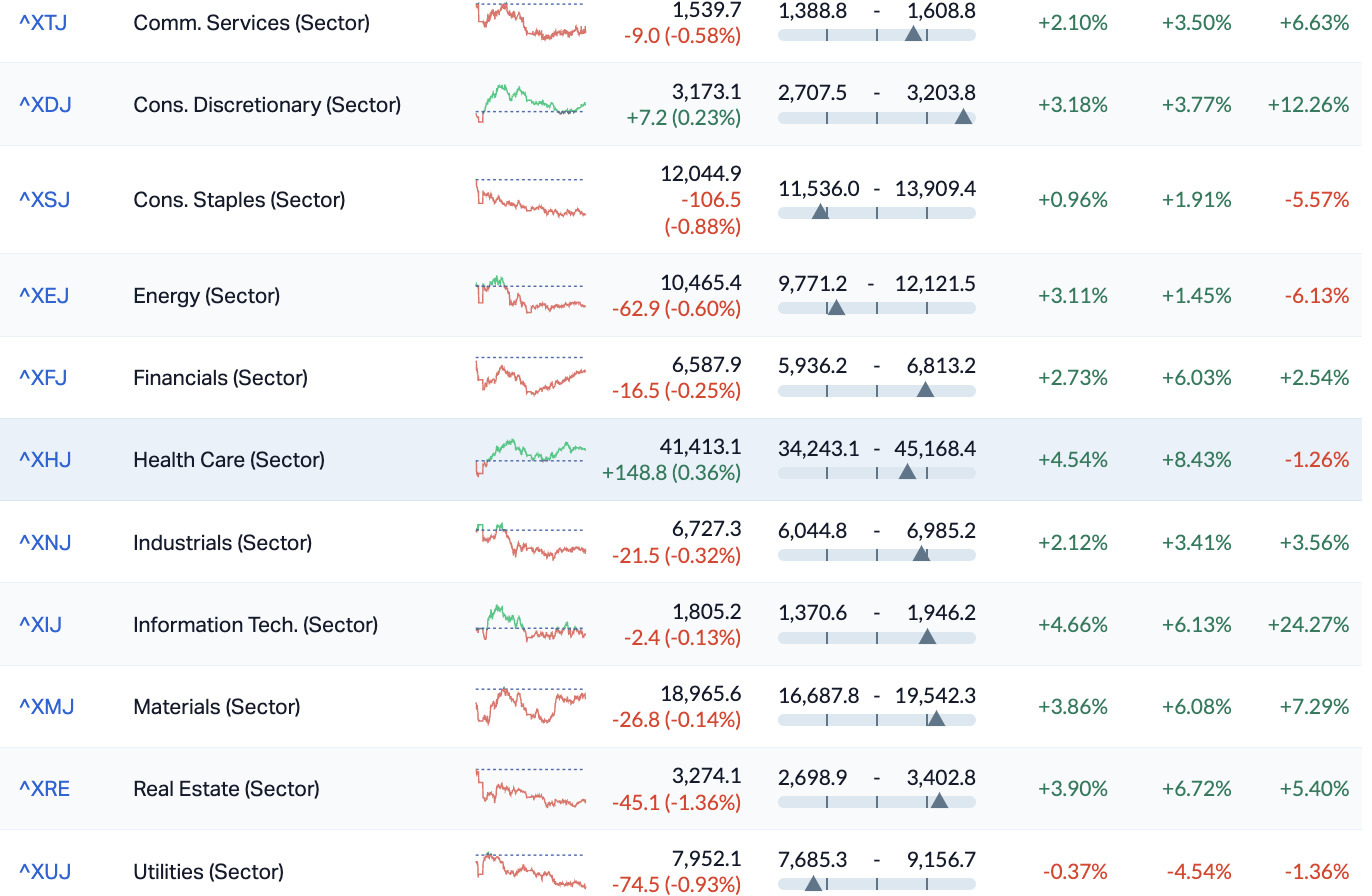

By mid-Monday-morning in Sydney, all sectors bar the Healthcare and IT (information technology) and Consumer Discretionary, were deep in the red zone.

Consumer discretionary large caps held the bourse from deeper losses, withe retail names climbing ahead of early January data which should show a handsome bump from last months Black Friday adventures.

Wesfarmers (ASX:WES) , JB HiFi (ASX:JBH) and Harvey Norman Holdings (ASX:HVN) were all higher on Monday in Sydney.

ASX Sectors on Monday

In company news on Monday, it’s been an M&A market day.

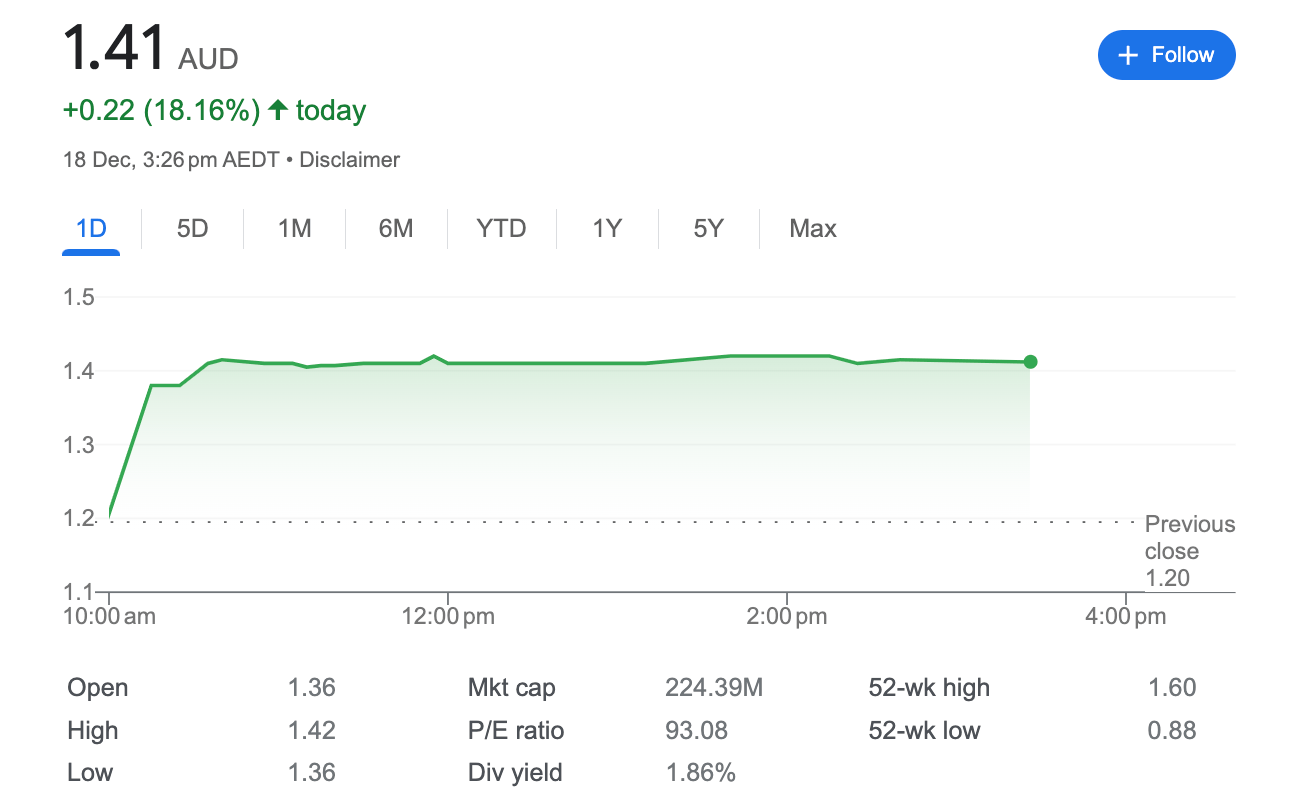

Major stakeholder Genesis Capital has made a big dig for little Aussie dental giant Pacific Smiles (ASX:PSQ) after the teeth tweaker dropped a weak trading update full of holes.

Currently minus a CEO, Pacific has been valued at circa $223.4mn (a $1.40 per share) by Genesis which already holds 18.75%.

The general feeling is Pacific could do worse, despite being caught on the hop.

Elsewhere, Adbri (ASX:ABC) has leapt skywards after receiving a non-binding indicative takeover play from CRH and the Barro Group at $3.20 cash per share – a 41% premium to last close.

And of course Link Administration Holdings (ASX:LNK) smashed Monday after entering into a scheme implementation deed with a subsidiary of Mitsubishi UFJ Financial Group, under which The Trust Bank has agreed to chomp up 100% of Link’s stock.

In the US…

Putting a further dampener on the freewheeling trade seen late last week, US (Chicago) Federal Reserve President Austan Goolsbee told Sunday night telly in the states that the Fed’s fight vs inflation was far from done.

“It’s too early to declare victory,” Goolsbee said during the Monday session in Asia.

Last week, the fickle Fed’s FOMC (Federal Open Market Committee ) nixed any further rate hikes this year and instead chose to advertise the path of loosening for the US benchmark federal funds rate – interest rates – which are currently at a range of 5.25% to 5.5% – the highest level in 22 years.

“We made a lot of progress,” Goolsbee told Face the Nation, despite the encouraging talk out of the central bank last week and as signs US inflation and the economy can meet in the Goldilocks zone – where there’s lots of porridge and no recession.

“So the thing to remember is every time in the past that the Fed or other central banks around the world have had to get inflation down a lot, it has basically always been accompanied by a major recession.”

The Fed began raising interest rates last year to tackle rampant inflation, which then peaked at a near 40-year high of 9.1% in June last year.

That’s gradually whittled away to 3.1% last month, though it’s still well above the Fed’s 2% target.

“I still caution everybody (the fight v inflation) is not done. And so the data is gonna drive what’s gonna happen to rates.”

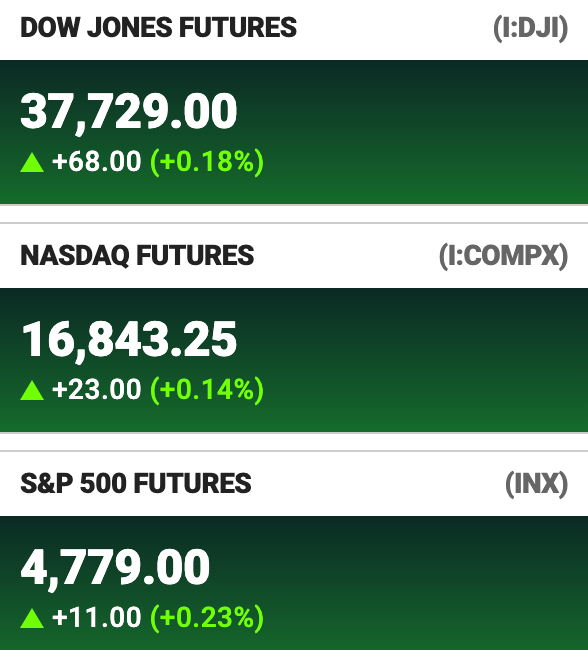

Asian equity markets were almost universally lower by late in the Sydney arvo, as investors digested the now 2 x hawkish rate remarks out of the states, as well as bracing for cash rate decisions for Japan (the Bank of Japan (BoJ) meets on monetary policy, Tuesday, while the People’s Bank of China (PBoC) rejigs its loan prime rates (LPR) on Wednesday.

Stock markets have fallen in Hong Kong, Shanghai, Shenzhen, Seoul Sydney and Tokyo.

At 4pm in Sydney, Futures tied to the 3 major US indices were ahead of the Friday open in New York:

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CLE | Cyclone Metals | 0.0015 | 50% | 9,220,000 | $10,471,172 |

| T3D | 333D Limited | 0.011 | 38% | 579,984 | $955,559 |

| FHS | Freehill Mining Ltd. | 0.004 | 33% | 16,266,336 | $8,549,503 |

| RML | Resolution Minerals | 0.004 | 33% | 12,500 | $3,771,875 |

| ABC | Adbri Limited | 2.99 | 32% | 4,532,024 | $1,483,058,063 |

| SLZ | Sultan Resources Ltd | 0.021 | 31% | 1,090,327 | $2,371,041 |

| NEU | Neuren Pharmaceut. | 22.01 | 28% | 2,184,684 | $2,169,335,687 |

| LNK | Link Admin Hldg | 2.16 | 27% | 9,087,593 | $877,858,718 |

| HMD | Heramed Limited | 0.025 | 25% | 994,047 | $5,590,284 |

| MRD | Mount Ridley Mines | 0.0025 | 25% | 1,440,016 | $15,569,766 |

| SIT | Site Group Int Ltd | 0.0025 | 25% | 1,009,828 | $5,204,980 |

| RIM | Rimfire Pacific | 0.016 | 23% | 18,286,534 | $27,368,182 |

| TAH | TABCORP Holdings Ltd | 0.9025 | 23% | 48,928,475 | $1,677,572,077 |

| AML | Aeon Metals Ltd. | 0.011 | 22% | 297,406 | $9,867,606 |

| ZMM | Zimi Ltd | 0.033 | 22% | 5,000 | $3,250,730 |

| SEN | Senetas Corporation | 0.017 | 21% | 1,913,072 | $18,497,969 |

| NXS | Next Science Limited | 0.34 | 21% | 276,474 | $81,674,629 |

| M2M | Mtmalcolmminesnl | 0.03 | 20% | 3,597,358 | $2,933,588 |

| WIN | Widgienickellimited | 0.12 | 20% | 266,768 | $29,794,505 |

| INR | Ioneer Ltd | 0.1375 | 20% | 8,768,370 | $242,812,397 |

| CI1 | Credit Intelligence | 0.215 | 19% | 17,389 | $15,848,138 |

| THR | Thor Energy PLC | 0.031 | 19% | 3,521,092 | $4,836,945 |

| WHK | Whitehawk Limited | 0.025 | 19% | 3,856,712 | $6,916,085 |

| PSQ | Pacific Smiles Grp | 1.4125 | 18% | 900,931 | $190,700,416 |

| TOY | Toys R Us | 0.013 | 18% | 3,398,246 | $10,807,099 |

Sultan Resources (ASX:SLZ) is the market leader this moring, up 37.5% for the day so far, presumably off the back of last week’s announcement that it submitted a programme of works to facilitate drilling to test the Calesi magmatic nickel prospect, which is the subject of a farm-in agreement with Rio Tinto Exploration (RTX), a subsidiary of Rio Tinto.

The news last week confirmed that pursuant to the agreement, RTX has now formally elected to farm-in to E70/5082, which forms part of Sultan’s broader Kondinin-Lake Grace exploration project, with a right to earn an 80% interest by sole funding $2m of exploration within 5 years.

Mt Malcolm Mines (ASX:M2M) is also moving nicely this morning, on news that the company has reported visual confirmation of the presence of pegmatite in historic drill spoil following an on-ground inspection of the company’s Lake Johnston Project’s tenure.

M2M intends to prioritise and carry out several staged exploration programs targeting lithium and rare earth mineralisation, the company says, with follow up geological mapping, additional sampling of historical drill spoil, rock chip sampling and sampling any outcropping pegmatites planned as a follow up evaluation.

HeraMED (ASX:HMD) has moved the needle about 25% this morning, on news that it has signed a Memorandum of Understanding with FemBridge, a leading innovator in maternal healthcare solutions, based in Winfield, West Virginia.

The MoU will see the companies collaborate on the development of a scalable, seamless, and comprehensive maternity care solution, building on previous work that saw FemBridge engaged by HeraMED as an out-sourced business development function.

“FemBridge and HeraMED will collaborate to integrate HeraCARE into a comprehensive service offering and source grants and payment options best suited to the offer,” HeraMED says, adding that by utilising FemBridge’s increased sales reach in their area of expertise will allow the more opportunity to focus on other verticals.

There were some big movers among the large caps on Monday, including a late charge by Tabcorp Holdings (ASX:TAH) on news that it has been awarded the new Victorian Wagering and Betting Licence by the Victorian Government, which is an exclusive licence for a period of 20 years, commencing in August 2024.

The key points of the announcement include that the new licence features modernised terms, “creating a level playing field in Victoria for taxes and fees and enhancing Tabcorp’s ongoing competitiveness”, and comes with no racing industry joint venture or obligations.

Neuren Pharmaceuticals (ASX:NEU) dropped some really good news, announcing that there’s been a stack of highly positive results from the Phase-2 clinical trial of its drug NNZ-2591 in children with Phelan-McDermid syndrome.

The open label Phase 2 trial in children aged three to 12 years was conducted at four hospitals in the US and with primary endpoints safety, tolerability, pharmacokinetics and efficacy over 13 weeks of treatment with NNZ-2591.

The company says that “significant improvement” was assessed by both clinicians and caregivers across clinically important aspects of Phelan-McDermid syndrome, “including communication, behaviour, cognition/learning and socialisation”.

Adbri (ASX:ABC) was soaring after the company revealed it had received a non-binding indicative takeover proposal from CRH and the Barro Group at a price of $3.20 cash per share, a 41% premium to last close.

And Link Administration Holdings (ASX:LNK) was climbing quickly on news that it has entered into a scheme implementation deed with Mitsubishi UFJ Trust & Banking Corporation (The Trust Bank), a consolidated subsidiary of Mitsubishi UFJ Financial Group, under which The Trust Bank has agreed to acquire 100% of the shares in Link Group by way of a scheme of arrangement.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Commpany | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| STK | Strickland Metals | 0.085 | -47% | 62,604,855 | $261,001,611 |

| WNX | Wellnex Life Ltd | 0.022 | -45% | 4,844,116 | $39,026,363 |

| ADS | Adslot Ltd. | 0.002 | -33% | 10,000,000 | $9,673,487 |

| KEY | KEY Petroleum | 0.001 | -33% | 1,000,000 | $2,951,892 |

| GTG | Genetic Technologies | 0.135 | -33% | 24,232 | $23,083,316 |

| RHY | Rhythm Biosciences | 0.125 | -32% | 2,134,445 | $40,911,379 |

| SAN | Sagalio Energy Ltd | 0.007 | -30% | 100,000 | $2,046,601 |

| VML | Vital Metals Limited | 0.007 | -30% | 72,444,385 | $53,061,498 |

| HCT | Holista CollTech Ltd | 0.01 | -29% | 304,000 | $3,903,201 |

| POS | Poseidon Nick Ltd | 0.01 | -29% | 78,584,793 | $51,972,487 |

| S3N | Sensore Ltd | 0.096 | -26% | 328,848 | $4,731,121 |

| DCX | Discovex Res Ltd | 0.0015 | -25% | 1,221,179 | $6,605,136 |

| RGS | Regeneus Ltd | 0.003 | -25% | 72,572 | $1,225,748 |

| RMX | Red Mount Min Ltd | 0.003 | -25% | 311,416 | $10,694,304 |

| TKL | Traka Resources | 0.003 | -25% | 2,124,567 | $3,501,317 |

| AUA | Audeara | 0.029 | -22% | 70,775 | $5,350,486 |

| 88E | 88 Energy Ltd | 0.004 | -20% | 19,569,215 | $123,204,013 |

| AGR | Aguia Res Ltd | 0.008 | -20% | 2,387,977 | $4,683,370 |

| DCL | Domacom Limited | 0.016 | -20% | 99,750 | $8,710,035 |

| KPO | Kalina Power Limited | 0.004 | -20% | 119,374 | $11,050,640 |

| EXT | Excite Technology | 0.0065 | -19% | 306,533 | $10,473,934 |

| XGL | Xamble Group Limited | 0.053 | -18% | 95,514 | $19,213,013 |

| ARD | Argent Minerals | 0.009 | -18% | 3,752,361 | $12,968,793 |

| A1G | African Gold Ltd. | 0.025 | -17% | 163,662 | $5,079,336 |

| 1MC | Morella Corporation | 0.005 | -17% | 1,717,235 | $37,072,797 |

TRADING HALTS

Syntara (ASX:SNT) – pending an announcement by the Company to the market in relation to the outcome of a capital raising.

First Lithium (ASX:FL1) – pending an announcement regarding material assay results.

Sarytogan Graphite (ASX:SGA) – The company hasreceived material spheroidization results and needs time to process the results for release to the market.

Azure Minerals (ASX:AZS) – ending the release of an announcement regarding a material update to the current change of control transaction.

MTM Critical Metals (ASX:MTM) – pending an announcement regarding a potential material acquisition.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.