FREE WHELAN: People find it hard to pick the bottom. Not Jimmy.

News

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

The US President Joe Biden only met our Albo on Wednesday and Wall Street’s already chucked on a casual 6%.

We’ve done alright too on the local exchange, I thought Monday went pretty well. Certainly, it looks like things are a little easier under our new emperator Antonius Norminius Albanesier.

Although, you’d be right to say correlation is not causation. And to be faaaaaiiir to the other bloke, the market was due.

Opposite of under, due.

The drop in the S&P 500 so far this year (13%) is currently the worst since 1970.

To any mug rubbing two numbers together it means pretty much nothing, other than it’s always cool to have a look at when a 6% week has happened in the past. Then stats begin to rub against trends.

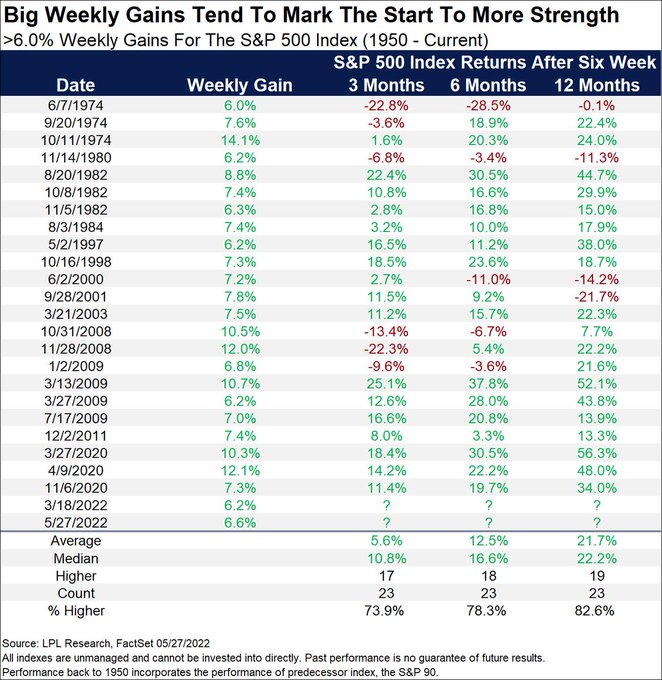

On average the S&P puts on another 12.5% in the following six months and was up 18 out of 23 times such a bump has happened since 1950.

So that’s pretty bullish. But we’ve seen stats in the past telling us April is statistically a bullish month (it wasn’t) and that earlier in the year Nasdaq intraday swings to 5% upside were almost always a sign of a longer-term bear market (which it was), so take this for what it is. Stats about the past.

Some people suggesting that if inflation sort of is peaking and data hasn’t been super great and that means maybe the Fed will not be as aggressive on their rate rises. Apparently the market prefers weak data and a less hawkish Fed to strong data and a hawkish Fed. Maybe they’ll not raise in September? Maybe…

Cynically you know what the biggest reason I have for the Fed still ploughing ahead and not giving a rat’s about the market anymore?

Always back self interest…

One of our core holdings is IHOO which is simply the largest 100 companies in the world (a lot of tech at the top). And I will not lie, I saw it moving to a point that should it fall through, and I was hesitant to hold for another 10-15% drawdown.

If I was stopped at that level I’d wait it out and go directly into staples or add to quality.

As usual my ability to set stops is renowned around the land for three reasons:

Stay the course and stay invested? The average return one year after a bear market finds the bottom is around 44% apparently. The hard part is finding that bottom.

Myself I still see there’s a lot of risk to the downside and that we in all probability take another leg down. The Fed still pushes ahead and valuations are still being reset. Take this rally to ease off some risk and assess where you want to be in the new world.

You need to be low leverage, have consistent earnings growth and a high return on equity. That screams quality. Focus yourself on what’s entailed in a good quality stock.

There’s a storm front coming in employee shares. About half of the ones issued by startups are worthless now. I have no verification of this stat but it sounds about right.

What you can expect ahead in a big way is fresh issued employee options at strikes and that means dilution. Pay attention to that.

Then you get Bolt (tech startup), which in February launched 100% full recourse loans so employees could fund the exercise of options.

Everyone said it was a bad idea.

Then last week they laid off 250 employees.

Please don’t take any more risk than you have to in this market…

Stay safe and all the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.