FREE WHELAN: FY23, a great time to reflect on what has been before what comes ahead

Experts

Experts

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Top of the afternoon to you and a happy new financial year!

Great though it is to be winning the Ashes in England shortly there’s matters to attend to in markets.

The end of the financial year and first half of the year is a great time to reflect on what has been before what comes ahead.

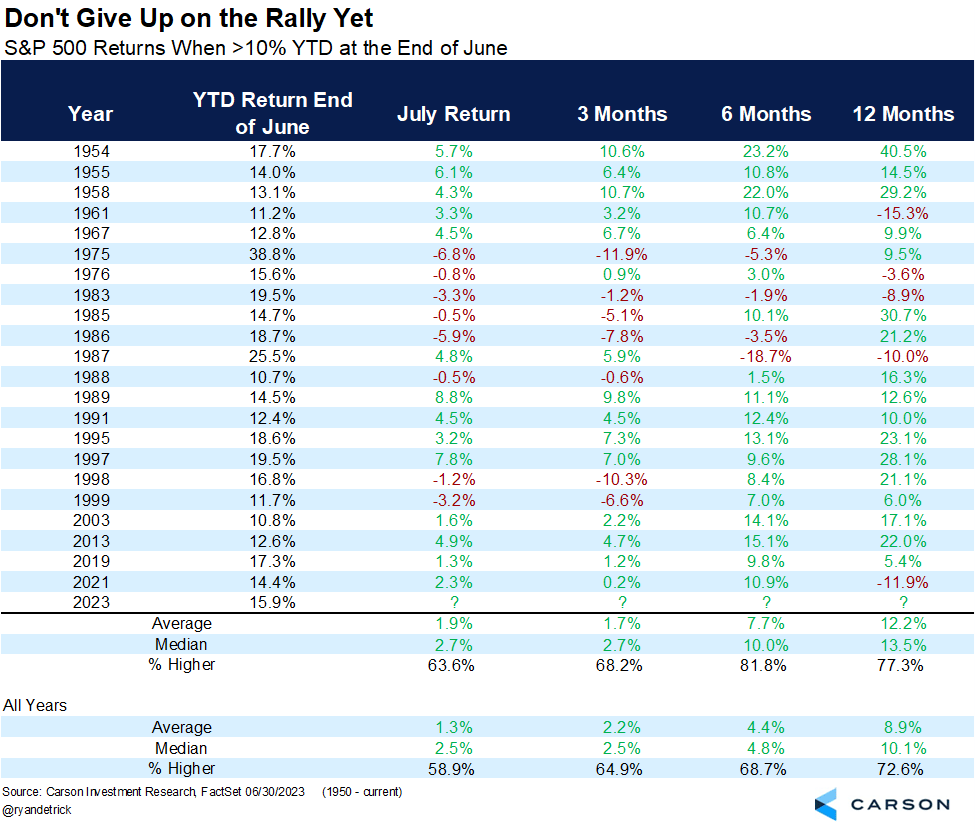

If the S&P 500 is up over 10% by the end of June.

The next 6 months are usually fairly ok, being up the last 11 times this has occurred.

Stay invested. I’m still gasping at just how a few stocks are keeping this market going and, using round numbers, the Nasdaq is up ~30%, the S&P 500 is up ~16% BUT if you equal weight that index instead of market weight it then it’s only up ~5%.

That’s quite a differential.

Staying with the research from Carson, they accurately predicted weakness in May, strength in June and they foresee July strength as well.

I’m inclined to agree that we can go higher and continue to encourage folks stay invested.

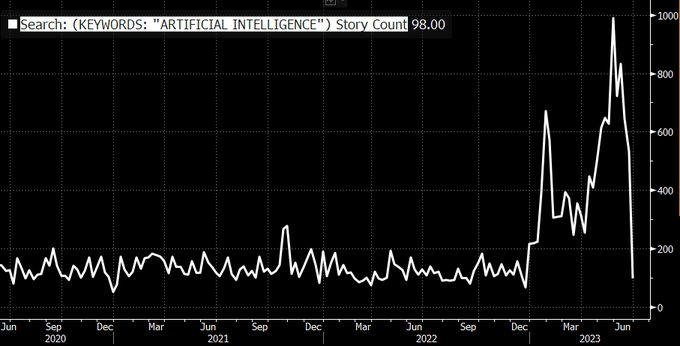

That being said, keep in mind that the rally in tech was greatly (overstated) attributed to the Artificial Intelligence revolution, which has apparently stopped being as exciting as it once was.

These are media mentions of Artificial Intelligence pulled off Bloomberg.

Looks like the hype has died but the functionality is still being discovered and improved every day.

So, we have the second half of the year ahead of us and we have to think about what’s still relevant. There’s more to come in my half year review which is available to register here:

Book a spot now and catch all of my views in a little more detail.

For now though I think the best location for a summary is the podcast from Friday so tune in and send any questions you have.

Of note is the fact that inflation is coming down here but I am deeply concerned by the impending Taylor Swift concert schedule which has thus shown that the Australian consumer is strong. I honestly think the RBA has a little more to go.

Meanwhile…

Bottom line is that we’re in a strange Twilight Zone place where good news is being read as good news in the States. That is a rare opportunity and one that hasn’t existed for a long time.

Markets have accepted that Central Banks won’t necessarily come to the rescue any time there’s an issue and so have effectively cut the cord from the liquidity drug it’s been on for such a long time. Strong economy means a strong economy for now.

This, however, is sitting with me from the CIO of PIMCO, Daniel Ivascyn in the FT over the weekend.

“Favouring high-quality government and corporate bonds for now, he is waiting for company credit ratings to be downgraded, which he said will prompt forced selling among vehicles such as collateralised loan obligations in the coming months and years. That will be the time to snap up bargains, he said.”

It’s entirely possible we have some earnings downgrades ahead of us. Don’t get too complacent.

Stay safe and a bigger update at the webinar.

All the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article