ETFs shorting US stocks top performers in 2022, Crypto ETFs feel chill of winter

BetaShares Crypto Innovators ETF (ASX:CRYP) felt the winter cold in 2022. Pic: Getty Images

- ETFs shorting US markets led the top performers in 2022

- Crypto ETFs feel the freeze of a crypto winter in 2022

- Investors urged to diversify amid global uncertainty in 2023

ETFs shorting US stocks, particularly tech, were the top performers in Australia in 2022, according to online investment advisor Stockspot, which builds custom portfolios using ETFs.

The Global X Ultrashort Nasdaq 100 hedge fund (ASX:SNAS) returned ~82% in CY22, followed by the BetaShares US Equities Strong Bear Hedge Fund – currency hedged (ASX:BBUS) which returned 44%.

It was a tough year for global markets as central banks hiked rates to contain rising inflation striking fears of an economic slowdown and recession.

Geopolitical tension with the war in Ukraine plus the ongoing fallout from the covid-19 pandemic put further pressure on markets.

Wall Street had its worst year since the 2008 global financial crisis.

The Dow Jones Industrial Average fared the best of the US indexes in 2022, down about 8.8%, while the S&P 500 tumbled 19.4%, while the tech-heavy Nasdaq sank 33.1%.

Stockspot Senior Manager – Investments and Business Initiatives Marc Jocum said he was not surprised by which ETFs took out the top spot in 2022.

“These results are not surprising given the terrible run US tech companies had in 2022 and the weak performance of the NASDAQ which fell around 33% in 2022,” he said.

“When the NASDAQ and broader U.S. share market falls, these inverse ETFs will do well.”

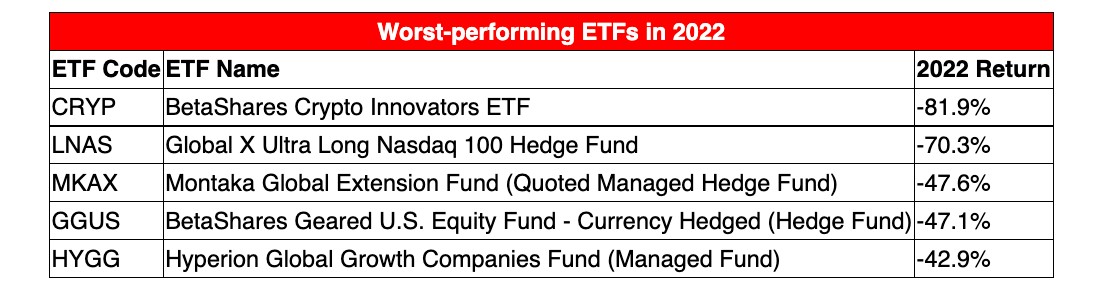

Crypto winter sees CRYP top 2022 ETF laggards

Last year was certainly challenging for crypto investors. Winter arrived and it was cold. At the start of 2022, the collective market cap of cryptocurrencies globally was ~$2.2 trillion but by the year end it fell to just below $800 billion.

The fall in crypto prices started with central banks tightening interest rates, effectively ending years of easy money policies which saw risky assets fall first.

The biggest industry story for crypto came in Q4 CY22, as Sam Bankman-Fried’s FTX collapsed due to alleged mismanagement of client funds and among a myriad of other factors a heavy reliance on FTX’s native token FTT.

Cosmos Asset Management delisted its Cosmos Global Digital Miners Access ETF (CBOE:DIGA) , which invested in companies associated with crypto mining.

The company also delisted its two pure cryptocurrency ETFs, the Cosmos Purpose Bitcoin Access ETF (CBOE:CBTC) and Cosmos Purpose Ethereum Access ETF (CBOE:CPET).

And the crypto fallout took a toll on the BetaShares Crypto Innovators ETF (ASX:CRYP), which broke an ETF record when it listed on the ASX on November 4, 2021, attracting more than $8 million within 45 minutes.

It was the biggest ETF loser in Australia 2022, with its performance falling ~82% in CY2022.

“Unsurprisingly, given crypto prices – like Bitcoin – tanked in 2022, the CRYP ETF fell given many of the companies in the ETF are leveraged to crypto prices, Jocum said.

“Investors turned away from crypto as it failed to provide protection against inflation and did not act as a store of value.

“Further headwinds such as rising interest rates and the bankruptcy of FTX and other crypto players could see crypto experience another volatile year.”

Energy and resource ETFs perform well

ETFs tracking energy and resources companies performed well in Australia in 2022 including BetaShares Global Energy Companies ETF – Currency Hedged – (ASX:FUEL), BetaShares Australian Resources Sector ETF (ASX:QRE) and SPDR S&P/ASX 200 Resources Fund (ASX:OZR).

“Also performing well was energy and resource companies which benefited from rising oil and commodity prices in 2022,” Jocum said.

“ETFs that hold energy companies or commodities outperformed other sectors.”

Looking forward to 2023

Experts have forecast continued uncertainty to hang over markets in 2023 with how companies adapt to a potential recession have an impact along with China’s moves away from its covid-19 zero policy.

“No one knows what will happen in 2023,” Jocum said.

“The best thing for investors to do is have a diversified portfolio of different asset classes rather than concentrating all their wealth in a single share,” he said.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.