XM’s Pete McGuire on FTX, monetary tightening and what levels BTC will crash or rally at in 2023

Via Getty

The legendary FX Whisperer from Coogee, Peter McGuire Chief Executive Officer of XM Australia has a peerless track record of calling it as it is, saving the sound and fury for the market movements themselves.

He’s the responsible manager of the FX giant’s Australian Financial Services License, he’s a hard man to pin down because when you’ve attained the rank of 4th dan black belt in IKO Goju-ryu karate and live at Coogee, the beach is always calling.

Pete takes two minutes from his busy Bloomberg, CNBC schedule to answer this about crypto at Christmas in 2022, (*just as the global cryptocurrency market cap is dipping up and down near the US$800bn mark)…

Pete, can cryptocurrencies stage a considerable comeback in 2023?

“Undoubtedly, 2022 has been a turbulent year for Bitcoin and cryptocurrency markets in general as the combination of rising interest rates, persistently high inflation and liquidity draining shifted investor interest towards defensive assets.

“On top of that, the crypto space also suffered from an alarming number of systemic failures, which dented investor trust in the broader digital sector and raised calls for regulatory intervention,” he adds.

Monetary tightening weighed on cryptos

“Through 2022, a barrage of developments negatively affected the performance of digital assets and most of these themes are not likely to subside at least in the first half of 2023.

“On the one hand, the high and sticky inflation eroded people’s disposable income despite the significant accumulation of savings within the pandemic and forced central banks to raise interest rates aggressively.

“Moreover, Covid-19 repercussions and geopolitical tensions deteriorated further the already adverse macroeconomic backdrop, increasing fears of an impending global recession. As expected, investors transferred their funds from cryptocurrencies to less risky assets in an attempt to find a shelter for the difficult times that could lie ahead.

“Moving forward, there seems to be limited upside potential for digital coins as major central banks have stated in all tones that monetary conditions will remain restrictive until price stability is restored, even if that leads to a recession.”

Peter says 2022 did provide a few invaluable lessons about cryptocurrencies’ position in the asset spectrum.

For instance, the myth that cryptocurrencies are not linked to traditional assets because they are not backed by any fundamental factors got blown out of the water, “due to their strong positive correlation with risky assets and especially growth stocks.”

Based on that, he says, BTC also failed to act as the inflation hedging tool everyone’s been so impressed with.

Systemic failures undermine investor sentiment

“This crypto bear market exposed flaws and failures in several cryptocurrency projects and business models, delivering significant blows to the trustworthiness of the broader sector. In addition, many crypto-related firms fell victims of hacking and frauds, indicating that despite its innovative features blockchain technology remains in developing stage, thus investors should be aware that idiosyncratic risks still exist,” McGuire says.

“In the beginning of the crypto market downtrend, small cryptocurrency firms that faced solvency issues were rescued by bigger players in the industry so that stability and trust in the sector would be preserved.

“However, as the crisis deepened and major digital coins suffered extensive losses, even behemoths such as FTX, which was the second largest crypto exchange in the world, collapsed. Stepping into 2023, there is no concrete evidence that the contagion from FTX’s failure is totally contained, igniting fears that the bankruptcy domino within the crypto environment could expand.

“Last but not least, the survivors within the crypto industry have already proceeded with massive layoffs throughout the year, which could be considered as a useful proxy for their managements’ forecasts and expectations over the growth prospects of the sector.”

McGuire: Regulators late to the party

“During this year’s capitulation, many market participants have blamed the lack of strict regulations for the turmoil in crypto markets. Even though there were recurring calls for regulatory intervention from US Senators, EU policy makers and central bank officials, every attempt to impose strict regulations has remained in embryonic stages.”

A universally approved and imposed regulatory framework currently seems like a far-fetched dream, but Peter says it could actually prove to be a decisive factor – removing a bit of the uncertainty in the broader crypto universe.

“Throughout 2022, crypto markets have been facing a liquidity crunch mainly due to the lack of investor confidence in the sector as more and more crypto-related firms collapse. As a result, thin liquidity magnifies losses as leveraged positions get liquidated faster due to the absence of buyers, causing significant downward spikes.”

“Hence, the big question that lies ahead is whether the imposition of stricter rules within the cryptocurrency space could prevent further capital flight towards other asset classes.”

Miners and energy transition

“At the current price levels, crypto mining is not attractive, and miners have started offloading their holdings on exchanges to cover rising costs in anticipation of even lower prices. Many Bitcoin miners had transferred their operations to northern Europe as electricity prices were lower due to the abundant hydroelectric power and low demand.

“Nevertheless, energy prices skyrocketed in those continents due to the increase in demand during the winter months, destroying the miners’ last refuge in Europe. The situation in the US is not better either, with Core Scientific, one of the largest listed US Bitcoin miners filing for bankruptcy last Wednesday as a result of the deadly combination of rising costs and declining Bitcoin prices,” McGuire says.

Looking into the future, less supply could boost prices, but investors watching miners go out of business could also harm their sentiment toward cryptos’ growth prospects. That being said, less energy intensive digital coins might outperform in the foreseeable future.

Have we reached the bottom?

A favourite question of Gregor and punters alike. One not many will take a crack at, except for PM.

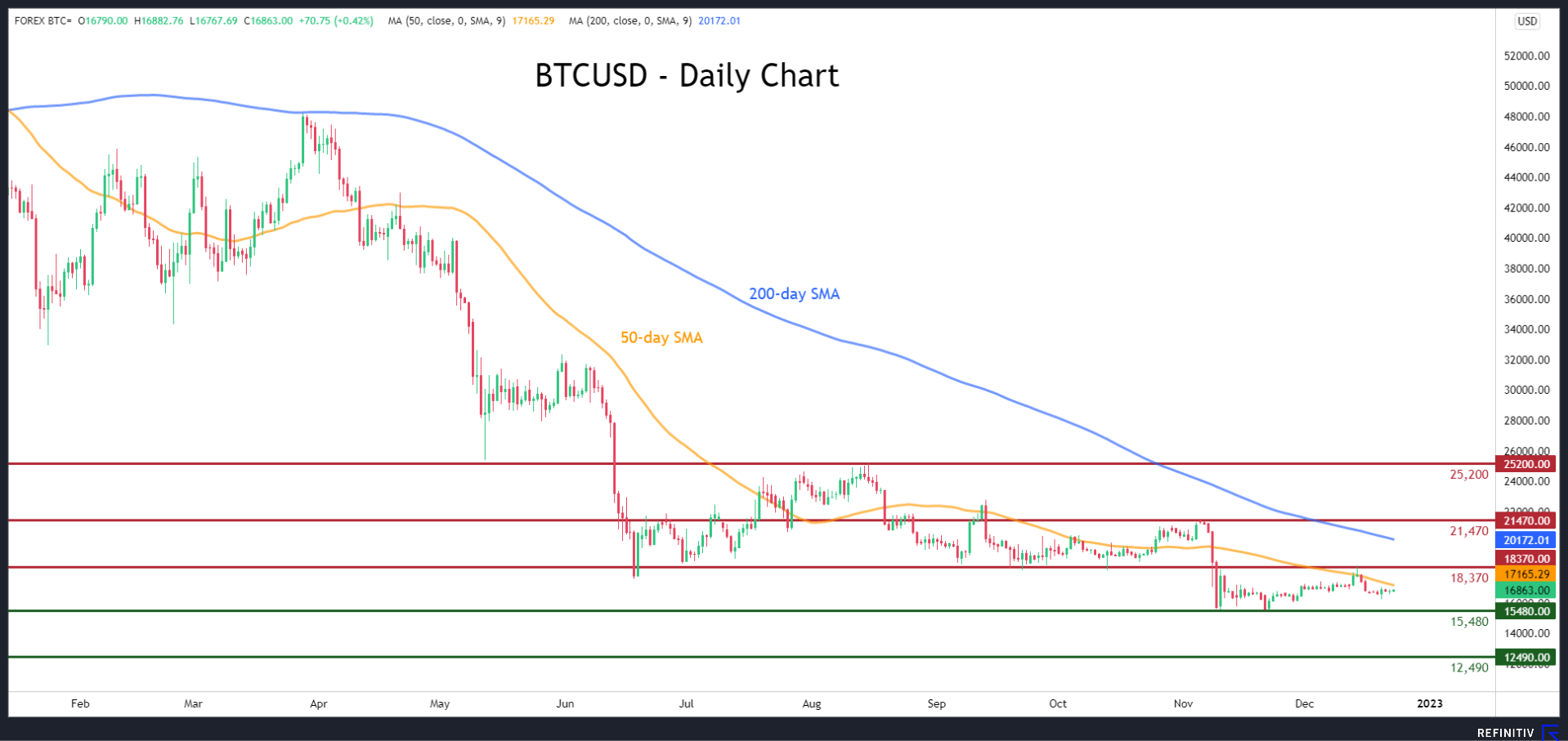

“BTC/USD has been rangebound in the past month as the broader risk-on sentiment in markets has been offset by idiosyncratic factors, which mainly stem from FTX’s fallout.”

So the one trillion dollar question – Are we going to see a fresh low in 2023 or will the king of cryptocurrencies stage a comeback?

“In the negative scenario, in case of a severe global recession that will inflict substantial damage to risky assets, Bitcoin could decline towards the August 2020 resistance of 12,490,” Pete forecasts.

“On the flipside, in case of some recovery, a jump above the August peak of 25,200 could spark a rally to the upside.”

So ladies and gentleman. It’s a flip of the coin. Place your bets.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.