Confessions of a Day Trader: When CBA won’t smile at me, I go to RIO!

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

MFG announced that their star fund manager was stepping down on health reasons pre market and the stock is down 11% or so.

Unlike other situations where a stock is marked down because they have failed market expectations, this is a bit different, as it gives an uncertainty to the investment mandates they hold. Because of that, this is a grab and run stock.

At bang on 11.00am, buy 1,500 and within 2 mins took a 10c turn. They must have some margin holders for this quick bounce to happen.

After that quick trade, buy some BRN and some BLD. Manage a 5c turn on BLD but cut the BRN for a small loss as got bored with them.

Plus $225.

Recap

Bought 1,500 MFG @ 16.60

Sold 1,500 MFG @ 16.70 ($150.00 profit)

Bought 2,000 BRN @ 1.665

Bought 2,500 BLD @ 3.81

Sold 2,500 BLD @ 3.86 ($125.00 profit)

Sold 2,000 BRN @ 1.640 (-$50.00 loss)

Couldn’t find anything to have a go at till around 3pm. So what’s that, a wait of 5 hours just looking around?

The two biggest fallers of the day had low volume and my watch list was just showing everything up, except Z1P, whom I didn’t want to touch as in a small range.

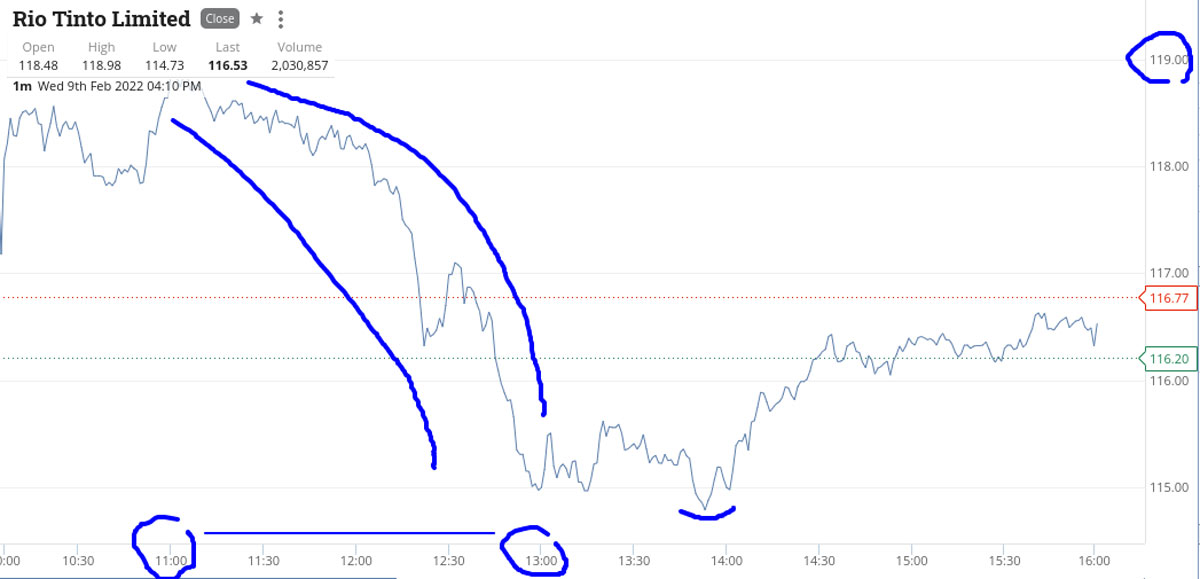

Finally – see chart – RIOs took a tumble and became very volatile with some very sharp moves. They had been up most of the day around the $118 level and ended the day with a range of ~$118.60 to ~$116.70, with the latter being after 3.00pm.

Stuck them on a limit and prayed to the trading God, to take me out.

Then look what happened! Up $280 but was a long wait coming:

Recap

Bought 1,000 RIO @ 117.22

Sold 1000 RIO @ 117.50 ($280 profit)

Cracking figures from CBA pre market sets them up for a big bang out of the gates and when they come back a bit on some profit taking, the other banks followed.

Picked up some ANZ and got a quick 9c turn and then 500 MQG, as their $200 barrier kept them down below today. Put them on a limit just below $197, which got hit.

Then FMG came on the radar later on, coming off a high of $22.58 and hitting a low of $21.02. Picked some up on the way down, took some pain and eventually got them out for a small profit in the 4.10pm ruck.

Up $507 and have added a chart on RIO as it had an amazing swing today of over $4.00 a share. Think CBA will continue their run up, as going ex div on the 16th of this month.

Recap

Bought 2,000 ANZ @ 27.05

Sold 2,000 ANZ @ 27.14 ($180.00 profit)

Bought 500 MQG @ 196.50

Sold 500 MQG @ 196.98 ($240.00 profit)

Bought 2,500 FMG @ 21.395

Sold 2,500 FMG @ 21.43 ($87.50 profit)

I only have eyes for one stock today and it’s CBA.

A high $100.78 (which is where it closed) and a low of $98.64. Got two goes today and it could have been more but didn’t want to push my luck.

Both goes gave me some pain before the gain as their moves quite volatile, though the underlying theme was up, as shown by their closing price.

Up $622 from them and have the feeling that if they can hold their closing level tomorrow, they may go to $102.00.

Recap

Bought 1,500 CBA @ 99.08

Sold 1,500 CBA @ 99.31 ($337.50 profit)

Bought 1,500 CBA @ 98.96

Sold 1,500 CBA @ 99.15 ($285.00 profit)

Well, CBA can’t hold their closing level from yesterday and end up in a range of $100.18 to $98.33 and close at $98.55.

I really thought this was going to be a zero deal day today, until CBA did it again with some sharp sell downs through the $99 level.

Second time round, just closed my eyes and upped the size, as could go either way but they did it again!

Plus $690 today and up $2324 gross for the week or $1927 net.

Recap

Bought 1,500 CBA @ 98.93

Sold 1,500 CBA @ 99.11 ($270.00 profit)

Bought 2,000 CBA @ 98.69

Sold 2,000 CBA @ 98.90 ($420.00 profit)