Confessions of a Day Trader: Underwater, not waving, washed up…. alive

News

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Not a good day in the office today.

Things got sold down and didn’t bounce, for whatever reasons, and today was one of those days when my trading methodology gets completely trashed.

I always don’t like Mondays as mentally it feels like a fresh start, when it should be just like any other trading day.

I’ve added a screenshot of my watch list, so you will be able to cry with me as I look at today’s P/L.

Down $770 and have cancelled Santa.

Recap

Bought 2,000 BHP @ 46.75

Bought 1,000 CBA @ 102.92

Sold 2,000 BHP @ 46.52 ($460 loss)

Sold 1,000 CBA @ 102.61 ($310 loss)

A bit of an amazing day, especially with RIOs as after they had a bit of a fall, they really started to move around. They started the day at $124.50 and ended it at $124.88 however, in between they hit a high of $126.12 and a low of $123.81.

When I got set at $124.60, I instantly watched them fall another 20c in literally 20 secs plus some more and it wasn’t until 3.58pm before they hit my limit.

Boy did they show some volatility. FMG were not as erratic, though I did leave a bit on the table. SHV had a big fall on news already out, so I just had to watch and wait for them to start to firm up.

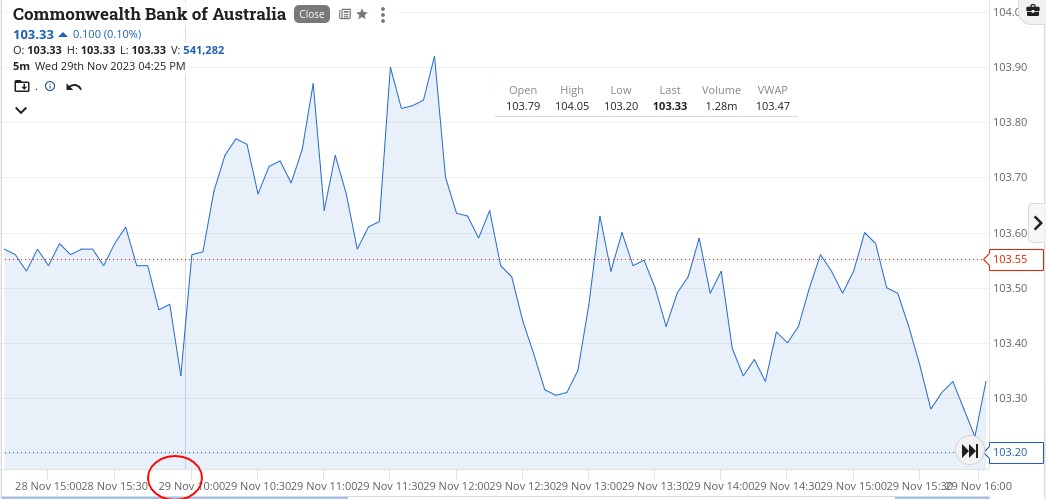

However, the day’s very first trade in CBA was the most bizarre, as they open for some reason at the wrong price. Really had to get my fingers and thumbs humming as below $103 seemed like a goer but they were moving pretty fast.

They reached their low of $102.35 and their high of $103.86 all within the first 30 mins of being open. Gripping stuff (and madness) all at the same time.

So, after today’s effort of plus $1,150 I am now up only $380 for two day’s effort and today it certainly felt like I was down in the trenches. See RIO’s chart and you will see what I mean.

Recap

Bought 2,000 CBA @ 102.90

Sold 2,000 CBA @ 103.05 ($300 profit)

Bought 2,500 SHV @ 3.18

Sold 2,500 SHV @ 3.22 ($100 profit)

Bought 1,000 RIO @ 124.60

Bought 5,000 FMG @ 24.58

Sold 5,000 FMG @ 24.66 ($400 profit)

Sold 1,000 RIO @ 124.95 ($350 profit)

WTC opened below $65 and started to bounce, so got some and rode them for a bit after a bit of pain before the gain.

CBA had another fall and I hovered over the buy button at $103.16 but chickened out, so missed them but RIOs headed towards the $124 level and I picked them up for the bounce, which came good and faster than yesterday’s result.

Up $560 and even though CBA didn’t go red, NAB and WBC did even with better CPI overtunes. Strange times!

Recap

Bought 1,000 WTC @ 65.08

Sold 1,000 WTC @ 65.29 ($210 profit)

Bought 1,000 RIO @ 124.16

Sold 1,000 RIO @ 124.51 ($350 profit)

‘Mmmmmm.’ That’s all I can say about today, as I was staring down the barrel of a few losses, when the market went a bit mental in some of my loss makers.

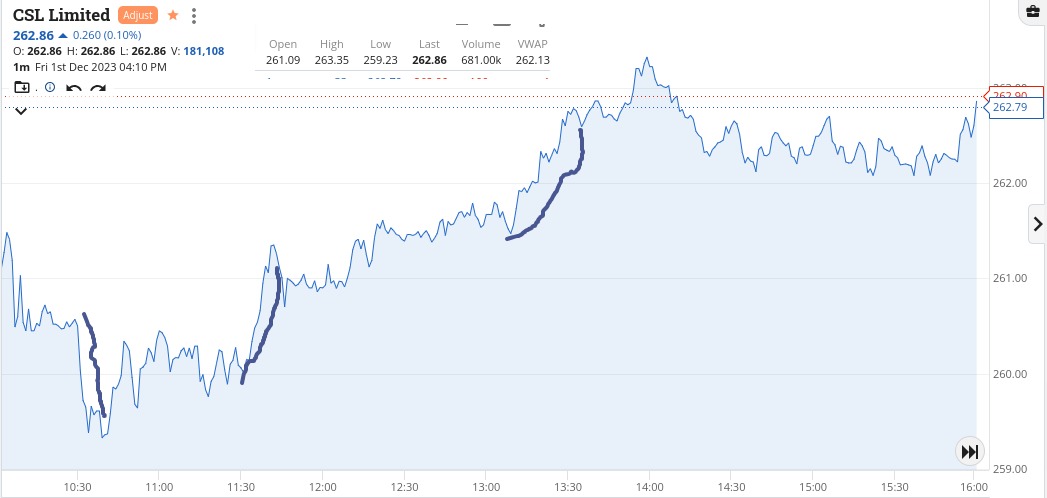

I was literally sitting on a park bench, overlooking Little Beach when my P/L made a major recovery, though I had to double down on CSL first.

When one of my customers said add them to your watch list, I didn’t realise how manic they would be.

If you look at their chart at the 4.10pm close, you may need to rub your eyes a bit. Unbelievable!

CTT were a late developer and took a bit of time before they went through my limit and basically kept going up.

Punters ask me how do I know if a share is about to go up and I say ‘easy, I just sell them and watch them go up’.

Far out. Anyway, up $485 but hurting a bit in the commission conkers.

PS. Got a bit John McEnroe and chalk dusty on the charts but you have to imagine that I would have smashed three racquets by the end of the day. Deep breaths, now breathe out and lie down in a dark room!

Recap

Bought 1,000 WTC @ 65.85

Bought 500 CSL @ 259.71

Bought 500 CSL @ 259.04

Sold 1,000 CSL @ 259.59 ($215 profit)

Sold 1,000 WTC @ 65.96 ($110 profit)

Bought 2,500 CTT @ 2.93

Sold 2,500 CTT @ 2.99 ($150 profit)

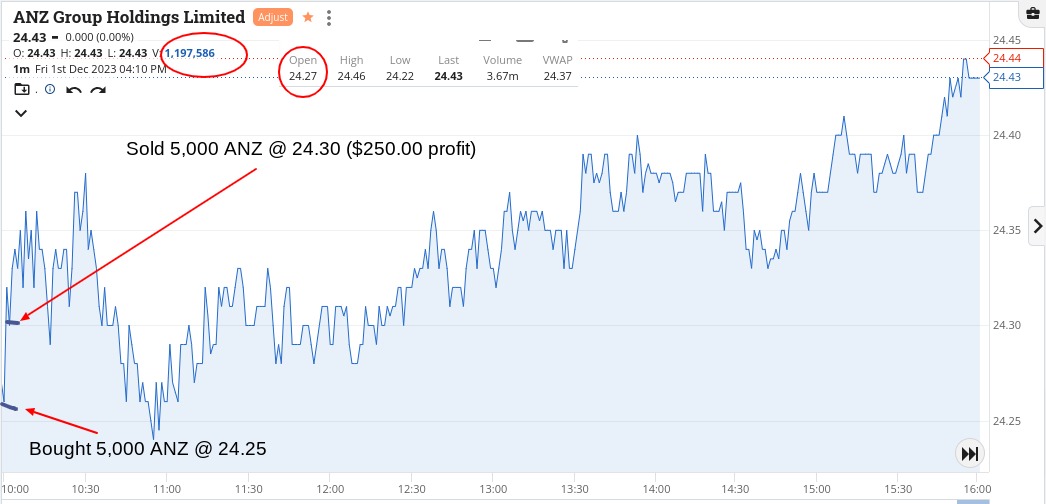

Got stuck into ANZ on the get-go, as it looked like CBA were going to open up at the $105 level, ahead of their opening. Then with seconds to go, they were marked lower and actually opened up at $104.65.

Either way, I managed to lock in a 5c turn and then nothing, as it felt that everything was going to weaken off.

Eventually RIOs starting trading in the $123s and I watched them for a bit and then dived in. They bounced nicely for me (for a change).

The stock that I am shocked at is CSL. They can move $1.50 in 2 minutes and boy do they move around erratically. Have added you a chart to see what I mean.

Anyway, after starting the week out underwater and waving, things started to go my way as the week went on and I managed to scramble to the shore at the end of the week, with my shorts still attached to me so I wasn’t exposed too much.

Up $640 today. The week came in up $2,065 gross or $1,524 net. I can only think that the weeks leading into Christmas are going to be hard trading wise.

Recap

Bought 5,000 ANZ @ 24.25

Sold 5,000 ANZ @ 24.30 ($250 profit)

Bought 1,000 RIO @ 123.75

Sold 1,000 RIO @ 124.14 ($390 profit)