Confessions of a Day Trader: Profiting from the EOFY sales

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

So COVID hits just 2 days before the financial year end. You can feel the mood of everyone who’s locked down with the school kids, in the market movements.

Starting off with APT, who are marked down from $129 to below $125. I had to go out and buy a facemask and whilst waiting in the check out I buy 300 at $123.44, as they are the biggest faller so far. Not a great move as it turns out.

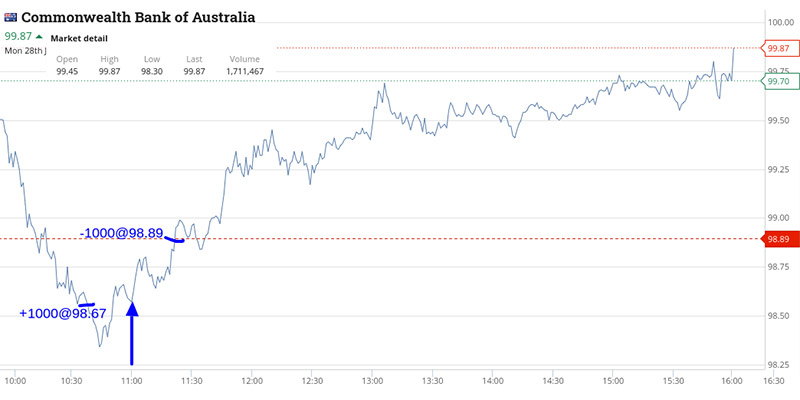

Buy 1,000 CBA at $98.67 and sell them at $98.89 into a rally. Keep adding and averaging down on APT, until they finally show a rally (see graph). Last purchase was at 119.11 which is down $10 from Friday’s close.

Eventually sell them all at 120.20, for a gross profit of $1086. Was down over $2600 at one point. Total profit for the day $1,346 gross.

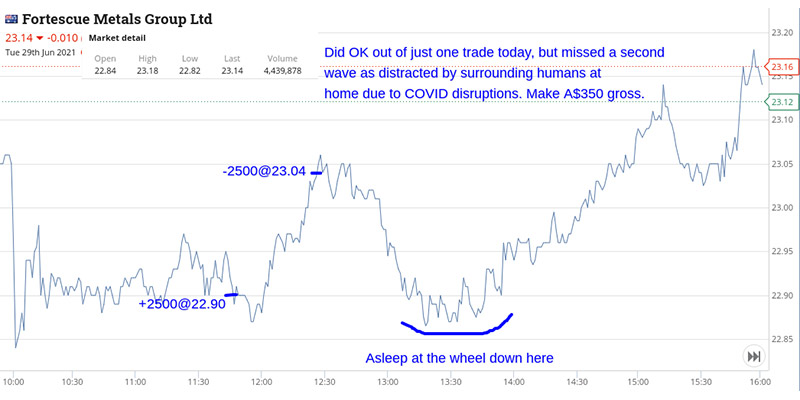

An interesting day to watch the market, with COVID news and numbers still filtering through. My problem today is I have a few humans at home with me, which is distracting my observations and concentration. First buy of the day is 2,500 FMG at below 23.00. In at $22.90 and out at $23.04. Nice bread and butter trade.

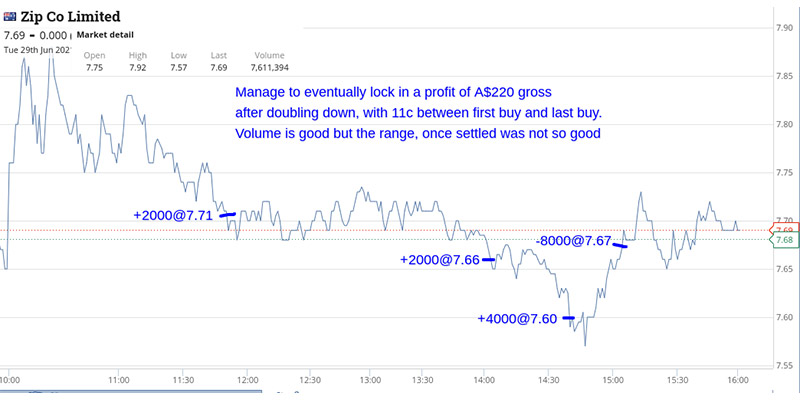

Z1P not so though, as they give me the same treatment as APT did yesterday. Eventually get out of them with a $220 profit but the gap between my first buy and my last buy is 11c.

CBA provide another opportunity as they head back towards $100 a share. Buy 2000 At $99.67, having watched them slowly climb up and out they go at $99.78.

Super Cheap Auto pop up as a big percentage faller and manage a 3c turn on 2,000. All up a nice $830, with not too much strain on the brain, besides Z1P.

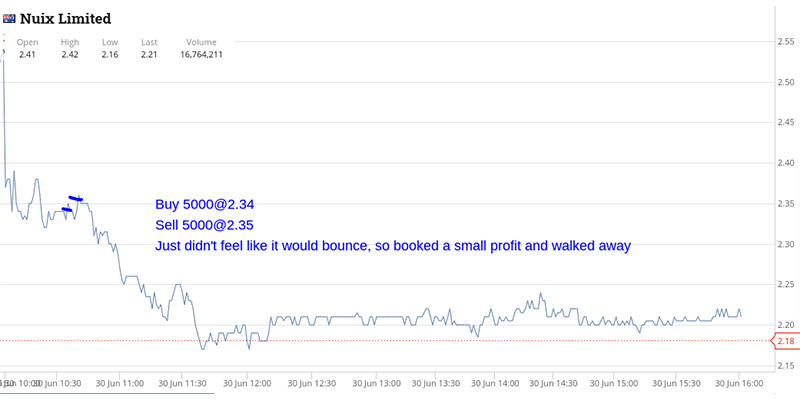

Last day of the tax year and many of the funds monthly valuations cut off points. I was hoping that there maybe a few stock touch ups at the close but this caught me wrong footed on AGL. Everything started out OK, with 1c turn on 5000 NXL early on, though they feel ‘not right’ for another day’s trade today.

CBA falling away but my first buy of 1,000 at $100.67 was a bit premature. Next buy was 1,000 at $100.38 and then 2,000 at $99.97. They eventually rallied back above $100 and out they go at $100.35. $410 profit.

Next buy is 5,000 Z1P at $7.71 as APT rallying and they have not yet caught up. They finally do and they are sold at $7.77 for a $300 profit. Then it all goes pear shaped for me when AGL come on the radar, down 7%.

I buy 1,000 at $8.47 (down from $9.00), then 2,000 at $8.27, then finally 3,000 at $8.21 and wait for the rally. It never comes, and disappointed I cut the 6,000 at $6.20 on the close. This wipes out more than my profit on CBA. End the day up $320, though without AGL, it would have been $770. Ouch.

A pinch and a punch, for the 1st of the month and off we go. At bang on 11.00am, I buy 300 APT at $117.80, 1,000 BHP at $48.21 and 1,000 CBA at $99.14 and sit back and wait.

First out the door are the 1,000 BHP at $48.39 and then the 300 APT at $118.30. That’s a combined profit of $330. Nice.

Then tickle in 1,000 CHN at $7.08, down from $7.40. Add another 1,000 CBA at $98.88 and buy 5,000 Z1P at $7.66. Then buy yet another parcel of 2,000 CBA shares at $98.76. Sell the 5,000 Z1P at $7.68, then the 4,000 CBA at 99.03 and then cut the 1,000 CHN at $7.05, so I can stop watching now and relax. Up $923 gross and it’s 12.30pm and time for lunch.

Today turns out to be a low volume day and very boring. Watch CBA slowly going below $99.00 and then just hanging around $98.80 to $99.00 level. I wait till below $99.00 to make my first purchase, having learnt to wait from the previous days trades.

At 11.31am, buy 1,000 at 98.91. At 12.31pm, buy 1,000 at 98.75 (that was a very long wait). At 1.09pm, they break out above $99.00 and at 1.12pm, I sell 2,000 at $99.05 for a $440 profit.

The only other trade was buying 2,000 NAB, just before the CBA purchase at $26.08 and then cutting them at $26.06 after locking in the CBA profit. Just didn’t have the capacity to continue looking at the snail movements.

So the wash up for the week was a gross profit of $3,742, less $932 in brokerage for net profits of $2,810. Worst trade was AGL on Wednesday and favourite trade of the week was CBA on Thursday.