Confessions of a Day Trader: I only get out of bed for 1000 RIOs under $1.09

News

News

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

TYR get whacked after their bidder walked away.

Down 17% and news came out pre-market, so all bad news out. Tickle in a couple of thousand and then notice RIOs are below $109.50.

They give me my first profit of the week, though TYR was misbehaving, so in between the RIO trade, had to double down. After closing out RIO, was happy to gear up a bit more on TYR.

Back into some more RIOs again at bang on $109.50 and then WBT were also looking a bit sick. Quick trade in them, then TYR finally came good.

Back into WBT and out of RIOs and happy to close out WBT for a small profit, so I don’t need to keep watching them.

Now I can have a sleep in the autumn sun and I awake to see the last two mins of trading.

Up $1,150. Nice start to the week.

Recap

Bought 2,000 TYR @ 1.290

Bought 1,000 RIO @ 109.42

Bought 2,000 TYR @ 1.255

Sold 1,000 RIO @ 109.92 ($500 profit)

Bought 4,000 TYR @ 1.230

Bought 1,000 RIO @ 109.50

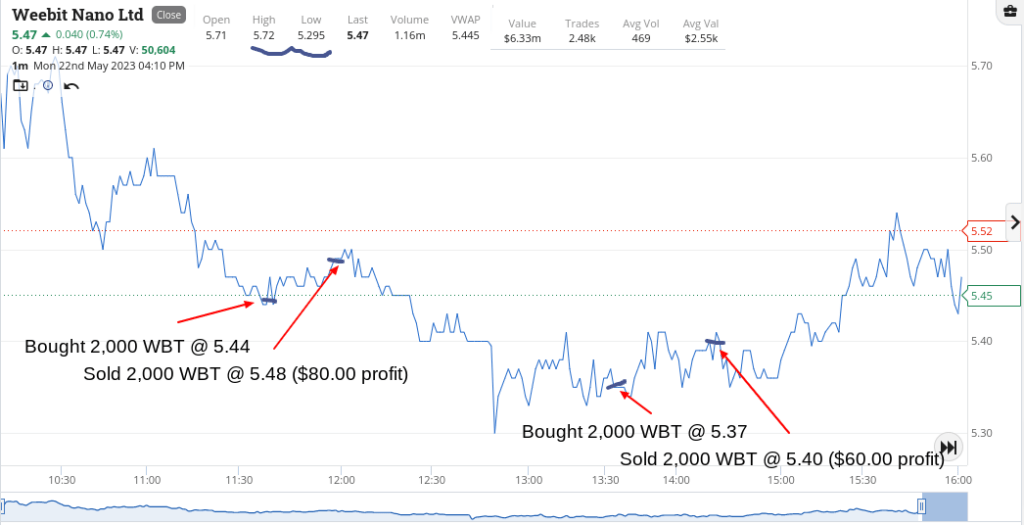

Bought 2,000 WBT @ 5.44

Sold 2,000 WBT @ 5.48 ($80 profit)

Sold 8,000 TYR @ 1.270 ($150 profit)

Bought 2,000 WBT @ 5.37

Sold 1,000 RIO @ 109.86 ($360 profit)

Sold 2,000 WBT @ 5.40 ($60 profit)

A bit of a drama filled day, today. Was happily going along with some bread and butter trading and then ended up with no positions until BRN came along.

Geared up in them by more than I should have, but I know they are a punters’ favourite from their rise to a $1bn company and their stock forum following.

Had them on a limit for a $200 profit, which they never hit and then watched in horror as they get suspended and don’t come out until 4.02pm, which means I don’t know if they will actually trade.

Luckily they do, so I am out in the 4.10pm session. So now I know the rules on a suspension going into the post 4.00pm match up.

So almost had to hold overnight, so this reminds me why the blue chips are better to trade, as I only think ANZ have managed to be suspended for four days since I have been doing this diary.

This lesson cost me $200 and takes my daily total to just plus $175, which is a lot of effort for not much return.

Recap

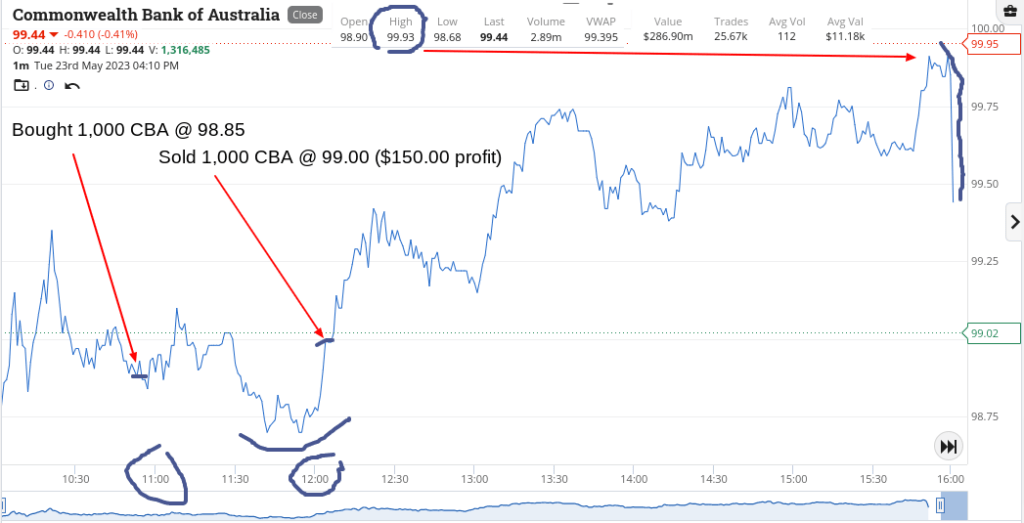

Bought 1,000 CBA @ 98.85

Bought 3,000 WBC @ 21.00

Sold 3,000 WBC @ 21.05 ($165 profit)

Sold 1,000 CBA @ 99.00 ($150 profit)

Bought 10,000 BRN @ 0.440

Bought 2,000 WBT @ 5.48

Sold 2,000 WBT @ 5.51 ($60 profit)

Sold 10,000 BRN @ 0.420 ($200 loss)

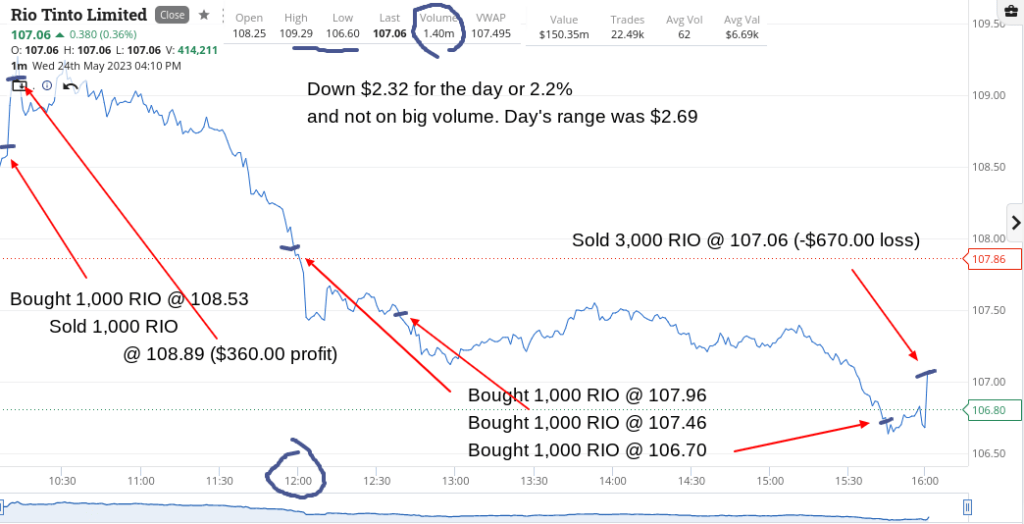

Kicked off the day in RIOs and ended the day in RIOs. So started out happy but ended in tears, as they decided to fall and fall before a slight tick up in the 4.10pm ruck.

CBA was easy, as they followed yesterday’s form and had a late(ish) rally after 11.00am at 11.15am, so that was cool, as was my first real early trade in RIOs.

Overnight they were down 1.5%, so the opening seemed a bit harsh to me, so that was OK but then at below $108, I thought here we go!

Wrong.

More a case of here we went, as they just kept going against me and then fell below $107.00 as we came into the final bend. Now they really did look overcooked, as you can see in their chart.

Up $180, so improved on yesterday’s effort by $5. Mmmmm. Not good.

Recap

Bought 1,000 RIO @ 108.53

Sold 1,000 RIO @ 108.89 ($360 profit)

Bought 1,000 CBA @ 98.99

Bought 1,000 CBA @ 98.86

Sold 2,000 CBA @ 99.17 ($490 profit)

Bought 1,000 RIO @ 107.96

Bought 1,000 RIO @ 107.46

Bought 1,000 RIO @ 106.70

Sold 3,000 RIO @ 107.06 ($670 loss)

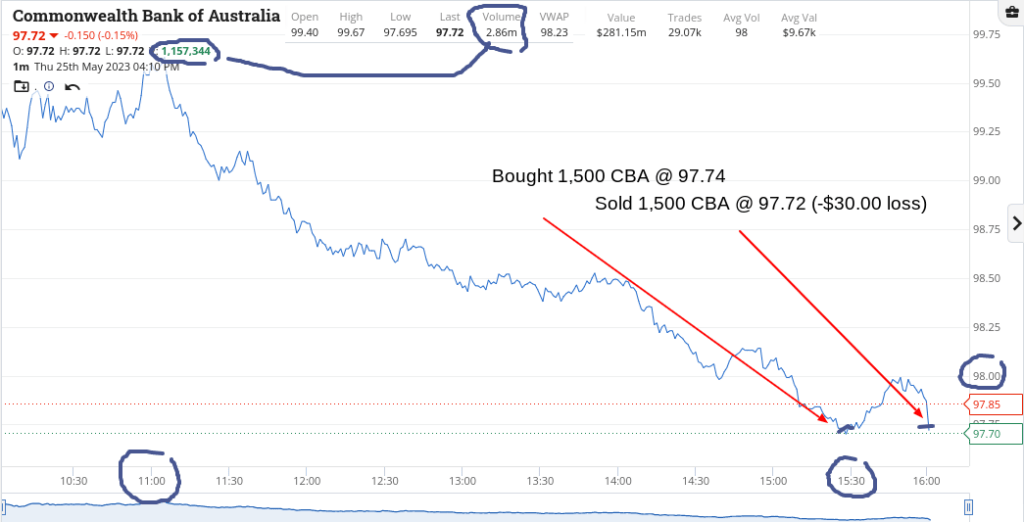

Wake up to a bit of a meltdown in overnight markets and after yesterday’s pounding in RIOs, I can’t see myself doing anything today.

This is a day when I definitely want to miss the next dance.

It was only till CBA finally cracked and started to trade around the $97.70 level that I decided it was time to have a go. This was just before 3.30pm, so that is a hell of a long time to just wait.

Their range today was $99.67 to $97.695 and their day volume was not big. They traded a total of 2.86m of which 1.15m were in the 4.10pm match up.

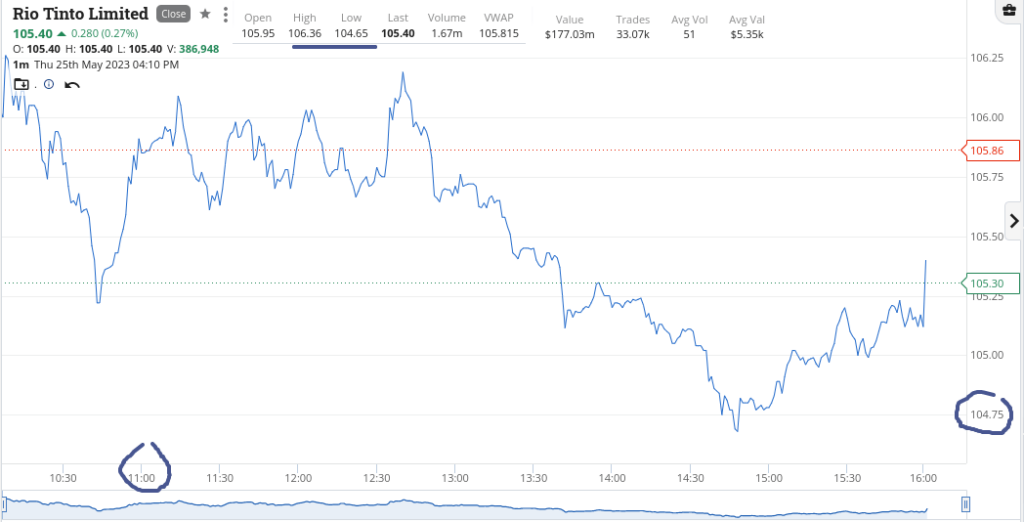

Looked at RIOs many times but just couldn’t get a feel for when they might pop. Their range was $106.36 to $104.65 on 1.46m of which 300,000 was in the 4.10pm match.

Managed to lose $30 in my only trade! I think I am lucky with that result as being a bottom picker today was not easy, at all.

Recap

Bought 1,500 CBA @ 97.74

Sold 1,500 CBA @ 97.72 ($30 loss)

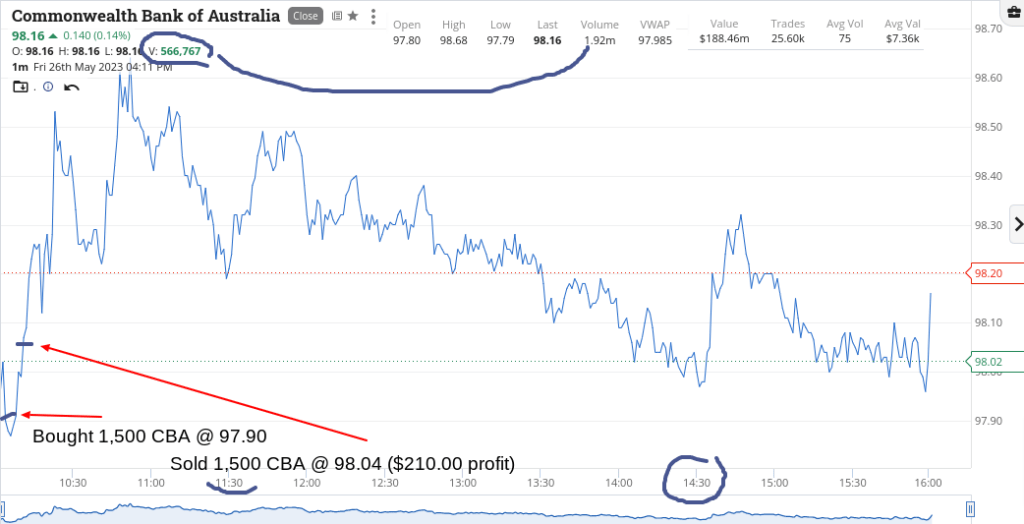

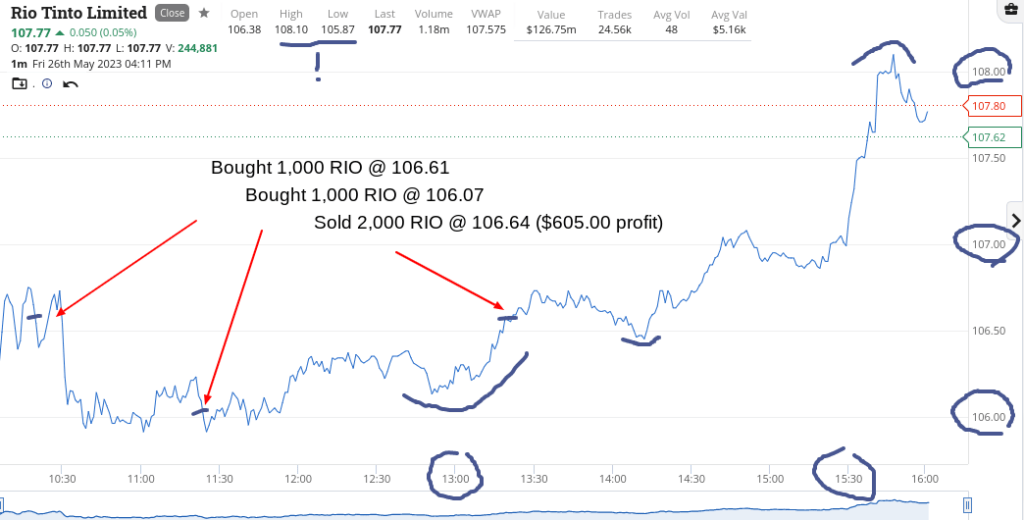

Up $1,215 today, as things seemed to settle down overnight a bit.

Had a really early one in CBA, who at below $98.00 felt like they wanted to breakout back through that level, then RIOs also felt like at some point they would turn around.

Had to have a go in them twice before they actually did. Their range today was $105.87 to $108.10 and at their closing price, they were up $2.37 on the day.

NHC still have their buyback on, so I just dabbled around in a larger size than normal, so I could take smaller turns, just to top up against some of this week’s losses.

You have to really see the chart in RIOs to really get a feel for how the day played out. Up $2,690 gross for the week or $1,949 net and the USA is shut on their Monday, so it should be quiet but steady for the ASX.

Recap

Bought 1,500 CBA @ 97.90

Sold 1,500 CBA @ 98.04 ($210 profit)

Bought 10,000 NHC @ 5.01

Bought 1,000 RIO @ 106.61

Bought 1,000 RIO @ 106.07

Sold 10,000 NHC @ 5.03 ($200 profit)

Bought 10,000 NHC @ 5.00

Sold 2,000 RIO @ 106.64 ($605 profit)

Sold 10,000 NHC @ 5.01 ($100 profit)

Bought 10,000 NHC @ 4.99

Sold 10,000 NHC @ 5.00 ($100 profit)