Confessions of a Day Trader: How I learned to stop worrying and love Rio even more

News

News

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

I don’t enjoy this, when a war breaks out and your job is to make a profit out of a conflict and the result of the deaths that occur. It makes me feel guilty.

So, today feels like this Friday coming up, which falls on the 13th of October.

Trying to go long halfway through a trading day, when headlines about yet another war dominate your screens, makes everything doubly hard.

If you look at the charts of RIO and FMG, you will see that at some point they take a plunge. Luckily for me I was out of FMG, though they did catch me out at the end of the day.

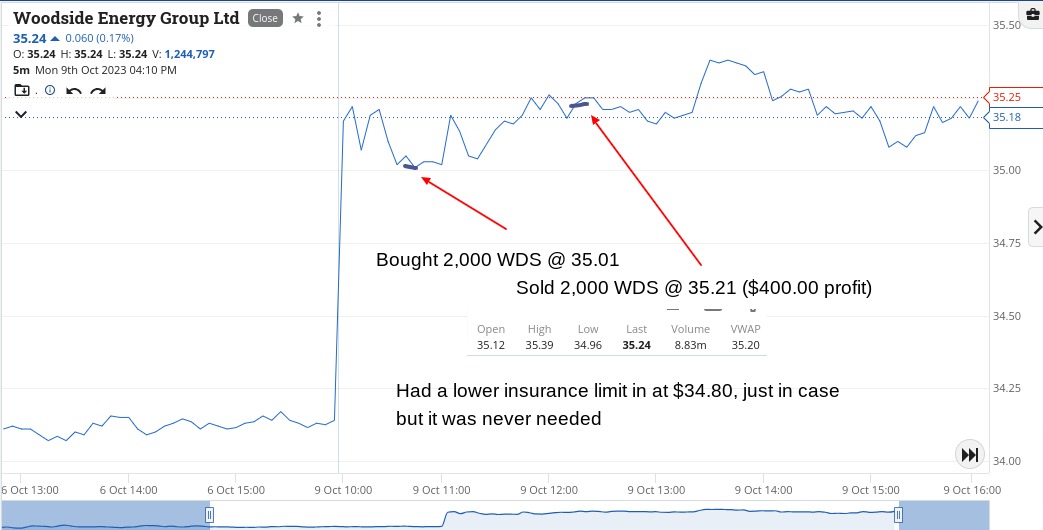

Woodside was my main winner today, as the price of oil shot up, FMG below $21, whereas WBT and AZS were just big fallers on my list.

Up $630, but not enjoying this.

Recap

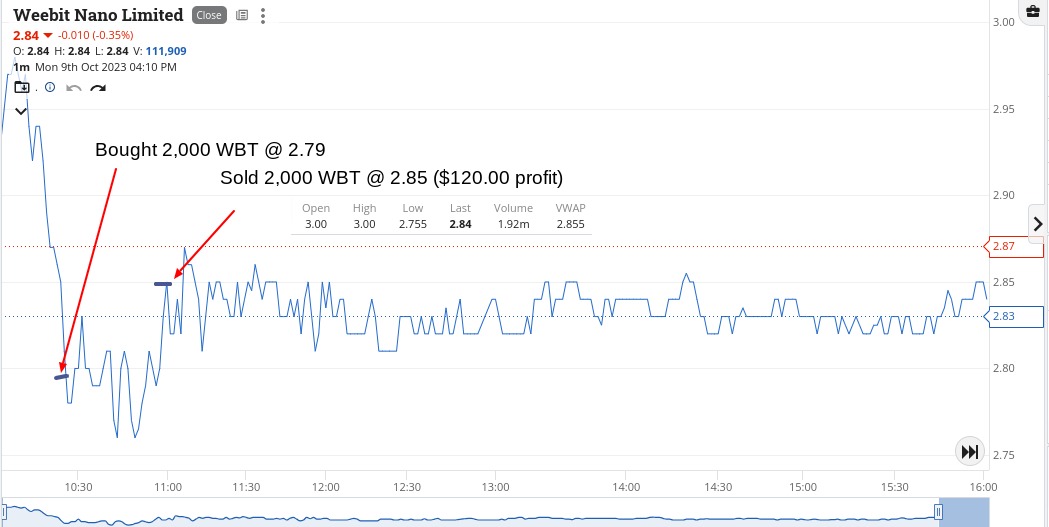

Bought 2,000 WBT @ 2.79

Bought 2,000 WDS @ 35.01

Sold 2,000 WBT @ 2.85 ($120 profit)

Sold 2,000 WDS @ 35.21 ($400 profit)

Bought 2,000 FMG @ 20.87

Sold 2,000 FMG @ 20.99 ($230 profit)

Bought 2,000 AZS @ 2.09

Bought 2,000 AZS @ 2.01

Sold 4,000 AZS @ 2.07 ($80 profit)

Bought 2,000 FMG @ 20.72

Sold 2,000 FMG @ 20.62 ($200 loss)

When CBA open up, they set the tone of the market for the rest of the day. They open +$1.00 at $100.99 and then hit a high of $101.19.

I’m a bit taken aback, as I wasn’t expecting so much strength and it leaves me kinda in No Man’s Land.

BHP, FMG and RIOs are the only ones on my watch list who are struggling to move out of the red.

RIO’s weakness today is almost as amazing as CBA’s strength. Their high was $113.95 and their low was $112.00. At their last trade, they closed at $112.20, which turns out to be down $1.00!

I only manage a trade in FMG, as I felt them lagging behind in the rallying stakes.

Up $160 and feeling a bit lost, trading wise today.

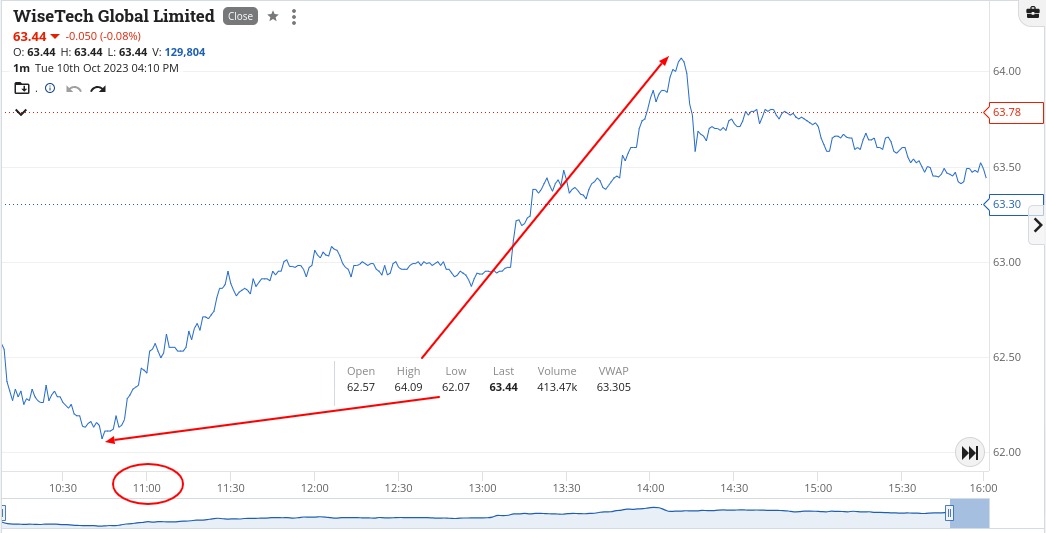

Have a look at the chat on WTC, as an example of how the day went. Exaggerated falls and gains with a $2.00 range.

Recap

Bought 2,000 FMG @ 20.75

Sold 2,000 FMG @ 20.83 ($160 profit)

Oh boy. Get into BHP as quick as I can and take a profit as quick as I can, then into CBA and WDS.

Out of WDS next and then CBA as they headed through my limit and towards the moon.

Wanted not to hang around too long in anything and the charts of RIO and CBA will show how manic the market is and not too much vol.

After yesterday’s bounce at 10.30am, I was going for the same reaction. First two OK and then CBA finally got there, thanks to an 11.00am special.

Just had to go back for seconds before the 4.00pm cut off. Out they went, as they acted like yesterday as well.

Anyway up $950 and still nervous re war etc.

Recap

Bought 2,000 BHP @ 44.81

Sold 2,000 BHP @ 44.88 ($140 profit)

Bought 2,000 CBA @ 100.60

Bought 2,000 WDS @ 35.69

Sold 2,000 WDS @ 35.76 ($140 profit)

Sold 2,000 CBA @ 100.75 ($310 profit)

Bought 2,000 CBA @ 100.46

Sold 2,000 CBA @ 100.64 ($360 profit)

Tabcorp are an early faller, down over 10% on their profit result. Just have to have a go in a tenner and very quickly walk away with $200 to go and have a punt with on Melbourne Cup day!

WDS and RIOs are the only ones really struggling on my watch list.

In fact RIOs give me two chances and both times they were looking kinda sick and both times they rallied nicely. Got a chance to go a third time but thought no.

Before the close they touched $115.

The strength in this market just blows me away and it’s all on low volume.

Very strange but will take being up $690 as a compliment to myself and my trading style.

Recap

Bought 10,000 TAH @ 0.87

Sold 10,000 TAH @ 0.89 ($200 profit)

Bought 2,000 WDS @ 35.76

Bought 1,000 RIO @ 113.86

Sold 2,000 WDS @ 35.84 ($160 profit)

Sold 1,000 RIO @ 113.99 ($130 profit)

Bought 1,000 RIO @ 113.50

Sold 1,000 RIO @ 113.70 ($200 profit)

Yes I know!

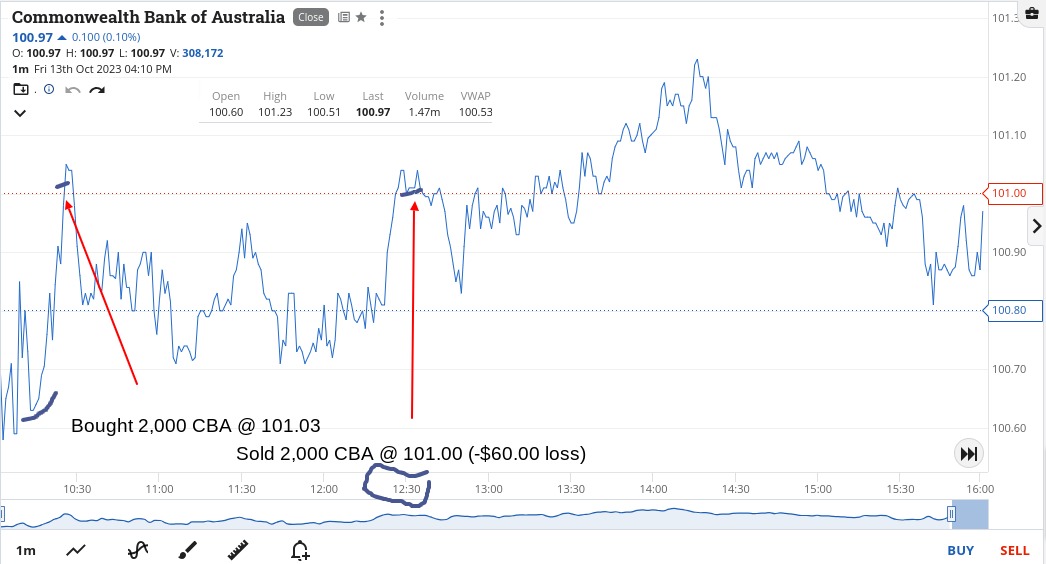

Could be a good day or could be a bad day. Either way, I want to be done and dusted by 12.30pm.

Wrong date, Friday book squaring and low volumes lead me to close out of everything by then.

CBA was the only one to give me real heart palpitations whilst the others were a bit less stressful, though it was my own fault for getting sucked in at the wrong time.

My trading in CBA today is not something I am that proud of and everything else is just so so.

I’m hoping that Friday night sees a movement down in the USA and if so, then volumes increase as they slide for us on Monday.

All of this low volume stuff is allowing prices to be pushed around too much by the bigger players.

So an interesting week that ended on Friday 13th! Up $330 today and $2,760 gross which came in at $2,178 net.

Now going to sit under the shade of a tree and read a book and escape.

Recap

Bought 2,000 CBA @ 101.03

Bought 1,000 RIO @ 114.14

Bought 2,000 NCM @ 25.78

Sold 1,000 RIO @ 114.35 ($210 profit)

Bought 2,000 WDS @ 35.81

Sold 2,000 NCM @ 25.83 ($100 profit)

Sold 2,000 CBA @ 101.00 ($60 loss)

Sold 2,000 WDS @ 35.85 ($80 profit)