Confessions of a Day Trader: Hoist the wet sail, this trader’s coming home!

News

News

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

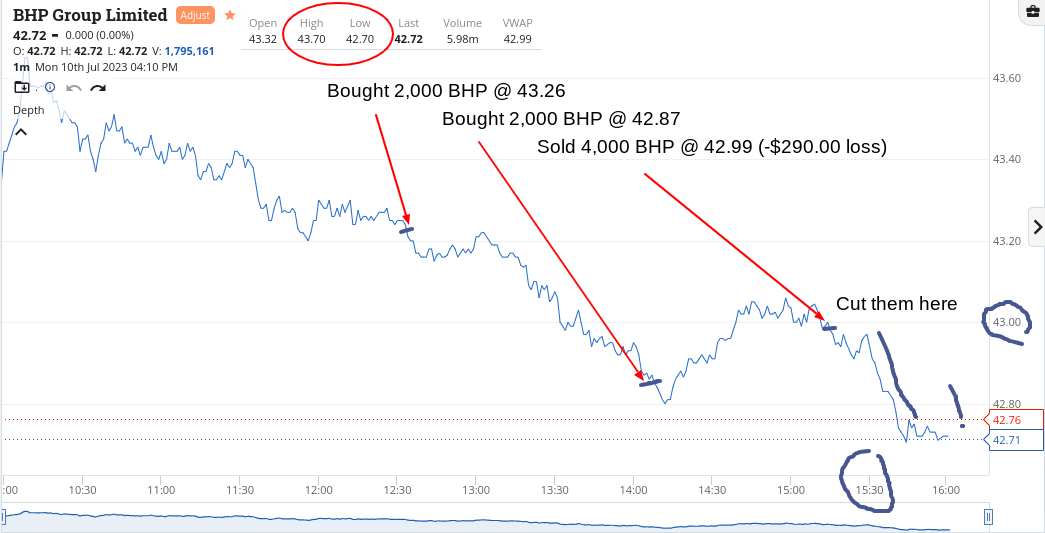

Well. I wished I had taken today off, just like Friday.

Waited around with some limits on lower down, got hit and had to cut them and then at 3.30pm, things got a bit brutal, so back again with mixed results. The charts really paint the picture.

As I said on Friday, was expecting weakness but have to be careful of what you wish for. Some of the ranges were big today, like RIO’s range of $110.19 to $113.25.

FMG’s range was $21.17 to $21.93 and they were the only one that I got right today. Really like sharp quick falls rather than slowly grinding down and I certainly got ground down today.

Down $170 today.

Recap

Bought 2,000 BHP @ 43.26

Bought 1,000 CBA @ 98.84

Bought 2,000 BHP @ 42.87

Sold 1,000 CBA @ 98.74 ($100 loss)

Sold 4,000 BHP @ 42.99 ($290 loss)

Bought 5,000 FMG @ 21.19

Bought 1,000 CBA @ 98.55

Sold 5,000 FMG @ 21.24 ($250 profit)

Sold 1,000 CBA @ 98.52 ($30 loss)

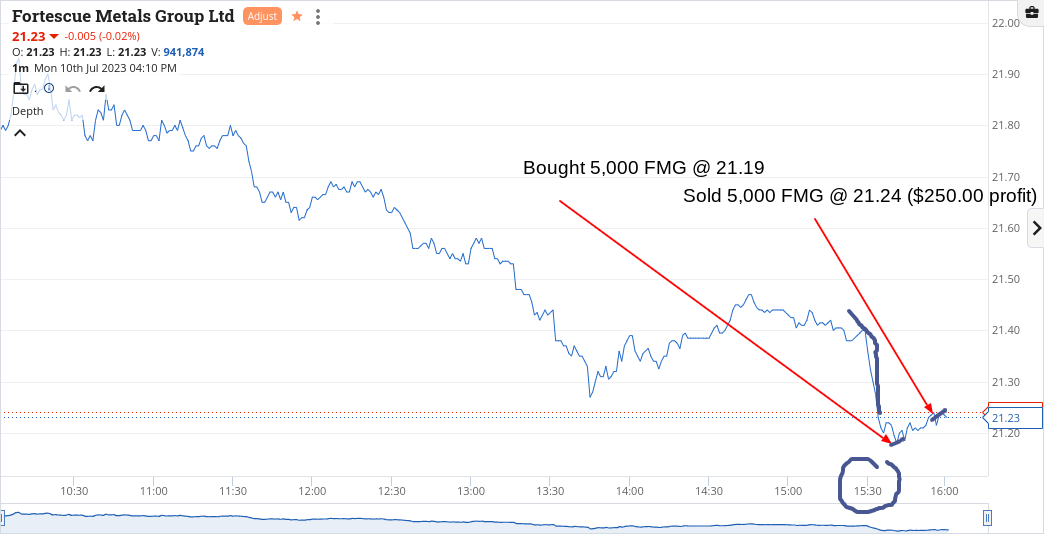

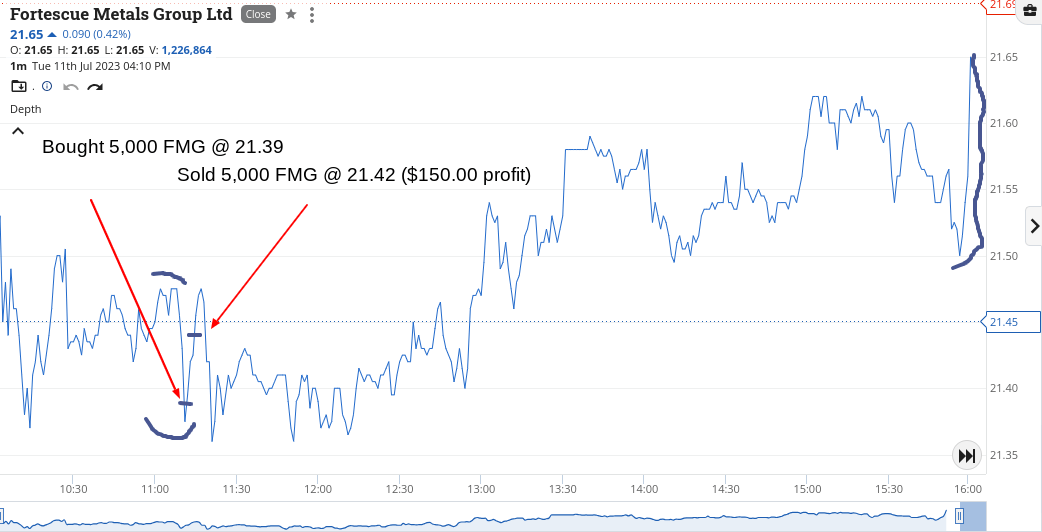

Another agonising day, where ranges and volumes remained small – and no volatility, which means a boring day waiting around for something to happen.

RIO’s range was $1.00 and CBA’s was $1.11 and they traded 1.8m of which 700,000 went through at 4.10pm.

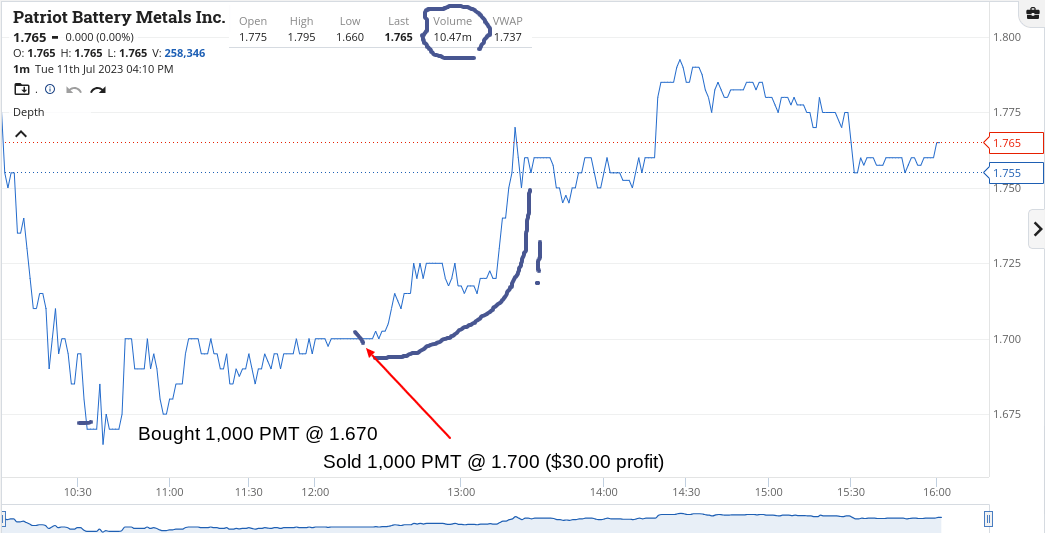

PMT responded to a shorters’ report and I just bought a small parcel to relieve the boredom and also to give me something to watch. Sold them after moving on from FMG.

Funnily enough, just as I added PMT to my watch list was the exact time that FMG took a swan dive. None of the other two, BHP and RIO did the same so, snapped some up and put them on a limit to sell.

Up $180, which makes up for yesterday’s effort.

Now up $10 after two days and 13 trades. Going off to paint something and watch it dry!

Recap

Bought 1,000 PMT @ 1.670

Bought 5,000 FMG @ 21.39

Sold 5,000 FMG @ 21.42 ($150 profit)

Sold 1,000 PMT @ 1.700 ($30 profit)

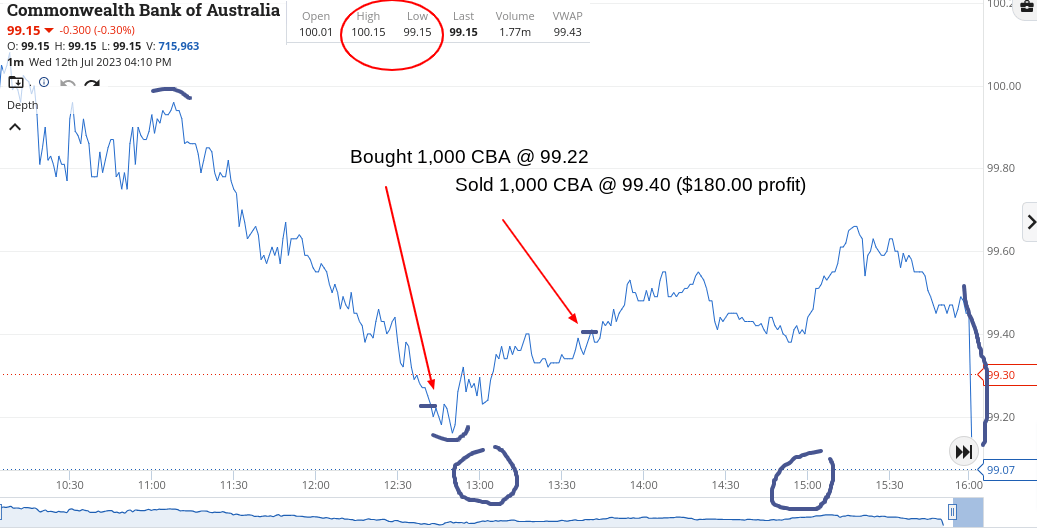

Another day of waiting around, with lower ranges than usual. CBA’s range today was exactly $1.00 – $99.15 to $100.15.

Managed to grab an 18c turn getting in to them just before lunch, but otherwise from that, everything was a waste of time.

RIO’s range was not much better at $1.14 – $112.92 to $114.06 and at their last price of $113.75, they were up $1.84 for the day.

Up $180 for the day and even though that was it, it was not from a lack of trying.

Recap

Bought 1,000 CBA @ 99.22

Sold 1,000 CBA @ 99.40 ($180 profit)

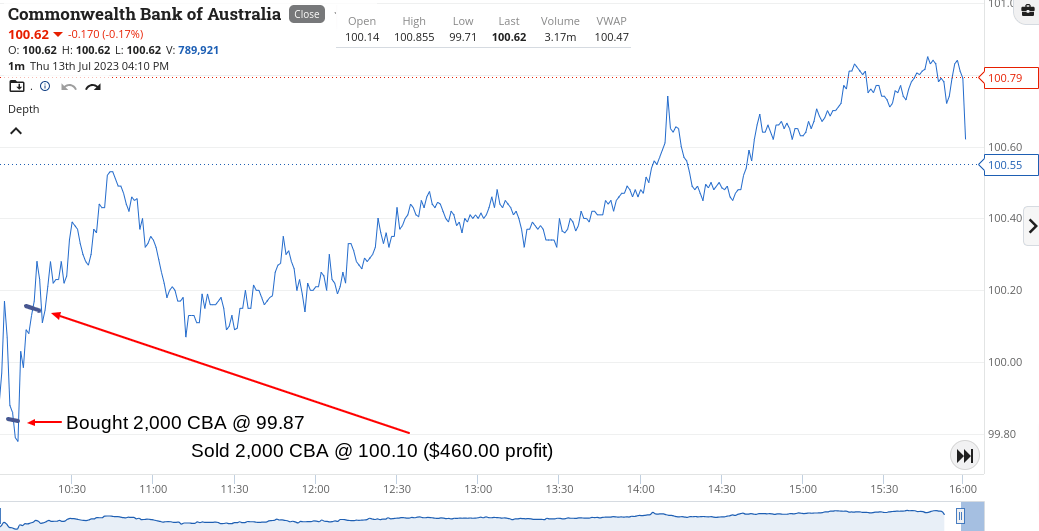

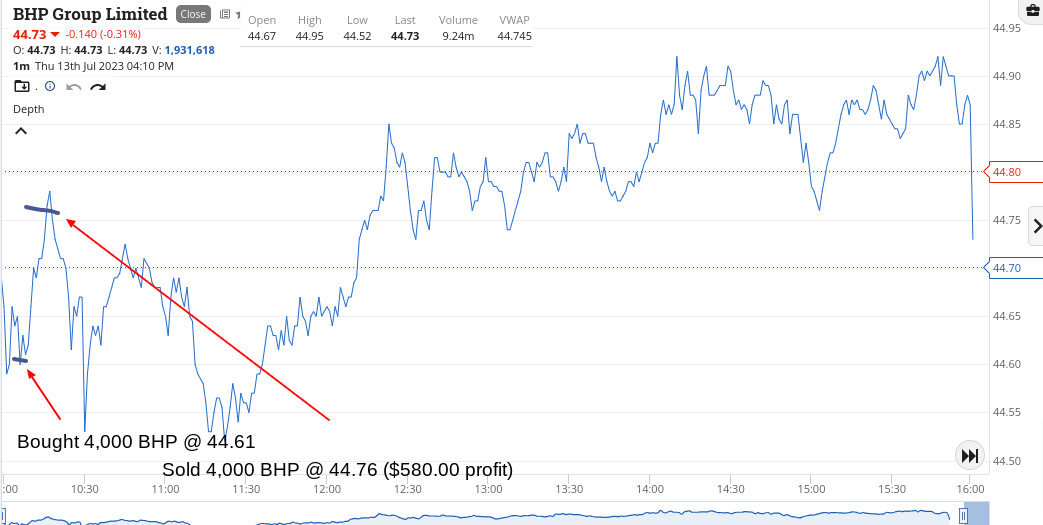

Today was like coming back from 40 days and 40 nights out in the wilderness.

Bullish tones coming out of America overnight were leading into a strong market today.

After the last three days, I had put a plan in place for today’s action in my head and was ready for 10.00am.

Ten mins into the market open and I couldn’t believe some of the prices being offered, so I hoovered up what I could at what I thought was the wrong price and put them onto sell at higher limits.

I then closed my phone and put it away for 30 mins in the belief that my gut feeling was correct.

Finished up $1,040 in first 30 mins of trading and then just walked away with a skip in my step. I’m back!

Recap

Bought 2,000 CBA @ 99.87

Bought 4,000 BHP @ 44.61

Sold 2,000 CBA @ 100.10 ($460 profit)

Sold 4,000 BHP @ 44.76 ($580 profit)

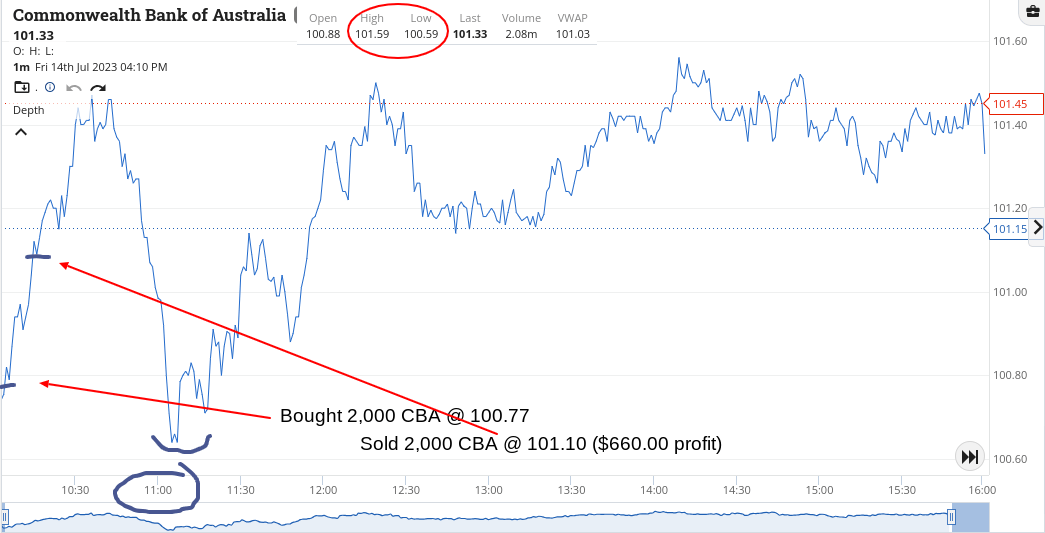

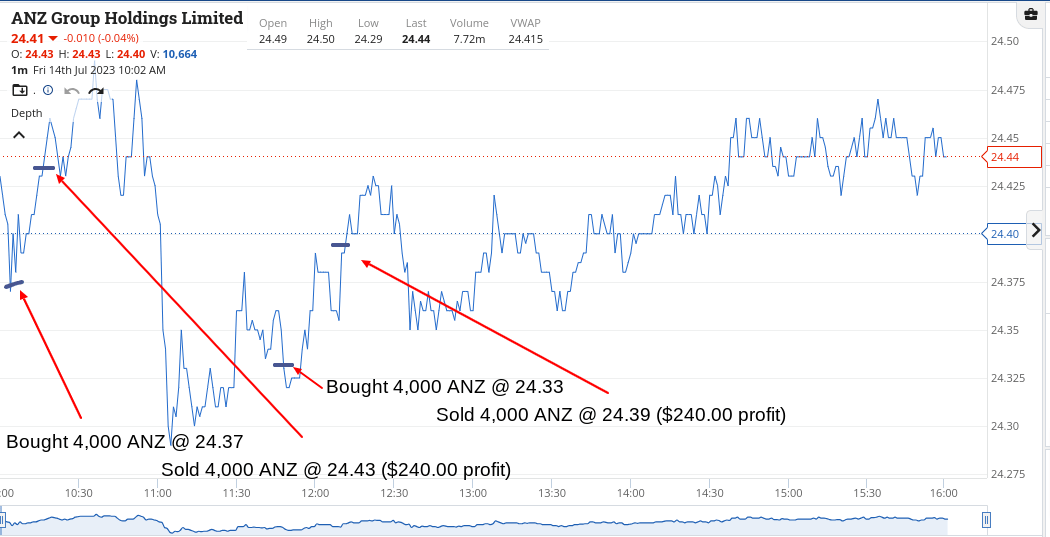

Bt some CBA and ANZ very early on and put them on a sell limit.

CBA were sensational at below $101.00 and ANZ gave me two goes at the cherry.

What can I say!

CBA did a classic 11.00am special but I didn’t care and their range for the day was $1.00 exactly

Up $1,140 today and $2,373 for the week which saw one minus day and two days that both only made $180.

Worked out at $1,833 net.

Bit mentally draining this week because of those slower days, so off for a nana nap ahead of the pub.

Recap

Bought 2,000 CBA @ 100.77

Bought 4,000 ANZ @ 24.37

Sold 4,000 ANZ @ 24.43 ($240 profit)

Sold 2,000 CBA @ 101.10 ($660 profit)

Bought 4,000 ANZ @ 24.33

Sold 4,000 ANZ @ 24.39 ($240 profit)