Confessions of a Day Trader: Back from the brink!

News

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

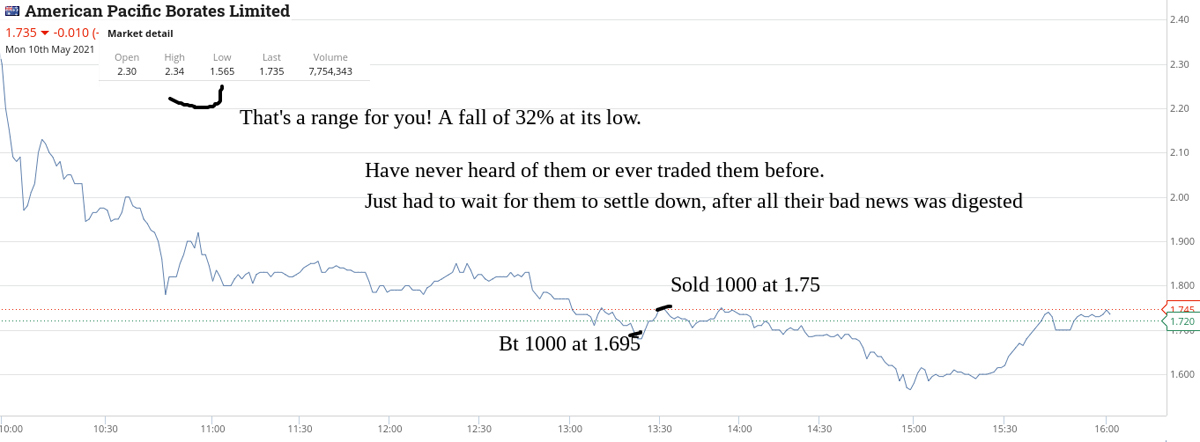

Cold shaken off, so ready to take on the week. Sit down at 11am to concentrate and there were a few big fallers today. A2M (-13%), IPL (-8.9%) and ABR (-25%) all had news out and were heavily marked down. By watching and waiting, I manage to make a combined profit of A$195 out of them.

Bad news and sharp knee reaction falls can work well. ABR, for example, down 25%, means that three more days like this and they will be 10c and not A$1.75.

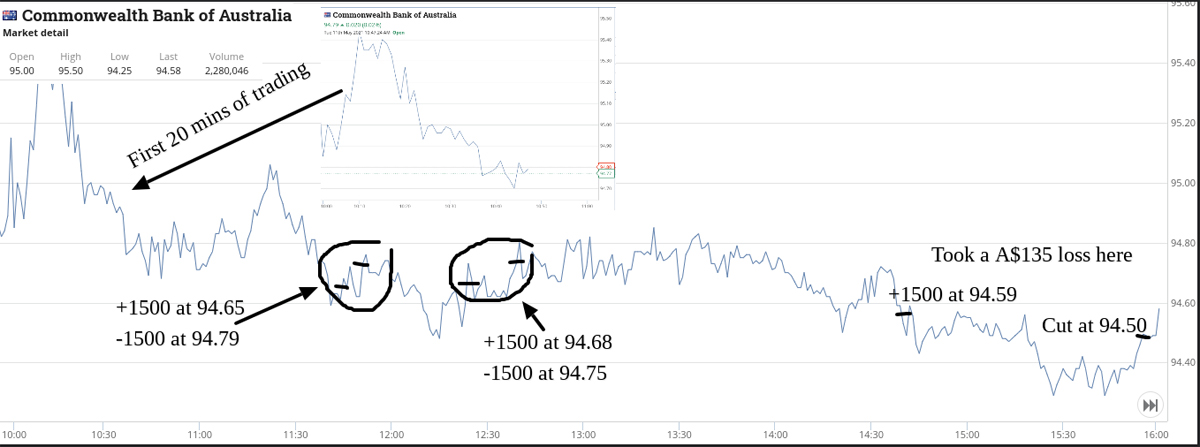

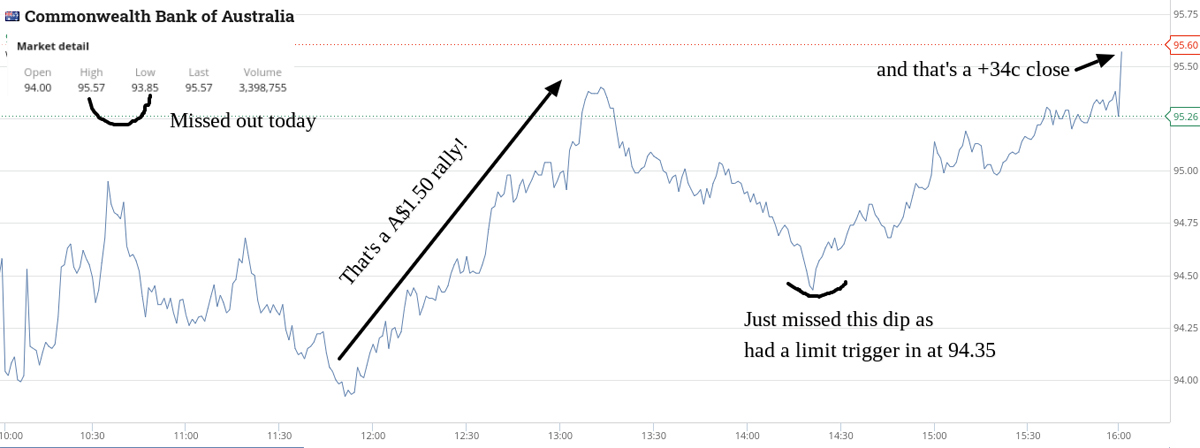

CBA opened up strong and met some profit taking, which saw them pushed down 50c or so halfway through the session. I ended up averaging down from 1000 shares to 3000 shares before they rallied. Was down A$400 at one point but they came back and I closed them out up A$260.

Get another 2c turn on Z1P three times on 2000 shares and also ended up booking a profit of A$57 on 250 APT. In at 94.80 and out at 95.03.

Total profit out of 18 trades was A$575 from six different companies.

+250 APT at 94.80; -250 at 95.03; Profit A$57 (A$10 round trip)

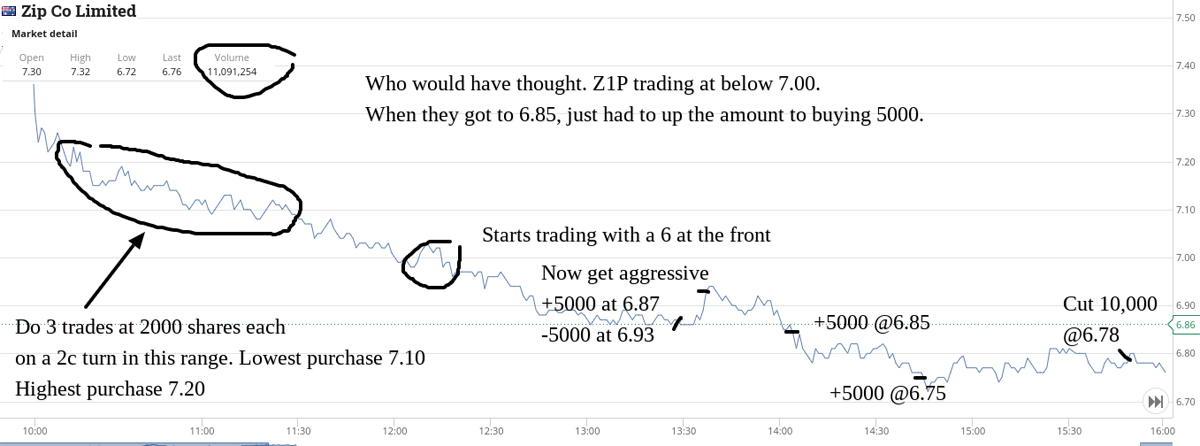

+2000 Z1P at 7.33; -2000 at 7.35; +2000 at 7.33; -2000 at 7.35; +2000 at 7.30; -2000 at 7.32; Profit A$120 (see graph)

+1000 A2M at 6.25; -1000 at 6.35; Pofit A$100 (they fell to 6.16 before recovering my way)

+2000 APL at 2.39; -2000 at 2.41; Profit A$40 (a ginger trade)

+1000 ABR at 1.695; -1000 at 1.75; Profit A$55

+1000 CBA at 94.88; +1000 at 94.65; +1000 at 94.55; -3000 at 94.78; Profit A$260 (first purchase timing was not good, as expecting a rally to 95.00, which did happen after position closed)

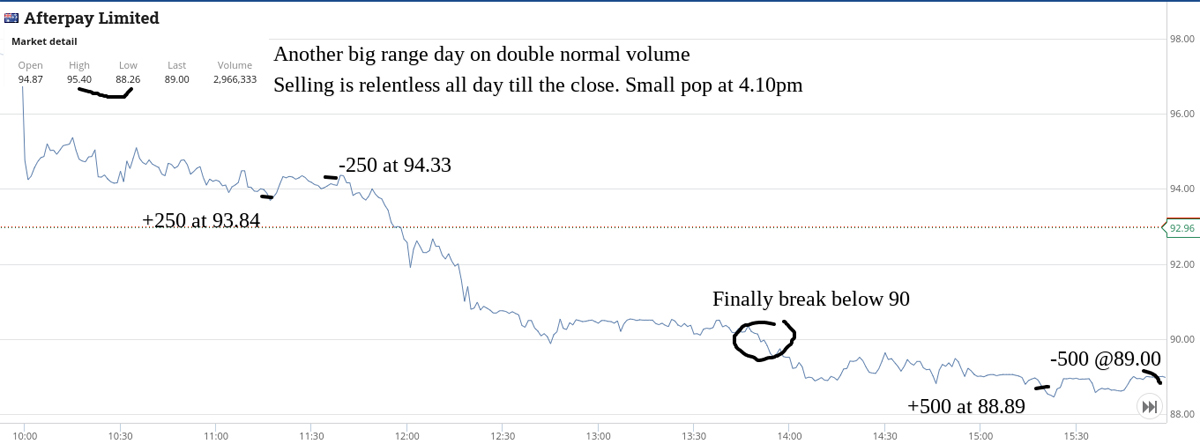

The rout in the BNPL stocks continues, with big trading ranges. In the morning some 2c in and out trades in Z1P pays for this week’s coffees, having decided to have a quick look at the 10.00am opening. Just can’t help myself and finally get out of my chair at midday, still in my dressing gown.

See the graphs for some of the fun.

Had a quick go in ABR again, which turns out a bit wrong, so had to double down twice and 2000 became 8000 before a 5c rally, from 1.50 to 1.55, gets me out of jail. Two days ago they were 2.30!

Finish the day up A$897 even after taking a few hits at the end of the day’s trading.

+2000 Z1P at 7.20; -2000 at 7.22; +2000 at 7.13; -2000 at 7.15; +2000 at 7.10; -2000 at 7.12; +5000 at 6.87; -5000 at 6.93; +5000 at 6.85; +5000 at 6.75; -10000 at 6.78; Profit A$120 (after taking a A$200 hit on last cut of 10,000 shares)

+250 APT at 93.84; -250 at 94.33; +500 at 88.89; -500 at 89.00; Profit A$177

And we’re off! The BNPL twins are out of the gates with a bang, which gradually runs out of steam. I am on a patient APT watch until 2.15pm, until I srike out at APT, with a flurry of trades as they fall below 91.00 after hitting 94 in the morning.

Every break down to another level triggers out some stops, so when getting close, I put in a limit at 15c below that level. So, when they looked like breaking below 91.00, in goes a limit order at 90.85 etc.

Did this at 91, 90 and 89. That’s why I don’t use stop losses.

Finally get to have a punt in PBH after three days of watching, when they fall below 12.00. All up plus A$757 for the day.

+2000 Z1P at 6.89; +3000 at 6.79; -5000 at 6.86; Profit A$160

+500 APT at 90.84; -500 at 90.99; +500 at 89.94; -500 at 89.96; +500 at 89.40; +500 at 88.78; -1000 at 89.31; Profit A$357 (Last sale of 1000 in the 4.10pm scrum)

+2000 PBH at 11.92; +2000 at 11.78; +4000 at 11.75; -8000 at 11.83; Profit A$240 (now punting in a punting company! Almost lost the bet but rallied on the final bend home)

Ever since my Lemsip episode, I have been trading like a possessed octopus and wonder how long it will last before taking a big hit. So far so good but don’t want to push it too much, so may sit back today. Let’s see.

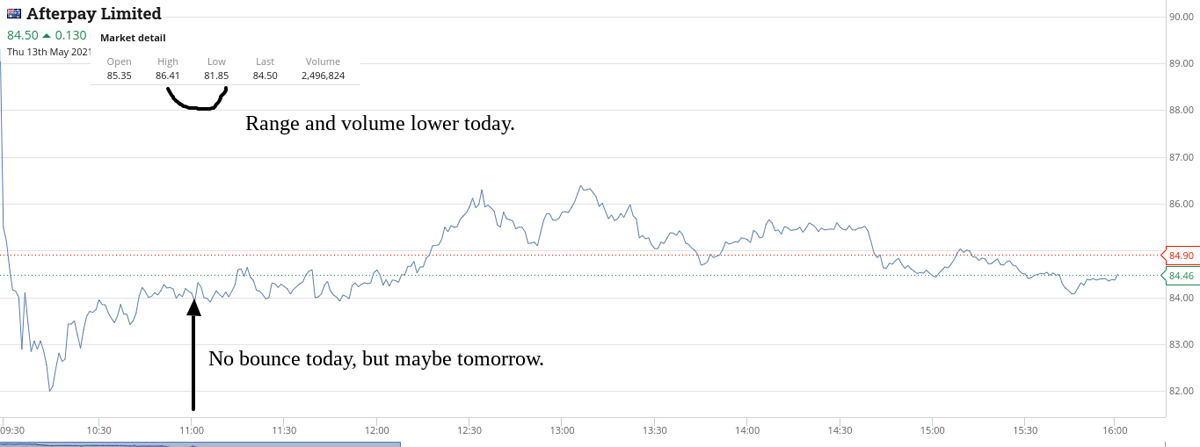

Falls overnight in USA gives my watch list an opening glow of red and I decide to leave everything alone. A mate texted me just before 11.00am to ask if I thought we may get an upwards movement in APT. I told her I don’t think so.

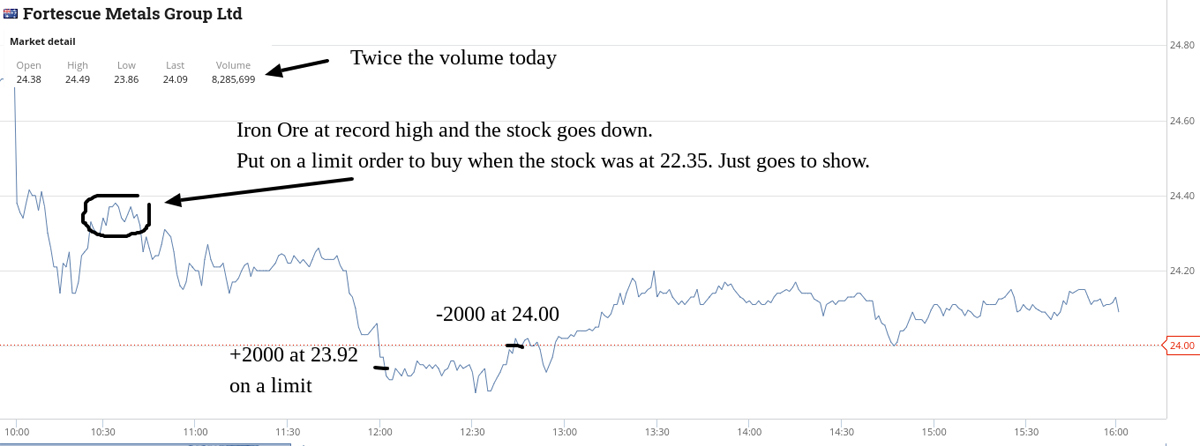

Have a go in 2000 FMG at 23.69 and make three cents in 30 seconds at 2.32pm but that’s it. Too hard today. Bank A$60.

(APT moved up $1.60 after 11am! Beautiful and clever!)

+2000 FMG at 23.69; -2000 FMG at 23.71; Profit A$60

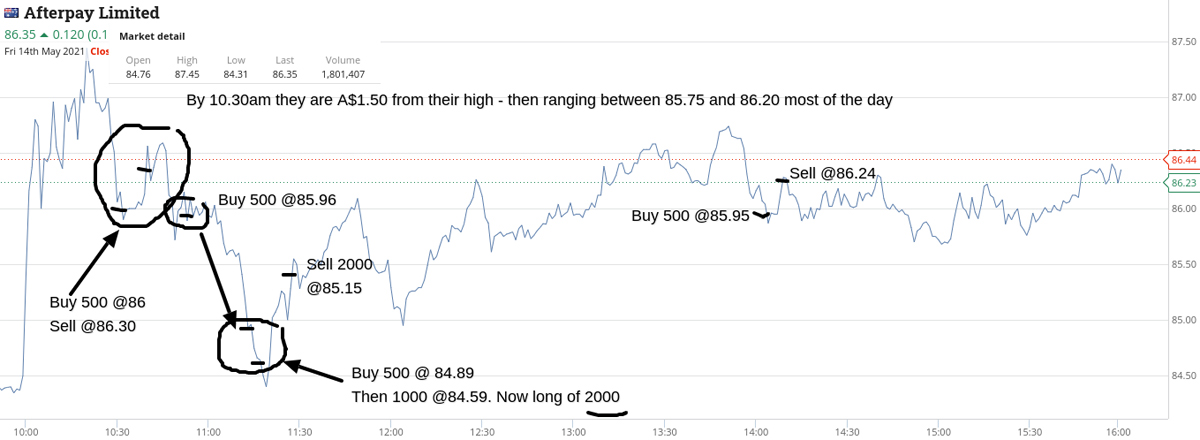

Get to sit down at screen at 10.15am. Focus on APT and buy 500 at 86.00, which is A$1.50 below their opening highs. Out at 86.30 on a bounce.

Not sure if will bounce at 11.00am, so buy 500 at 85.96 just in case at 10.56am. Mmmmm no bounce.

Buy another 500 at 84.89 and then 1000 at 84.59. Time is 11.20am. Then the bounce comes and out at 85.15. Profit in APT is A$580 for the day.

Their range wasn’t massive but 3 months ago, could only trade half of this size for the same capital outlay.

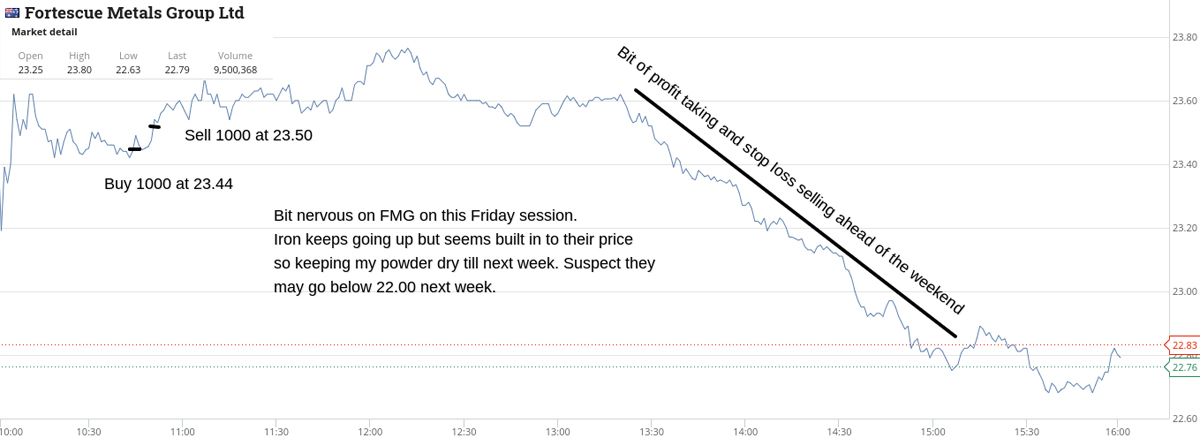

I also bought 1000 FMG at 23.44 and sold them quickly at 23.50 just after 11.00am.

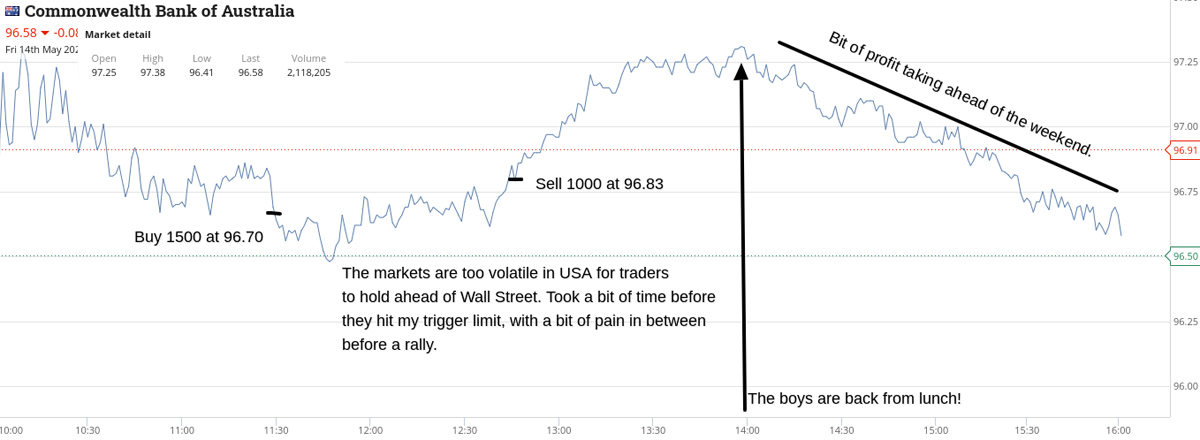

Stepped to the plate on CBA at 11.30am and buy 1500 at 96.70. Have to wait till 12.15pm before they hit my limit. Always knew 97.00 would be a magical level today.

BHP have that magical 50.00 sign on them and being a Friday they eventually break down through it and never come back. Bt 1000 at 50.23 and later 1500 at 49.84. Sold the first lot at 50.30 and the second lot at 49.92.

At beer time I calculate +A$935 on the back of my drink coaster. I think I was down on every trade before they all came good. Cheers! Here’s to Monday.

+500 APT at 86.00; -500 at 86.30; +500 at 85.96; +500 at 84.89; +1000 at 84.59; -2000 at 85.15; +500 at 85.95; -500 at 86.24; Profit A$580 (smaller swings but bigger size of trades at these lower levels)

+1000 FMG at 23.44; -1000 FMG at 23.50; Profit A$60

+1500 CBA at 96.70; -1500 CBA at 96.83; Profit A$195 (took a bit of pain before the gain!)

+1000 BHP at 50.23; -1000 BHP at 50.30; +1500 at 49.84; -1500 at 49.92; Profit A$190

Gross profit: A$3224

Less brokerage: A$564

Net Profit: A$2660

Most satisfying: APT (Fri)

Least satisfying: CBA (Mon)