Confessions of a Day Trader: A quick working week’s a good working week

News

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Take whole day off and don’t even look at the screen. This gives me a complete two-day break as I have learnt that you need to take complete breaks to refresh your focus and take a brain holiday, especially as the market volume will be very low, through lack of interest.

Ahh. This is nice.

Back into it. APT and Z1P open up strong and FMG, BHP and Rio all open up lower on China-related wobbles.

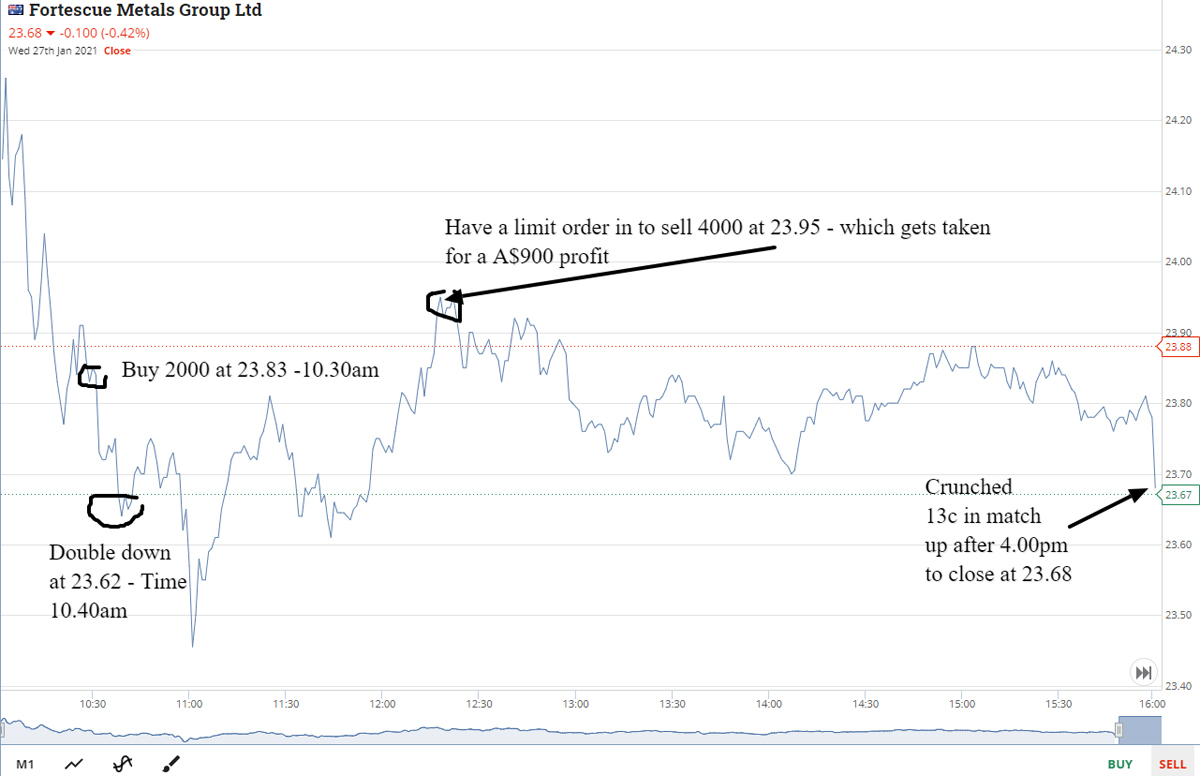

Watch FMG go below 24.00 and at bang on 10.30am, buy 2000 for 23.83. Ten mins later, I am down $400 so double down for another 2000 at 23.62. Good start to the day!

I can’t believe that a stock that’s yielding 10% at 25.00 is trading at 23.60, so am determined to see this through for a good profit. Put on a limit to sell 4000 at 23.95 because at that level someone will think they are heading to 24.00 plus.

Later when I check to see how my strategy is going, my position has been closed out at 23.95. So was down $400, close out at a $900 profit and close my book for the day. Maybe tomorrow they could have a 22 in the front. Let’s see.

+2000 FMG at 23.83, +2000 FMG at 23.62, -4000 FMG at 23.95, Profit $900 (was down $400 at one point)

Well indeed, we do see FMG with a 22.00 on the front of their price. Have a limit in at 22.75 at 11am but keeps hitting 22.78 and bouncing, so adjust limit up a bit and eventually get filled at 11.22am.

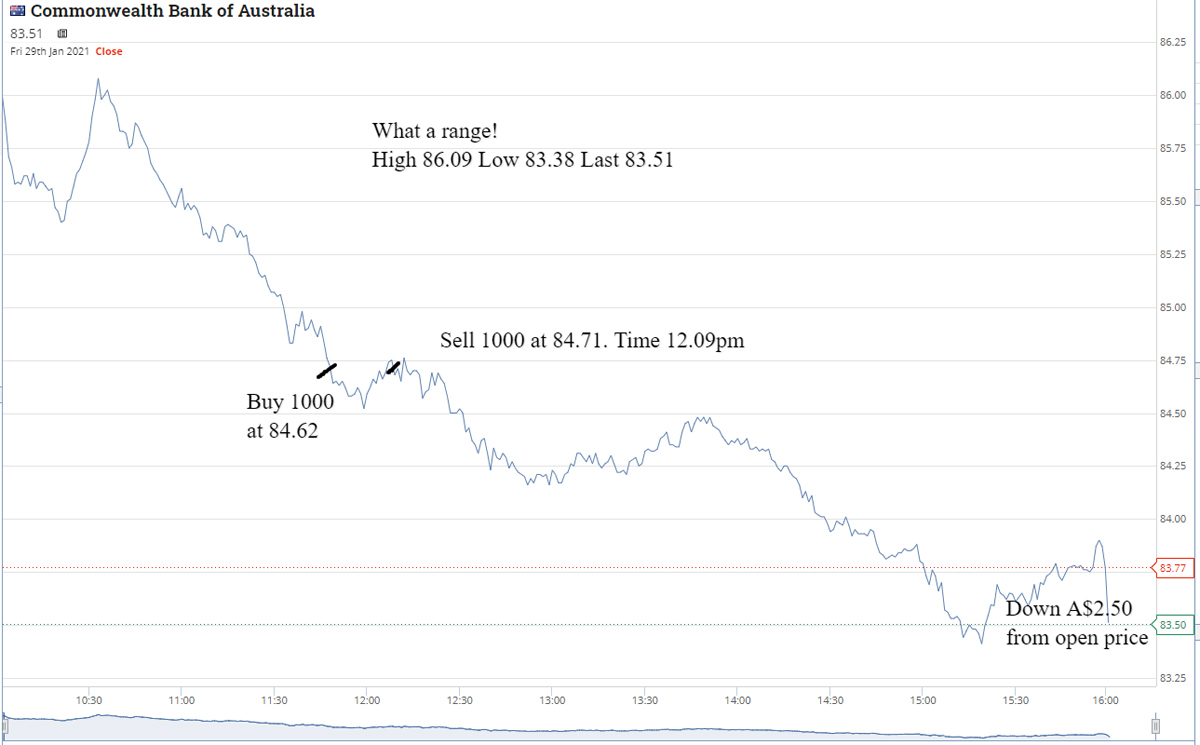

Buy 1000 CBA at 84.19, knowing that if they fall to 84.00, I will be down around $200. Time is 10.58am.

They do fall below 84.00 but seeing as they were 86.60 yesterday, I hold and wait with a limit order in to sell at 84.50. After selling FMG for $800 profit, I adjust CBA down from 84.50 to 84.42 and when sold, I walk away for the rest of the day up $1030.

+1000 CBA at 84.19, -1000 CBA at 84.42, Profit $230

+4000 FMG at 22.78, -4000 FMG at 22.98, Profit $800

FMG fall below 22.00 and CBA ended the day with a massive range and finished $2.50 below their opening price.

As we are getting the market wobbles, happier to trade good yielders and earners. At 11.50am, I buy 2000 FMG at 22.28 and sell them 30 mins later at 22.40.

They fall below 22.00 and I have to buy 1000 just for the sake of it. On Wednesday I traded some at 23.95!

Have them on a limit of 22.20 and was in profit but got too greedy and cut them for a $145 loss at 21.84. CBA gave me a small $90 profit after buying 1000 at 84.62 and selling them 15 mins later for 84.71.

All up plus $275 for the day.

+2000 FMG at 22.28, +1000 FMG at 21.985, -2000 FMG at 22.40, -1000 FMG at 21.84, Profit $185 (after $145 loss)

+1000 CBA at 84.62, -1000 CBA at 84.71, Profit $90

Gross profit for week: $2,205

Brokerage: $170

Net profit for week: $2,035

Most Satisfying: FMG +A$900

Least Satisfying: FMG -A$145

Includes two days off!