Confessions of a Day Trader: A quick week’s a good week

News

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Nice to have a break and a brain reboot.

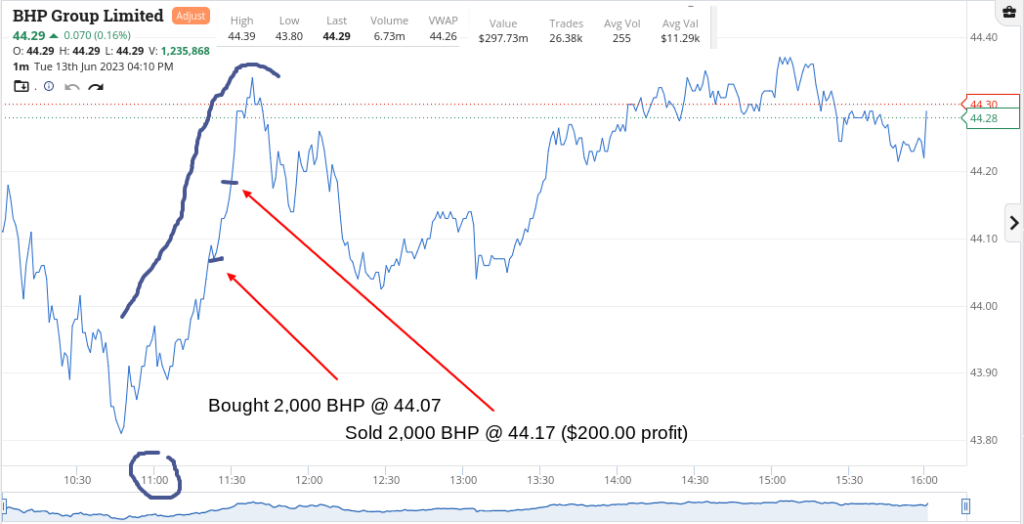

Caught some BHP on the upside, just after 11.00am and put them on with a 10c turn on them, Caught them in their updraught!

WBC were lagging behind the other banks, with CBA breaking out above $96.00, so did the same in them but took a smaller turn.

In fact, CBA’s day range today was 70c and BHP’s was 41c, which I suppose is suspected after a little extra day off.

Tomorrow, we are halfway through the week! Up $290.

Recap

Bought 2,000 BHP @ 44.07

Bought 3,000 WBC @ 20.20

Sold 2,000 BHP @ 44.17 ($200 profit)

Sold 3,000 WBC @ 20.23 ($90 profit)

Mixed messages coming in from America overnight, which most of my watchlist see as good news and everything opens up on a higher note.

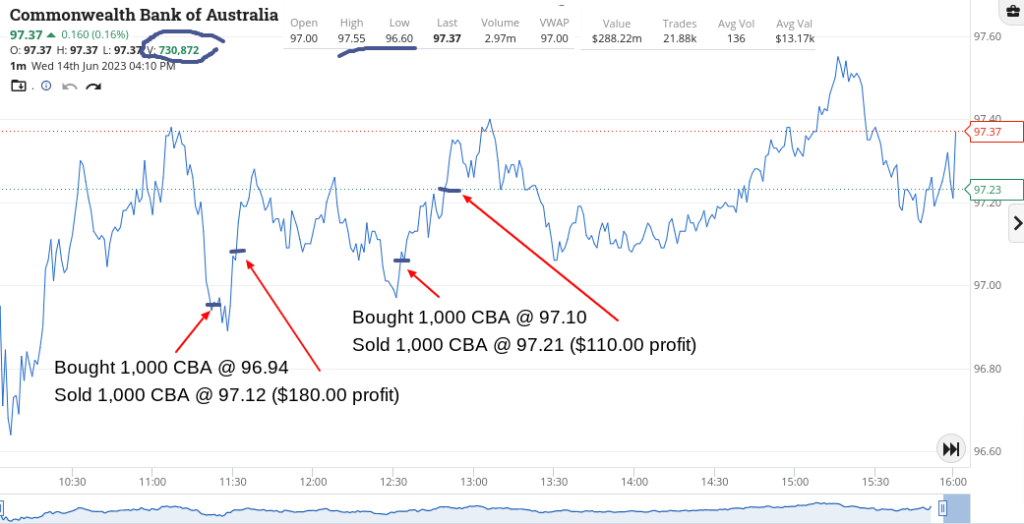

CBA now trading around the $97 level and I got one go on the way down, just before 11.30am and another one on the way up, at just after 12.30pm. Their volume is getting better today and their range was 95c over the day as well.

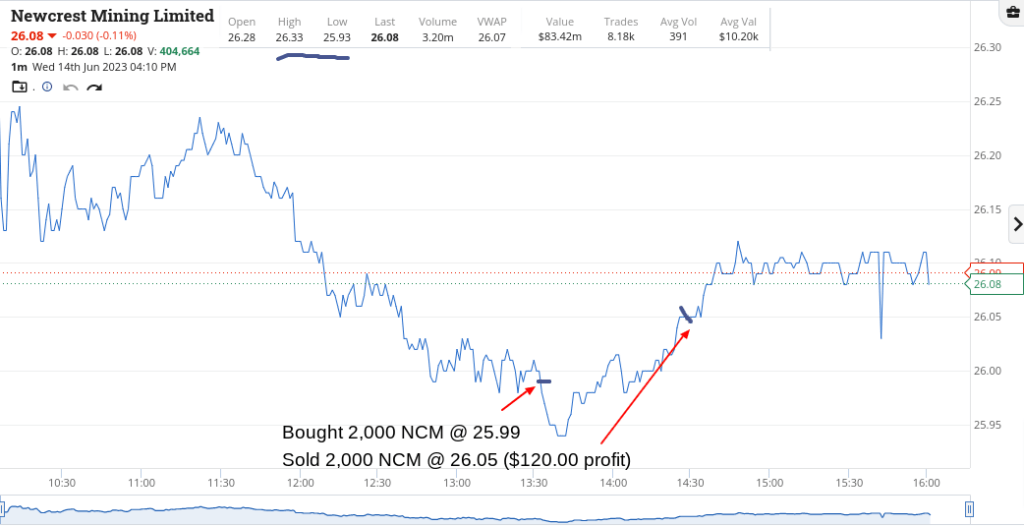

NCM was the only other play for me today. They were hovering around the $26.00 level, going in and out and then they popped nicely.

Not big profits today but happy to take any crumbs off the table at the moment.

Up $410.

Recap

Bought 1,000 CBA @ 96.94

Sold 1,000 CBA @ 97.12 ($180 profit)

Bought 1,000 CBA @ 97.10

Bought 2,000 NCM @ 25.99

Sold 2,000 NCM @ 26.05 ($120 profit)

Sold 1,000 CBA @ 97.21 ($110 profit)

Really am scratching around and trying to find little trading nuggets.

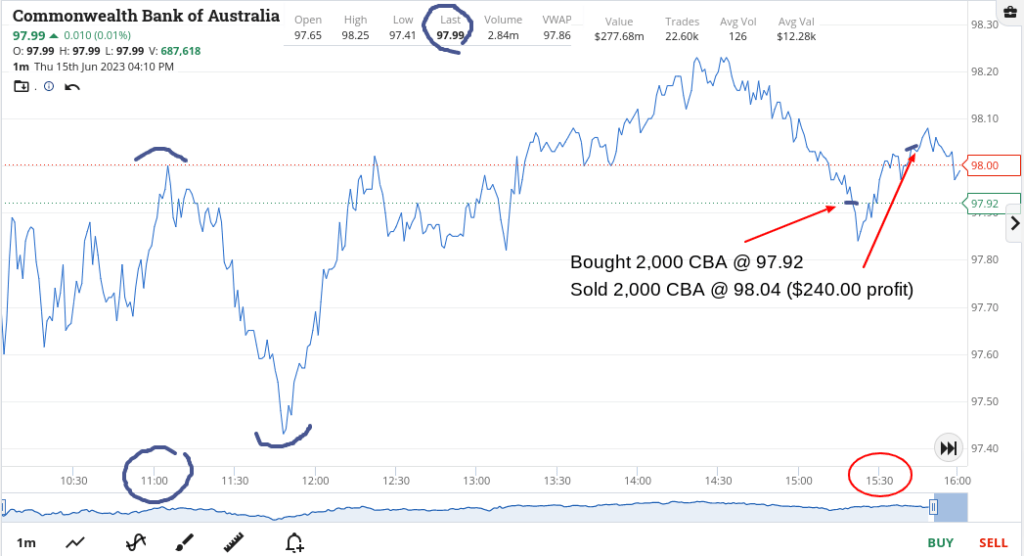

At least volumes are better today and day ranges are a bit more stretched out than recently.

Got to go twice in NCM below $26.00, once in BHP at below $46.00 and lastly once in CBA below $98.00.

CBA actually closed at $97.99, so just couldn’t make it above a round number at the death.

Mixed messages in the market today after employment figures came in a bit better than expected and the bond market now has those 10-year bonds back to hovering around the 4% mark.

Up $580, thanks mainly to those round number market price levels.

Recap

Bought 2,000 NCM @ 25.90

Sold 2,000 NCM @ 25.95 ($100 profit)

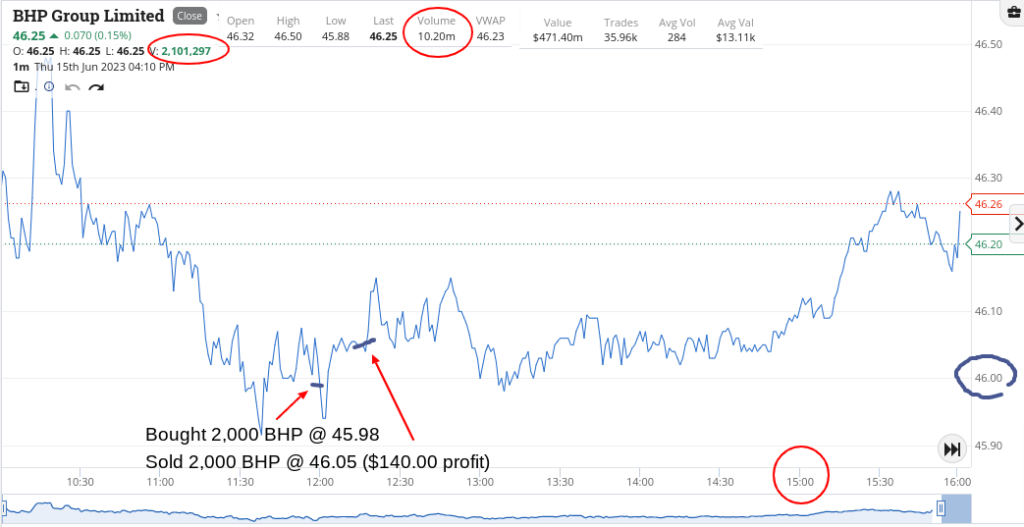

Bought 2,000 BHP @ 45.98

Sold 2,000 BHP @ 46.05 ($140 profit)

Bought 2,000 NCM @ 25.87

Sold 2,000 NCM @ 25.92 ($100 profit)

Bought 2,000 CBA @ 97.92

Sold 2,000 CBA @ 98.04 ($240 profit)

An interesting day today. CBA closed the day up $1.36 at $99.35. On Tuesday they were arm wrestling me around that $96.00 level. Their range today was $1.27 and on good volume showing 6.4m and that closing price was their day’s high.

So on the back of that, my picture of the day is painted in their chart.

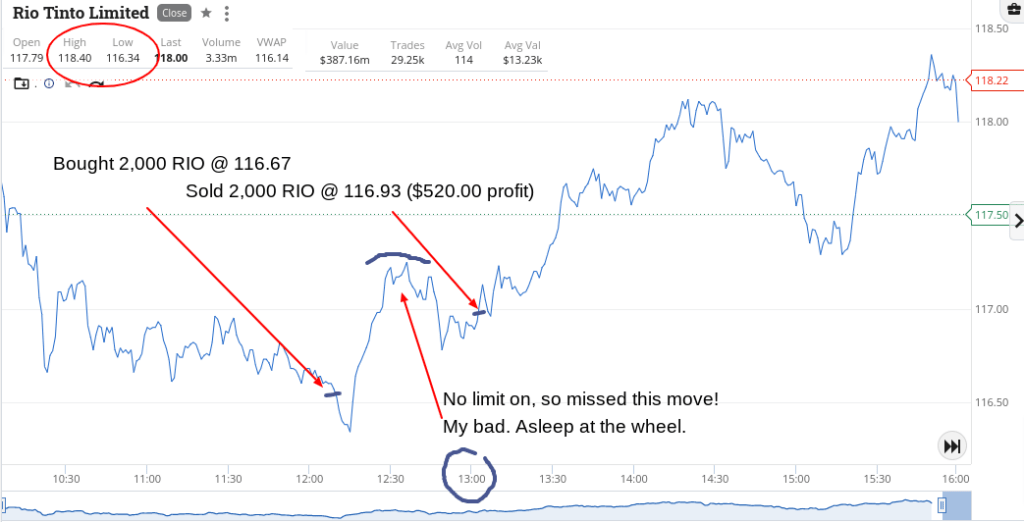

RIOs came in good and it was only after I sold them that they really took off. I spent too much time staring at them around the $116.90/93 level, as I had them on a limit of $16.99. Eventually adjusted it down to meet the market and bingo, off they went.

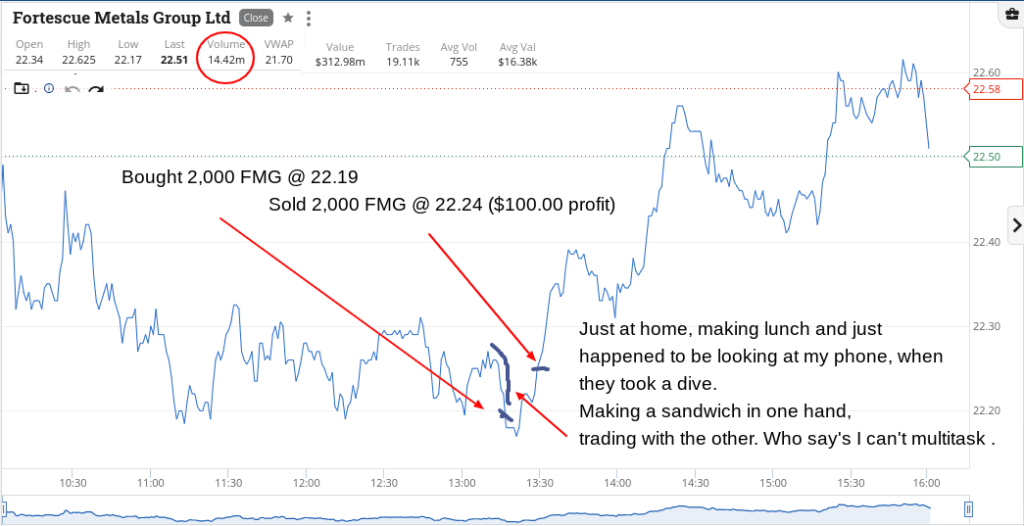

FMG were just a token trade to make me feel a bit better but boy oh boy, RIO’s range for the day was $116.34 to $118.40 on 3.3m.

Monday will be interesting, as Wall Street is shut on their Monday, so am suspecting this strength to hang around, even as 10yr bonds hit a yield of 4.04%.

Up $620 today and up $1,900 gross or $1,488 net and that’s from a four-day week.

Recap

Bought 2,000 RIO @ 116.67

Sold 2,000 RIO @ 116.93 ($520 profit)

Bought 2,000 FMG @ 22.19

Sold 2,000 FMG @ 22.24 ($100 profit)