Confessions of a Day Trader: $1190 in a day – my kind of inflation!

News

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

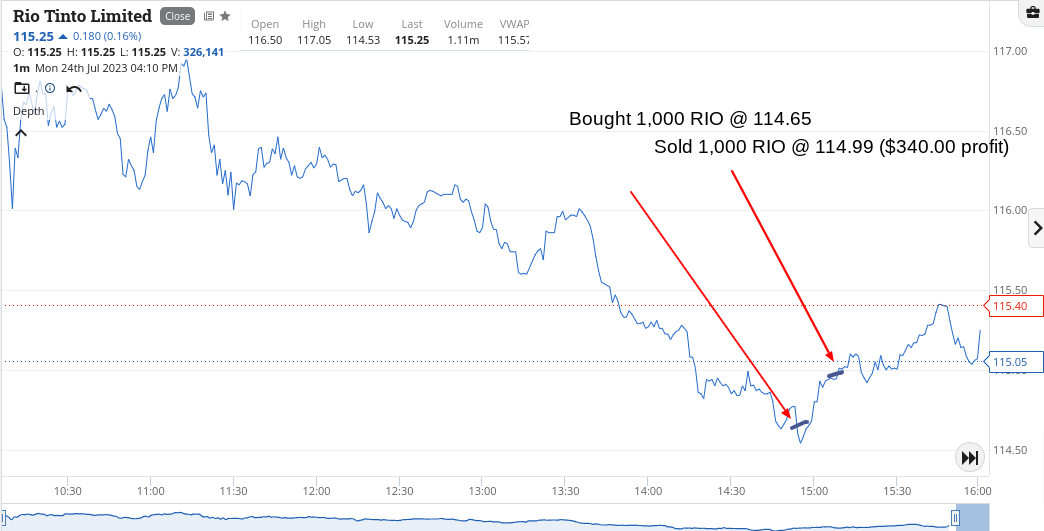

Over the weekend I was reading that a big American investment bank had placed a sell on BHP and RIO.

I’ve seen this happen before and the selling can be just constant and grinding, hence me waiting till the last half hour to get into RIOs.

Took a bit of discipline but I just had push notifications on levels, which when reached, I would adjust them down again. Got the feeling that BHP was not going to recover and in fact they closed 1c above their day’s low.

But with RIOs you could sense that they were a tad oversold, plus the time was coming into the 3.00/3.30pm zone.

Bt 1000 at $114.65, which I had to chase up from $114.60 and put them on at just 1c below $115, just in case they broke it, which they did. Left $400 on the table but such is life.

Up $340 on a cold and wet day in NSW.

Recap

Bought 1,000 RIO @ 114.65

Sold 1,000 RIO @ 114.99 ($340 profit)

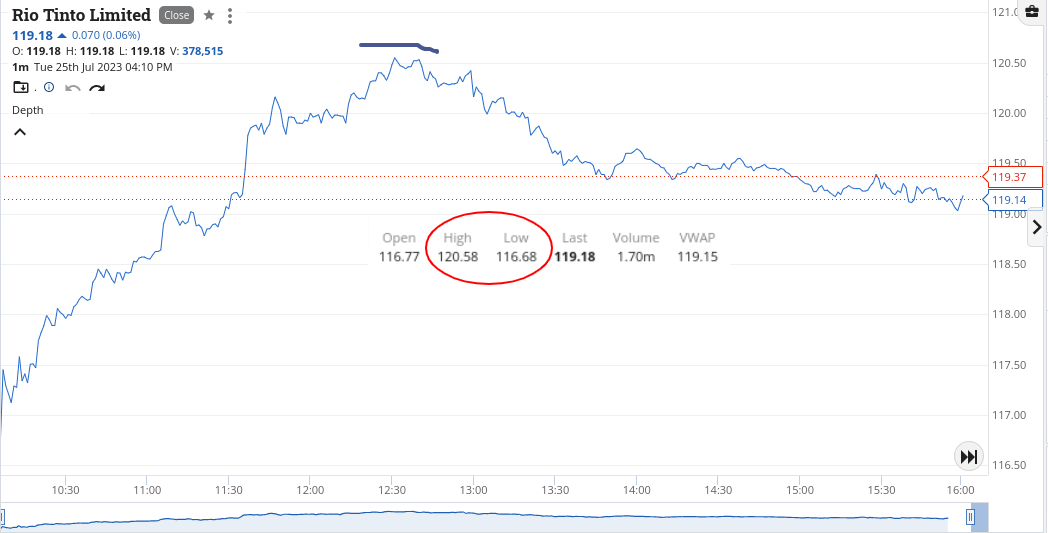

OMG! RIOs, which traded as low as $114.52 yesterday, touched $120 today!

In fact, their range was a whopping $4.00 today. It was like someone had taken their foot off the spring, after yesterday’s selling.

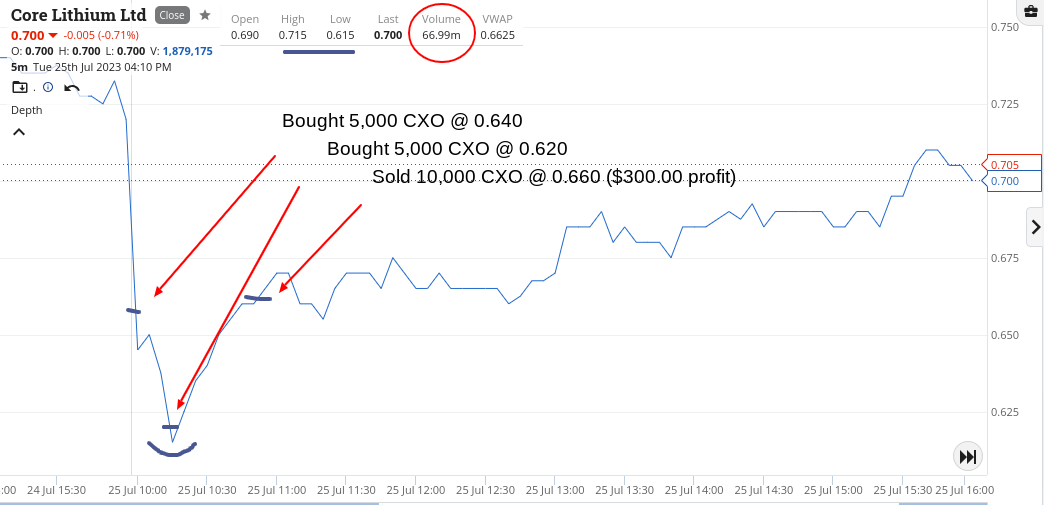

Leaving them aside, had a nice little win in CXO, who fell about 15% yesterday and were down another 11% or so today. 10 more trading days like that and they would be worth 1c.

I don’t think so! In for some at 64c and limit in lower down at 62c, which got hit. They closed at 70c or down 2% for the day on 67m shares.

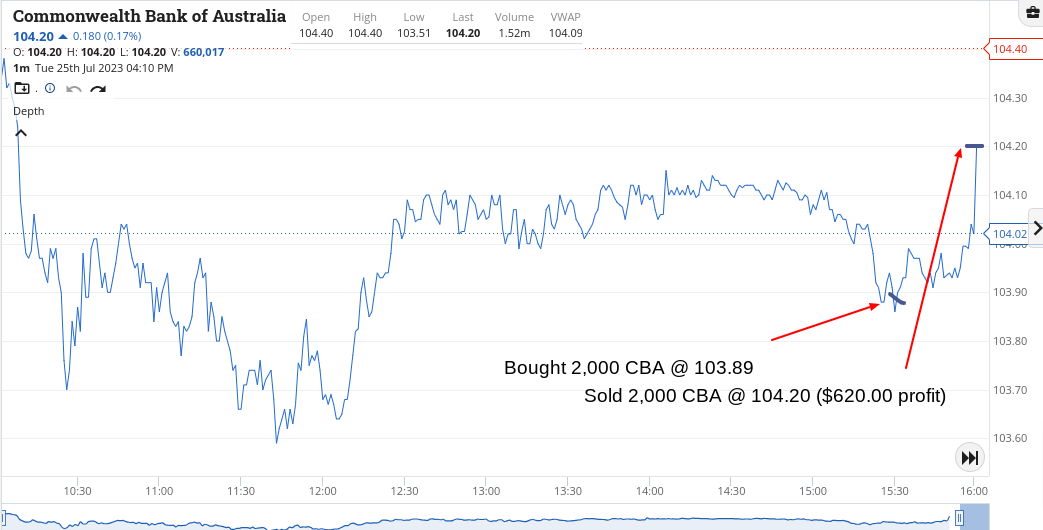

CBA were boring today and with about 20 mins to go, had a quick pop at them and at BHP, who were not being as spectacular as RIO. Had mixed results, but managed to come out at the end of the day up $580.

Bought 5,000 CXO @ 0.640

Bought 5,000 CXO @ 0.620

Sold 10,000 CXO @ 0.660 ($300 profit)

Bought 2,000 CBA @ 103.89

Bought 2,000 BHP @ 45.99

Sold 2,000 CBA @ 104.20 ($620 profit)

Sold 2,000 BHP @ 45.82 ($340 loss)

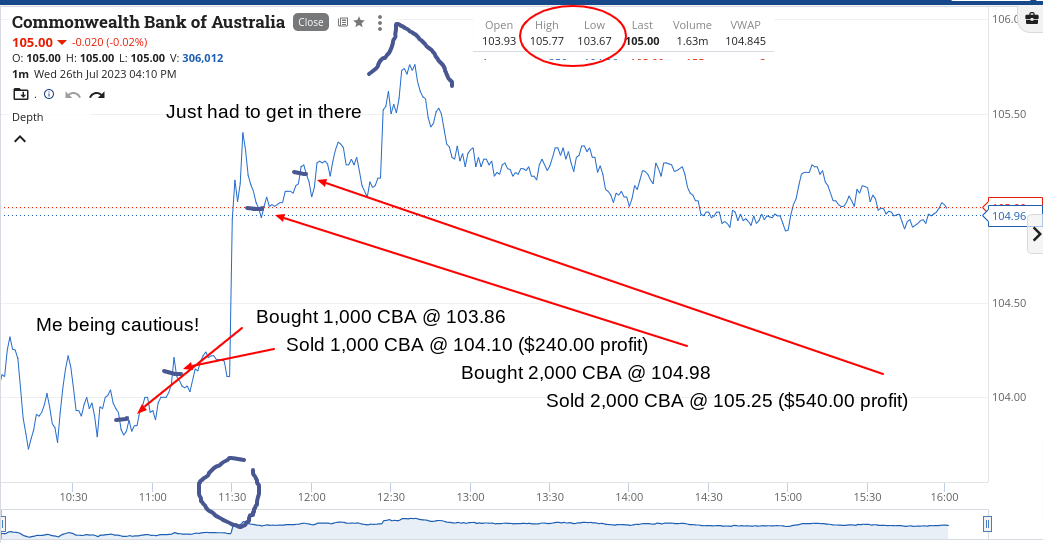

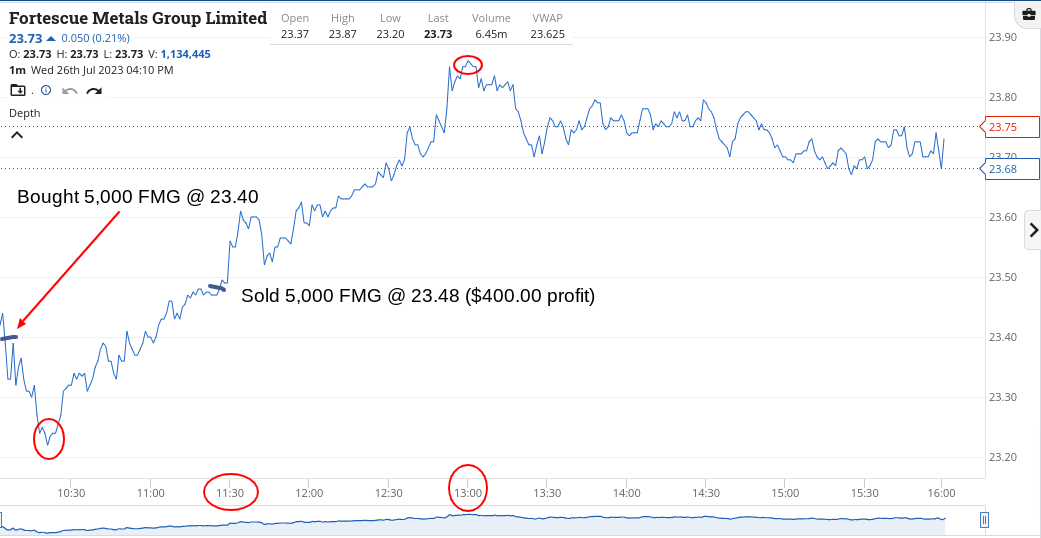

Busy day at the office, with new inflation figures lighting a fire under my watch list.

Managed to get in some early trades before the 11.30am inflation figure release and one after it.

The iron ores came out of the traps early and I got sucked into what I thought would be a quick in and out but messed up the timing a bit.

Even they rallied strongly after 11.30am, which just goes to show how index trading affects the blue chips.

Banks I understand but the iron ore reactions always stumps me. Anyway what am I to say about Mr Market and his merry gang of stocks.

Up $1,190 is all I have to say. I’ll let the charts do the rest of the talking!

Recap

Bought 5,000 FMG @ 23.40

Bought 1,000 CBA @ 103.86

Bought 1,000 NST @ 11.42

Sold 1,000 CBA @ 104.10 ($240 profit)

Sold 5,000 FMG @ 23.48 ($400 profit)

Sold 1,000 NST @ 11.43 ($10 profit)

Bought 2,000 CBA @ 104.98

Sold 2,000 CBA @ 105.25 ($540 profit)

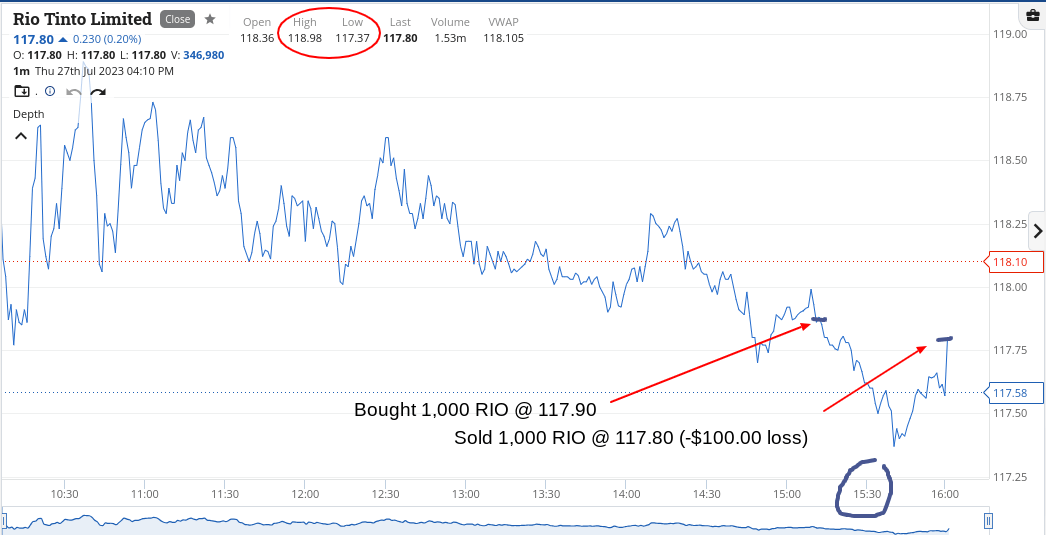

Things got a bit more back to normal today – I managed to make the grand old sum of $10 today.

I can’t really add much more than that and if it wasn’t a late 4.10pm surge in the millionaires factory stock, it could have been far worse.

In fact, you wish you had have lost $200, as telling someone that you ’made $10 trading today’ leads to more questions than you want to answer.

See charts!

Recap

Bought 1,000 MQG @ 174.94

Sold 1,000 MQG @ 175.03 ($90 profit)

Bought 1,000 RIO @ 117.90

Sold 1,000 RIO @ 117.80 ($100 loss)

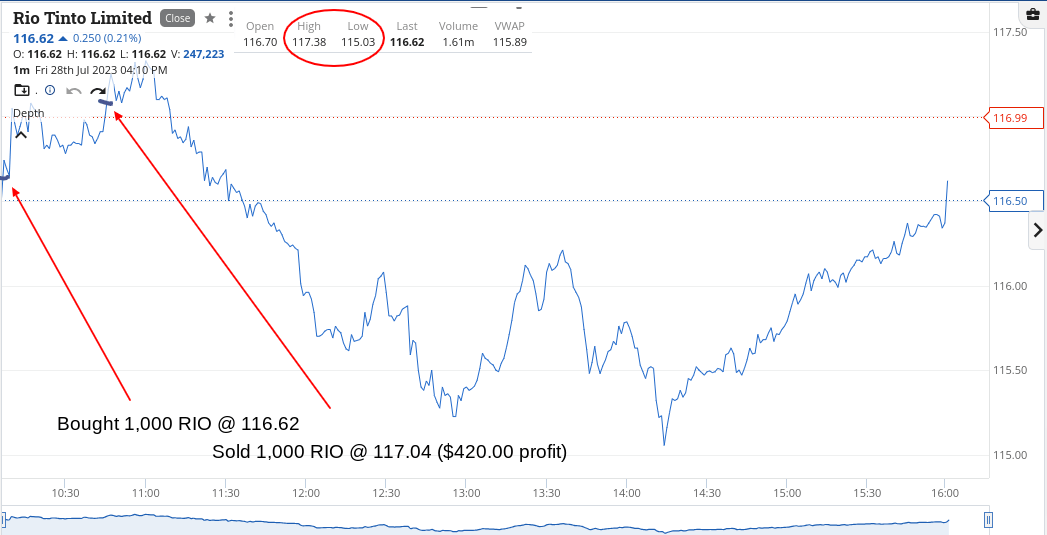

What an end to the week.

Up $900 today after staring down a loss of over $1,000, thanks to CBA.

You could have gone long or short in them today and still come out smelling of roses. Their range was $104.82 to $106.09 and their last price was $105.50.

I got my timing wrong, having thought yet again that here was a quick trade, and I even had a limit sell on straight after the buy.

It took way longer than I thought to get there, but when it did, it kept on going. And going.

RIOs was a lucky one to sell, as I was just looking at them as they broke the $117.00 level and out the door they went.

So for the week, up $3,032 gross and $2,396 net for the week and boy has it been a long one!

Recap

Bought 2,000 CBA @ 105.51

Bought 1,000 RIO @ 116.62

Sold 1,000 RIO @ 117.04 ($420 profit)

Sold 2,000 CBA @ 105.75 ($480 profit)