Closing Bell: Wall St loses bottle over rates; ASX spits dummy over said lost bottle; China stagnates (a bit less); USD crushes AUD

News

News

The ASX200 has closed lower on Friday, ending the session -0.6% lower, but ahead 1.8% for the week.

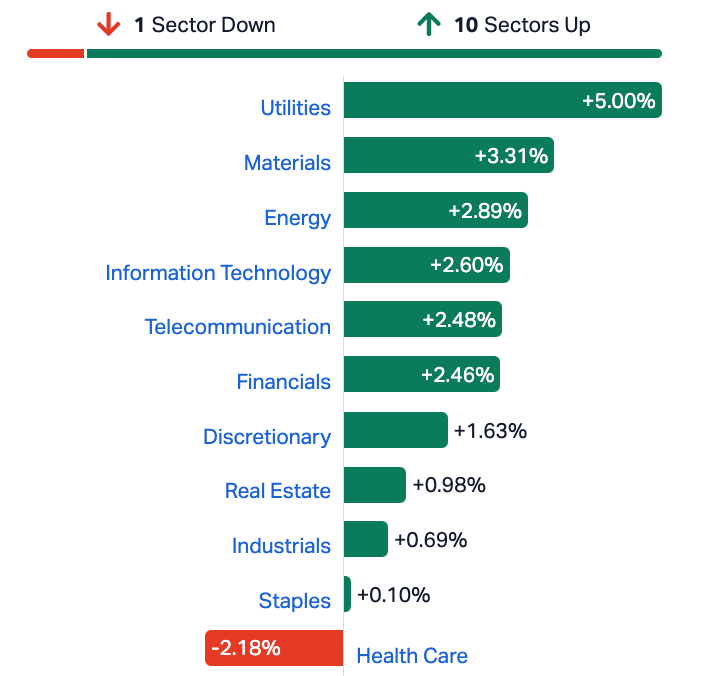

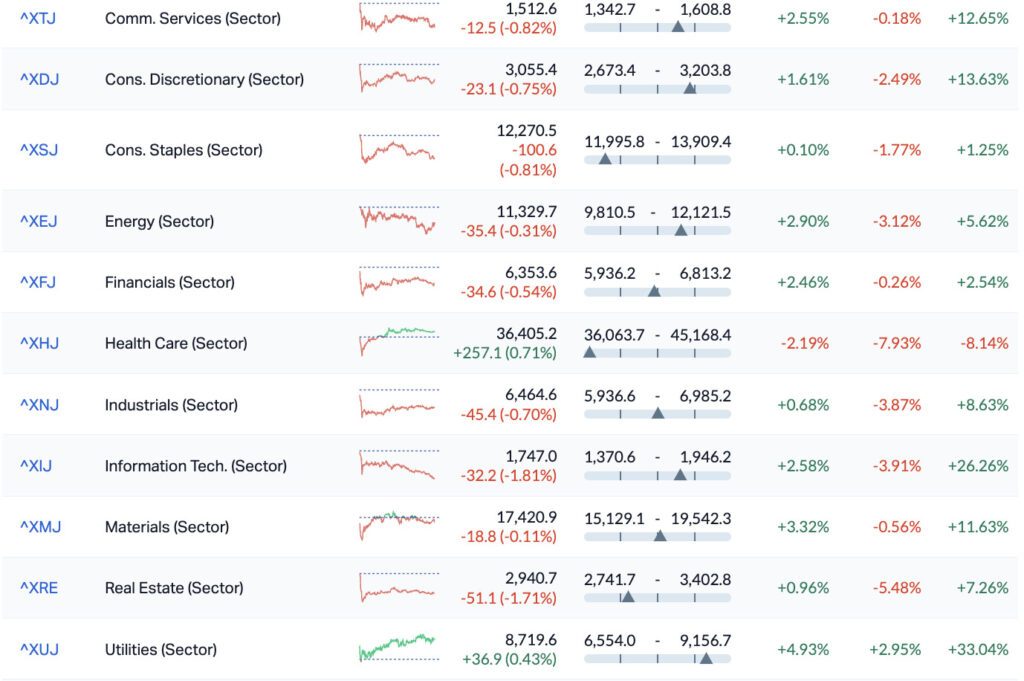

Healthcare and Utilities Sectors were the only corners of the ASX benchmark index to end in the green.

That said, Healthcare was the only sector not to end Friday with some goodies to take home for the weekend, with all other 10 sectors making gains over the last five sessions.

Weak Wall Street leads emerged following the overnight release of sizzlier-than-anticipated US consumer inflation numbers. That, BTW, hit our wee Aussie dollarbuck at once.

As the USD surged, ours plunged giving up without a complaint – some 1.5% overnight to be wallowing back around a hideously weak US63.20¢.

What does that mean for gold? Read on Macduff, I say (‘cos i wrote a little onnit below).

Meantime, both the annual and monthly headline inflation reads in the states kicked higher than expectations and hopes over September, helping Wall Street mess its undies again and likewise galvanising investor anxiety around the idea that the Fed will keep holding rates higher for longer.

And BTFW, also not helping last night – the chatty Boston Fed President Susan Collins who declared the data ‘underscores uneven progress toward restoring price stability’.

It’s her view that the Fed might have to raise rates again to get on top of their inflation. Terrific. Thanks a lot Susan. Stay mum about it next week, pls.

Among the littler companies, the ASX Small Ords (XSO) lost -1.2%, to end the week ahead +1.6% and the ASX Emerging Co’s (XEC) index lost -0.8%, halving its weekly gains at +0.8%

Javelin Minerals (ASX:JAV) , says that following completion of its due diligence, it’s decided not to go ahead with the proposed off-market Takeover Bid for Gecko Minerals Limited (“Gecko”) and ‘accordingly has now provided notice to Gecko of the termination of the Takeover Bid Implementation Agreement.’

Bad luck for Gecko, and the details of the decision aren’t available yet, but we’ll follow that for sure.

Meantime, JAV says it will be going ahead with the capital raising announced on September 6 anyway, and will also seek approval at its AGM for the issue of 5,000,000,000 options to the company’s corporate advisors and for the consolidation of the company’s shares on a 10 for one basis as previously announced.

As announced on October 5 2023 the AGM will be held on November 21 2023 and full details of all resolutions will be set out in the Notice of AGM which will be released in the week commencing October 16 2023.

Coventry Group (ASX:CYG) has dropped a decent first quarter update -–securing sales of $94.606m, up more than +6% on the prior year as well as unaudited EBITDA of $5.446m, up +10.8%.

Robert Bulluss, Group CEO and MD, said the group delivered solid returns:

“Initiatives to grow EBITDA1 % to Sales to 10% in the medium term have delivered early positive improvements and our strategy based on specialisation and service excellence is continuing to be resilient.

“These buy-side and sell-side initiatives were implemented early in the financial year and started to become evident in the month of September with EBITDA up 26.7% on the pcp.

“We expect the run-rate from these initiatives to continue to improve over the December quarter.

“There was some weakness in the Konnect and Artia New Zealand business due to the recessionary environment in New Zealand and the businesses exposure to residential construction through roofing screws.

“Konnect is the dominant industrial fasteners business in New Zealand and we expect the business to become even stronger through this period as competitors withdraw from the market. There are already signs of green shoots in the economy driven by all-time record rates of immigration.”

Gold prices rested around $1,880 an ounce on Friday after walking away from two-week highs in the previous session.

That’ll be the stronger US dollar what trampled the AUD as well as US Treasury yields getting mad again after last night’s US consumer inflation data.

The latest ABS data on arrivals and departures out of Australia dropped earlier, with the total number of people leaving the country apparently at its highest level since the pandemic shut the borders.

Arrivals meanwhile rising quickly – the Americans and Kiwi’s OFC, but now China’s relaxed its whacky COVID travel rules, there’s welcome resurgence in numbers from our largest trading partner, largest tourism and education export destination.

And while we’re on Beijing, China’s consumer prices unexpectedly stagnated in September 2023, missing market forecasts of a 0.2% gain and following a 0.1% rise in August. A fall in food prices quickened amid ample supply ahead of the Golden Week break while cost of non-food rose further.

Meantime, factory gate prices extended falls for the 12th straight month but the rate of drop has eased in recent months.

But it’s not all total gloom, doom and ineffective economic policy – exports shrank for a fifth straight month, too – but for softest pace in the run – suggesting some kind of gradual stabilisation.

Chinese exports fell 6.2% y-o-y to USD 299.13 billion in September 2023, following an 8.8% drop in the previous month, and better than forecasts of a 7.6% fall.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MXC | Mgc Pharmaceuticals | 0.002 | 100% | 3,850,473 | $4,427,968 |

| HOR | Horseshoe Metals Ltd | 0.012 | 50% | 1,265,869 | $5,147,829 |

| FIN | FIN Resources Ltd | 0.024 | 26% | 23,942,171 | $11,799,672 |

| DDT | DataDot Technology | 0.005 | 25% | 8,057,736 | $4,843,811 |

| IPB | IPB Petroleum Ltd | 0.016 | 23% | 5,945,142 | $7,346,592 |

| FTZ | Fertoz Ltd | 0.082 | 22% | 1,036,814 | $17,274,933 |

| MEL | Metgasco Ltd | 0.011 | 22% | 387,397 | $9,574,981 |

| NAG | Nagambie Resources | 0.022 | 22% | 592,490 | $10,471,074 |

| MGT | Magnetite Mines | 0.395 | 22% | 79,668 | $24,948,641 |

| SWF | Selfwealth | 0.17 | 21% | 990,711 | $32,971,340 |

| GBZ | GBM Rsources Ltd | 0.018 | 20% | 944,897 | $9,304,827 |

| PKD | Parkd Ltd | 0.03 | 20% | 28,014 | $2,545,458 |

| TG1 | Techgen Metals Ltd | 0.03 | 20% | 46,666 | $1,929,207 |

| RIM | Rimfire Pacific | 0.006 | 20% | 2,000,000 | $10,526,224 |

| 1AI | Algorae Pharma | 0.014 | 17% | 220,186 | $19,628,882 |

| CZN | Corazon Ltd | 0.014 | 17% | 503,473 | $7,387,175 |

| LRL | Labyrinth Resources | 0.007 | 17% | 333,566 | $7,125,262 |

| TGH | Terragen | 0.029 | 16% | 94,208 | $9,227,028 |

| MEG | Megado Minerals Ltd | 0.037 | 16% | 105,124 | $8,142,578 |

| EVR | Ev Resources Ltd | 0.015 | 15% | 1,314,648 | $12,167,793 |

| GIB | Gibb River Diamonds | 0.03 | 15% | 433,906 | $5,499,246 |

| ICR | Intelicare Holdings | 0.015 | 15% | 110,373 | $2,715,900 |

| TOY | Toys R Us | 0.015 | 15% | 1,108,075 | $11,997,935 |

| VTM | Victory Metals Ltd | 0.23 | 15% | 870,292 | $16,179,931 |

| AYA | Artryalimited | 0.235 | 15% | 260,053 | $12,922,897 |

Horseshoe Metals (ASX:HOR) staged a late surge to take top spot for Small Caps on Friday, jumping a very handy 50% in short order off the back of a happy and well-received half-year report.

There’s a bit to digest in there, but the nuts and bolts of it are a sizeable reduction in losses compared to the same period last year, down to $646,912 against 2022’s $1,596,059 drop, which corresponds to a diluted loss per share of $0.106 versus the $0.304 loss last year.

Fertoz (ASX:FTZ), climbing 40.3% early on Thursday’s news that its Fertify NPKS plant in Montana, USA has achieved nameplate capacity of 40,000 tons per annum after two months of operation, but eased to around +25% by close of play.

Fertoz has reached the milestone with the facility working at double-shift capacity, but says that 50,000 tons per year is “achievable with triple shift operation”, as it ramps up production of its regenerative and organic all-in-one NPKS pellets to farmers in time for Spring in the US.

Meanwhile, peer-to-peer investing solution provider SelfWealth (ASX:SWF) was up 22% after acknowledging there’s some truth behind recent media speculation of a potential transaction with Stakeshop.

However, that offer was knocked back in short order by Selfwealth as it “did not offer appropriate value to Selfwealth shareholders”, and as such there’s been very little in the way of negotiation on the topic thus far.

Fin Resources (ASX:FIN) resumed its recent climb, up 21% (+110% for the week) on Monday’s news about abundant spodumene crystals within a broad pegmatite outcrop at Cancet West, 45km west of Winsome Resources’ (ASX:WR1) Cancet lithium deposit and 100km west of Patriot Battery Metals’ (ASX:PMT) Corvette Lithium Deposit.

Nagambie Resources (ASX:NAG) is up 22.2% this morning on the heels of an update from the Nagambie antimony-gold mine in Victoria, which the company says now boasts an “average antimony stope grade of 5.6% Sb”, making the Nagambie Mine discovery “the highest-grade antimony mineralisation in Australia”.

Nagambie says highlights include 13.4g/t AuEq (3.7% Sb plus 6.3g/t Au) over 1.2m EHT in hole NAD019; and 16.5g/t AuEq (7.9% Sb plus 1.3g/t Au) over 1.2m EHT in hole NAD044 – but it’s probably worth noting that mineralisation is 209m and 330m below surface in those holes respectively.

Fertoz (ASX:FTZ), climbing 40.3% on yesterday’s news that its Fertify NPKS plant in Montana, USA has achieved nameplate capacity of 40,000 tons per annum after two months of operation.

Fertoz has reached the milestone with the facility working at double-shift capacity, but says that 50,000 tons per year is “achievable with triple shift operation”, as it ramps up production of its regenerative and organic all-in-one NPKS pellets to farmers in time for Spring in the US.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| KNM | Kneomedia Limited | 0.002 | -33% | 37,996 | $4,514,356 |

| CCE | Carnegie Cln Energy | 0.0015 | -25% | 12,967,586 | $31,285,147 |

| MRD | Mount Ridley Mines | 0.0015 | -25% | 8,560,901 | $15,569,766 |

| IBX | Imagion Biosys Ltd | 0.0125 | -22% | 14,644,661 | $20,892,265 |

| 88E | 88 Energy Ltd | 0.0055 | -21% | 144,541,571 | $154,830,585 |

| AVJ | AVJennings Limited | 0.275 | -20% | 3,457,753 | $140,334,142 |

| HFY | Hubify Ltd | 0.016 | -20% | 94,113 | $9,922,726 |

| M4M | Macro Metals Limited | 0.004 | -20% | 600,000 | $9,935,389 |

| MRQ | Mrg Metals Limited | 0.002 | -20% | 219,360 | $5,514,797 |

| LBT | LBT Innovations | 0.009 | -18% | 3,265,233 | $3,914,904 |

| BGE | Bridgesaaslimited | 0.032 | -18% | 66,460 | $1,538,004 |

| SRI | Sipa Resources Ltd | 0.019 | -17% | 12,396 | $5,247,637 |

| AHN | Athena Resources | 0.005 | -17% | 3,412,881 | $6,422,805 |

| EDE | Eden Inv Ltd | 0.0025 | -17% | 50,056 | $10,090,911 |

| FAU | First Au Ltd | 0.0025 | -17% | 316,667 | $4,355,980 |

| ME1 | Melodiol Glb Health | 0.005 | -17% | 4,113,931 | $17,683,922 |

| SAN | Sagalio Energy Ltd | 0.01 | -17% | 17,634 | $2,455,922 |

| SHO | Sportshero Ltd | 0.02 | -17% | 324,478 | $13,800,026 |

| SUV | Suvo Strategic | 0.027 | -16% | 113,953 | $25,936,419 |

| NWM | Norwest Minerals | 0.028 | -15% | 125,330 | $9,489,794 |

| RNO | Rhinomed Ltd | 0.035 | -15% | 153,059 | $11,714,507 |

| ESK | Etherstack PLC | 0.24 | -14% | 14,949 | $36,905,961 |

| HCD | Hydrocarbon Dynamic | 0.006 | -14% | 1,343,849 | $4,547,661 |

| PKO | Peako Limited | 0.006 | -14% | 970,018 | $3,689,593 |

| PUA | Peak Minerals Ltd | 0.003 | -14% | 1,000 | $3,644,818 |

Rhythm Biosciences (ASX:RHY) – Paused for a speeding ticket.

Rincon Resources (ASX:RCR) – Pending the release of exploration results.

Pinnacle Minerals (ASX:PIM) – Pending an announcement in relation to a proposed acquisition.

Saturn Metals (ASX:STN) – Pending the release of an announcement regarding a capital raising.