Closing Bell: Uranium stocks surge as crunch looms; Actinogen, Kalina lead ASX gains

Uranium stocks rose after Kazatomprom’s update. Picture Getty

- Aussie shares rose on Fed rate cut hopes

- Kelsian plunged, while Kalina, Actinogen and Kogan surged

- Uranium stocks gained on Kazatomprom’s production guidance cut

Aussie shares have kicked off the week strongly, buoyed by US Fed Reserve Chairman Jerome Powell’s comments that interest rate cuts are imminent.

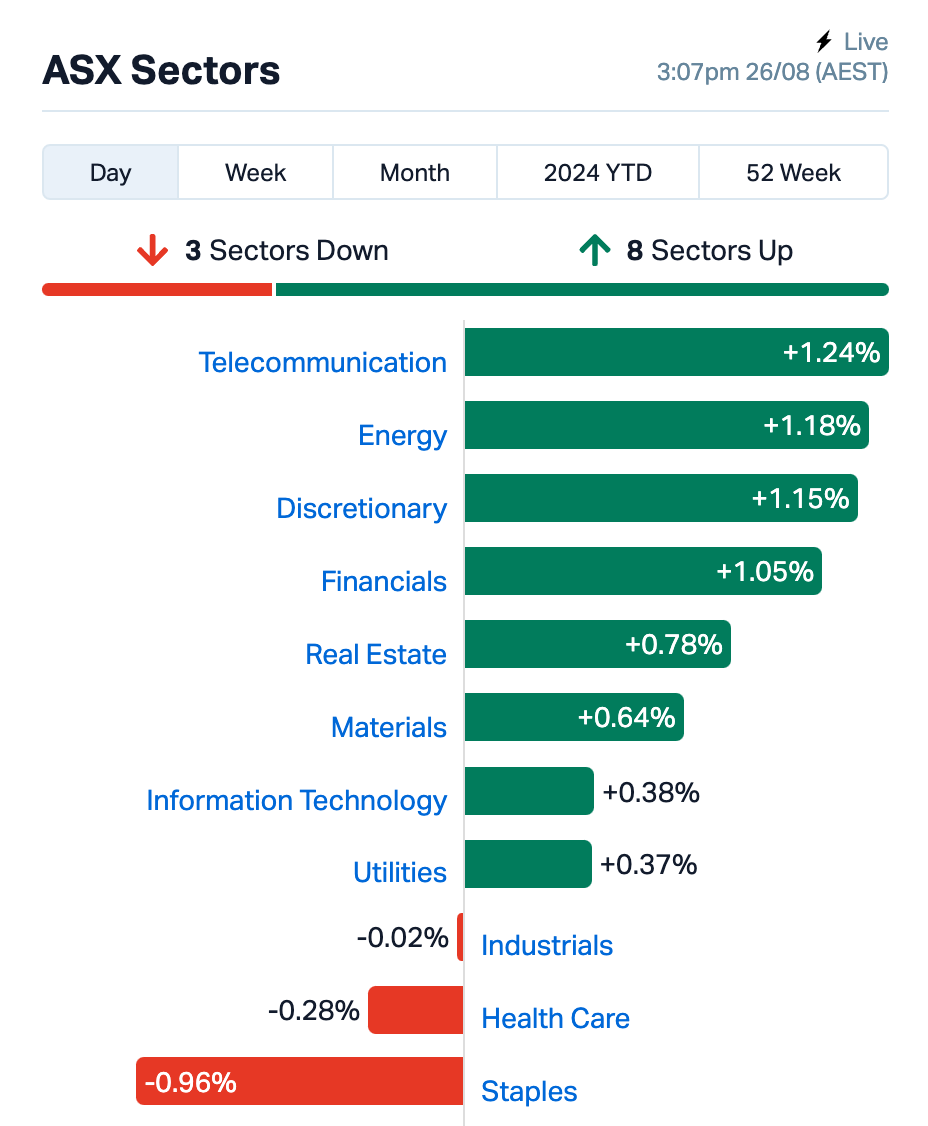

The benchmark ASX 200 index rose by 0.6%, with the Real Estate sector, which is highly sensitive to interest rate changes, and Telcos leading the gains.

Powell’s comments at the Jackson Hole economic symposium over the weekend provided the clearest signal yet that US inflation is under control, and that it’s time for the Fed to adjust its policies.

“We will do everything we can to support a strong labour market as we make further progress towards price stability,” Powell declared.

Meanwhile, Energy stocks also climbed this afternoon as tensions in the Middle East rise following an Israeli strike on Hezbollah targets in southern Lebanon.

Uranium stocks were also among the winners after Kazakhstan-based Kazatomprom, the world’s largest uranium producer, significantly cut its production guidance for 2025.

Kazatomprom has cut guidance by 17% to 25,000-26,500 tonnes due to project delays and sulphuric acid shortages, raising concerns about a potential supply crunch for uranium.

Deep Yellow (ASX:DYL) was one big gun that did well, up nearly 18%, alongside fellow yellowcake diggers Paladin Energy (ASX:PDN) and Boss Energy (ASX:BOE) – up 11% and 9% respectively.

Today’s earnings season highlights

The earnings reporting season on the ASX continues. Transport operator Kelsian Group (ASX:KLS) plunged 26% after flagging upcoming spending plans.

Kelsian said it was set to invest between $180 million and $190 million in FY25 to upgrade its bus and ferry fleets and acquire new assets.

The company, however, posted impressive results for FY24, with revenue up 42.2% to $2.02 billion and profits rising sharply by 176.2% to $58 million.

Wealth giant Perpetual (ASX:PPT) slipped 2.5% after signalling that it was set to record over $500 million in losses for FY24 due to significant withdrawals. The company reported $12 billion in outflows from the funds managed by J O Hambro and TSW.

Lithium producer, Pilbara Minerals (ASX:PLS) was up slightly despite seeing its revenue drop by 69% and its net income plummet by 89% in FY24.

The sharp decline is due to the collapse in lithium prices, which have fallen by over 65% in the past year.

“Pilbara Minerals shareholders will be feeling a little numb this morning as the lithium winter continues to wreak havoc on the miner’s financials,” said Josh Gilbert at eToro.

Payments terminal company Tyro (ASX:TYR) surged by 15% after significantly boosting its full year after-tax profits to $25.7 million, a fourfold increase from last year

Aussie Broadband (ASX:ABB) also surged 14% after declaring its maiden fully franked final dividend of 4 cents, and reported a 21% increase in NPAT, reaching $26.38 million.

And, Kogan.com (ASX:KGN) rallied 10% after the company announced a 7.5 cent fully franked final dividend, up from no dividend last year.

Kogan also reported a turnaround in profit, with NPAT of $83,000 compared to a $25.85 million loss the previous year.

What else happened today?

Across the region today, Asian stocks rose for the third day in a row, and the yen reached a 3-week high as expectations of potential Fed Reserve interest rate cuts boosted market sentiment.

The Nikkei however fell due to the yen’s strength.

Meanwhile, the People’s Bank of China (PBOC) kept its one-year policy loan rate unchanged at 2.3%, after cutting it by 0.2% in July.

Elsewhere, gold remained steady near its record high on Monday.

The price of gold has surged over 20% this year, driven by hopes of lower rates, and demand for safe-haven assets due to geopolitical uncertainties.

The Aussie dollar also rallied to nearly US68 cents this afternoon as the US dollar weakened following Powell’s speech.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| KPO | Kalina Power Limited | 0.011 | 120% | 15,582,733 | $12,431,970 |

| ACW | Actinogen Medical | 0.049 | 104% | 114,620,090 | $65,082,682 |

| CNJ | Conico Ltd | 0.002 | 100% | 680,000 | $2,201,528 |

| GCM | Green Critical Min | 0.004 | 75% | 16,227,604 | $2,937,085 |

| FTZ | Fertoz Ltd | 0.038 | 52% | 56,245 | $6,256,222 |

| SFG | Seafarms Group Ltd | 0.003 | 50% | 549,890 | $9,673,198 |

| CT1 | Constellation Tech | 0.002 | 33% | 645,562 | $2,212,101 |

| EDE | Eden Inv Ltd | 0.002 | 33% | 1,293,274 | $6,162,314 |

| ENT | Enterprise Metals | 0.004 | 33% | 292 | $3,309,952 |

| G6M | Group 6 Metals Ltd | 0.032 | 28% | 693,789 | $25,100,571 |

| ADG | Adelong Gold Limited | 0.005 | 25% | 433,378 | $4,471,956 |

| CRB | Carbine Resources | 0.005 | 25% | 70,000 | $2,206,951 |

| EEL | Enrg Elements Ltd | 0.003 | 25% | 258,197 | $2,019,930 |

| ICG | Inca Minerals Ltd | 0.005 | 25% | 140,000 | $3,242,146 |

| IVX | Invion Ltd | 0.003 | 25% | 254,696 | $13,275,731 |

| JAV | Javelin Minerals Ltd | 0.003 | 25% | 5,102,860 | $8,553,692 |

| SMM | Somerset Minerals | 0.005 | 25% | 15,286,779 | $4,123,995 |

| TAS | Tasman Resources Ltd | 0.005 | 25% | 33,500 | $3,220,998 |

| VML | Vital Metals Limited | 0.003 | 25% | 6,453,833 | $11,790,134 |

| WGR | Westerngoldresources | 0.026 | 24% | 350,000 | $3,577,456 |

| PPS | Praemium Limited | 0.513 | 23% | 4,457,621 | $200,036,229 |

| CZN | Corazon Ltd | 0.006 | 20% | 2,742,965 | $3,339,528 |

| VTX | Vertexmin | 0.130 | 18% | 1,893,957 | $14,745,573 |

| HMD | Heramed Limited | 0.020 | 18% | 2,476,170 | $10,765,247 |

| DYL | Deep Yellow Limited | 1.175 | 18% | 7,494,393 | $969,457,541 |

Best performing small cap today was Actinogen Medical (ASX:ACW), which surged by up to 125% after announcing promising results from its XanCIDD phase 2a trial. Data shows that ACW’s lead drug, Xanamem, consistently improved symptoms of depression across various endpoints at a 10 mg dose. This supports the conclusion that Xanamem is effective in managing brain cortisol levels, and has antidepressant activity.

Kalina Power (ASX:KPO), a clean energy focused company, was up on news that is has signed an MOU with a major US data centre developer to build AI-focused data centres in Alberta, Canada using natural gas with carbon capture. Kalina aims to capitalise on Alberta’s data centre boom and meet the growing electricity demand. The company says its low-CO2 power projects are well-suited to meet this demand.

Constellation Resources (ASX:CR1) was up after delivering its annual report, which is essentially a whole lot of ‘thumbs up’ for the company which is in the process of diversifying into helium, and is currently enjoying “preferred applicant” status with the WA government for six Special Prospecting Authorities with an Acreage Option (“SPA-AO”) applications covering 56,192km2. “These first mover applications capture two basin scale opportunities that are considered highly prospective for natural hydrogen and helium,” the company says.

Critical minerals and base metals explorer Iltani Resources (ASX:ILT) was up on news that it is commencing follow-up exploration at its high-grade Antimony Reward deposit, part of the Herberton project in Northern Queensland, where historic drilling has already delivered intercepts such as 3m @ 3.49% Sb from 62m including 2m @ 5.51% Sb from 62m downhole.

Poseidon Nickel (ASX:POS) was rising after a rock chip sampling program across its Black Swan and Lake Johnson projects firmed up gold prospectivity at both sites. At Black Swan, chip samples with grading up to 1.25g/t Au have come back from the lab, while soil results have successfully extended the Billy Ray Cu-Au soil anomaly into the largely untested Mantis tenement at Lake Johnson.

Javelin Minerals (ASX:JAV) is celebrating a major boost to the resource at the Coogee gold-copper project in Western Australia, which has ballooned by 158% to 3.65Mt at 1.08 g/t gold for 126,685 ounces of gold and 1.01Mt at 0.41% copper containing 4,133t copper metal.

And, lithium-brine developer Anson Resources (ASX:ASN) has been granted an Underground Injection Control (UIC) application for Class V wells to dispose of the processed brine at its Green River lithium project in Utah.

This will enable the company to re-inject the spent brine from its Direct Lithium Extraction (DLE) processing plant back into subsurface formations. This is in line with ASN’s plan to drill new disposal wells, at the time of construction of the production plant, for the injection and disposal of the spent brine from its lithium extraction process as part of the development of the project into production.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AVE | Avecho Biotech Ltd | 0.002 | -33% | 1,064,676 | $9,507,891 |

| PUR | Pursuit Minerals | 0.002 | -33% | 911,239 | $10,906,200 |

| HMG | Hamelingoldlimited | 0.090 | -28% | 344,750 | $19,687,500 |

| EXL | Elixinol Wellness | 0.003 | -25% | 175,051 | $5,284,729 |

| GMN | Gold Mountain Ltd | 0.003 | -25% | 134,452 | $15,629,893 |

| OAR | OAR Resources Ltd | 0.002 | -25% | 1,253,299 | $6,601,669 |

| CLG | Close Loop | 0.238 | -25% | 6,580,004 | $167,532,708 |

| KLS | Kelsian Group Ltd | 3.795 | -24% | 5,844,019 | $1,351,591,743 |

| CR9 | Corellares | 0.005 | -23% | 2,166,910 | $3,023,101 |

| BCB | Bowen Coal Limited | 0.012 | -20% | 13,978,819 | $42,737,687 |

| 88E | 88 Energy Ltd | 0.002 | -20% | 5,843,843 | $72,334,530 |

| ESR | Estrella Res Ltd | 0.004 | -20% | 3,294,138 | $8,796,859 |

| MOM | Moab Minerals Ltd | 0.004 | -20% | 300,000 | $3,969,071 |

| RIL | Redivium Limited | 0.004 | -20% | 431,756 | $13,654,274 |

| RML | Resolution Minerals | 0.002 | -20% | 10,391,026 | $4,025,055 |

| STM | Sunstone Metals Ltd | 0.008 | -20% | 4,307,273 | $38,519,036 |

| ZMI | Zinc of Ireland NL | 0.008 | -20% | 5,545 | $2,131,443 |

| IMI | Infinitymining | 0.022 | -19% | 324,404 | $3,206,342 |

| FL1 | First Lithium Ltd | 0.120 | -17% | 240,557 | $11,549,773 |

| IXU | Ixup Limited | 0.024 | -17% | 3,367,864 | $44,884,825 |

| NHF | NIB Holdings Limited | 6.050 | -17% | 4,890,329 | $3,526,516,086 |

| AKN | Auking Mining Ltd | 0.010 | -17% | 659,561 | $3,824,244 |

| FGH | Foresta Group | 0.005 | -17% | 9,640,392 | $14,132,274 |

IN CASE YOU MISSED IT

Javelin Minerals (ASX:JAV) has upgraded its Coogee gold resource by 158% to 126,685oz based on historical drill data and the current gold price.

James Bay Minerals (ASX:JBY) has kicked off field exploration activities at the La Grande East project in Quebec, Canada, focusing on 340 high priority targets including two magnetic lows that extend into Patriot Battery Metals’ (ASX:PMT) Shaakichiuwaanaan property.

CuFe (ASX:CUF) has entered into a binding agreement to 100% of its iron ore rights at the JWD mine to Newcam Minerals for $12m as the company shifts its focus to assets which offer greater potential for value creation.

Finexia Financial Group (ASX:FNX) saw significant loan book growth in FY24, further demonstrating the group’s unwavering commitment to its private credit strategy despite persistent challenges confronting the broader economy.

Tryptamine Therapeutics (ASX:TYP) has completed its Phase 1b study of its lead program TRP-8803, an innovative and scalable IV-infusion of psilocin – the only time that an IV-infused psilocin solution has been used anywhere in the world.

Antipa Minerals (ASX:AZY) has boosted its Calibre resource in WA by 19% to reach more than 2Moz of gold, 45km east of Rio Tinto’s (ASX:RIO) Winu copper-gold project.

Perpetual Resources (ASX:PEC) has raised more than $1m to advanced exploration at the Raptor rare earths and Isabella lithium proejcts in Minas Gerais, Brazil.

Anson Resources (ASX:ASN) has secured the approval to dispose processed brine at its Green River lithium project in Utah through the use of disposal wells on its purchased private property, an important milestone ahead of future lithium production.

TRADING HALTS

Bass Oil (ASX:BAS) – pending the announcement of results from Kiwi 1 Completion and commencement of the Extended Production Test in the Cooper Basin.

Riversgold (ASX:RGL) – pending an announcement regarding results from the Northern Zone Gold Project.

Macro Metals (ASX:M4M) – pending an announcement regarding exploration results at the Goldsworthy East Project.

Omega Oil & Gas (ASX:OMA) – pending the release of an announcement related to a material capital raising.

IXUP (ASX:IXU) – pending the release of an announcement related to a material business update.

Frontier Energy (ASX:FHE) – requested in connection with a proposed capital raising.

Energy Resources of Australia (ASX:ERA) – pending the release of an announcement in relation to a capital raising.

At Stockhead we tell it like it is. While Anson Resources, Javelin Minerals, James Bay Minerals, CuFe, Finexia Financial Group, Tryptamine Therapeutics, Anitpa Minerals and Perpetual Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.