Closing Bell: The ASX has chosen not to be on Wednesday

"Alas! Poor Yorick… Wait, who was Yorick again?" Via Getty

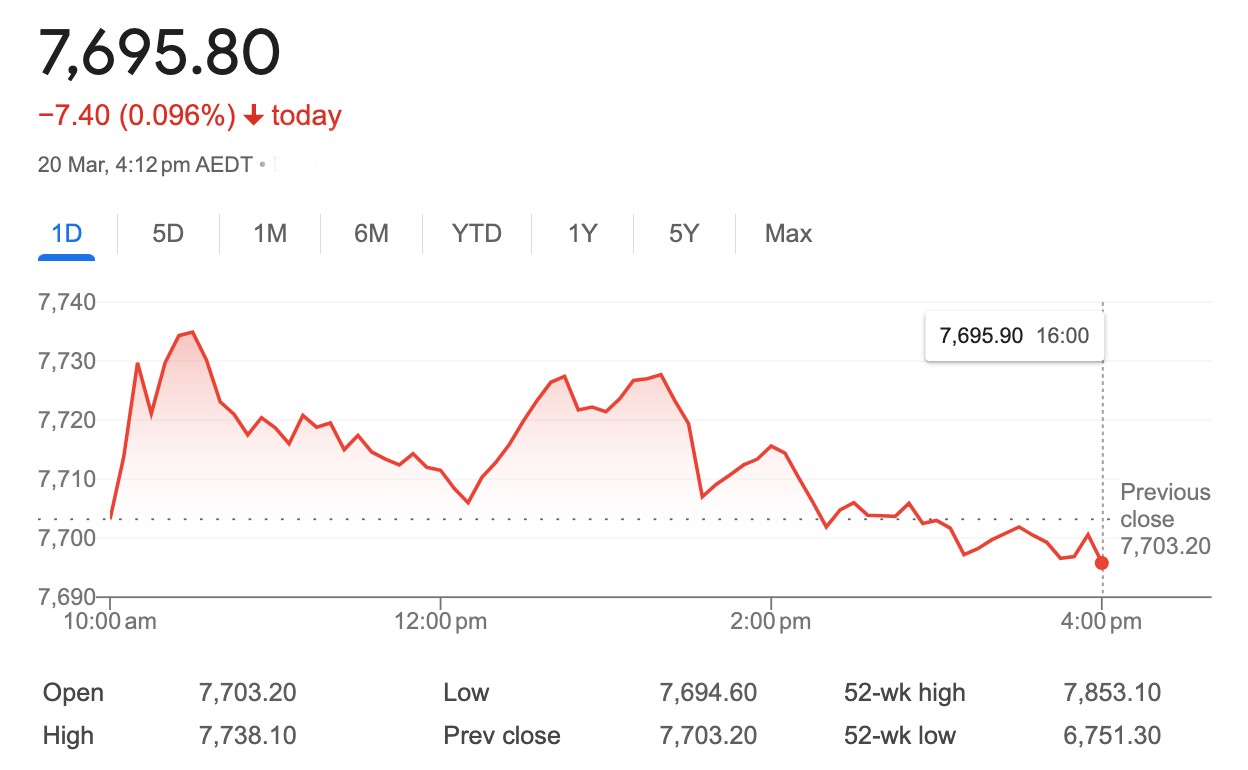

- The ASX200 has ended… well, just be glad it’s ended

- Energy stocks lead soft gains

- Small Caps led by Lord Resources

The ASX has ended Wednesday lower… well, we’ve all ended a bit lower during a session that promised a little and gave slightly less than nothing.

At 4.15 pm on Wednesday, the S&P/ASX200 closed seven points or 0.01% lower…

A day after the Reserve Bank of Australia kept rates on hold for another month and a few hours before the US Fed probably does the same, local markets gave up early leads to spend the afternoon leaking money.

The Fed is roundly expected to keep the fed funds rate steady at a 23-year high of 5.25%-5.5% for a fifth straight month when the FOMC crew emerge bleary eyed from their two-day meet at circa 5am this morning, Sydenham time.

There’s been some positive movements in Hong Kong as equity traders picked up a fallen baton by China’s own central bank, the People’s Bank of China (PBoC), which has kept its key lending rates steady – the one-year loan prime rate at 3.45%, and the five-year rate at 3.95%. They lopped a record 25bps off the 1-yr LPR in February.

The other mildly supportive factor supporting the Hang Seng is doing the opposite here.

The notable improvement over the first two months of the year in China’s industrial output and some punchy fixed investment might be good for the goose, but all these ASX-listed ganders selling rocks and such into China would’ve been hoping for further softness… and in turn some panic from policymakers who appear intent not to reach into Beijing’s Big Bag of Infrastructure-based stimulus.

Iron ore prices had collapsed into a seven-month low of US$98 a tonne on Friday, but have since recovered about 6% in Singapore.

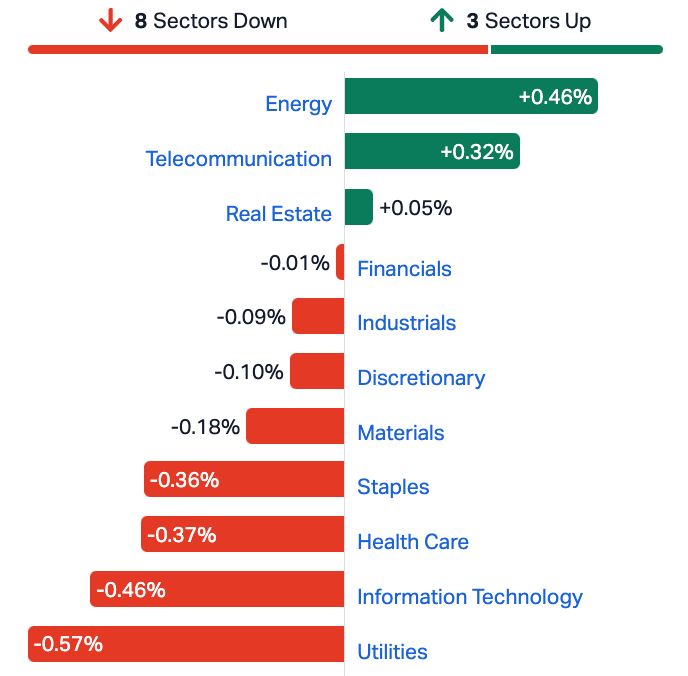

Of the 11 ASX sectors, the impetus came from toppy global oil prices, which are sitting comfy at four-month highs.

All the majors rallied in the AM, and traders took the cream off in the PM. Woodside Energy Group (ASX:WDS) , Santos (ASX:STO), coal miner New Hope Corp (ASX:NHC) and Whitehaven Coal (ASX:WHC) all trimmed early gains.

The Financial sector also trimmed morning gains with a large knife this arvo.

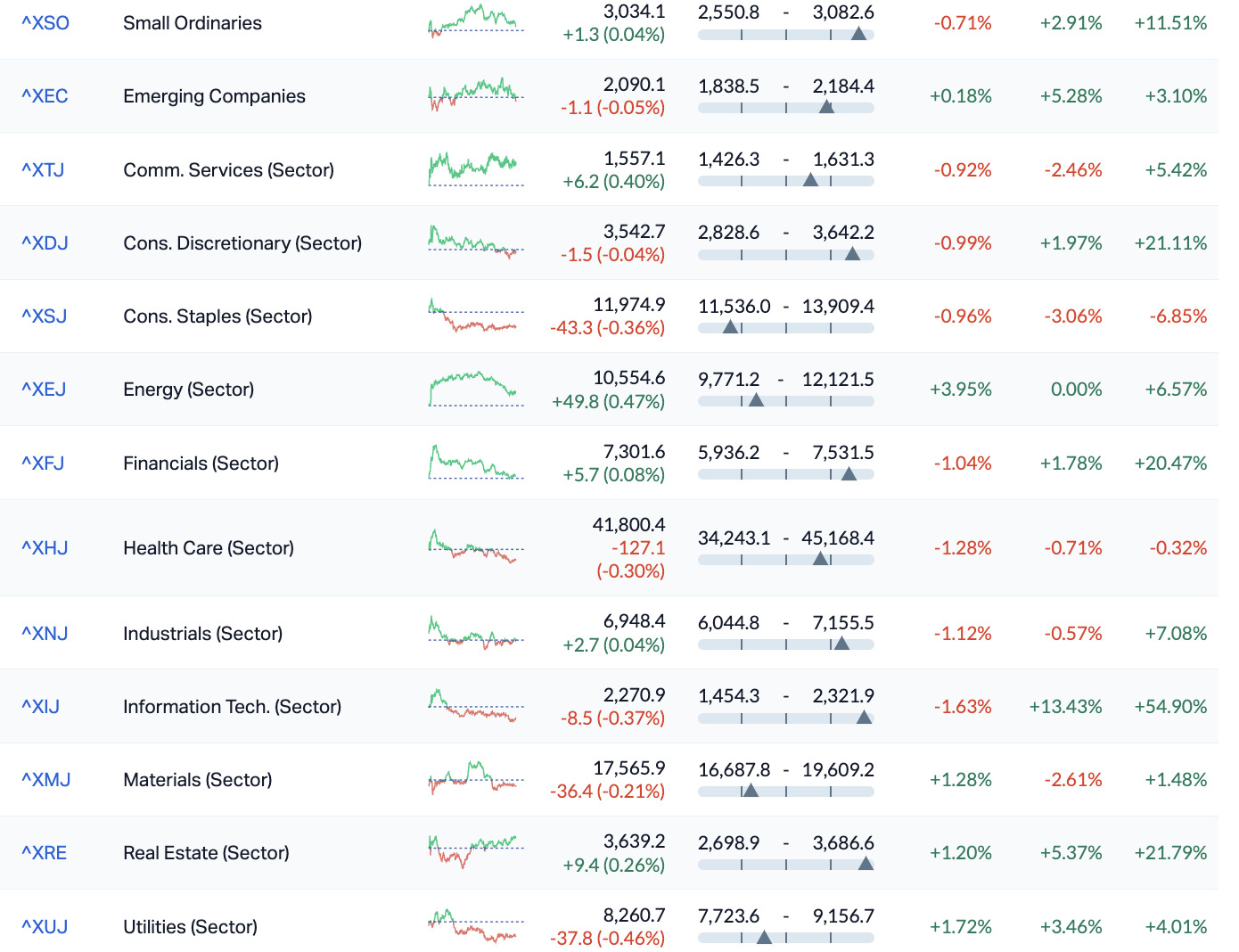

The Small Ords (XSO) and the Emerging Co’s (XEC) ended a smidgen either side of nothing on Wednesday.

ASX Sectors at 4pm on Wednesday

In the States…

Wall Street ended higher overnight as investors ho-hummed ahead of the Fed’s big day.

The lately-a-laggard 30-stock Dow Jones IA found 0.8% – its best session in almost a month.

The fatter S&P500 added 0.55% – a fatter fresh record high.

The tech-heavy Nasdaq Composite gained about 0.4%, as four of seven mega tech stocks ended higher.

Tesla was not one of them.

US stock futures are slightly lower on Wednesday in Sydney:

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| RIL | Redivium Limited | 0.005 | 67% | 12,195,807 | $8,192,564 |

| ADS | Adslot Ltd | 0.003 | 50% | 3,000,000 | $6,448,991 |

| LRD | Lord Resources | 0.076 | 49% | 25,840,382 | $1,893,738 |

| LIO | Lion Energy Limited | 0.036 | 44% | 30,604,108 | $10,924,444 |

| PLG | Pearl Gull Iron | 0.034 | 36% | 285,984 | $5,113,545 |

| SRX | Sierra Rutile | 0.105 | 35% | 9,253,036 | $33,090,443 |

| SOV | Sovereign Cloud Holdings | 0.044 | 34% | 110,936 | $11,126,776 |

| AVE | Avecho Biotech Ltd | 0.004 | 33% | 12,908,653 | $9,507,891 |

| AVD | Avada Group Limited | 0.65 | 31% | 135,165 | $42,042,837 |

| BEO | Beonic Ltd | 0.026 | 30% | 214,805 | $8,489,899 |

| SCN | Scorpion Minerals | 0.039 | 30% | 3,358,893 | $12,283,686 |

| PBL | Parabellum Resources | 0.069 | 28% | 79,199 | $3,364,200 |

| COD | Coda Minerals Ltd | 0.14 | 27% | 175,151 | $15,660,851 |

| DME | Dome Gold Mines Ltd | 0.19 | 27% | 457 | $54,682,304 |

| KNB | Koonenberry Gold | 0.03 | 25% | 16,700 | $3,305,075 |

| ECT | Env Clean Tech Ltd | 0.005 | 25% | 221,245 | $11,457,242 |

| SGC | Sacgasco Ltd | 0.01 | 25% | 1,069,605 | $6,237,497 |

| PEK | Peak Rare Earths Ltd | 0.23 | 24% | 1,829,578 | $49,199,226 |

| 1AI | Algorae Pharma | 0.011 | 22% | 889,391 | $14,952,172 |

| MXO | Motio Ltd | 0.028 | 22% | 40,000 | $6,168,562 |

| ASM | Ausstrat Materials | 1.19 | 20% | 745,489 | $165,124,062 |

| AQX | Alice Queen Ltd | 0.006 | 20% | 1,425,872 | $3,454,921 |

| BLZ | Blaze Minerals Ltd | 0.006 | 20% | 58,262 | $3,142,791 |

| GTI | Gratifii | 0.006 | 20% | 1,162,240 | $6,846,113 |

| ABE | Australian Bond Exchange | 0.025 | 19% | 59,388 | $2,366,030 |

Making late moves is cybersecurity and cloud services provider Sovereign Cloud Holdings (ASX:SOV), which has successfully locked in the institutional component of its 2.95 for 1 pro-rata accelerated renounceable entitlement offer announced on Monday.

The company says the institutional component of the Entitlement Offer raised circa $21mn at $0.03 per new SOV fully paid ordinary share.

Sovereign Cloud Holdings – trading as AUCloud – launched the capital raise to acquire three local names after Fairfax reported that Ord Minnett was building support to recapitalise the business.

AUCloud has secured deals to acquire PCG Cyber, Venn IT and Arado, the latter provides cloud and managed services in Queensland.

But still leading out the Wednesday small cap gladiators is lithium hopeful Lord Resources (ASX:LRD), which now has a strategic partnership with high-flying Mineral Resources (ASX:MIN) after securing a farm-in agreement out at the Horse Rocks Lithium Project.

MD Barnaby Egerton-Warburton is stoked.

“The agreement validates the strong work Lord has already completed at the Horse Rocks Lithium Project and provides the opportunity to collaborate with a world-class exploration team drawing on their knowledge and expertise of this highly prospective lithium region,” Egerton-Warburton says.

Subject to the satisfaction of conditions – including MinRes completing satisfactory due diligence on the tenement – MinRes will spend $1mn in exploration, to earn 40% of the Project.

Lord says the Farm-in Agreement will let it maintain exposure to a high-value project while also going in hard on the exploration at its Jingjing Lithium Project.

It’s a lithium pincer movement.

Meanwhile, Lion Energy (ASX:LIO) has development approval for its hydrogen generation and refuelling hub project at the Port of Brisbane, with construction to kick off Q2 this year.

As you can see from this excellent visual, it’s close to 70+ bus depots… wait for it…

… which is handy because LIO says the strategic location will allow the hub to initially focus on supplying hydrogen to domestic public bus fleets, truck fleets, and fuel cell gensets and other customers across the construction and mining industry.

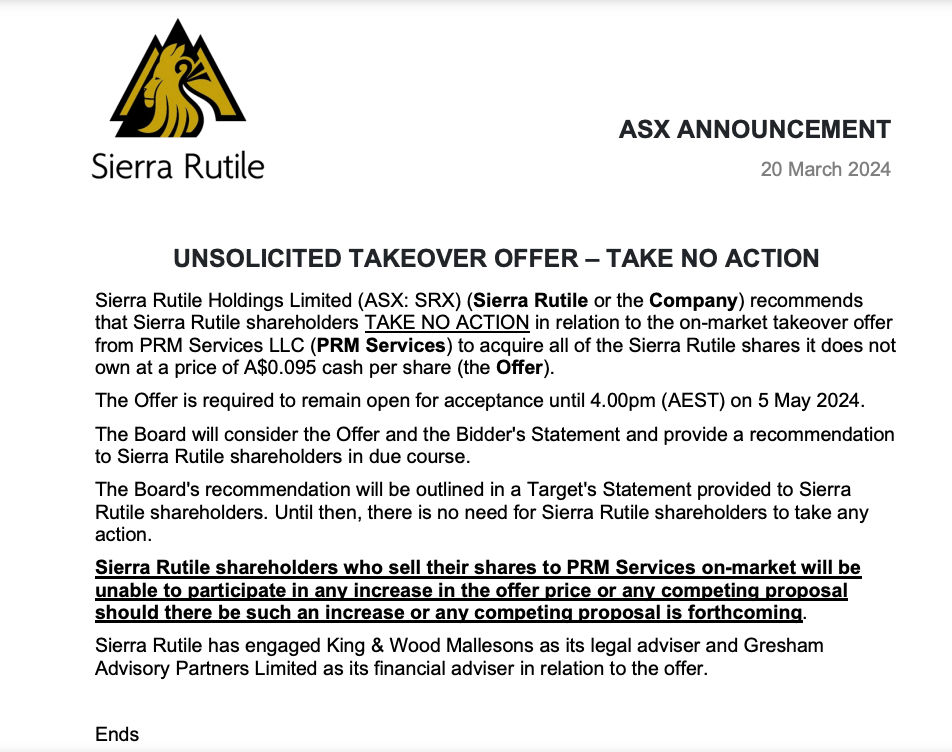

And Sierra Rutile (ASX:SRX) has had a busy morning, although in the rutile game an unsolicited takeover offer is always a welcome hassle.

A quick refresher – Sierra runs multi-deposit mineral sands mining in Sierra Leone a gig which has made it “the largest producer of natural rutile in the world”.

And rutile?

Well. Rutile is the highest-grade naturally occurring TiO2 feedstock used to make pigments, laminates, plastic stuff and packaging, inks, clothing, sunscreen, toothpaste… it’s all over the cosmetic industry.

It’s handy for a welding electrode as well as being used to make titanium.

PRM Services made the bid and this is what the SRX Board suggests should be done with it…

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CLZDC | Classic Minerals | 0.014 | -72% | 14,665,728 | $12,890,085 |

| AXP | AXP Energy Ltd | 0.001 | -50% | 662,170 | $11,649,361 |

| AYM | Australia United Min | 0.002 | -33% | 300,000 | $5,527,732 |

| JPR | Jupiter Energy | 0.016 | -27% | 203,462 | $28,020,348 |

| GMN | Gold Mountain Ltd | 0.003 | -25% | 10,596,184 | $9,111,514 |

| LNU | Linius Tech Limited | 0.0015 | -25% | 35,000 | $10,393,481 |

| CLV | Clover Corporation | 0.62 | -23% | 738,958 | $134,434,470 |

| PLC | Premier1 Lithium Ltd | 0.028 | -22% | 320,000 | $6,284,667 |

| S66 | Star Combo | 0.12 | -20% | 4,467 | $20,262,447 |

| ATH | Alterity Therap Ltd | 0.004 | -20% | 5,464,074 | $26,190,089 |

| ALA | Arovella Therapeutic | 0.125 | -19% | 8,034,951 | $143,399,217 |

| HPC | The Hydration Company | 0.013 | -19% | 180,000 | $4,242,269 |

| CG1 | Carbonxt Group | 0.072 | -18% | 325,633 | $28,593,105 |

| EQN | Equinox Resources | 0.175 | -17% | 728,368 | $21,246,751 |

| GSM | Golden State Mining | 0.01 | -17% | 210,029 | $3,352,448 |

| IVX | Invion Ltd | 0.005 | -17% | 21,043 | $38,547,193 |

| NGS | NGS Ltd | 0.01 | -17% | 561,591 | $3,014,729 |

| TIG | Tigers Realm Coal | 0.005 | -17% | 84,169 | $78,400,214 |

| BM8 | Battery Age Minerals | 0.105 | -16% | 1,293,028 | $11,470,040 |

| AMM | Armada Metals | 0.016 | -16% | 10,000 | $3,952,000 |

| ABX | ABX Group Limited | 0.056 | -15% | 427,575 | $16,502,661 |

| OMX | Orange Minerals | 0.023 | -15% | 100,000 | $2,315,255 |

| HHR | Hartshead Resources | 0.006 | -14% | 3,887,947 | $19,660,775 |

| MOZ | Mosaic Brands Ltd | 0.12 | -14% | 255,297 | $24,990,902 |

ICYMI – PM Edition

Altech Batteries (ASX:ATC) is proceeding with the funding phase for its proposed CERENERGY solid state sodium chloride battery factory in Saxony, Germany, after the DFS outlined robust economics, including annual revenue of €106 million and EBITDA of €51 million.

Pure Hydrogen (ASX:PH2) could soon be supplying hydrogen fuel cell vehicles to the state government of Piauí in Brazil after signing a MoU to foster development of its green hydrogen economy.

Rio Tinto-backed Sovereign Metals (ASX:SVL) has delivered 30t of bulk ore samples from its Kasiya project in Malawi – the world’s largest natural rutile deposit and second-biggest flake graphite deposit – to engineering consultants Paterson & Cooke for pivotal pre-production test work.

Vertex Minerals (ASX:VTX) is raising $3.28 million for the refurbishment of its recently purchased Gekko plant, which will soon process material from the 225,000oz Reward gold mine in NSW.

Spartan Resources (ASX:SPR) has reported yet another batch of high-grade intersections both inside and outside its growing Never Never deposit, which has once again highlighted the expanding underground potential of its Dalgaranga project.

Viridis Mining & Minerals (ASX:VMM) officially has an ionic adsorption clay-hosted REE deposits in its possession at the Colossus project in Brazil following confirmatory test work by rare earths metallurgical specialists ANSTO.

Strategic Energy Resources (ASX:SER) has been granted a new exploration licence, which appears to be a western extension to the Koonenberry copper-nickel belt in NSW and has been interpreted as analogous to the Tier-1 Pechenga copper-nickel camp in Russia.

As the days count down towards completion of its joint takeover by SQM and Hancock Prospecting, Azure Minerals (ASX:AZS) has delivered more significant mineralised intersections grading up to 1.55% Li2O, providing further confirmation the Target Area 3 at its Andover discovery in the Pilbara hosts a substantial lithium deposit.

TG Metals (ASX:TG6) has now defined four drill targets at the Lake Johnston project in WA, with some larger and of higher-grade than the soil anomaly which defines its breakthrough Burmeister lithium discovery.

Pantera Minerals (ASX:PFE) has announced a leadership restructure – including the appointment of Barnaby Edgerton-Warburton as executive chairman and CEO and strategic advisor Tim Goldsmith joining the board as a non-executive director – ahead of the US-focused lithium company’s maiden well re-entry at the Superbird project in Arkansas during the second half of the year.

And Belararox (ASX:BRX) can now proceed with advanced exploration activities at the Lola target, within its Toro-Malambo-Tambo (TMT) project in Argentina, after the environmental impact assessment was approved.

At Stockhead, we tell it like it is. While Altech Batteries, Azure Minerals, Belararox, Lord Resources, Pantera Minerals, Pure Hydrogen, Sovereign Metals, Spartan Resources, Strategic Energy Resources, TG Metals, Vertex Minerals and Viridis Mining & Minerals are Stockhead advertisers, they did not sponsor this article.

Trading Halts

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.