Fully charged: Altech sets sights on funding following solid state battery factory DFS

Altech is moving to the funding phase for its planned CERENERGY® plant that will produce 120 1MWh batteries per annum. Pic via Getty Images

- Altech Batteries DFS outlines robust economics for planned 120MWh plant for CERENERGY® solid state batteries

- Project has an estimated capex of €156m and is expected to deliver annual revenue of €106m and EBITDA of €51m

- Company considers returns to be attractive given the small-scale of the plant

- Green light given to proceed with funding phase

Special Report: Altech Batteries is proceeding with the funding phase for its proposed CERENERGY® solid state sodium chloride battery factory in Saxony, Germany, after the DFS outlined robust economics.

The project, which is being developed by Altech Batteries’ (ASX:ATC) 75%-owned German subsidiary Altech Batteries GmbH and Fraunhofer IKTS under a 75:25 joint venture, is aimed at commercialising a 120MWh plant which will produce the company’s unique CERENERGY® solid-state batteries.

CERENERGY® batteries require just common table salt (sodium chloride) and nickel with no need for lithium, cobalt, graphite and copper, limiting exposure to critical metal price rises and supply chain concerns.

They are capable of operating at a very wide temperature range (-40 degrees Celsius to +60 degrees Celsius), are fire and explosion-proof, and have a life span of more than 15 years, making them ideally suited for grid energy storage use.

Over their life, they are estimated to reduce costs by up to 40% compared to regular lithium-ion batteries and boast an emissions footprint at least 50% lower than that of lithium-ion batteries.

Battery packs with capacities of 5kWh and 10kWh have already been developed while manufacturing is underway for larger capacity 60kWh battery pack prototypes that will be the base unit for production.

Solid returns

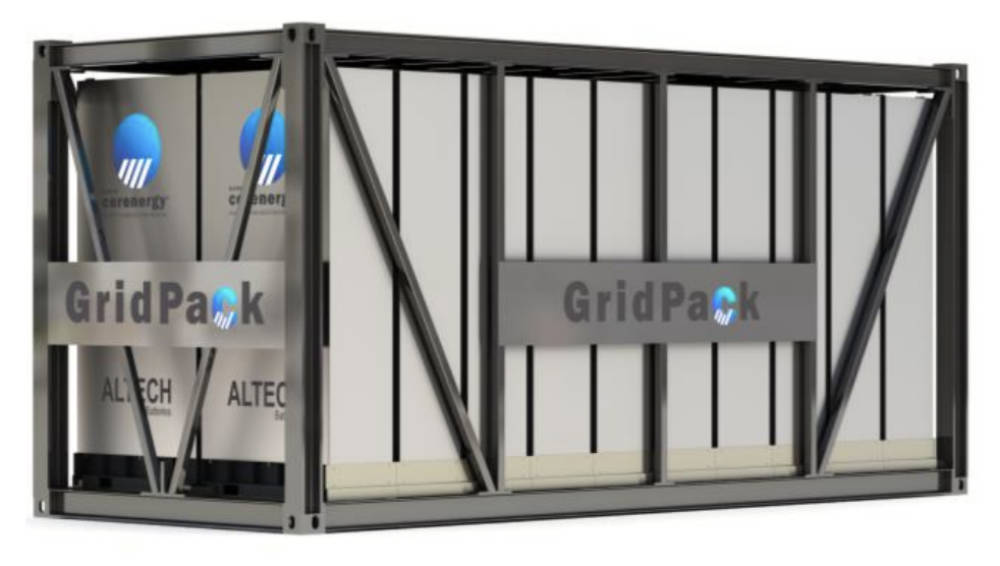

The DFS for the plant, which will be capable of producing 120 1MWh GridPack batteries per annum for a capital cost of €156 million (~$260 million).

This will generate annual revenue of €106 million and EBITDA of €51 million to deliver pre-tax net present value (NPV) of €169 million and internal rate of return (IRR) of 19%.

Payback is estimated at 3.7 years.

ATC says the project economics are compelling considering the relatively small scale of this first production line capacity.

Each 1MWh GridPack will have up to 18 60kWh battery packs installed and connected to pack power management system housed in a standard container.

Seeking funding

Given the anticipated 28% compound annual growth rate estimated for the grid storage market, the company’s board and joint venture partners have given the green light for the project to proceed to the funding phase.

This will integrate equity, grants, and debt-like venture capital loans, acknowledging the importance of both financial and non-financial support for project success.

It is expected to include contributions from entities such as the European Investment Bank, the Ministry of Economics and Environment, the European Innovation Council, and various federal and regional initiatives.

Ongoing discussions suggest that equity and mezzanine financing are vital components for successful implementation, complementing equity and grant contributions.

Offtake discussions

ATC has non-disclosure agreements with major utility conglomerates in Germany that have shown a keen interest in acquiring CERENERGY® GridPack batteries.

Advanced discussions are under way for the pre-selling of the entire initial production line for five years to two prominent utility companies.

This article was developed in collaboration with Altech Batteries, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.