Closing Bell: Small cap index edges higher, WA1 Resources now up 550% in 4 sessions

Pumped. Via Getty

- ASX 200 rises over 1% on Monday after strong US leads, before Tuesday RBA meeting

- Small cap index finds nuthin’ as energy, materials fall

- Up circa 550%, WA1 is still rising

This is happening. Always trust a chartered professional accountant.

Lucky I bought them back last week! $WA1.ax https://t.co/eU0phPACRW via @StockheadAU

— 8020Invest (@8020invest) October 30, 2022

At home, we’re closing up shop ahead of the Reserve Bank decision. The benchmark ASX 200 (up 1%) started really well and has since been a little bit uncommitted.

Not as bad as the small caps index (XEC) though, which is up by 0.043% at 4.01PM in Sydney, which one could call flat, but I feel it’s a win.

Ahead of the Monday open over in the United States, the 3 x Wall Street majors aren’t falling over themselves but they are united in their futures:

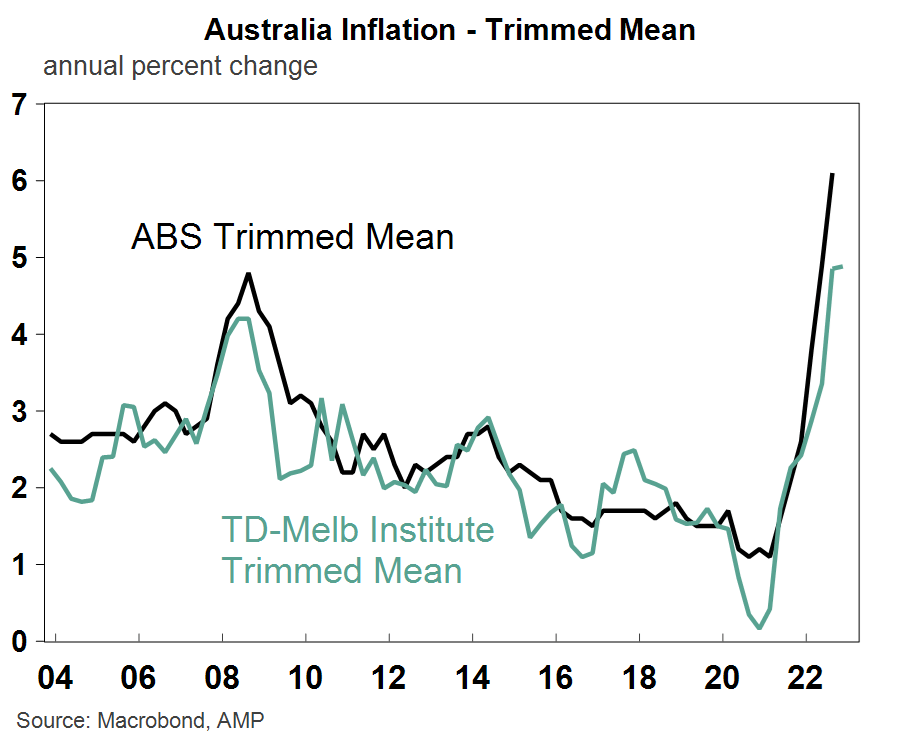

And this is what the RBA watches – it’s trimmed and it’s mean and it’s what might decide the Other Cup on the first Tuesday in November:

Scott Solomon, associate portfolio manager of T. Rowe Price’s Dynamic Global Bond Strategy reckons the RBA will stick to its guns and hike 25 basis points (bps) at tomorrow’s November meet.

“The recent hot CPI print does increase the risk of an upside surprise but, in reality, a move to 50bps would mean a sharp U-turn in thinking from the RBA.”

Solomon says RBA Governor Dr P.Lowe is intent on allowing effects from prior hikes to flow through to Bridge street.

“He’s acutely aware that many mortgages are due to reset over the next couple of months and doesn’t want to unnecessarily burden the population.”

“Furthermore, he’s quite proud of the levels of employment reached by the Australian economy and has zero desire to prematurely destroy that. I expect the market to focus attention on the updated economic projections that will be released a couple days post the RBA’s decision.”

That said, AMP’s Diana Mousina says the acceleration in the September quarter trimmed mean inflation indicates the RBA could go the full fitty on the cash rate (0.50%) over concern that inflation is not coming down quickly enough.

“However, we think 0.25% is more likely because…”

1/ RBA concern that a 0.25% rather than a 0.5% would lead to an “unhelpful reaction in inflation expectations and financial markets” has not occurred after the October meeting as markets are still pricing in a high cash rate peak of 4%

2/drawing out rate hikes over several meetings rather than doing oversized rate hikes would help to keep public attention focussed for longer on the RBA’s resolve to get inflation back to target and;

3/ the RBA doesn’t need to be as aggressive in its rate hikes because it meets more frequently than the other global central banks.

“But, clearly it’s going to be a close call,” she says.

Elsewhere, retail spending rose by 0.6% in August, but that’s probably just the inflation talking.

Annual retail spending is now running at 17.9% on a year ago which is extremely strong and well above the pre-covid trend of retail spending.

Mousina says the continuing strength in retail sales so far likely reflects a combination of accumulated savings built up through the pandemic (a buffer for households), positive wealth effects from the rise in home prices and the still strong jobs market.

“Monthly inflation, according to the ABS, rose by 0.6% over the month which would mean that real retail spending or the volume of retail sales was around flat in September,” Diana says.

CommSec chief economist Craig James reckons there’s growing evidence we’ve been holding back on the spending amid higher interest rates and the inflation which begets it. Or begat it.

Pick one.

Meanwhile in China

Wuhan and Macau are back in lockdown and mainland shares listed on the Hang Seng are paying the price.

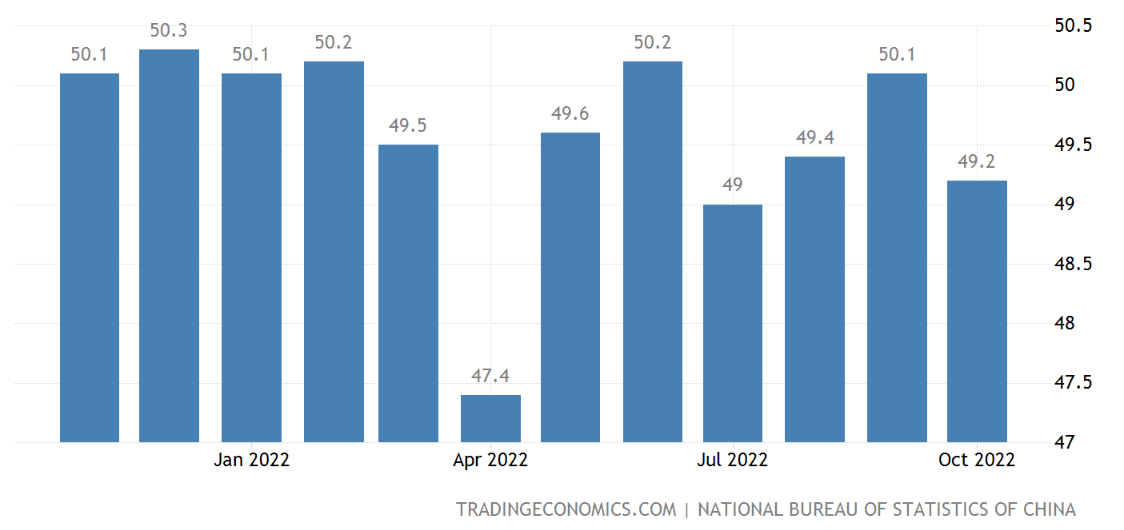

China’s official PMI data has also come in weaker-then-expected for October and that hasn’t helped trade in the Hang Seng’s China Enterprises Index (CEI).

China’s National Bureau of Statistics (NBS) says the Purchasing Managers’ Index data at 49.2 is a miss.

The CEI shed well over 2.4%, ahead of lunch and follows a tough streak indeed, while the Hong Kong index has managed to trade in the green on Monday for a nice change.

The bleeding began last week when the CEI clocked its worst ever single session of losses, the inspiration being Chinese President Xi Jinping’s incredibly successful party congress which included a recommitment to zero-COVID and a lifetime hold on power.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| CODE | COMPANY | PRICE | % TODAY | VOLUME | MARKET CAP |

|---|---|---|---|---|---|

| CBR | Carbon Revolution | 0.38 | 77% | 8,886,274 | $44,485,631 |

| MOB | Mobilicom Ltd | 0.014 | 56% | 2,352,185 | $11,981,517 |

| WYX | Western Yilgarn NL | 0.165 | 50% | 366,075 | $4,530,075 |

| MEB | Medibio Limited | 0.0015 | 50% | 1,179,744 | $3,320,594 |

| WA1 | Wa1Resourcesltd | 1.24 | 48% | 11,322,528 | $24,389,406 |

| CNR | Cannon Resources | 0.435 | 38% | 1,846,903 | $24,262,523 |

| MGG | Mogul Games Grp Ltd | 0.002 | 33% | 6,993,923 | $4,895,162 |

| NZS | New Zealand Coastal | 0.004 | 33% | 6,489,142 | $3,381,015 |

| TSC | Twenty Seven Co. Ltd | 0.002 | 33% | 19,730,828 | $7,982,442 |

| VOL | Victory Offices Ltd | 0.041 | 32% | 124,473 | $4,893,288 |

| NUH | Nuheara Limited | 0.215 | 30% | 1,621,289 | $22,637,229 |

| SOV | Sovereign Cloud Hldg | 0.15 | 25% | 195,550 | $14,715,315 |

| MTB | Mount Burgess Mining | 0.005 | 25% | 1,200,030 | $3,436,684 |

| ERW | Errawarra Resources | 0.21 | 24% | 24,534 | $9,278,916 |

| RXL | Rox Resources | 0.2025 | 23% | 17,989 | $27,875,256 |

| ECG | Ecargo Hldg | 0.018 | 20% | 71,428 | $9,228,750 |

| AQS | Aquis Ent Ltd | 0.15 | 20% | 7,151 | $4,464,897 |

| BPP | Babylon Pump & Power | 0.006 | 20% | 371,619 | $12,288,857 |

| NNG | Nexion Group | 0.11 | 20% | 95,425 | $7,440,133 |

| NTO | Nitro Software Ltd | 2.06 | 19% | 4,815,533 | $423,964,803 |

| SGQ | St George Min Ltd | 0.07 | 17% | 14,696,129 | $42,001,068 |

| IPT | Impact Minerals | 0.007 | 17% | 698,864 | $14,888,223 |

| TMX | Terrain Minerals | 0.007 | 17% | 3,000,000 | $4,564,566 |

| BNL | Blue Star Helium Ltd | 0.036 | 16% | 7,991,137 | $49,171,272 |

| SER | Strategic Energy | 0.0185 | 16% | 190,000 | $4,555,899 |

Cannon Resources (ASX:CNR) is mulling an offer which values the recently listed Rox Resources (ASX:RXL) nickel spinout at about $45m, with the board recommending shareholders agree to the takeover by private equity firm Kinterra that has a juicy all-cash $0.45c per CNR share on the table.

The price represents a 43% premium to Cannon’s last closing price and 58% premium to 30-day VWAP, and has the Cannon leadership team positively pushing for investors to say yes to get the conditional offer past the 50.1% threshold for the deal to go through.

However, it is well below the +66c share price peak reached late last year.

Reuben says the resource at CNR’s flagship Fisher East project, 145km northeast of Leinster in WA’s northeastern goldfields, has grown since listing from 78,000t to 134,000t tonnes of nickel grading 1.8%.

“The (growing) resource base is as big as you will find in a company with a $23 million market, and its proximity to the Leinster line of nickel projects owned by BHP, IGO, and others, gives it strategic appeal,” legendary columnist Barry Fitz said earlier this month.

The deal needs 50.1% minimum acceptance from shareholders to go through.

Carbon Revolution (ASX:CBR), whose lightweight carbon fibre wheels apparently end up gracing some of the world’s best and most-sought after cars, probably like Peter’s tractor and Reuben’s 23 utes, has delivered an ambush of a first quarter.

The CBR share price has had its own Monday revolution, here’s some highlights:

• Q1 FY23 revenue of $10.4 million, (66.2% over the pcp)

• Ford launches new Mustang core vehicle program with the option of Carbon Revolution’s

wheels, the first time CBR’s wheels have featured on a Ford core vehicle program

• Current cash, $10.7m following committed expenditure on new wheel programs

and the Mega-line project with emerging challenges in delivering anticipated financing

• MMI grant approved, first tranche of $4.8m expected soon

• Significant progress with a strategic partner ‘to enable the business’ long-term growth

potential and funding needs’

Balkan Mining and Minerals (ASX:BMM) shares have jumped 15%, following the snatching of a 100% lithium project in Ontario.

Tango is the name, the location is Georgia Lake. BMM says it’s part of the “Thunder Bay Mining District.”

It’s a second lucky lithium dip into Canada for Balkan, the company’s 4th lithium project altogether.

Balkan will pay some CAD$0.5m for the project; BMM says a capital raising for CAD$400,00 is already on the go.

Oh. And this is WA1 Resources (ASX:WA1) today…

Reuben is all over it, and it’s a fascinating yarn, especially if you’ve skin in the game.

The junior explorer finished the week up 500%, from 14c to 84c per share.

ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| CODE | COMPANY | PRICE | % TODAY | Volume | MktCap |

|---|---|---|---|---|---|

| LER | Leaf Res Ltd | 0.014 | -46% | 11,512,274 | $30,058,154 |

| EML | EML Payments Ltd | 0.415 | -34% | 33,009,753 | $235,595,783 |

| ARE | Argonaut Resources | 0.001 | -33% | 651,268 | $8,142,807 |

| CLE | Cyclone Metals | 0.002 | -33% | 100,000 | $18,350,211 |

| KOB | Koba Resources | 0.175 | -33% | 3,905,449 | $16,900,000 |

| GO2 | Go2 People | 0.01 | -23% | 1,156,260 | $5,286,297 |

| RAG | Ragnar Metals Ltd | 0.017 | -23% | 4,200,916 | $8,342,068 |

| RXM | Rex Minerals Limited | 0.15 | -21% | 3,576,401 | $112,604,308 |

| AUK | Aumake Limited | 0.004 | -20% | 4,809,289 | $3,857,235 |

| KFE | Kogi Iron Ltd | 0.004 | -20% | 132,000 | $8,160,389 |

| MYE | Metarock Group Ltd | 0.19 | -19% | 744,186 | $30,783,249 |

| PWN | Parkway Corp Ltd | 0.007 | -18% | 10,247,416 | $18,812,884 |

| SKN | Skin Elements Ltd | 0.024 | -17% | 380,200 | $12,563,591 |

| OLY | Olympio Metals Ltd | 0.15 | -17% | 72,993 | $6,852,874 |

| EMU | EMU NL | 0.005 | -17% | 6,984,082 | $4,123,609 |

| GLV | Global Oil & Gas | 0.0025 | -17% | 10,013,161 | $5,620,064 |

| RR1 | Reach Resources Ltd | 0.005 | -17% | 4,078,684 | $11,460,304 |

| TD1 | Tali Digital Limited | 0.0025 | -17% | 187,637 | $3,697,892 |

| CNQ | Clean Teq Water | 0.38 | -16% | 376,691 | $20,323,109 |

| GML | Gateway Mining | 0.059 | -16% | 188,585 | $15,820,767 |

| MIO | Macarthur Minerals | 0.135 | -16% | 499,215 | $26,504,558 |

| BGE | Bridge SaaS | 0.11 | -15% | 58,895 | $3,774,681 |

| SHO | Sportshero Ltd | 0.018 | -14% | 429,848 | $11,965,682 |

| ARO | Astro Resources NL | 0.003 | -14% | 269,985 | $17,126,434 |

| M3M | M3 Mining | 0.12 | -14% | 1,684 | $4,885,829 |

No. Not gunna.

THINGS YOU MAY HAVE MISSED BECAUSE IT’S RAINING AGAIN

Moho Resources (ASX:MOH) has received early indications that magmatic nickel sulphides are present at the T4 target within its Silver Swan North project near Kalgoorlie, Western Australia.

While no replacement for full laboratory analysis, portable XRF readings on several samples taken from reverse circulation drilling at T4 identified six anomalous zones with intercepts of between 2m and 9m that host more than 2,000 parts per million (ppm) nickel coincidental with greater than 100ppm copper.

Of particular interest was the deepest intercept of 3m including 1m at 3,333ppm nickel, 114ppm copper and 203ppm cobalt from a down-hole depth of 46m in hole SSMH0158 as this is at the base of the regolith and has an elevated cobalt value.

Moho adds that more than 100m of spinifex and cumulate textured ultramafics were observed in hole SSMH0157.

Assays are pending and the company is planning further exploration including drilling across the targets to further confirm mineralisation.

Regenerative bone and tissue implant specialist Osteopore (ASX:OSX) has achieved record revenue of S$460,684 ($482,890) for Q3 CY22.

Revenue increased 6.6% over Q2 CY22, resulting in the fourth consecutive quarter of revenue growth, and a 164% increase over the previous year’s revenue for the corresponding period of Q3 CY21.

The strong result was led by increasing sales from Vietnam and Singapore, along with consistent volume of implants for rhinoplasty (nose surgery) applications within Korea.

Increasing numbers of patients are going to hospital to seek treatment and surgeons are getting familiar with Osteopore’s technology, which has led to an increase in neurosurgery cases and demand for Osteopore’s implants.

The company said it was particularly witnessing strong demand from Vietnam, where over 40% of implants delivered in July were used in surgeries.

“This required another large order to be shipped during the quarter to meet demand,” Osteopore said in its update.

TRADING HALTS

Australian Strategic Materials (ASX:ASM) – Capital Raise.

Jade Gas Holdings (ASX:JGH) – Capital Raise.

Todd River Resources (ASX:TRT) – Capital Raise.

Little Green Pharma (ASX:LGP) – Capital Raise.

Althea Group Holdings (ASX:AGH) – Capital Raise.

Amaero International (ASX:3DA) – Entitlement Offer.

Sparc Technologies (ASX:SPN) – Capital Raise.

R3D Resources (ASX:R3D) – R3D’s got an announcement to make about a long term 100% offtake deal at its Copper Sulphate plant.

MoneyMe (ASX:MME) – MME is taking time to pull together a response to a recent media report.

Viridis Minerals and Mining (ASX:VMM) – VMM has an announcement regarding an update to an earlier ASX announcement.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.