Closing Bell: Reversal of Fortune 2 – The ASX Benchmark Bites Back

Via Getty

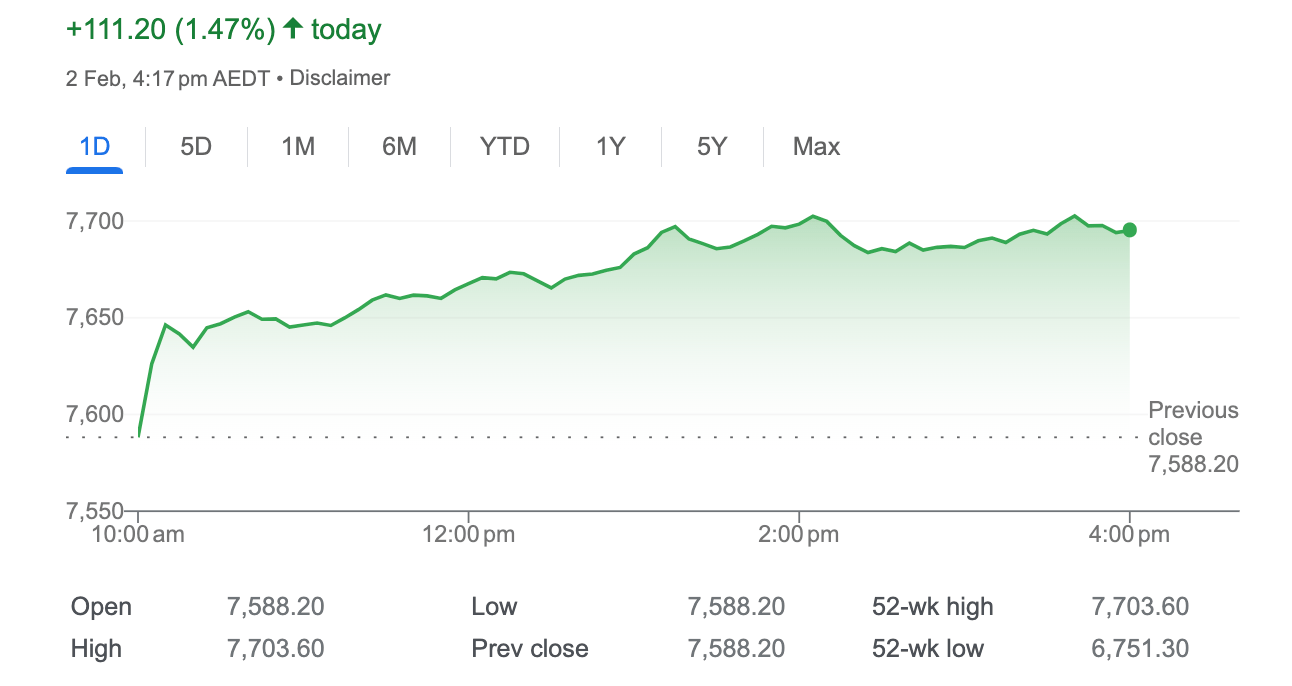

- ASX spanks Friday, match out at 1.47pc higher

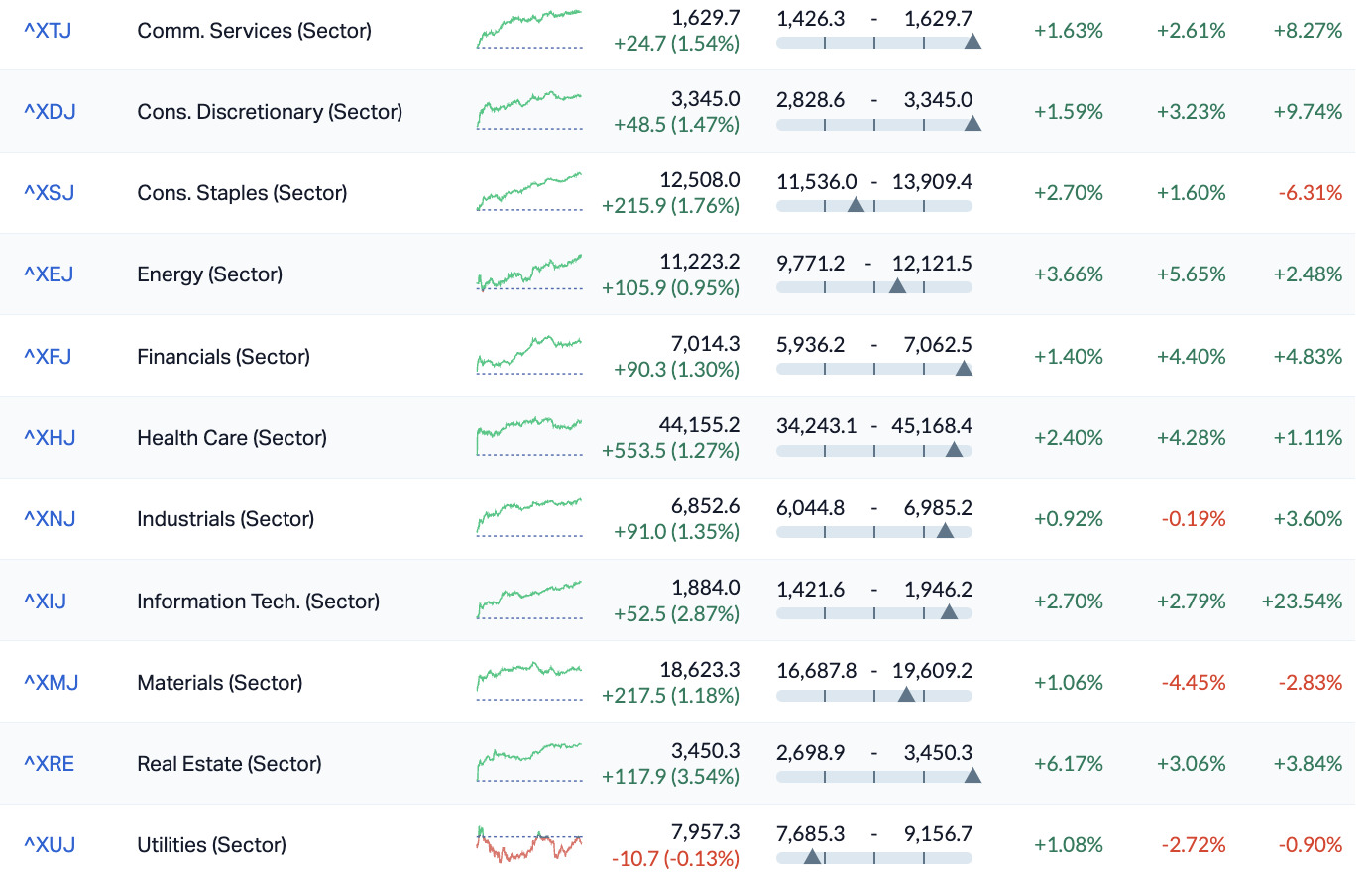

- Sectors led by Property

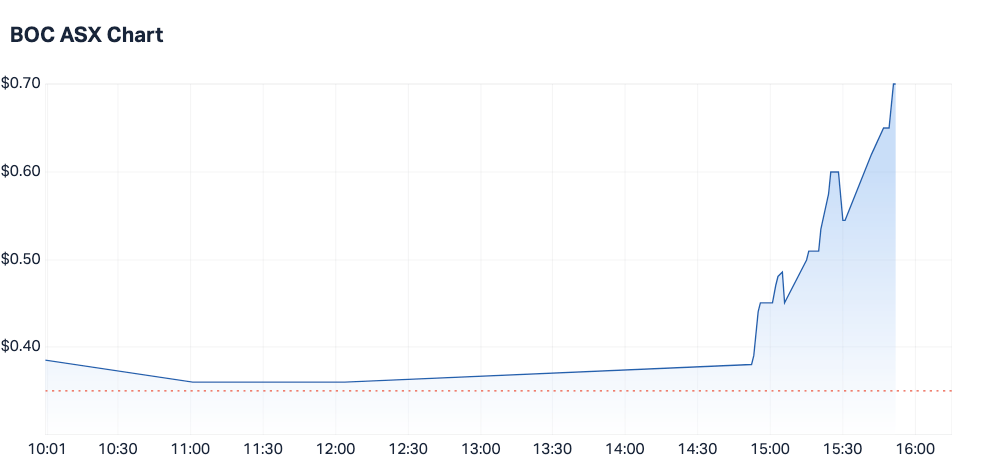

- Small cap winners led by late surging BOC

Betraying the kind of fearful symmetry on Friday which excites technical analysts and romantic poets (but doesn’t seem to bother US traders), local markets have risen from the ignominy of Thursday to end the week with four out of five, which Meatloaf would undoubtedly approve of.

Even with Thursday’s abberation, the benchmark has added almost 2% for the week.

At 4.15pm on February 2, the S&P/ASX200 was up 106 points or 1.47% to 7,694.40.

It’s a record for the new, plucky 2024 version of the benchmark and follows hotly on the disgraceful Eddie Jones coached Wallabies-style 1.2% capitulation on Thursday.

And let us not forget that one came itself hotly in the wake of Wednesday’s new intraday record high.

You can see where I’m going on this.

Everyone’s excited.

Almost everyone can literally taste the rate cuts pouring out of the Reserve Bank, now that inflation has been thwarted, yada yada.

On that front, the Aussie numbers bureau says the Q4 PPI (producer price index) rose by 0.9% during Q423, easing nicely from a 12 month-high of 1.8% struck in Q3.

It was the 14th straight quarter of rising prices, squarely on the shoulders of conflict driven energy prices.

Following in the shadow of another perplexingly broad-based rally on Wall Street overnight, by lunchtime in Sydney, the ASX 200 was already more than 1% greener, as all sorts of sectors emerged from the bunkers of the previous session to greet Friday in Sydney with the blinking possibility.

The ASX Financial sector, the Materials companies, most of the bigger IT names, and quite a few Healthcare stocks all traded higher.

Undaunted, Property stocks were the surprise package, gaining well over 2% before drinks.

No need to make a song and dance over it, but we are through the looking glass (again) now, people – the benchmark waved at its previous all-time high of 7692.00 points earlier in the session.

In the last month of business, the ASX has gained 2.5% and, after all the huffing and puffing in the last year, it’s slightly maddening to think we’re just 2.2% the wiser.

Local blue chips studiously set about regaining the points lost on Thursday’s bloodletter – CBA, BHP and Rio all significantly higher.

With a few moments before the closing bell in Sydney, remarkably, Utilities is the only sector not making sun-sodden hay.

ASX Sectors on Friday

![]()

We’re watching oil…

I’m all out of trust as WTI crude futures managed to stop the wondrous slide this week at around the US$75 per barrel mark earlier on Friday.

The benchmark is still looking short by about 5% this week, largely on the misbegotten idea that this business in the Middle East might settle down, which has put pause to the Red Sea disruption worries.

Reports of a ceasefire deal between Israel and Hamas are surely cut from the same mad cloth that started it all, although some outlets suggest Hamas is looking the deal over.

Oil boffins are structurally a barrel half full bunch and apparently remain hopeful some kind of truce in Gaza means some kind of end to the Houthi attacks on Red Sea shipping.

A Qatari official has said there’s no ceasefire. And somehow Qatar is the voice of reason this time.

Meanwhile, the cartel with the well OPEC+ kept its current production policy, keeping output cuts of 2.2 million barrels per day in place for the first quarter. On the demand side, according to the EIA, worldwide demand will likely increase by 2 million barrels per day in 2024, much more demanding than the previous forecast of 1.24 million bpd.

Meanwhile, in the States…

Seems the panic was temporary, at least temporarily.

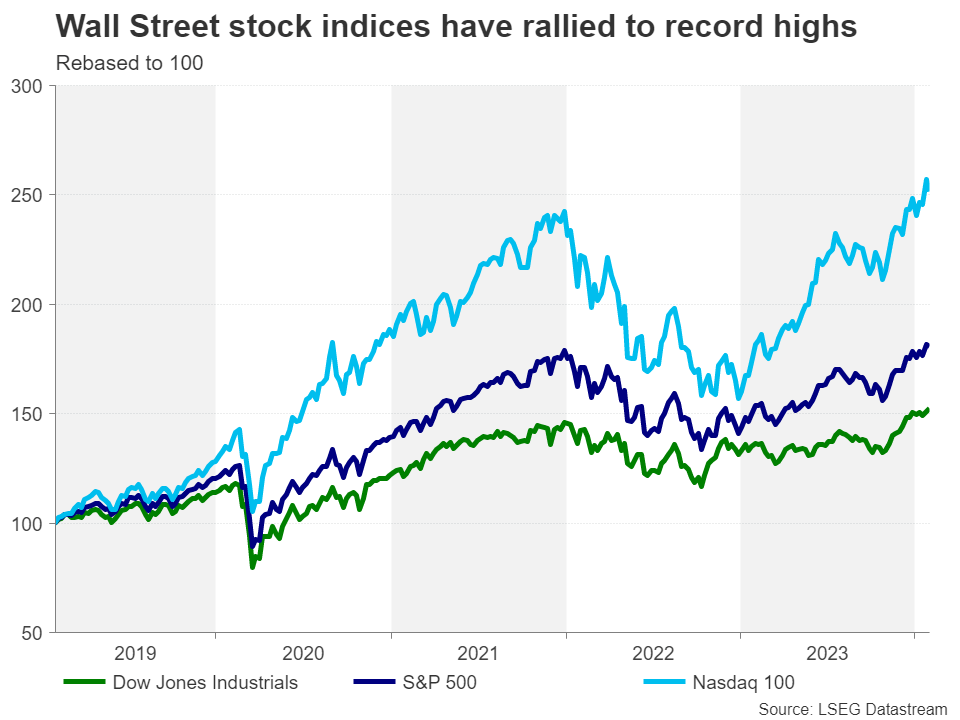

Overnight Wall Street rallied with the abandon of late stage Parkinson’s. All three majors ended well over 1% higher, led by the tech heavy Nasdaq which didn’t even break a sweat to close 1.33% more enormous.

Naturally, the path to profit in New York was paved with an array of bets on Mega Tech, rapidly filling the void left by the previous session of reversals when Alphabet and Microsoft sank despite reporting stronger profits than analysts expected. Microsoft climbed 1.6% regaining most of the 2.6% it gave up on Wednesday.

Meanwhile, Google daddy Alphabet added a mere 0.8% after the previous session debacle (falling 7.5%)

US Futures were higher in Sydney at 3.30pm on Friday.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| BOC | Bougainville Copper | 0.7 | 100% | 633,019 | $140,371,875 |

| NPM | Newpeak Metals | 0.022 | 69% | 616,335 | $1,299,373 |

| BP8 | Bph Global Ltd | 0.0015 | 50% | 4,730,762 | $1,835,563 |

| CCZ | Castillo Copper Ltd | 0.006 | 50% | 7,604,226 | $5,198,021 |

| MCT | Metalicity Limited | 0.003 | 50% | 250,000 | $8,970,108 |

| MKG | Mako Gold | 0.019 | 36% | 23,130,494 | $9,273,732 |

| AUK | Aumake Limited | 0.004 | 33% | 2,833,415 | $5,743,220 |

| ADY | Admiralty Resources. | 0.01 | 25% | 1,775,115 | $10,428,633 |

| CHK | Cohiba Min Ltd | 0.0025 | 25% | 1,815,558 | $5,060,460 |

| DEL | Delorean Corporation | 0.045 | 25% | 733,627 | $7,765,953 |

| PNX | PNX Metals Limited | 0.005 | 25% | 1,600,000 | $21,522,499 |

| RR1 | Reach Resources Ltd | 0.0025 | 25% | 619,695 | $6,420,594 |

| YRL | Yandal Resources | 0.11 | 22% | 390,406 | $21,125,354 |

| 5GG | Pentanet | 0.069 | 21% | 853,404 | $21,302,451 |

| SMS | Starmineralslimited | 0.042 | 20% | 370,628 | $2,657,298 |

| OPN | Oppenneg | 0.006 | 20% | 1,372,428 | $5,645,898 |

| RMX | Red Mount Min Ltd | 0.003 | 20% | 20,558 | $6,683,940 |

| SKN | Skin Elements Ltd | 0.006 | 20% | 1,081,925 | $2,947,430 |

| AM7 | Arcadia Minerals | 0.066 | 20% | 7,375 | $5,997,756 |

| NGL | Nightingale Intel | 0.049 | 20% | 514,707 | $4,404,787 |

| VKA | Viking Mines Ltd | 0.013 | 18% | 23,800 | $11,277,843 |

| FCG | Freedomcaregrouphold | 0.175 | 17% | 57,218 | $3,582,586 |

| HOR | Horseshoe Metals Ltd | 0.007 | 17% | 1,000,000 | $3,878,872 |

| KPO | Kalina Power Limited | 0.0035 | 17% | 100,146 | $6,630,384 |

| RIE | Riedel Resources Ltd | 0.0035 | 17% | 372,737 | $6,671,507 |

In very, very late mail, this is what maths and geometry has to say about Bougainville Copper (ASX:BOC) in the last 60 mins or so…

BOC jumped 100%, and all of it in the final 90 minutes on Friday afternoon, on news that the company has been awarded a five-year extension to its EL01 exploration licence for the Panguna project in Central Bougainville.

This is huge news for BOC, and caps a horrifying 5-year wait to see how the chips were going to fall, after the Autonomous Bougainville Government basically said “nope – not yours” to BOC over Panguna, and the political and legal fighting began.

Mako Gold (ASX:MKG) was shining happily and making great headway on news that rock chip sampling at the Tchaga North prospect within its Napié project in Côte d’Ivoire has discovered gold-mineralised areas with top assays of up to 79.5g/t gold.

Delorean (ASX:DEL) is moving upwards for the second time this week, up another 25% on Friday to take the company past +66.6% for the year so far – the only news we’ve had from them is the quarterly that dropped earlier in the week.

Metallica Minerals (ASX:MLM) and Freedom Care Group (ASX:FCG) are on the move for reasons known only to them, and Yandal Resources (ASX:YRL) has jumped a Richie Benaud-pleasing 22.22%, on news that the company has received firm commitments for 31.2 million shares at $0.08 a pop, set to raise A$2.5 million before costs, with the money earmarked to accelerate exploration.

Most of the afternoon’s big winners were little companies making decent jumps on no news – including HitIQ (ASX:HIQ) , Dubber Corp (ASX:DUB) and Gold Hydrogen (ASX:GHY), with the latter possibly getting some belated love from the investor prezzo it dropped on Thursday morning.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| INP | Incentiapay Ltd | 0.003 | -25% | 162,120 | $5,110,859 |

| MHC | Manhattan Corp Ltd | 0.003 | -25% | 5,233,943 | $11,747,919 |

| MRD | Mount Ridley Mines | 0.0015 | -25% | 1,076,594 | $15,569,766 |

| DTR | Dateline Resources | 0.01 | -23% | 941,957 | $17,284,230 |

| VAR | Variscan Mines Ltd | 0.011 | -21% | 1,302,521 | $5,306,005 |

| BMH | Baumart Holdings Ltd | 0.08 | -20% | 1,742 | $14,474,476 |

| PNT | Panthermetalsltd | 0.04 | -20% | 20,000 | $4,358,308 |

| HCD | Hydrocarbon Dynamic | 0.004 | -20% | 7,088,316 | $3,848,330 |

| KNM | Kneomedia Limited | 0.002 | -20% | 2,500,003 | $3,833,178 |

| KOR | Korab Resources | 0.008 | -20% | 1,109,867 | $3,670,500 |

| PUR | Pursuit Minerals | 0.004 | -20% | 6,424,501 | $14,719,857 |

| SHN | Sunshine Metals Ltd | 0.009 | -18% | 4,667,486 | $13,464,093 |

| IBX | Imagion Biosys Ltd | 0.09 | -18% | 657,601 | $3,591,121 |

| ASR | Asra Minerals Ltd | 0.005 | -17% | 1,519,017 | $9,818,974 |

| BYH | Bryah Resources Ltd | 0.01 | -17% | 789,301 | $5,203,287 |

| IBG | Ironbark Zinc Ltd | 0.005 | -17% | 550,881 | $9,563,236 |

| MTL | Mantle Minerals Ltd | 0.0025 | -17% | 352,015 | $18,592,338 |

| NET | Netlinkz Limited | 0.005 | -17% | 10,550,377 | $23,270,690 |

| TMK | TMK Energy Limited | 0.005 | -17% | 249,723 | $36,735,476 |

| TMR | Tempus Resources Ltd | 0.005 | -17% | 13,982 | $4,141,740 |

| TX3 | Trinex Minerals Ltd | 0.005 | -17% | 4,734,629 | $8,922,148 |

| PEK | Peak Rare Earths Ltd | 0.21 | -16% | 1,636,356 | $66,485,440 |

| HAW | Hawthorn Resources | 0.082 | -15% | 7,800 | $32,496,514 |

| GSM | Golden State Mining | 0.011 | -15% | 522,094 | $3,631,818 |

| NGS | NGS Ltd | 0.011 | -15% | 2,323,780 | $3,265,956 |

In Case You Missed It

QEM (ASX:QEM) is celebrating the start of a Queensland Government initiative that will see the state owned energy company Powerlink lead a study to explore the delivery of enabling network infrastructure and supporting reliability of supply to regional communities along the CopperString corridor, including QEM’s flagship Julia Creek vanadium / oil shale project.

Vertex Minerals (ASX:VTX) announced today it has secured a Gekko gold gravity processing plant, which are renowned for their low-energy mining capacity, smart design and high-tech capabilities, to be deployed at the company’s flagship Reward mine in the Hill End gold project in NSW.

Lithium hunter Chariot Corporation (ASX:CC9) is making excellent progress at its flagship Black Mountain project, hitting multiple mineralised intersections from the first three of eight holes drilled so far at the project in Wyoming, USA.

Conrad Asia Energy (ASX:CRD) is raising up to $15m to progress its Mako gas field towards production and fast-track commercial opportunities, targeting the best estimate (2C) contingent resource of 413 billion cubic feet of gas at the company’s cornerstone Mako gas field in the 76.5% owned Duyung PSC.

Kula Gold (ASX:KGD) has announced a very pleasant surprise, after the company uncovered substantial epithermal gold prospectivity at the Cobra and Mustang prospects while drilling at its Kirup project near the giant Greenbushes lithium mine.

Drilling at the Dickson Well target within Power Minerals’ (ASX:PNN) Eyre Peninsula project in South Australia has delivered a staggering hit of 14,152ppm total rare earth oxides (TREO), with drill hole PKD23-19 averaging 5,025ppm (or 0.5%) TREO over 3m and included 1,473ppm magnet rare earth oxide (MREO) from 43m.

NickelX (ASX:NKL) has started a reverse circulation drill program covering 86km2 of the entire Barra Barra greenstone belt, which will initially test two high priority geophysical targets at its Dalwallinu nickel project in WA’s West Yilgarn mining province.

TRADING HALTS

M3 Mining (ASX:M3M) – pending an announcement pertaining to a material capital raising.

Sultan Resources (ASX:SLZ) – pending an announcement by the company in relation to a capital raisin.

Aurum Resources (ASX:AUE) – for the purposes of considering, planning and executing a capital raising.

European Lithium (ASX:EUR) – pending an announcement in connection with an update on a NASDAQ merger transaction, the timing of the special meeting of Sizzle shareholders and an update on the potential investments from strategic parties.

Capstone Copper (ASX:CSC) – pending an announcement in connection with a Canadian “bought deal” capital raising of common shares.

Credit Intelligence (ASX:CI1) – pending an announcement in relation to receipt of a Writ of Summons via e-mail from Mr. Ka Sek Wong, a former director and a current substantial holder of the company.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.